Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you answer the question 4 and 5. Please... CASE 19 STANLEY PRODUCTS CREDIT POLICY Twenty-nine-years old and already the inventor of two patented products,

could you answer the question 4 and 5. Please...

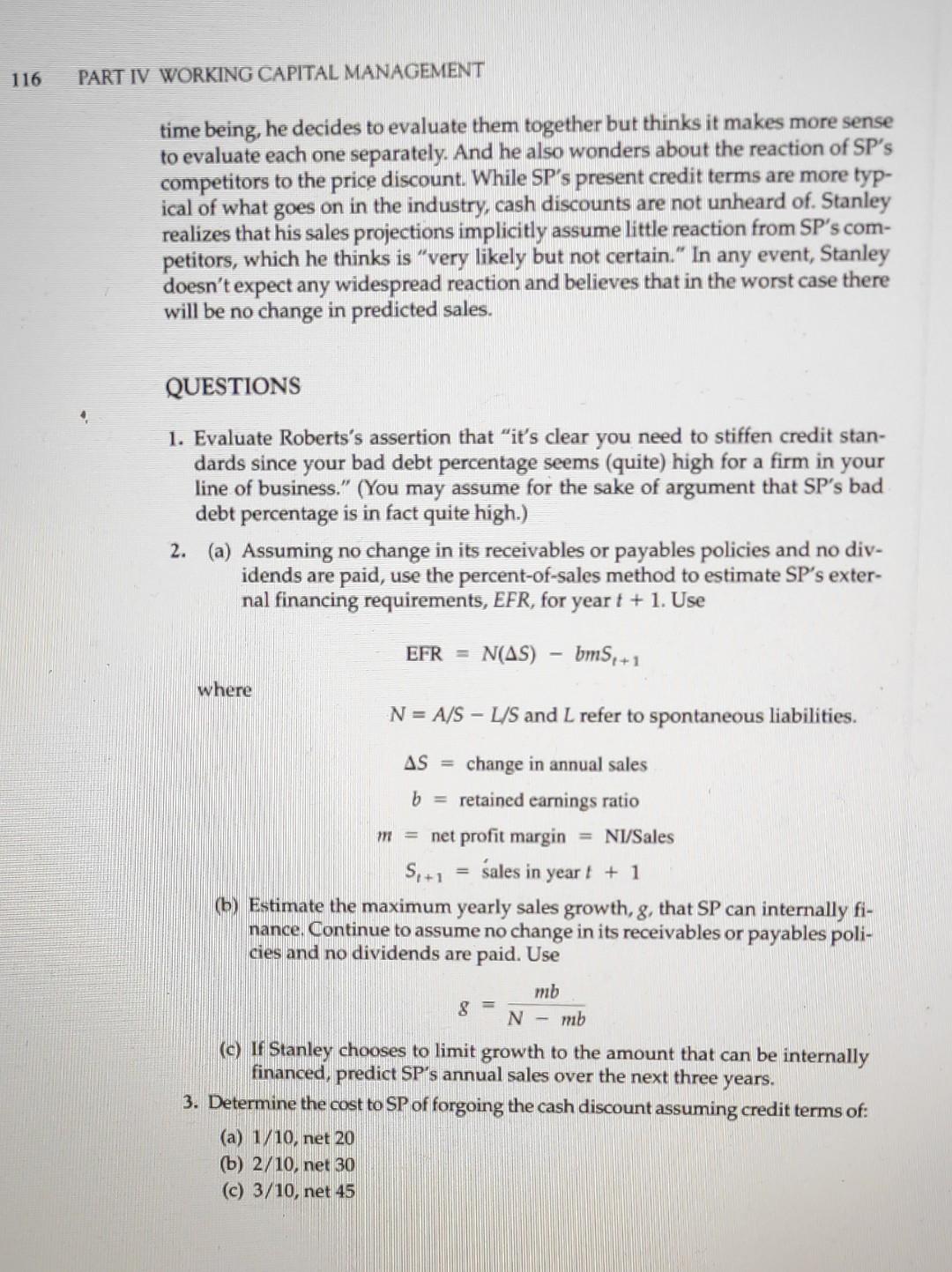

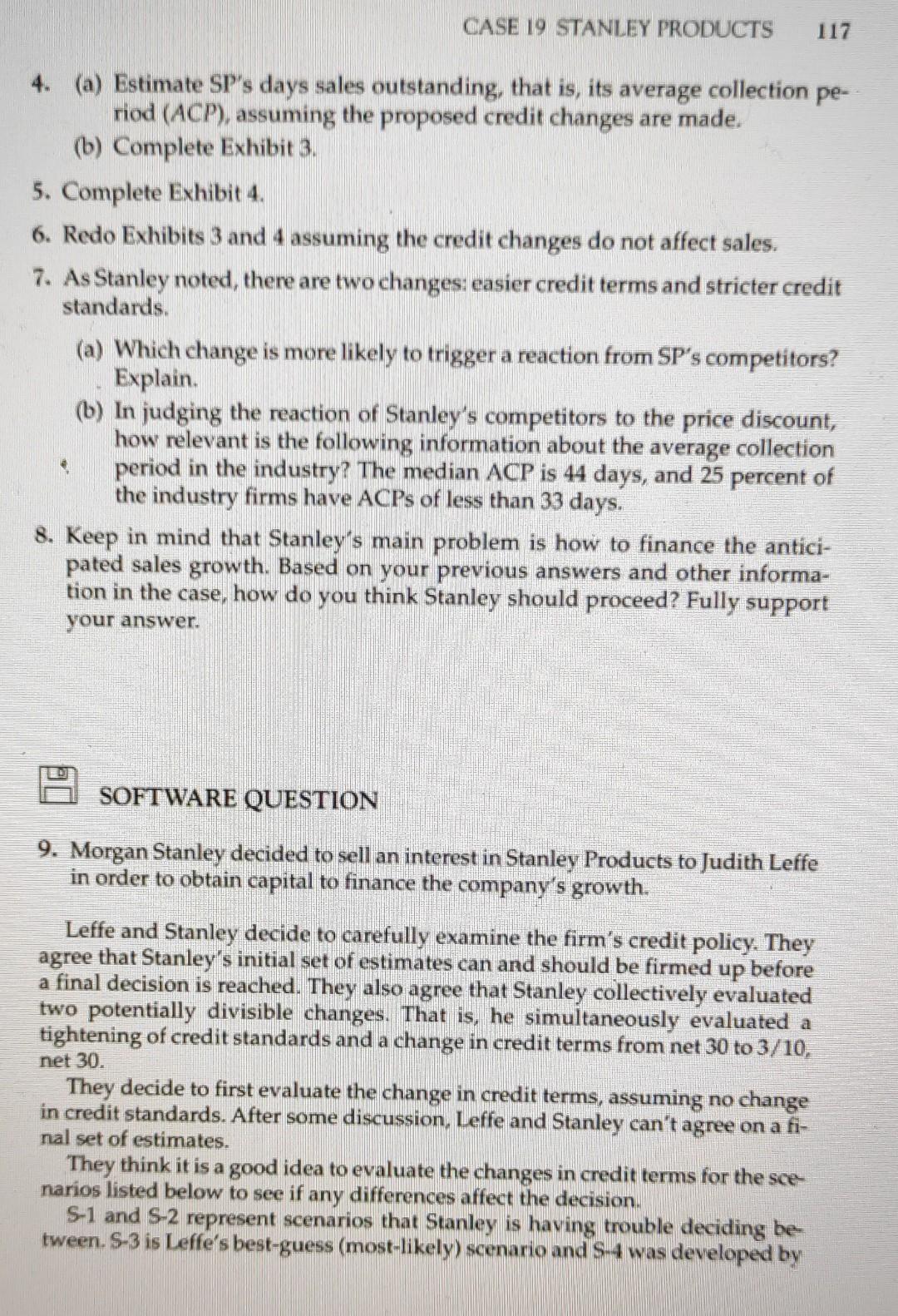

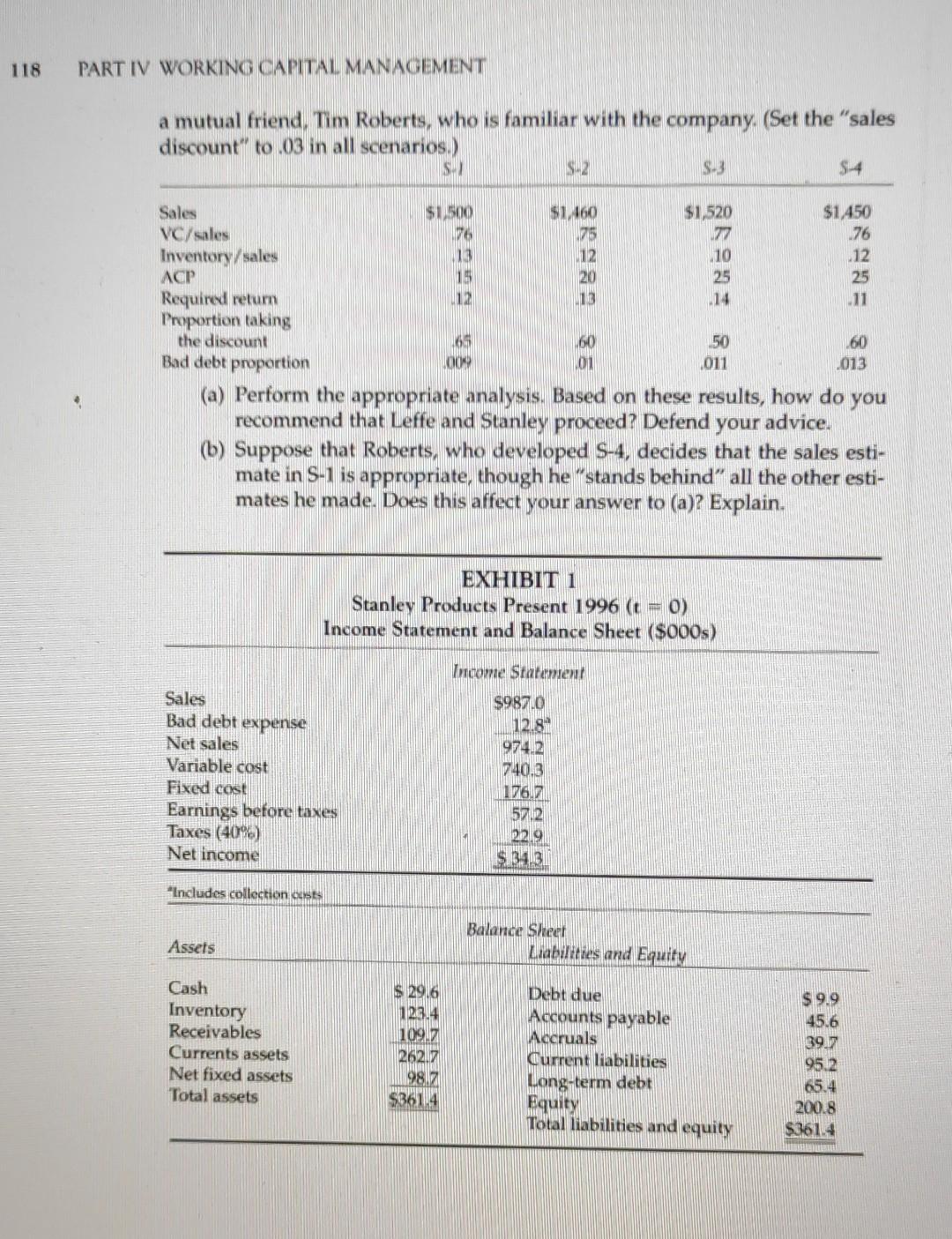

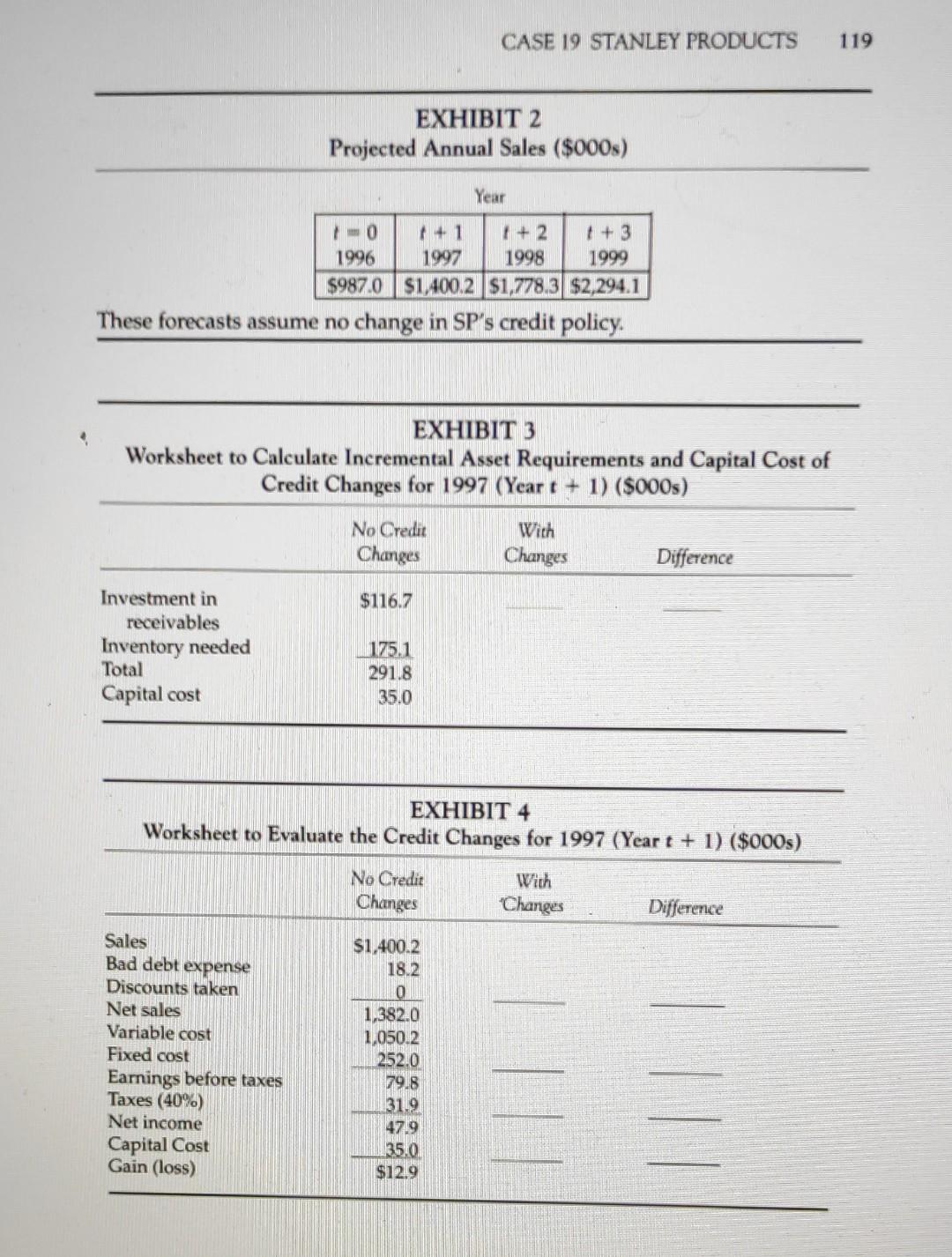

CASE 19 STANLEY PRODUCTS CREDIT POLICY Twenty-nine-years old and already the inventor of two patented products, Morgan Stanley has unquestioned technical expertise. Stanley grew up in his dad's sealant business and four years ago, in 1992, decided to start Stanus Products (SP), his own company. A chemistry major. Stanley thoroughly enjoys the research and development side of the business, which he pursues mainly on weekends. It is literally true that SP is Stanley's vocation and avocation. And he has developed a number of products for commercial and home use. He is espe- cially proud of Quick Jel, an adhesive with improved qualities, and NoRust, an unusually effective and easy-to-use rust treatment in aerosol form. SP has something of a regional reputation, and sales reached nearly si mil- lion in the most recent fiscal year. At the suggestion of a colleague Faith Allen, Stanley set up exhibits at a number of trade shows. He was at first reluctant to take the time from the day-to-day operation of the business to do so, but Allen persuasively argued that this was a relatively inexpensive way to gain exposure. Good advice, it appears, judging by the expected sales for the next three years. (See Exhibit 2.) Based on advance orders and the unusually large number of product in- quiries, Stanley believes that sales will increase by over 40 percent next year (1997) and will more than double in three years. These forecasts flatter Stanley's scientific side because they imply that users recognize the technical superiority of SP's products. His business side is more cautious, however. Such large growth will undoubtedly require external financing, and Stanley is unsure how best to raise any needed funds, especially since his ability to supply capital is quite limited 114 PART IV WORKING CAPITAL MANAGEMENT BANK FINANCING Stanley's first reaction is to approach First National, SP's bank. No formal re- quest has been made, but conversations with Tina McClellan, a loan officer, in- dicate that the best rate Stanley can expect is 13 percent, somewhat higher than Stanley expected. She cautioned, however, that SP might not be able to obtain any loan whatsoever. The main problems, McClellan explained, are the soft economy and regulators who are forcing banks to be stricter. Tighter credit stan- dards are simply an inevitable consequence of all this, with the result that a sort of two-tiered loan structure develops. Larger, more stable businesses are on one tier. Because they are considered to be more creditworthy, they get the loans. And they get a reasonable rate because they generate transaction revenue well over five figures per year. Small businesses, like SP are the second tier. Lenders will require of them greater loan documentation, more collateral, and higher rates. And in many cases small firms will be denied any loan at all. McClellan urged Stanley to make any request "very well justified and suggested he shop around and look at other banks, OTHER OPTIONS Discouraged by this conversation, Stanley met with Tim Roberts, a lifelong friend and Stanley's informal business adviser Over lunch they listed other op- tions that Stanley might pursue 1. Pass up trade discounts and use suppliers with the longest pay period. Most of SP's purveyors offer 2/10, net 30. That is, SP receives a 2 percent cash dis- count if it pays within 10 days and is allowed 30 days if it passes up the dis- count. A few suppliers offer 1/10 net 20 and, in some cases, SP receives 2/10, 45. Stanley would, of course, be careful not to take so long to pay as to en- danger his credit standing, 2. Offer more enticing credit terms in order to shorten the firm's average col- lection period. SP currently offers net 30, and would consider 3/10, net 30. 3. Limit growth to what can be internally financed. 4. Take in a partner. 5. Reduce the firm's inventory and fixed-asset requirements. Stanley quickly dismisses the fifth possibility. He is quite capable at the pro- duction side of the business and feels that there is little slack in these items. Though Stanley finds the limit-growth and partner options distasteful, he can see advantages to each. By capping annual growth it is more likely that the firm will not get out of control. He is painfully aware of one area company that went under a few years ago because of (according to the corporate grapevine too much growth too fast. CASE 19 STANLEY PRODUCTS 115 Taking in a partner represents the flip side of the preceding option. Stanley believes that with some searching, he could find an individual who would not only supply capital but also would be willing to assume managerial responsi- bilities. Such a person-properly selectedwould allow Stanley to concentrate on the technical side of the company that he enjoys so much. Roberts thinks the first two options are worth pursuing and proceeds to state their case. "Look at it this way," he muses. "Think of your purveyors as mini- banks, each capable of providing you a bit of credit. True, no single one of these minibanks provides much financing, but put them all together and I bet you'll end up with a sizeable amount, especially if you can locate more suppliers will- ing to let you take 45 days to pay. And think of your receivables as miniloans you make. If these loans are paid earlier, that means more cash for you. Put all this together and, who knows, perhaps you can tell your bank to take a hike politely, of course." And Roberts has a suggestion regarding SP's credit stan- dards. He is a bit alarmed at the firm's bad debt expense, which is 1.3 percent of sales. "It's clear you need to stiffen credit standards since your bad debt per- centage seems pretty darn high for a firm in your line of business." STANLEY'S REACTION Impressed with Roberts's arguments, Stanley decides to pursue these options first. After some thought he decides to consider altering SP's credit terms from net 30 to 3/10, 30; that is, he would offer a 3 percent discount to customers who pay within 10 days, and 30 days of credit would be offered to customers who pass up the discount. At the same time he would also tighten SP's credit stan- dards, as Roberts suggested. Stanley believes that 60 percent of sales will involve the 3 percent discount, and these buyers will take the full 10 days to pay. He also thinks that 30 percent of the sales will be paid on day 30 and 10 percent will be late on day 50. Further, bad debt expense, including collection costs, is predicted to be 0.7 percent of sales. The proposed changes in SP's credit terms and standards should affect sales in two ways. On one hand, the cash discount will attract new customers. On the other hand, the tighter credit standards will result in SP losing some customers, Stanley believes, however, that the sales-enhancing effect will dominate, and he predicts an increase of 5 percent in sales. (Note: The forecasts in Exhibit 2 are based on the existing credit policy.) Variable cost is predicted to remain at 75 percent of sales. The percent of sales method can be used to determine inventory requirements, and the appropriate after-tax cost of capital (required return) is 12 percent for any funds tied up in receivables and inventory. Plant and equipment needs will remain unaffected by the relatively modest sales changes that might result from the credit changes. As Stanley ponders these issues, a number of points cross his mind. He no- tices that there are really two separate questions to answer: Is it a good idea to alter the terms of credit? Is it a good idea to tighten credit standards? For the 116 PART IV WORKING CAPITAL MANAGEMENT time being, he decides to evaluate them together but thinks it makes more sense to evaluate each one separately. And he also wonders about the reaction of SP's competitors to the price discount. While SP's present credit terms are more typ- ical of what goes on in the industry, cash discounts are not unheard of. Stanley realizes that his sales projections implicitly assume little reaction from SP's com- petitors, which he thinks is "very likely but not certain." In any event, Stanley doesn't expect any widespread reaction and believes that in the worst case there will be no change in predicted sales. QUESTIONS 1. Evaluate Roberts's assertion that "it's clear you need to stiffen credit stan- dards since your bad debt percentage seems (quite) high for a firm in your line of business." (You may assume for the sake of argument that SP's bad debt percentage is in fact quite high.) 2. (a) Assuming no change in its receivables or payables policies and no div- idends are paid, use the percent-of-sales method to estimate SP's exter- nal financing requirements, EFR, for year t + 1. Use EFR = N(AS) - bm5+1 where N = A/S - L/S and L refer to spontaneous liabilities. AS = change in annual sales b = retained earnings ratio m = net profit margin = NI/Sales S,+1 = sales in year t + 1 (b) Estimate the maximum yearly sales growth, g, that SP can internally fi- nance. Continue to assume no change in its receivables or payables poli- cies and no dividends are paid. Use mb 8 = N - mb (c) If Stanley chooses to limit growth to the amount that can be internally financed, predict SP's annual sales over the next three years. 3. Determine the cost to SP of forgoing the cash discount assuming credit terms of: (a) 1/10, net 20 (b) 2/10, net 30 (C) 3/10, net 45 CASE 19 STANLEY PRODUCTS 117 4. (a) Estimate SP's days sales outstanding, that is, its average collection pe- riod (ACP), assuming the proposed credit changes are made. (b) Complete Exhibit 3. 5. Complete Exhibit 4. 6. Redo Exhibits 3 and 4 assuming the credit changes do not affect sales. 7. As Stanley noted, there are two changes easier credit terms and stricter credit standards (a) Which change is more likely to trigger a reaction from SP's competitors? Explain. (b) In judging the reaction of Stanley's competitors to the price discount, how relevant is the following information about the average collection period in the industry? The median ACP is 44 days, and 25 percent of the industry firms have ACPs of less than 33 days. 8. Keep in mind that Stanley's main problem is how to finance the antici- pated sales growth. Based on your previous answers and other informa- tion in the case, how do you think Stanley should proceed? Fully support your answer. SOFTWARE QUESTION 9. Morgan Stanley decided to sell an interest in Stanley Products to Judith Leffe in order to obtain capital to finance the company's growth. Leffe and Stanley decide to carefully examine the firm's credit policy. They agree that Stanley's initial set of estimates can and should be firmed up before a final decision is reached. They also agree that Stanley collectively evaluated two potentially divisible changes. That is, he simultaneously evaluated a tightening of credit standards and a change in credit terms from net 30 to 3/10, net 30. They decide to first evaluate the change in credit terms, assuming no change in credit standards. After some discussion, Leffe and Stanley can't agree on a fi- nal set of estimates. They think it is a good idea to evaluate the changes in credit terms for the sce narios listed below to see if any differences affect the decision. S-1 and S-2 represent scenarios that Stanley is having trouble deciding be tween. S-3 is Leffe's best-guess (most-likely) scenario and S-4 was developed by 118 PART IV WORKING CAPITAL MANAGEMENT a mutual friend, Tim Roberts, who is familiar with the company. (Set the "sales discount" to 03 in all scenarios.) S. S-2 $.3 $ 4 KSSR 20 12 14 Sales $1.500 $1,460 $1,520 $1.450 VC/sales 76 175 177 176 Inventory/sales 13 12 10 .12 ACP 15 25 25 Required return 13 11 Proportion taking the discount 166 60 50 160 Bad debt proportion 009 011 2013 (a) Perform the appropriate analysis. Based on these results, how do you recommend that Leffe and Stanley proceed? Defend your advice. (b) Suppose that Roberts, who developed S-4, decides that the sales esti- mate in S-1 is appropriate, though he'stands behind" all the other esti- mates he made. Does this affect your answer to (a)? Explain. 011 EXHIBIT 1 Stanley Products Present 1996 (t = 0) Income Statement and Balance Sheet ($000s) Income Statement Sales Bad debt expense Net sales Variable cost Fixed cost Earnings before taxes Taxes (40%) Net income $987.0 12.8 9742 740.3 176.7 5702 229 $ 343 *Includes collection Cust Assets Balance Sheer Liabilities and Equity Cash Inventory Receivables Currents assets Net fixed assets Total assets $ 2916 1234 1097 26217 9817 Debt due Accounts payable Accruals Current Liabilities Long-term debt Equity Total liabilities and equity $9.9 45.6 395 952 65.4 200.8 $3614 $8614 CASE 19 STANLEY PRODUCTS 119 EXHIBIT 2 Projected Annual Sales ($000s) Year 0 +1 1 + 2 + 3 1996 1997 1998 1999 $987.0 $1,400.2 $1,778.3 $2,294.1 These forecasts assume no change in SP's credit policy. EXHIBIT 3 Worksheet to Calculate Incremental Asset Requirements and Capital Cost of Credit Changes for 1997 (Year 1 + 1) ($000s) No Credit Changes With Changes Difference $116.7 Investment in receivables Inventory needed Total Capital cost 175.1 291.8 35.0 EXHIBIT 4 Worksheet to Evaluate the Credit Changes for 1997 (Yeart + 1) ($000s) No Credit Changes With *Changes Difference Sales Bad debt expense Discounts taken Net sales Variable cost Fixed cost Earnings before taxes Taxes (40%) Net income Capital Cost Gain (loss) $1,400.2 18.2 0 1,382.0 1,050.2 252.0 79.8 31.9 47.9 135.0 $12.9 CASE 19 STANLEY PRODUCTS CREDIT POLICY Twenty-nine-years old and already the inventor of two patented products, Morgan Stanley has unquestioned technical expertise. Stanley grew up in his dad's sealant business and four years ago, in 1992, decided to start Stanus Products (SP), his own company. A chemistry major. Stanley thoroughly enjoys the research and development side of the business, which he pursues mainly on weekends. It is literally true that SP is Stanley's vocation and avocation. And he has developed a number of products for commercial and home use. He is espe- cially proud of Quick Jel, an adhesive with improved qualities, and NoRust, an unusually effective and easy-to-use rust treatment in aerosol form. SP has something of a regional reputation, and sales reached nearly si mil- lion in the most recent fiscal year. At the suggestion of a colleague Faith Allen, Stanley set up exhibits at a number of trade shows. He was at first reluctant to take the time from the day-to-day operation of the business to do so, but Allen persuasively argued that this was a relatively inexpensive way to gain exposure. Good advice, it appears, judging by the expected sales for the next three years. (See Exhibit 2.) Based on advance orders and the unusually large number of product in- quiries, Stanley believes that sales will increase by over 40 percent next year (1997) and will more than double in three years. These forecasts flatter Stanley's scientific side because they imply that users recognize the technical superiority of SP's products. His business side is more cautious, however. Such large growth will undoubtedly require external financing, and Stanley is unsure how best to raise any needed funds, especially since his ability to supply capital is quite limited 114 PART IV WORKING CAPITAL MANAGEMENT BANK FINANCING Stanley's first reaction is to approach First National, SP's bank. No formal re- quest has been made, but conversations with Tina McClellan, a loan officer, in- dicate that the best rate Stanley can expect is 13 percent, somewhat higher than Stanley expected. She cautioned, however, that SP might not be able to obtain any loan whatsoever. The main problems, McClellan explained, are the soft economy and regulators who are forcing banks to be stricter. Tighter credit stan- dards are simply an inevitable consequence of all this, with the result that a sort of two-tiered loan structure develops. Larger, more stable businesses are on one tier. Because they are considered to be more creditworthy, they get the loans. And they get a reasonable rate because they generate transaction revenue well over five figures per year. Small businesses, like SP are the second tier. Lenders will require of them greater loan documentation, more collateral, and higher rates. And in many cases small firms will be denied any loan at all. McClellan urged Stanley to make any request "very well justified and suggested he shop around and look at other banks, OTHER OPTIONS Discouraged by this conversation, Stanley met with Tim Roberts, a lifelong friend and Stanley's informal business adviser Over lunch they listed other op- tions that Stanley might pursue 1. Pass up trade discounts and use suppliers with the longest pay period. Most of SP's purveyors offer 2/10, net 30. That is, SP receives a 2 percent cash dis- count if it pays within 10 days and is allowed 30 days if it passes up the dis- count. A few suppliers offer 1/10 net 20 and, in some cases, SP receives 2/10, 45. Stanley would, of course, be careful not to take so long to pay as to en- danger his credit standing, 2. Offer more enticing credit terms in order to shorten the firm's average col- lection period. SP currently offers net 30, and would consider 3/10, net 30. 3. Limit growth to what can be internally financed. 4. Take in a partner. 5. Reduce the firm's inventory and fixed-asset requirements. Stanley quickly dismisses the fifth possibility. He is quite capable at the pro- duction side of the business and feels that there is little slack in these items. Though Stanley finds the limit-growth and partner options distasteful, he can see advantages to each. By capping annual growth it is more likely that the firm will not get out of control. He is painfully aware of one area company that went under a few years ago because of (according to the corporate grapevine too much growth too fast. CASE 19 STANLEY PRODUCTS 115 Taking in a partner represents the flip side of the preceding option. Stanley believes that with some searching, he could find an individual who would not only supply capital but also would be willing to assume managerial responsi- bilities. Such a person-properly selectedwould allow Stanley to concentrate on the technical side of the company that he enjoys so much. Roberts thinks the first two options are worth pursuing and proceeds to state their case. "Look at it this way," he muses. "Think of your purveyors as mini- banks, each capable of providing you a bit of credit. True, no single one of these minibanks provides much financing, but put them all together and I bet you'll end up with a sizeable amount, especially if you can locate more suppliers will- ing to let you take 45 days to pay. And think of your receivables as miniloans you make. If these loans are paid earlier, that means more cash for you. Put all this together and, who knows, perhaps you can tell your bank to take a hike politely, of course." And Roberts has a suggestion regarding SP's credit stan- dards. He is a bit alarmed at the firm's bad debt expense, which is 1.3 percent of sales. "It's clear you need to stiffen credit standards since your bad debt per- centage seems pretty darn high for a firm in your line of business." STANLEY'S REACTION Impressed with Roberts's arguments, Stanley decides to pursue these options first. After some thought he decides to consider altering SP's credit terms from net 30 to 3/10, 30; that is, he would offer a 3 percent discount to customers who pay within 10 days, and 30 days of credit would be offered to customers who pass up the discount. At the same time he would also tighten SP's credit stan- dards, as Roberts suggested. Stanley believes that 60 percent of sales will involve the 3 percent discount, and these buyers will take the full 10 days to pay. He also thinks that 30 percent of the sales will be paid on day 30 and 10 percent will be late on day 50. Further, bad debt expense, including collection costs, is predicted to be 0.7 percent of sales. The proposed changes in SP's credit terms and standards should affect sales in two ways. On one hand, the cash discount will attract new customers. On the other hand, the tighter credit standards will result in SP losing some customers, Stanley believes, however, that the sales-enhancing effect will dominate, and he predicts an increase of 5 percent in sales. (Note: The forecasts in Exhibit 2 are based on the existing credit policy.) Variable cost is predicted to remain at 75 percent of sales. The percent of sales method can be used to determine inventory requirements, and the appropriate after-tax cost of capital (required return) is 12 percent for any funds tied up in receivables and inventory. Plant and equipment needs will remain unaffected by the relatively modest sales changes that might result from the credit changes. As Stanley ponders these issues, a number of points cross his mind. He no- tices that there are really two separate questions to answer: Is it a good idea to alter the terms of credit? Is it a good idea to tighten credit standards? For the 116 PART IV WORKING CAPITAL MANAGEMENT time being, he decides to evaluate them together but thinks it makes more sense to evaluate each one separately. And he also wonders about the reaction of SP's competitors to the price discount. While SP's present credit terms are more typ- ical of what goes on in the industry, cash discounts are not unheard of. Stanley realizes that his sales projections implicitly assume little reaction from SP's com- petitors, which he thinks is "very likely but not certain." In any event, Stanley doesn't expect any widespread reaction and believes that in the worst case there will be no change in predicted sales. QUESTIONS 1. Evaluate Roberts's assertion that "it's clear you need to stiffen credit stan- dards since your bad debt percentage seems (quite) high for a firm in your line of business." (You may assume for the sake of argument that SP's bad debt percentage is in fact quite high.) 2. (a) Assuming no change in its receivables or payables policies and no div- idends are paid, use the percent-of-sales method to estimate SP's exter- nal financing requirements, EFR, for year t + 1. Use EFR = N(AS) - bm5+1 where N = A/S - L/S and L refer to spontaneous liabilities. AS = change in annual sales b = retained earnings ratio m = net profit margin = NI/Sales S,+1 = sales in year t + 1 (b) Estimate the maximum yearly sales growth, g, that SP can internally fi- nance. Continue to assume no change in its receivables or payables poli- cies and no dividends are paid. Use mb 8 = N - mb (c) If Stanley chooses to limit growth to the amount that can be internally financed, predict SP's annual sales over the next three years. 3. Determine the cost to SP of forgoing the cash discount assuming credit terms of: (a) 1/10, net 20 (b) 2/10, net 30 (C) 3/10, net 45 CASE 19 STANLEY PRODUCTS 117 4. (a) Estimate SP's days sales outstanding, that is, its average collection pe- riod (ACP), assuming the proposed credit changes are made. (b) Complete Exhibit 3. 5. Complete Exhibit 4. 6. Redo Exhibits 3 and 4 assuming the credit changes do not affect sales. 7. As Stanley noted, there are two changes easier credit terms and stricter credit standards (a) Which change is more likely to trigger a reaction from SP's competitors? Explain. (b) In judging the reaction of Stanley's competitors to the price discount, how relevant is the following information about the average collection period in the industry? The median ACP is 44 days, and 25 percent of the industry firms have ACPs of less than 33 days. 8. Keep in mind that Stanley's main problem is how to finance the antici- pated sales growth. Based on your previous answers and other informa- tion in the case, how do you think Stanley should proceed? Fully support your answer. SOFTWARE QUESTION 9. Morgan Stanley decided to sell an interest in Stanley Products to Judith Leffe in order to obtain capital to finance the company's growth. Leffe and Stanley decide to carefully examine the firm's credit policy. They agree that Stanley's initial set of estimates can and should be firmed up before a final decision is reached. They also agree that Stanley collectively evaluated two potentially divisible changes. That is, he simultaneously evaluated a tightening of credit standards and a change in credit terms from net 30 to 3/10, net 30. They decide to first evaluate the change in credit terms, assuming no change in credit standards. After some discussion, Leffe and Stanley can't agree on a fi- nal set of estimates. They think it is a good idea to evaluate the changes in credit terms for the sce narios listed below to see if any differences affect the decision. S-1 and S-2 represent scenarios that Stanley is having trouble deciding be tween. S-3 is Leffe's best-guess (most-likely) scenario and S-4 was developed by 118 PART IV WORKING CAPITAL MANAGEMENT a mutual friend, Tim Roberts, who is familiar with the company. (Set the "sales discount" to 03 in all scenarios.) S. S-2 $.3 $ 4 KSSR 20 12 14 Sales $1.500 $1,460 $1,520 $1.450 VC/sales 76 175 177 176 Inventory/sales 13 12 10 .12 ACP 15 25 25 Required return 13 11 Proportion taking the discount 166 60 50 160 Bad debt proportion 009 011 2013 (a) Perform the appropriate analysis. Based on these results, how do you recommend that Leffe and Stanley proceed? Defend your advice. (b) Suppose that Roberts, who developed S-4, decides that the sales esti- mate in S-1 is appropriate, though he'stands behind" all the other esti- mates he made. Does this affect your answer to (a)? Explain. 011 EXHIBIT 1 Stanley Products Present 1996 (t = 0) Income Statement and Balance Sheet ($000s) Income Statement Sales Bad debt expense Net sales Variable cost Fixed cost Earnings before taxes Taxes (40%) Net income $987.0 12.8 9742 740.3 176.7 5702 229 $ 343 *Includes collection Cust Assets Balance Sheer Liabilities and Equity Cash Inventory Receivables Currents assets Net fixed assets Total assets $ 2916 1234 1097 26217 9817 Debt due Accounts payable Accruals Current Liabilities Long-term debt Equity Total liabilities and equity $9.9 45.6 395 952 65.4 200.8 $3614 $8614 CASE 19 STANLEY PRODUCTS 119 EXHIBIT 2 Projected Annual Sales ($000s) Year 0 +1 1 + 2 + 3 1996 1997 1998 1999 $987.0 $1,400.2 $1,778.3 $2,294.1 These forecasts assume no change in SP's credit policy. EXHIBIT 3 Worksheet to Calculate Incremental Asset Requirements and Capital Cost of Credit Changes for 1997 (Year 1 + 1) ($000s) No Credit Changes With Changes Difference $116.7 Investment in receivables Inventory needed Total Capital cost 175.1 291.8 35.0 EXHIBIT 4 Worksheet to Evaluate the Credit Changes for 1997 (Yeart + 1) ($000s) No Credit Changes With *Changes Difference Sales Bad debt expense Discounts taken Net sales Variable cost Fixed cost Earnings before taxes Taxes (40%) Net income Capital Cost Gain (loss) $1,400.2 18.2 0 1,382.0 1,050.2 252.0 79.8 31.9 47.9 135.0 $12.9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started