Answered step by step

Verified Expert Solution

Question

1 Approved Answer

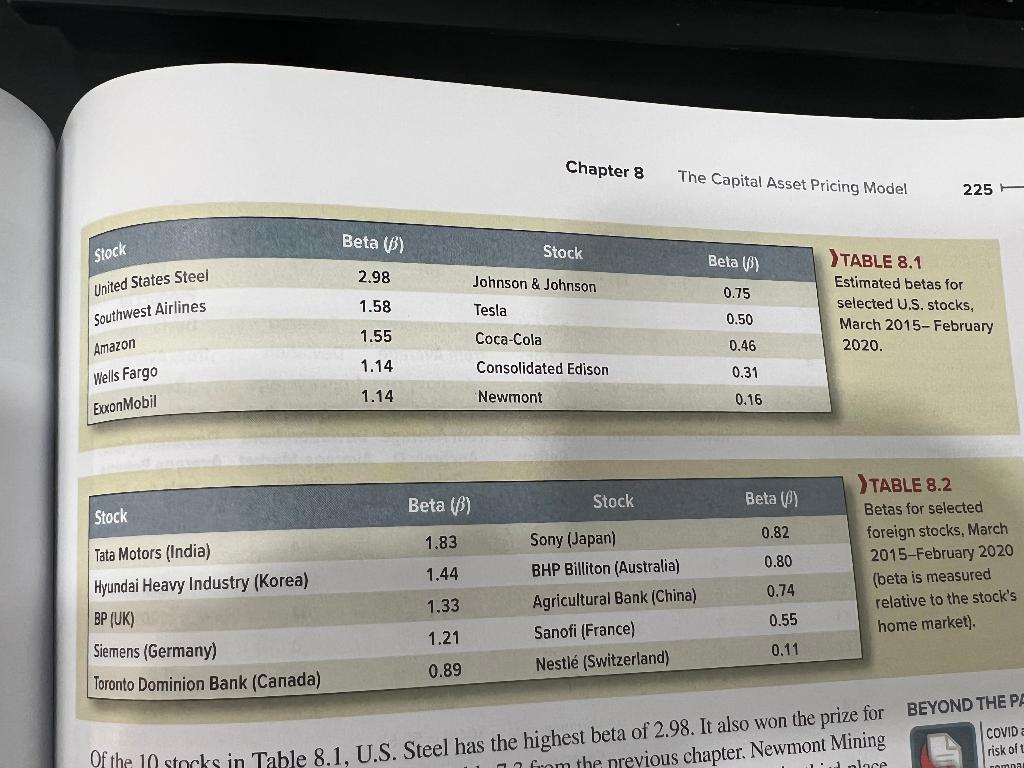

could you explain #5? Chapter 8 The Capital Asset Pricing Model 225 TABLE 8.1 stimated betas for elected U.S. stocks, Aarch 2015- February 2020. TABLE

could you explain #5?

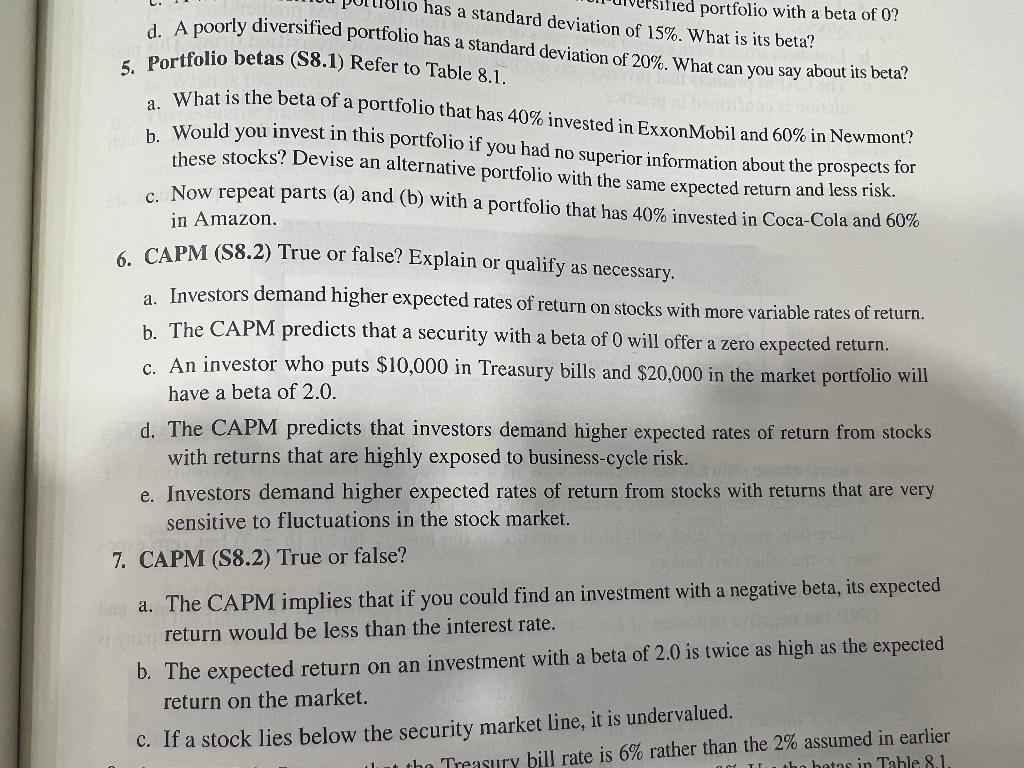

Chapter 8 The Capital Asset Pricing Model 225 TABLE 8.1 stimated betas for elected U.S. stocks, Aarch 2015- February 2020. TABLE 8.2 Betas for selected foreign stocks, March 2015-February 2020 (beta is measured relative to the stock's home market). Of the 10 stocks in Table 8.1, U.S. Steel has the highest beta of 2.98. It also won the prize for teviation of 20%. What can you say about its beta? a. What is the beta of a portfolio that has 40% invested in ExxonMobil and 60% in Newmont? b. Would you invest in this portfolio if you had no superior information about the prospects for these stocks? Devise an alternative portfolio with the same expected return and less risk. c. Now repeat parts (a) and (b) with a portfolio that has 40% invested in Coca-Cola and 60% in Amazon. 6. CAPM (S8.2) True or false? Explain or qualify as necessary. a. Investors demand higher expected rates of return on stocks with more variable rates of return. b. The CAPM predicts that a security with a beta of 0 will offer a zero expected return. c. An investor who puts $10,000 in Treasury bills and $20,000 in the market portfolio will have a beta of 2.0. d. The CAPM predicts that investors demand higher expected rates of return from stocks with returns that are highly exposed to business-cycle risk. e. Investors demand higher expected rates of return from stocks with returns that are very sensitive to fluctuations in the stock market. 7. CAPM (S8.2) True or false? a. The CAPM implies that if you could find an investment with a negative beta, its expected return would be less than the interest rate. b. The expected return on an investment with a beta of 2.0 is twice as high as the expected return on the market. c. If a stock lies below the security market line, it is undervaluedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started