Could you also calculate along with GAP, this bank's risk-adjusted assets and excess reserves? thank you!

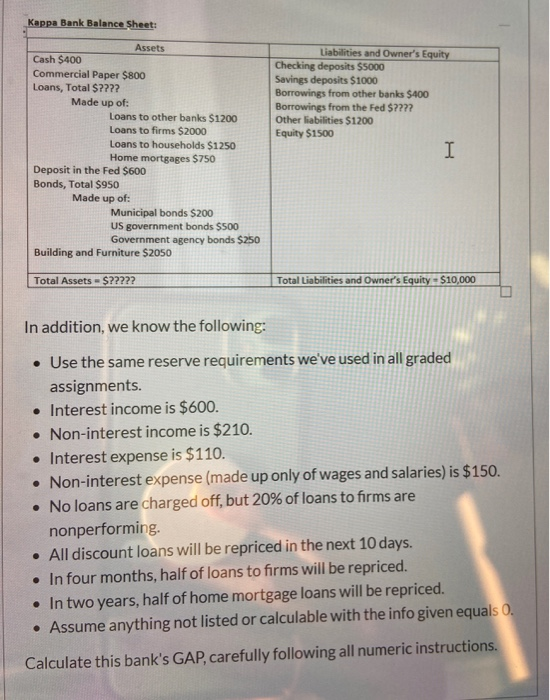

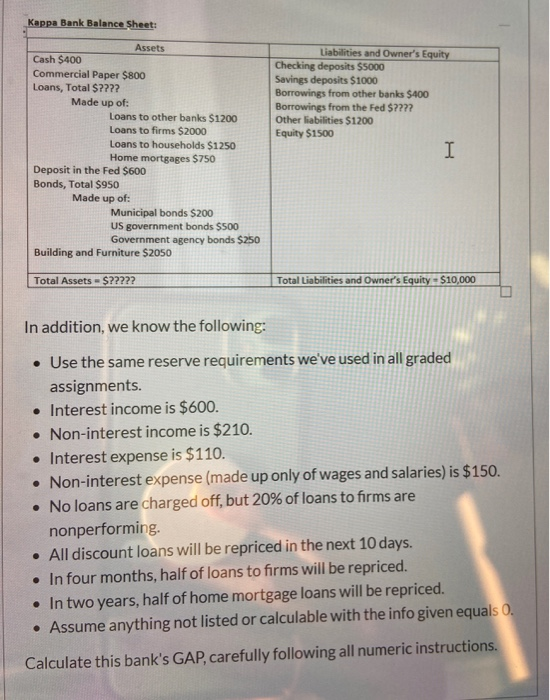

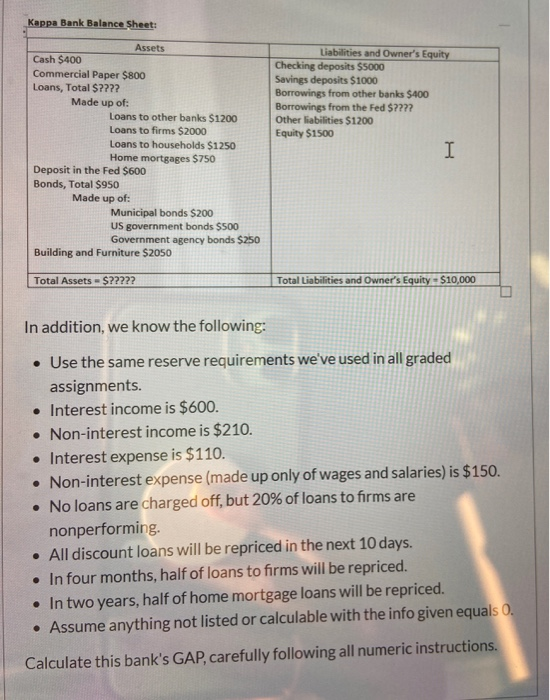

Kappa Bank Balance Sheet: Assets Cash $400 Commercial Paper $800 Loans, Total $???? Made up of: Loans to other banks $1200 Loans to firms $2000 Loans to households $1250 Home mortgages $750 Deposit in the Fed $600 Bonds, Total $950 Made up of: Municipal bonds $200 US government bonds $500 Government agency bonds $250 Building and Furniture $2050 Liabilities and Owner's Equity Checking deposits 55000 Savings deposits $1000 Borrowings from other banks $400 Borrowings from the Fed $???? Other liabilities $1200 Equity $1500 I Total Assets - $????? Total Liabilities and Owner's Equity = $10,000 In addition, we know the following: Use the same reserve requirements we've used in all graded assignments. Interest income is $600. Non-interest income is $210. Interest expense is $110. Non-interest expense (made up only of wages and salaries) is $150. No loans are charged off, but 20% of loans to firms are nonperforming. All discount loans will be repriced in the next 10 days. In four months, half of loans to firms will be repriced. In two years, half of home mortgage loans will be repriced. Assume anything not listed or calculable with the info given equals 0. Calculate this bank's GAP, carefully following all numeric instructions. Kappa Bank Balance Sheet: Assets Cash $400 Commercial Paper $800 Loans, Total $???? Made up of: Loans to other banks $1200 Loans to firms $2000 Loans to households $1250 Home mortgages $750 Deposit in the Fed $600 Bonds, Total $950 Made up of: Municipal bonds $200 US government bonds $500 Government agency bonds $250 Building and Furniture $2050 Liabilities and Owner's Equity Checking deposits 55000 Savings deposits $1000 Borrowings from other banks $400 Borrowings from the Fed $???? Other liabilities $1200 Equity $1500 I Total Assets - $????? Total Liabilities and Owner's Equity = $10,000 In addition, we know the following: Use the same reserve requirements we've used in all graded assignments. Interest income is $600. Non-interest income is $210. Interest expense is $110. Non-interest expense (made up only of wages and salaries) is $150. No loans are charged off, but 20% of loans to firms are nonperforming. All discount loans will be repriced in the next 10 days. In four months, half of loans to firms will be repriced. In two years, half of home mortgage loans will be repriced. Assume anything not listed or calculable with the info given equals 0. Calculate this bank's GAP, carefully following all numeric instructions