Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you help answer Questions 3a & 3b.? ATLANTIC HEALTHCARE CASE STUDY 4 STOCK VALUATION ATLANTIC HEALTHCARE is an investor owned hospital chain that owns

could you help answer Questions 3a & 3b.?

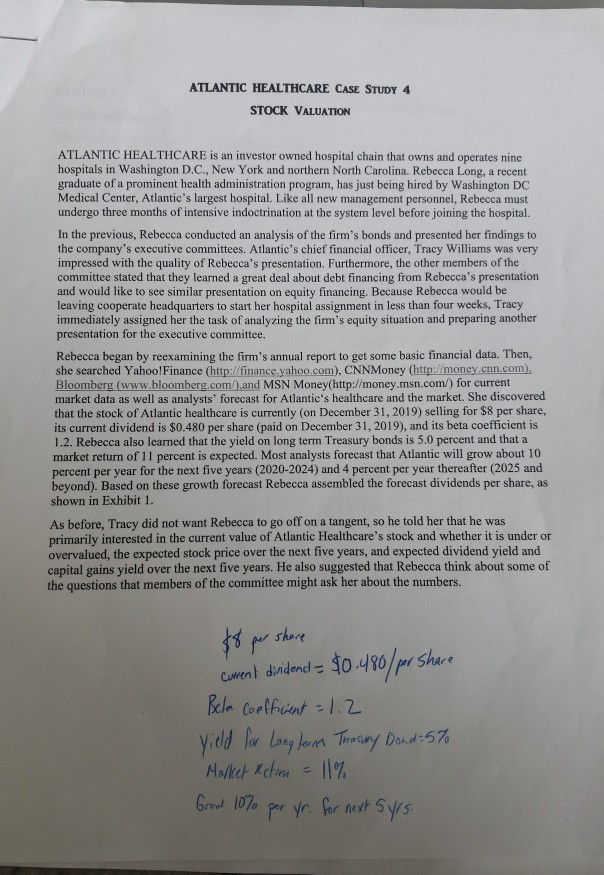

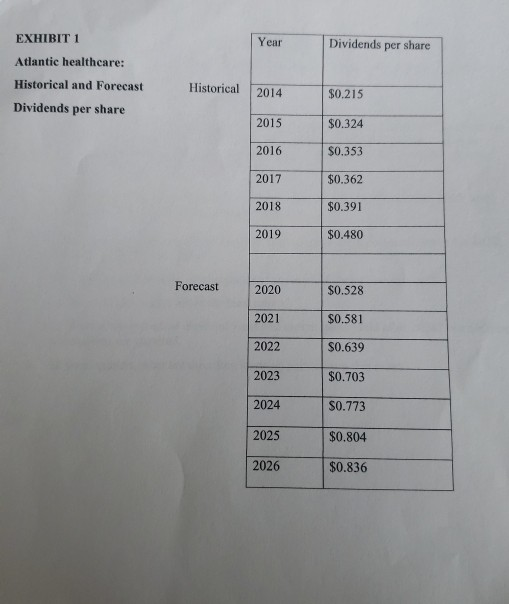

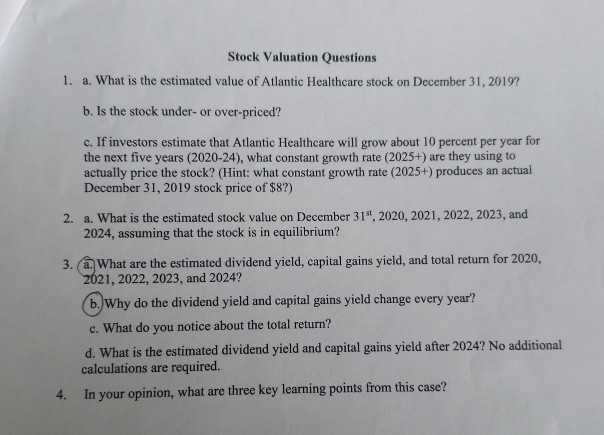

ATLANTIC HEALTHCARE CASE STUDY 4 STOCK VALUATION ATLANTIC HEALTHCARE is an investor owned hospital chain that owns and operates nine hospitals in Washington D.C., New York and northern North Carolina. Rebecca Long, a recent graduate of a prominent health administration program, has just being hired by Washington DC Medical Center, Atlantic's largest hospital. Like all new management personnel, Rebecca must undergo three months of intensive indoctrination at the system level before joining the hospital In the previous, Rebecca conducted an analysis of the firm's bonds and presented her findings to the company's executive committees. Atlantic's chief financial officer, Tracy Williams was very impressed with the quality of Rebecca's presentation. Furthermore, the other members of the committee stated that they learned a great deal about debt financing from Rebecca's presentation and would like to see similar presentation on equity financing. Because Rebecca would be leaving cooperate headquarters to start her hospital assignment in less than four weeks, Tracy immediately assigned her the task of analyzing the firm's equity situation and preparing another presentation for the executive committee. Rebecca began by reexamining the firm's annual report to get some basic financial data. Then, she searched Yahoo! Finance (http://finance.yahoo.com), CNNMoney (http://money.cnn.com), Bloomberg (www.bloombers.com/) and MSN Money(http://money.msn.com/) for current market data as well as analysts' forecast for Atlantic's healthcare and the market. She discovered that the stock of Atlantic healthcare is currently on December 31, 2019) selling for $8 per share, its current dividend is $0.480 per share (paid on December 31, 2019), and its beta coefficient is 1.2. Rebecca also learned that the yield on long term Treasury bonds is 5.0 percent and that a market return of 11 percent is expected. Most analysts forecast that Atlantic will grow about 10 percent per year for the next five years (2020-2024) and 4 percent per year thereafter (2025 and beyond). Based on these growth forecast Rebecca assembled the forecast dividends per share, as shown in Exhibit 1. As before, Tracy did not want Rebecca to go off on a tangent, so he told her that he was primarily interested in the current value of Atlantic Healthcare's stock and whether it is under or overvalued, the expected stock price over the next five years, and expected dividend yield and capital gains yield over the next five years. He also suggested that Rebecca think about some of the questions that members of the committee might ask her about the numbers. 88 per share current dividend = $0.480/per Share Bela Coefficient = 1.2 yield for long term Treasury Dond: 5% Market Ketone = 11% Grow 10% per yr. for next Syrs. EXHIBIT 1 Year Dividends per share Atlantic healthcare: Historical and Forecast Dividends per share Historical 2014 $0.215 2015 $0.324 2016 $0.353 2017 $0.362 2018 $0.391 2019 $0.480 Forecast 2020 $0.528 2021 $0.581 2022 $0.639 2023 $0.703 2024 $0.773 2025 $0.804 2026 $0.836 Stock Valuation Questions 1. a. What is the estimated value of Atlantic Healthcare stock on December 31, 2019? b. Is the stock under-or over-priced? c. If investors estimate that Atlantic Healthcare will grow about 10 percent per year for the next five years (2020-24), what constant growth rate (2025+) are they using to actually price the stock? (Hint: what constant growth rate (2025+) produces an actual December 31, 2019 stock price of $87) 2. a. What is the estimated stock value on December 31", 2020, 2021, 2022, 2023, and 2024, assuming that the stock is in equilibrium? 3. a. What are the estimated dividend yield, capital gains yield, and total return for 2020, 2021, 2022, 2023, and 2024? (b.)Why do the dividend yield and capital gains yield change every year? c. What do you notice about the total return? d. What is the estimated dividend yield and capital gains yield after 2024? No additional calculations are required. 4. In your opinion, what are three key learning points from this caseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started