Question

I need step by step calculator computations for Parts I,II,& III (Expected NPV,Standard deviation, CV,& the value of the option). I will rate. Computations need

I need step by step calculator computations for Parts I,II,& III (Expected NPV,Standard deviation, CV,& the value of the option). I will rate. Computations need to be in this format:

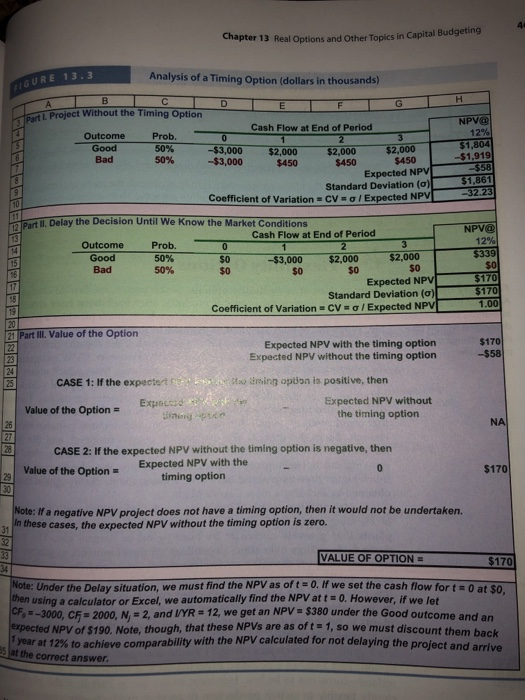

Part I: Project without the Growth Option:

NPV (Good): You can use row 2 of the calculator with the following inputs:

CF0 = -3000; C01 = 1500; F01 = 3; I = 12; CPT NPV; NPV = $603

Note: If you don't feel comfortable using the frequency key, you can enter the cash flows as follows:

CF0 = -3000; C01 = 1500; F01 = 1; C02 = 1500; F02 = 1; C03 = 1500; F03 =1

You follow the same procedure for the bad outcome and you get NPV = -$358

Expected NPV:

(.5*603) + (.5*(-358)) = $122

Standard Deviation:

SQRT[..5(603-122)^2 + .5(-358-122)^2] = $480

CV:

480/122 = 3.93

Part II: Project with the Option

The calculations are identical to part I. When you follow the calculations noted above, you get the following numbers:

Expected NPV = $1,503

Std. Dev. = $1,861

CV = 1.24

Part III: Value of the Option

Value of the option is the expected NPV with the option - expected NPV without the option. In this case:

Value of the option = $1,503 - $122 = $1,381

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started