Could someone solve this problem for me.

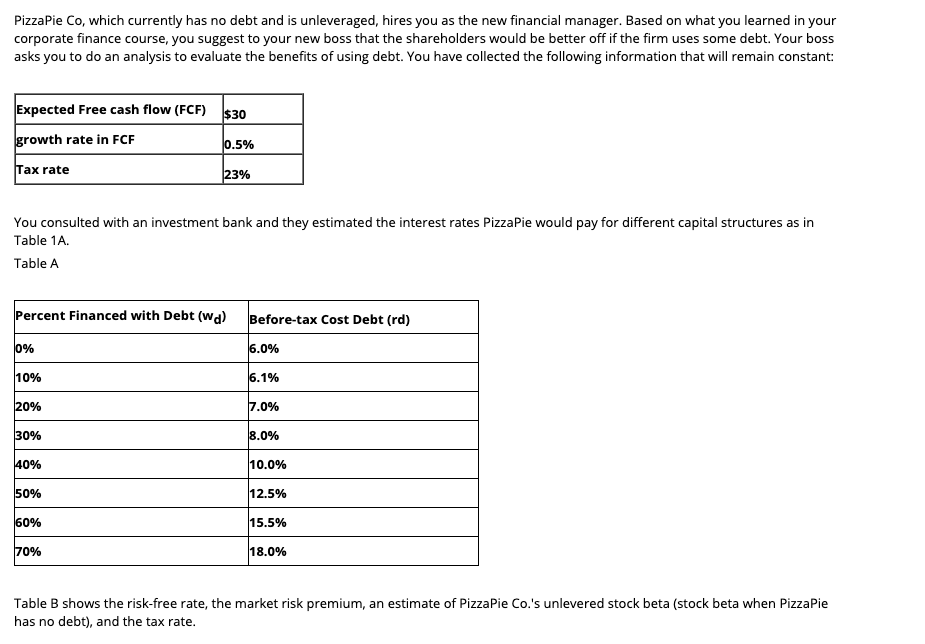

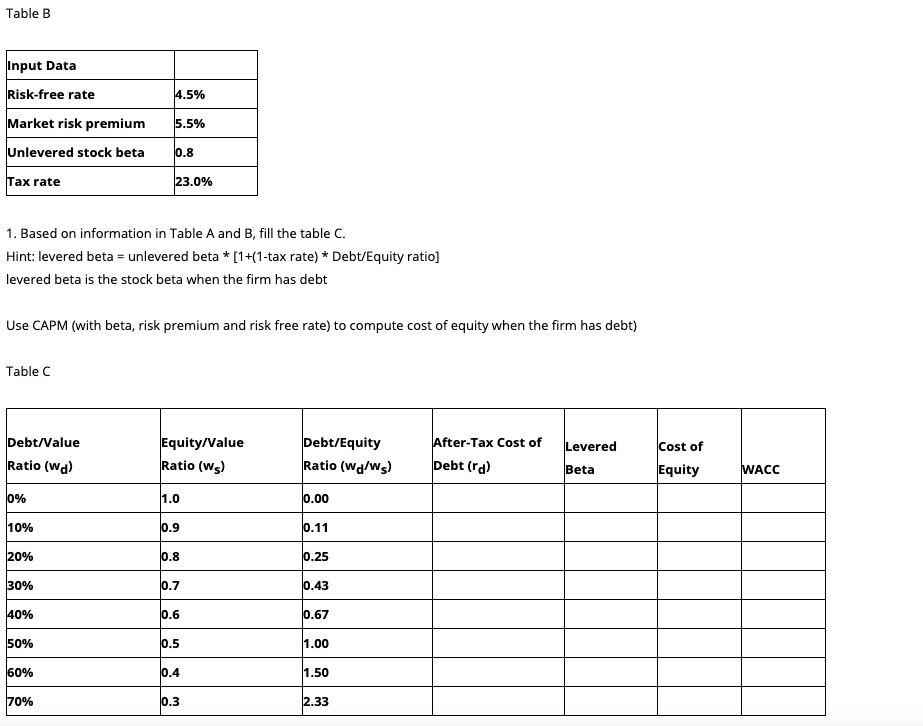

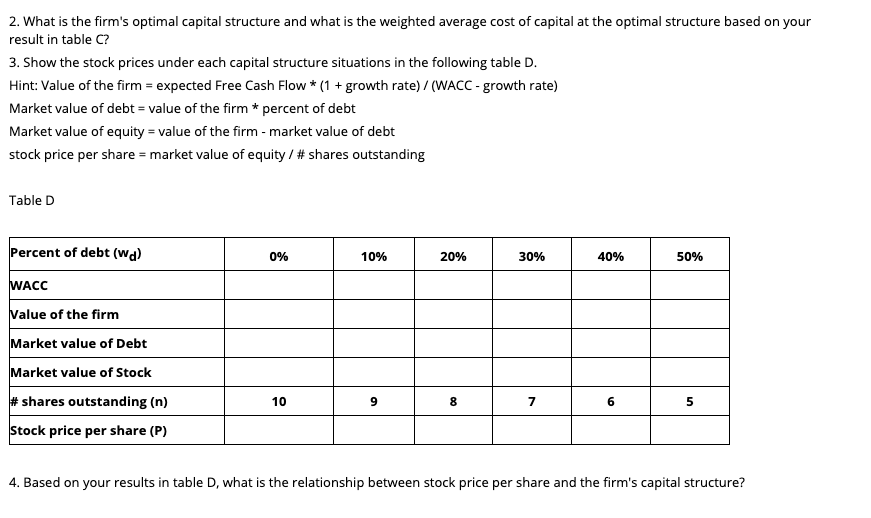

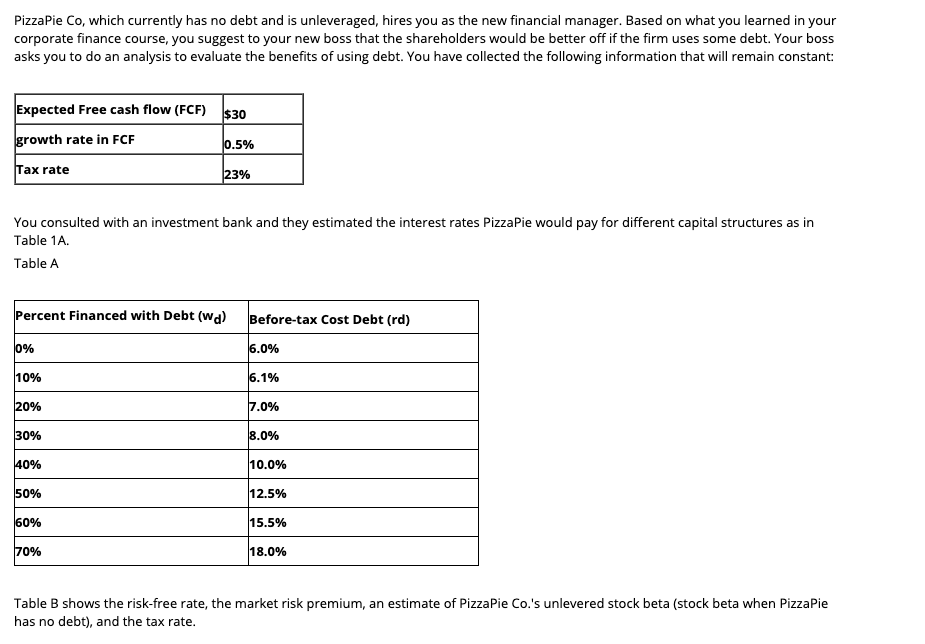

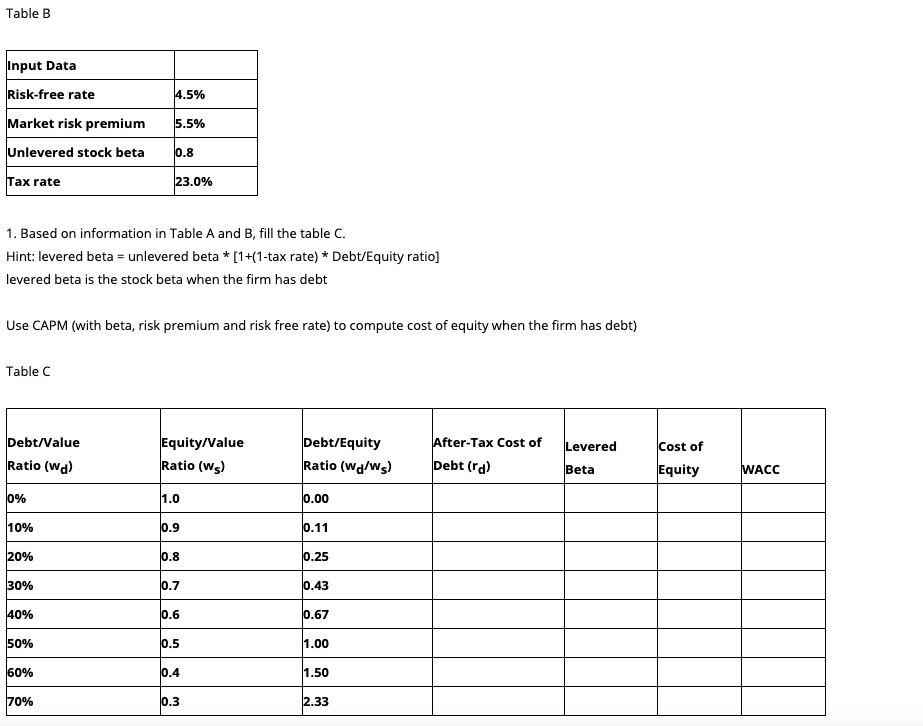

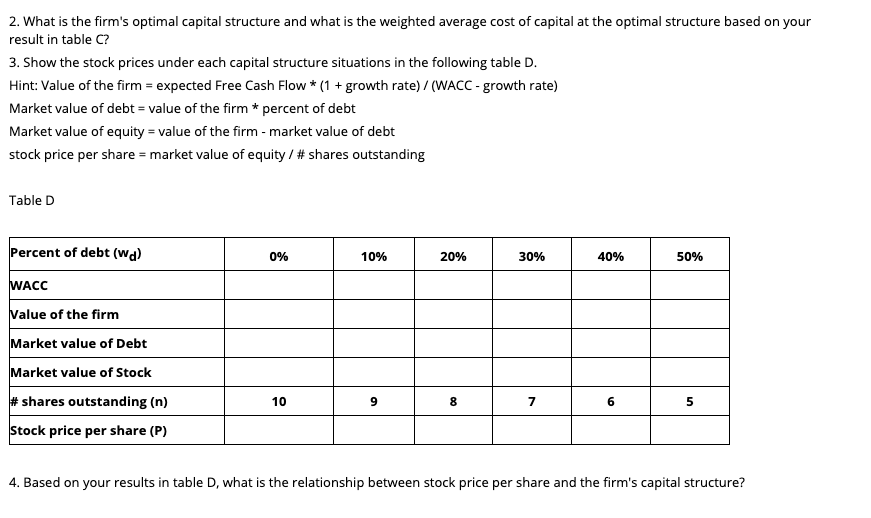

PizzaPie Co, which currently has no debt and is unleveraged, hires you as the new financial manager. Based on what you learned in your corporate finance course, you suggest to your new boss that the shareholders would be better off if the firm uses some debt. Your boss asks you to do an analysis to evaluate the benefits of using debt. You have collected the following information that will remain constant Expected Free cash flow (FCF) $30 growth rate in FCF 0.5% Tax rate 23% You consulted with an investment bank and they estimated the interest rates PizzaPie would pay for different capital structures as in Table 1A. Table A Percent Financed with Debt (wa) Before-tax Cost Debt (rd) 10% 6.0% 10% 6.1% 20% 7.0% 30% 8.0% 40% 10.0% 50% 12.5% 60% 15.5% 70% 18.0% Table B shows the risk-free rate, the market risk premium, an estimate of Pizza Pie Co.'s unlevered stock beta (stock beta when PizzaPie has no debt), and the tax rate. Table B Input Data Risk-free rate 4.5% 5.5% Market risk premium Unlevered stock beta 0.8 Tax rate 23.0% 1. Based on information in Table A and B, fill the table C. Hint: levered beta = unlevered beta * [1+(1-tax rate) * Debt/Equity ratio) levered beta is the stock beta when the firm has debt Use CAPM (with beta, risk premium and risk free rate) to compute cost of equity when the firm has debt) Table C Levered Debt/Value Ratio (wa) Equity/Value Ratio (ws) Debt/Equity Ratio (wd/ws) After-Tax Cost of Debt (ra) Cost of Equity Beta WACC 10% 1.0 0.00 10% 0.9 10.11 20% 0.8 0.25 30% 10.7 0.43 40% 10.6 0.67 50% 10.5 1.00 60% 10.4 1.50 70% 10.3 2.33 2. What is the firm's optimal capital structure and what is the weighted average cost of capital at the optimal structure based on your result in table C? 3. Show the stock prices under each capital structure situations in the following table D. Hint: Value of the firm = expected Free Cash Flow *(1 + growth rate)/(WACC - growth rate) Market value of debt = value of the firm * percent of debt Market value of equity = value of the firm - market value of debt stock price per share = market value of equity / # shares outstanding Table D Percent of debt (wa) 0% 10% 20% 30% 40% 50% WACC Value of the firm Market value of Debt Market value of Stock 10 9 8 7 6 5 # shares outstanding (n) Stock price per share (P) 4. Based on your results in table D, what is the relationship between stock price per share and the firm's capital structure