Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could u help me with it thank you 1. Mario and Luigi each own half of a mushroom pizza parlor. They want to expand by

could u help me with it thank you

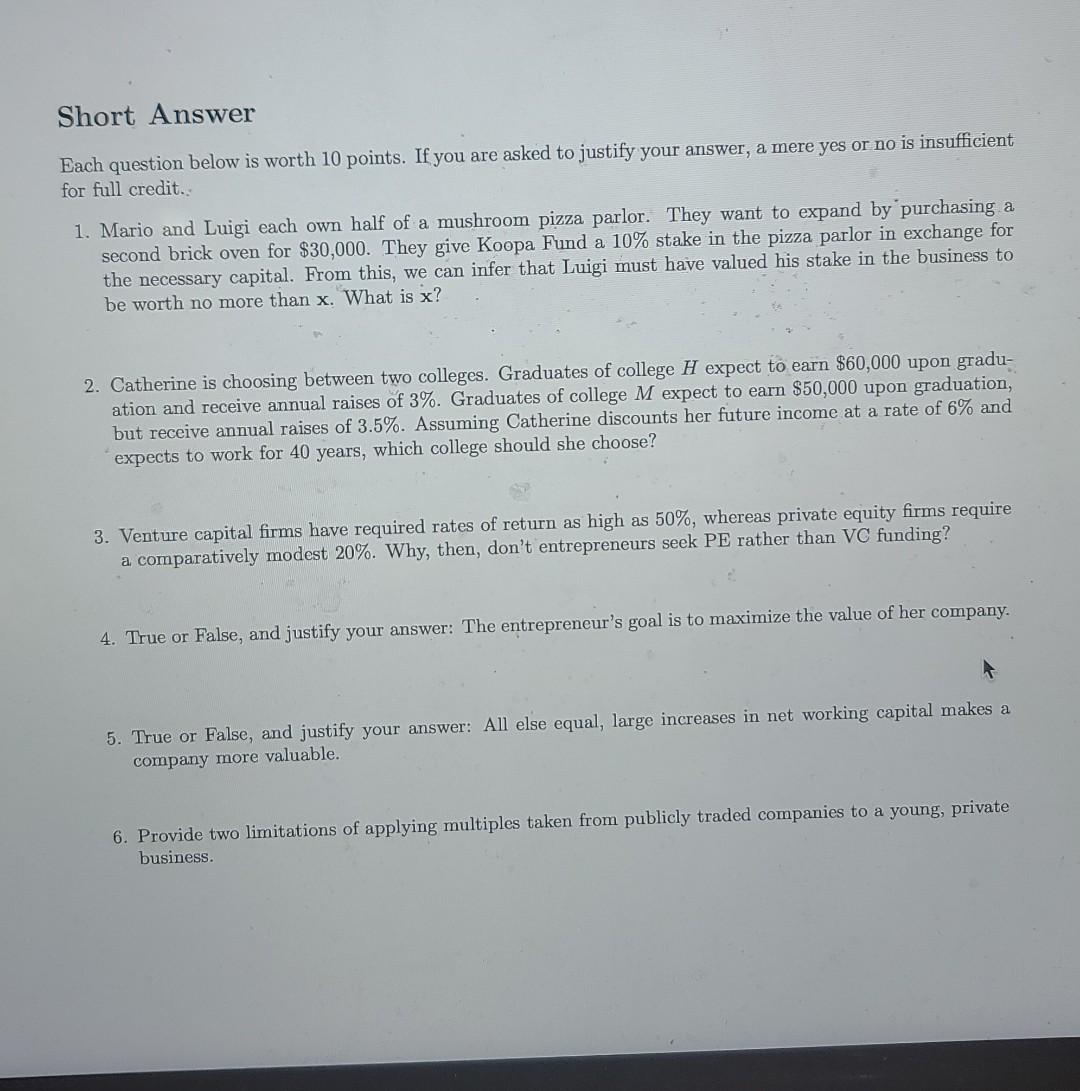

1. Mario and Luigi each own half of a mushroom pizza parlor. They want to expand by purchasing a second brick oven for $30,000. They give Koopa Fund a 10% stake in the pizza parlor in exchange for the necessary capital. From this, we can infer that Luigi must have valued his stake in the business to be worth no more than x. What is x ? 2. Catherine is choosing between two colleges. Graduates of college H expect to earn $60,000 upon graduation and receive annual raises of 3%. Graduates of college M expect to earn $50,000 upon graduation, but receive annual raises of 3.5%. Assuming Catherine discounts her future income at a rate of 6% and expects to work for 40 years, which college should she choose? 3. Venture capital firms have required rates of return as high as 50%, whereas private equity firms require a comparatively modest 20%. Why, then, don't entrepreneurs seek PE rather than VC funding? 4. True or False, and justify your answer: The entrepreneur's goal is to maximize the value of her company. 5. True or False, and justify your answer: All else equal, large increases in net working capital makes a company more valuable. 6. Provide two limitations of applying multiples taken from publicly traded companies to a young, private businessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started