Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could someone please help On April 1, 2020, Marin Company received a condemnation award of $447,200 cash as compensation for the forced sale of the

could someone please help

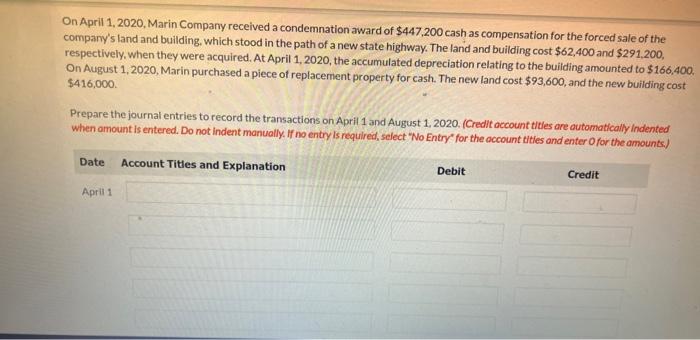

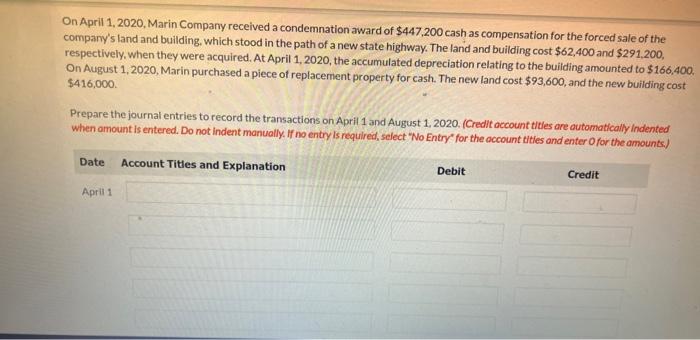

On April 1, 2020, Marin Company received a condemnation award of $447,200 cash as compensation for the forced sale of the company's land and building. which stood in the path of a new state highway. The land and building cost $62,400 and $291,200, respectively, when they were acquired. At April 1,2020, the accumulated depreciation relating to the building amounted to $166,400 On August 1,2020, Marin purchased a piece of replacement property for cash. The new land cost $93,600, and the new building cost $416,000. Prepare the journal entries to record the transactions on April 1 and August 1, 2020. (Credit occount titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount tities and enter O for the amounts.) April 1 Aug. 1 eTextbork and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started