Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could use some help with walking through these please. i was not given a beta of stock could you attempt using 1? i will contact

Could use some help with walking through these please.

i was not given a beta of stock could you attempt using 1? i will contact my professor for additional information

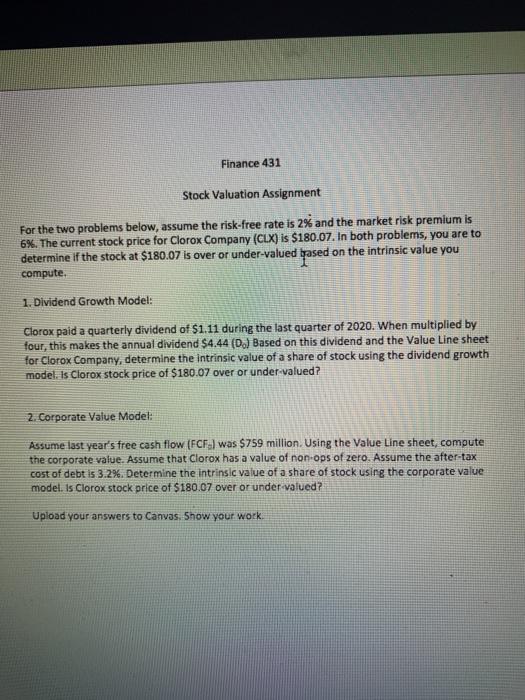

Finance 431 Stock Valuation Assignment For the two problems below, assume the risk-free rate is 2% and the market risk premium is 6%. The current stock price for Clorox Company (CLX) is $180.07. In both problems, you are to determine if the stock at $180.07 is over or under-valued rased on the intrinsic value you compute. 1. Dividend Growth Model: Clorox paid a quarterly dividend of $1.11 during the last quarter of 2020. When multiplied by four, this makes the annual dividend $4.44 (D.) Based on this dividend and the Value Line sheet for Clorox Company, determine the intrinsic value of a share of stock using the dividend growth model. Is Clorox stock price of $180.07 over or under-valued? 2. Corporate Value Model: Assume last year's free cash flow (FCF) was $759 million. Using the Value Line sheet, compute the corporate value. Assume that Clorox has a value of non-ops of zero. Assume the after-tax cost of debt is 3.2%. Determine the intrinsic value of a share of stock using the corporate value model . Is Clorox stock price of $180.07 over or under valued? Upload your answers to Canvas Snow your work Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started