could someone provide answers for 2,3,4

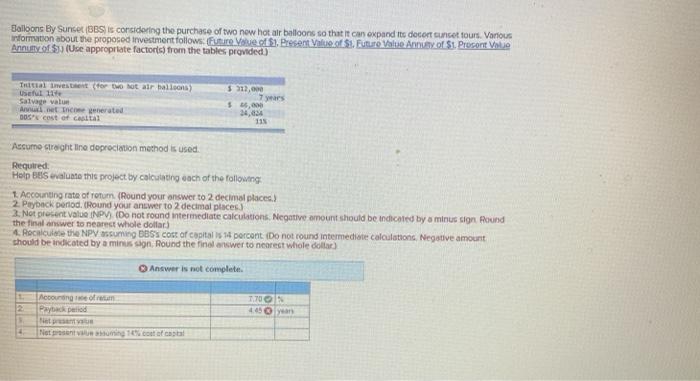

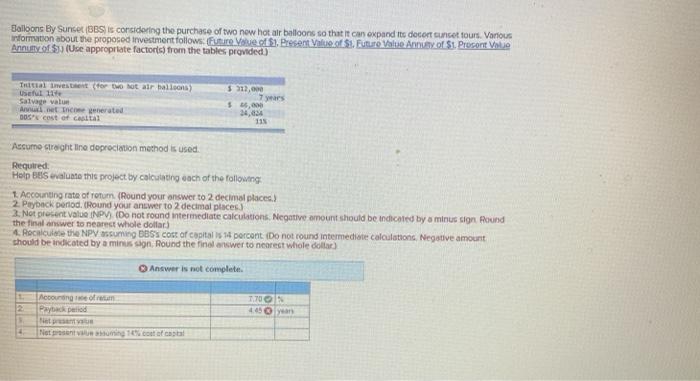

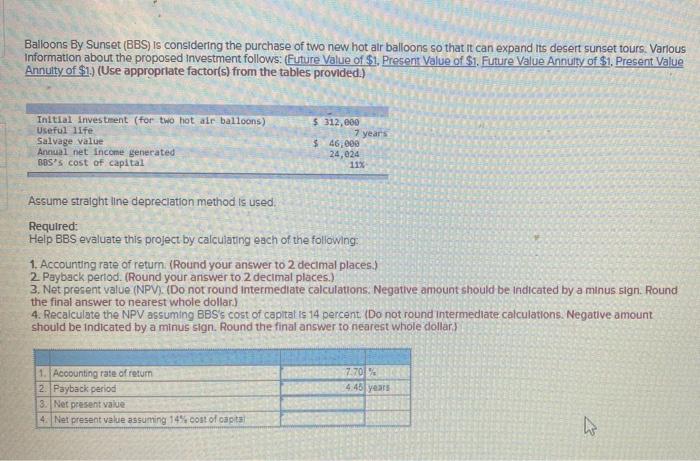

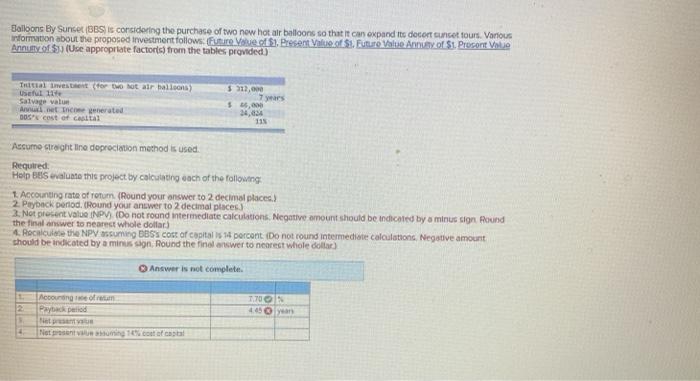

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its decort sunset fours. Various information about the proposed investment follows. Future Value of $1. Present Value of St. Future Value Annay of St. Procont Value Annuity of $ (Use appropriate factors from the tables provided) Totes or wo we air balloons US Salvage value Annettorated DOS cost of catal 112,000 7 years $ 25,000 115 24.3 Assume straight line depreciation method is used. Required Help BUS valuate this project by calculating each of the following 1. Accounting rate of rotum. (Round your answer to 2 decimal places. 2. Payback period (Round your answer to 2 decimal places) 2. Not present Value INPV) (Do not round intermediate calculations. Negative amount should be indicated by a minus sign Round the final answer to nearest whole dollar) 4. Rochiuloa the NPV assuming DBSs cost of cooltel Ds 14 percent. Do not round Intermediate calculations. Negative amount should be indkated by a minus sign, Round the final answer to nearest whole dollar Answer is not complete 1700 40 years courange of reta Payback period Net Notenticostal Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various Information about the proposed investment follows: (Future Value of $1. Present Value of $1. Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided.) $ 312,000 Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital 7 year's $ 46,000 24,024 Assume straight line depreciation method is used Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of retum (Round your answer to 2 decimal places:) 2. Payback period. (Round your answer to 2 decimal places.) 3. Net present value (NPV). (Do not found intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) 4. Recalculate the NPV assuming BBS's cost of capital is 14 percent. (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar) 7.70% 4.45 years 1. Acoounting rate of return 2. Payback period 3. Net present value 4. Net present value assuming 14% cost of capita w