Question

Could someone tell me if I recorded these into the correct special journals and if I then post the following entries into the general journal?

Could someone tell me if I recorded these into the correct special journals and if I then post the following entries into the general journal? And if so how one might do that? And what might that look like?

March 1 Received the amount owed from Bach Company, one of our customers, no discount allowed.

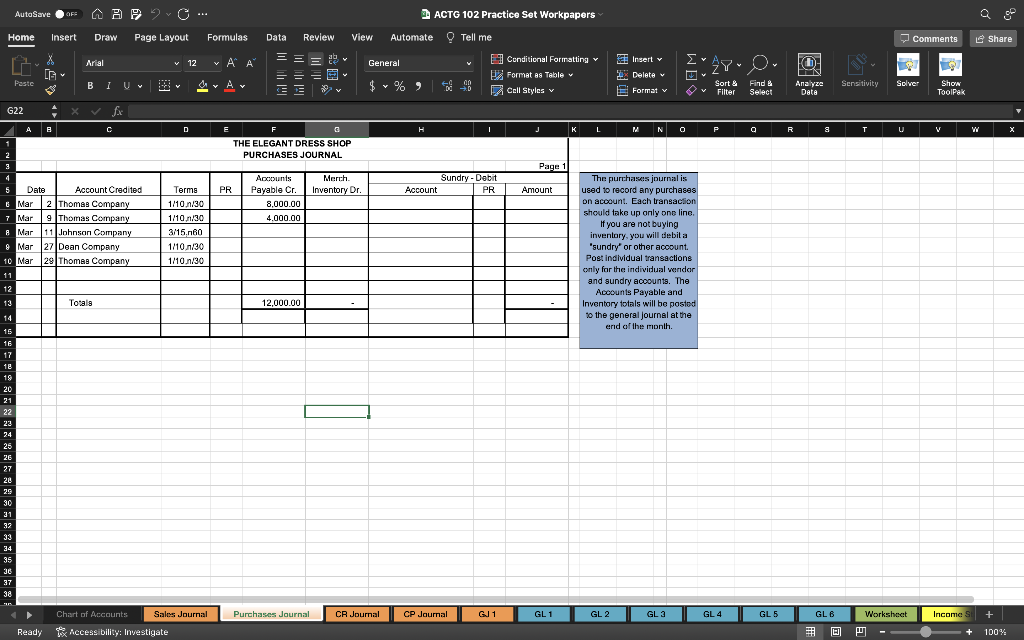

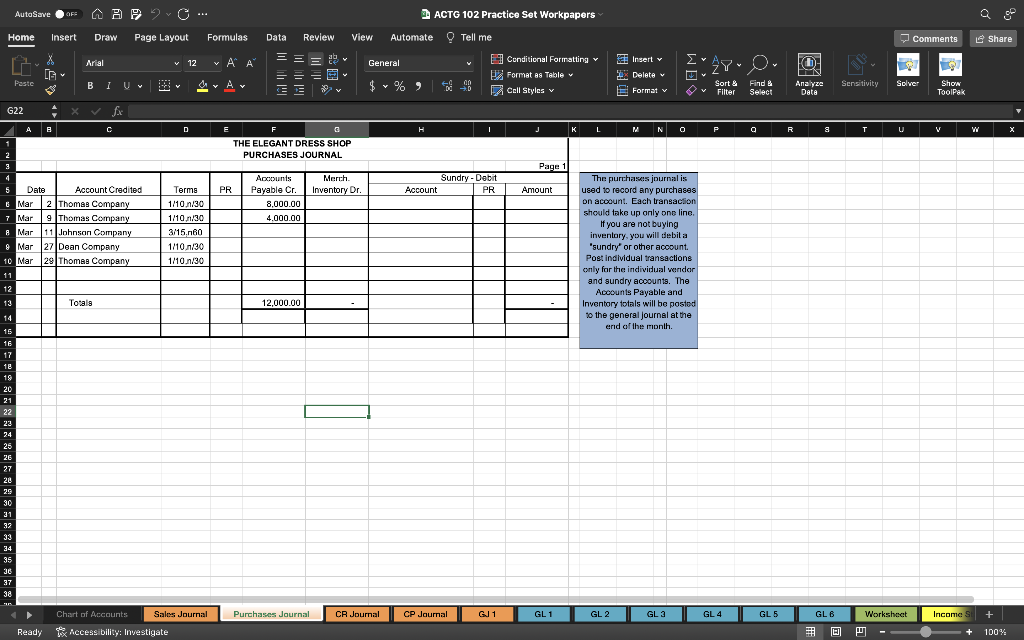

March 2 Purchased merchandise from Thomas Company on account, $8,000; discount terms are 1/10, n/30.

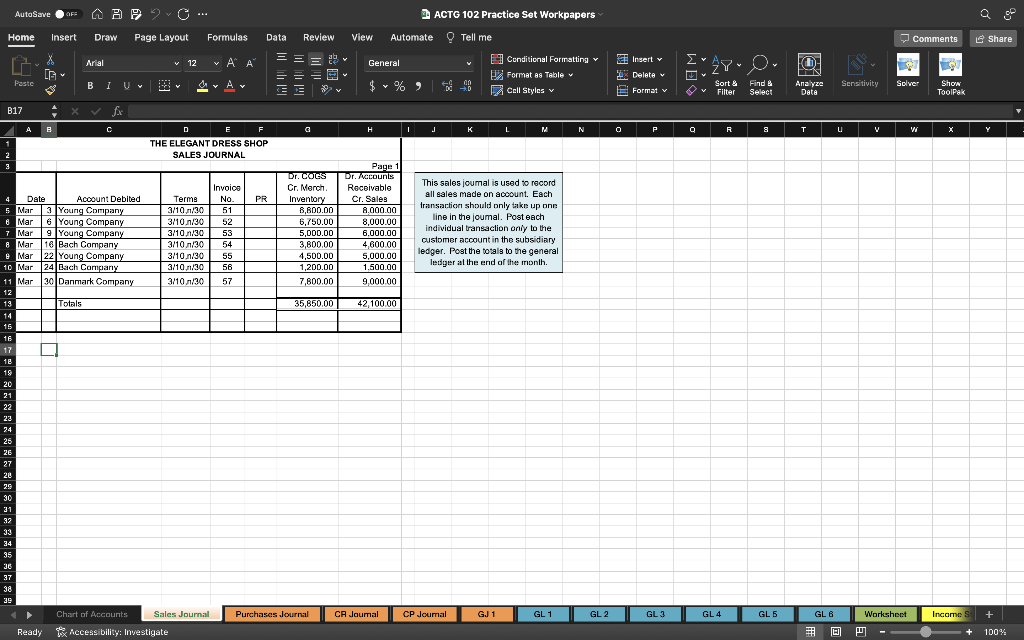

March 3 Sold merchandise to Young Company on account, retail price $8,000, cost $6,800, invoice number 51; discount terms 3/10, n/30.

March 6 Sold merchandise to Young Company on account, retail price $8,000, cost $6,750, invoice number 52; discount terms 3/10, n/30.

March 9 Purchased merchandise from Thomas Company on account, $4,000; discount terms 1/10, n/30.

March 9 Sold merchandise to Young Company on account, retail price $6,000, cost $5,000, invoice number 53, discount terms 3/10, n/30.

March 10 Young Company returned merchandise sold for $3,200 with a cost of $3,000 from invoice number 52.

March 11 Purchased merchandise from Johnson Company on account, $14,000; discount terms 3/15, n/60.

March 12 Sold merchandise for $25,000 cash. Cost $20,000

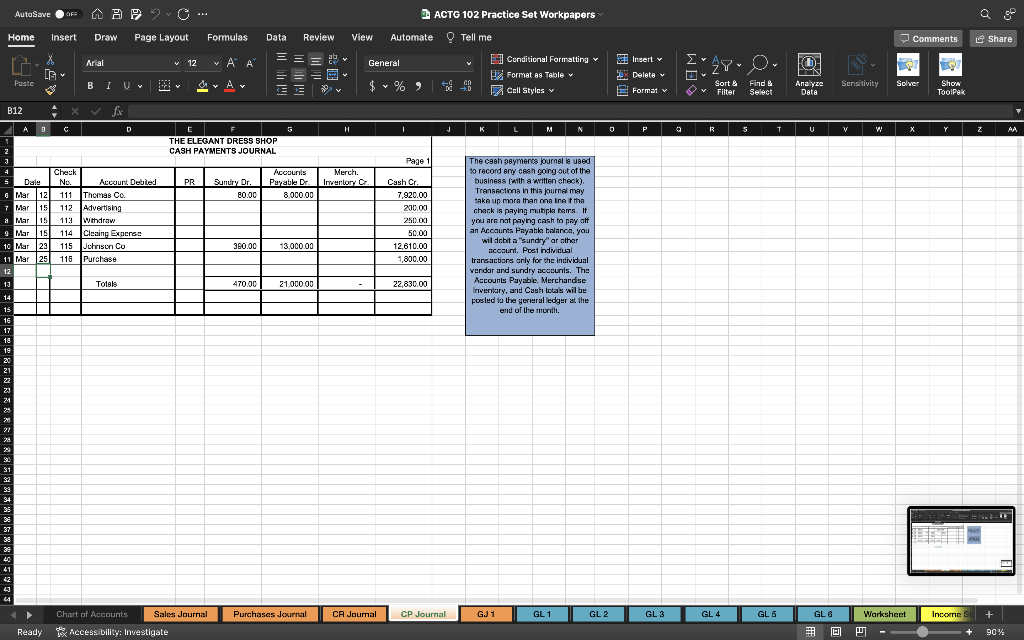

March 12 Paid Thomas Company for March 2nd transaction, check number 111, discount taken.

March 13 Sold $5,000 of merchandise for cash. Cost $4,000

March 14 Returned merchandise to Johnson Company for the amount of $1,000.

March 15 Paid $200 for advertising expenses, check number 112.

March 15 The owner withdrew $250 for her own personal use, check number 113.

March 15 Paid $50 for cleaning expenses, check number 114.

March 16 Received payment from Young Company for invoice number 52, less discount allowed on the balance of this invoice. Hint: the original sale occurred on March 6th and there was a subsequent return on March 10th).

March 16 Young Company paid invoice number 51, $8,000, no discount allowed.

March 16 Sold merchandise to Bach Company on account, retail price $4,600, cost $3,800, invoice number 54; discount terms 3/10, n/30.

March 21 Purchased delivery truck on account from Mannys Garage, $20,000, no discount terms.

March 22 Sold merchandise to Young Company on account, retail price $5,000, cost $4,500invoice number 55; terms 3/10, n/30.

March 23 Paid the balance owed to Johnson Company, taking the sales discount, check number 115. Hint: the original purchase transaction was on March 11th with a subsequent return on March 14th.

March 24 Sold merchandise to Bach Company on account, retail price $1,500, cost $1,200 invoice number 56; discount terms 3/10, n/30.

March 25 Purchase merchandise for $1,800, check number 116.

March 27 Purchase merchandise on account from Dean Company, $5,000; discount terms 1/10, n/30.

March 28 Young Company paid invoice number 55 dated March 22nd, less discount.

March 28 Bach Company paid invoice number 54 dated March 16th, no discount allowed.

March 29 Purchase merchandise from Thomas Company on account, $13,000; discount terms 1/10, n/30.

March 30 Sold merchandise to Danmark Company on account, retail price $9,000, cost $7,800, invoice number 57; terms 3/10, n/30.

THE ELEGANT DRESS SHOP PURCHASES JOURNAL THE ELEGANT DRESS SHOP PURCHASES JOURNAL THE ELEGANT DRESS SHOP CASH PAYMENTS JOURNAL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started