Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you help me answer the question C in the third photo plz. What information you need? You can check the 2019 financial result of

Could you help me answer the question C in the third photo plz.

What information you need? You can check the 2019 financial result of AIR NEWZEALAND from their homepage, please Google it, this question is really puzzled

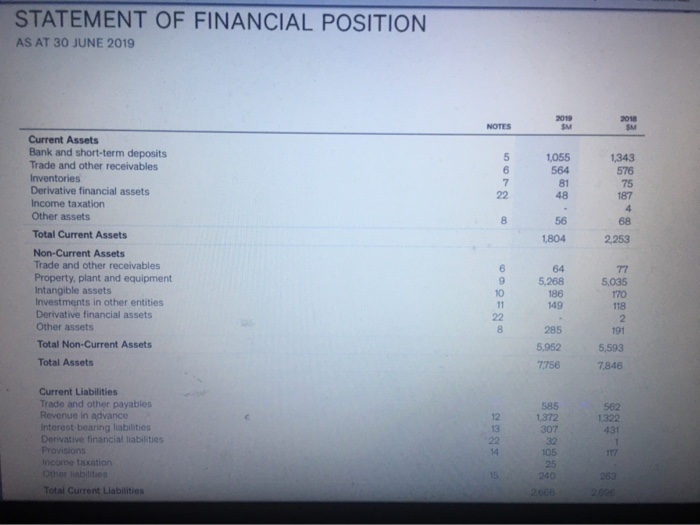

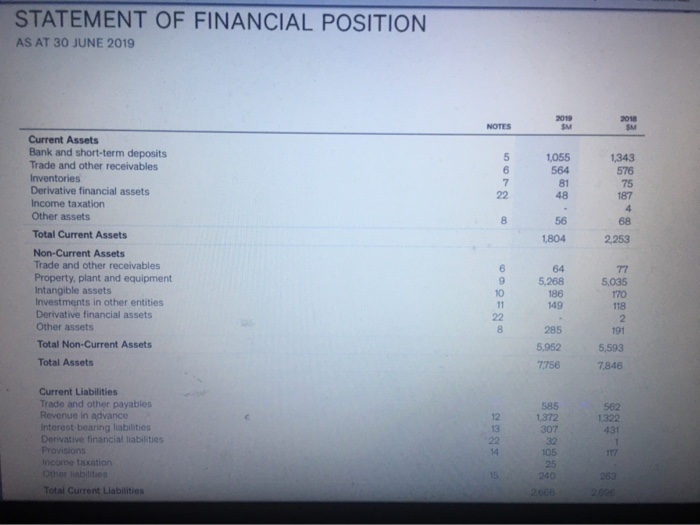

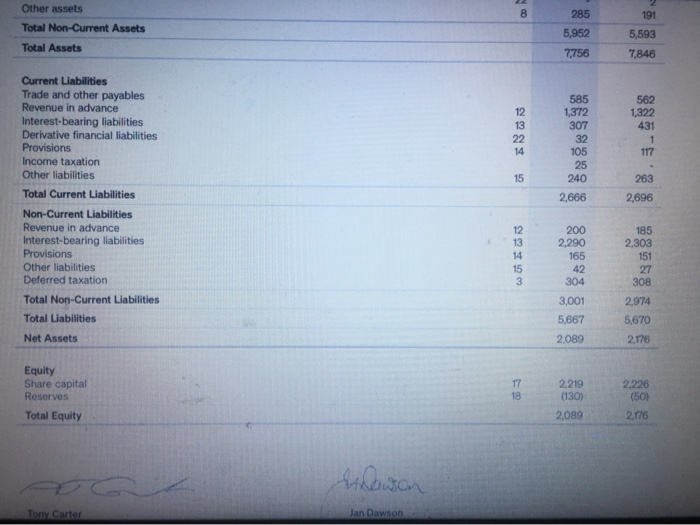

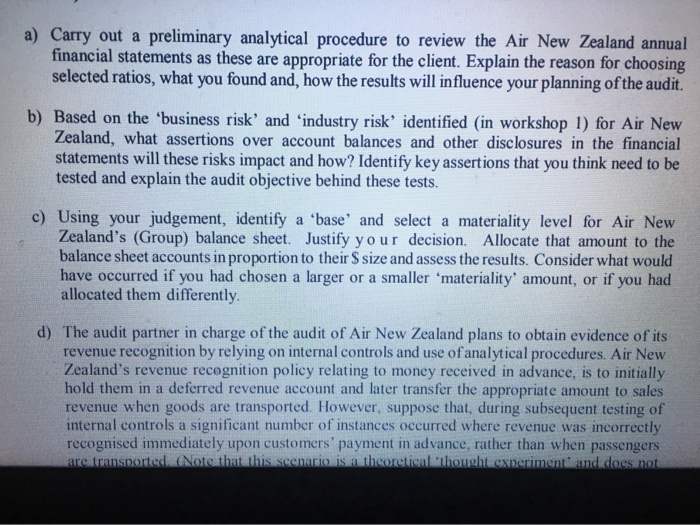

STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2019 NOTES 2019 SM 2018 SM 5 6 7 22 1,055 564 81 48 1,343 576 75 187 4 68 8 56 1804 2,253 Current Assets Bank and short-term deposits Trade and other receivables Inventories Derivative financial assets Income taxation Other assets Total Current Assets Non-Current Assets Trade and other receivables Property, plant and equipment Intangible assets Investments in other entities Derivative financial assets Other assets Total Non-Current Assets Total Assets 6 9 10 11 22 8 64 5.268 186 149 77 5,035 170 118 2 191 5,593 7,846 285 5,952 7756 . Current Liabilities Trade and other payables Revenue in advance Interest bearing liabilities Derivative financial liabilities Provisions Income taxation Other liabilities Total Current Liabilities 562 1322 431 12 13 22 14 585 1372 307 32 105 25 240 2696 8 285 191 Other assets Total Non-Current Assets Total Assets 5,952 7,756 5,593 7,846 Current Liabilities Trade and other payables Revenue in advance Interest-bearing liabilities Derivative financial liabilities Provisions Income taxation Other liabilities 12 13 22 14 585 1,372 307 32 105 25 240 562 1322 431 1 117 15 263 Total Current Liabilities 2,666 2,696 Non-Current Liabilities Revenue in advance Interest-bearing liabilities Provisions Other liabilities Deferred taxation 12 13 14 15 200 2,290 165 42 304 185 2,303 151 27 308 3 Total Non-Current Liabilities Total Liabilities Net Assets 3,001 5,667 2,089 2,974 5,670 2,176 Equity Share capital Reserves 17 18 2,219 (130) 2,226 (50) Total Equity 2,089 2,176 aa Dawson Tony Carter Jan Dawson a) Carry out a preliminary analytical procedure to review the Air New Zealand annual financial statements as these are appropriate for the client. Explain the reason for choosing selected ratios, what you found and, how the results will influence your planning of the audit. b) Based on the 'business risk' and 'industry risk' identified in workshop 1) for Air New Zealand, what assertions over account balances and other disclosures in the financial statements will these risks impact and how? Identify key assertions that you think need to be tested and explain the audit objective behind these tests. c) Using your judgement, identify a 'base' and select a materiality level for Air New Zealand's (Group) balance sheet. Justify your decision. Allocate that amount to the balance sheet accounts in proportion to their $ size and assess the results. Consider what would have occurred if you had chosen a larger or a smaller 'materiality' amount, or if you had allocated them differently. d) The audit partner in charge of the audit of Air New Zealand plans to obtain evidence of its revenue recognition by relying on internal controls and use of analytical procedures. Air New Zealand's revenue recognition policy relating to money received in advance, is to initially hold them in a deferred revenue account and later transfer the appropriate amount to sales revenue when goods are transported. However, suppose that, during subsequent testing of internal controls a significant number of instances occurred where revenue was incorrectly recognised immediately upon customers' payment in advance, rather than when passengers are transported. (Note that this scenario is a theoretical thought experimenti and does not STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2019 NOTES 2019 SM 2018 SM 5 6 7 22 1,055 564 81 48 1,343 576 75 187 4 68 8 56 1804 2,253 Current Assets Bank and short-term deposits Trade and other receivables Inventories Derivative financial assets Income taxation Other assets Total Current Assets Non-Current Assets Trade and other receivables Property, plant and equipment Intangible assets Investments in other entities Derivative financial assets Other assets Total Non-Current Assets Total Assets 6 9 10 11 22 8 64 5.268 186 149 77 5,035 170 118 2 191 5,593 7,846 285 5,952 7756 . Current Liabilities Trade and other payables Revenue in advance Interest bearing liabilities Derivative financial liabilities Provisions Income taxation Other liabilities Total Current Liabilities 562 1322 431 12 13 22 14 585 1372 307 32 105 25 240 2696 8 285 191 Other assets Total Non-Current Assets Total Assets 5,952 7,756 5,593 7,846 Current Liabilities Trade and other payables Revenue in advance Interest-bearing liabilities Derivative financial liabilities Provisions Income taxation Other liabilities 12 13 22 14 585 1,372 307 32 105 25 240 562 1322 431 1 117 15 263 Total Current Liabilities 2,666 2,696 Non-Current Liabilities Revenue in advance Interest-bearing liabilities Provisions Other liabilities Deferred taxation 12 13 14 15 200 2,290 165 42 304 185 2,303 151 27 308 3 Total Non-Current Liabilities Total Liabilities Net Assets 3,001 5,667 2,089 2,974 5,670 2,176 Equity Share capital Reserves 17 18 2,219 (130) 2,226 (50) Total Equity 2,089 2,176 aa Dawson Tony Carter Jan Dawson a) Carry out a preliminary analytical procedure to review the Air New Zealand annual financial statements as these are appropriate for the client. Explain the reason for choosing selected ratios, what you found and, how the results will influence your planning of the audit. b) Based on the 'business risk' and 'industry risk' identified in workshop 1) for Air New Zealand, what assertions over account balances and other disclosures in the financial statements will these risks impact and how? Identify key assertions that you think need to be tested and explain the audit objective behind these tests. c) Using your judgement, identify a 'base' and select a materiality level for Air New Zealand's (Group) balance sheet. Justify your decision. Allocate that amount to the balance sheet accounts in proportion to their $ size and assess the results. Consider what would have occurred if you had chosen a larger or a smaller 'materiality' amount, or if you had allocated them differently. d) The audit partner in charge of the audit of Air New Zealand plans to obtain evidence of its revenue recognition by relying on internal controls and use of analytical procedures. Air New Zealand's revenue recognition policy relating to money received in advance, is to initially hold them in a deferred revenue account and later transfer the appropriate amount to sales revenue when goods are transported. However, suppose that, during subsequent testing of internal controls a significant number of instances occurred where revenue was incorrectly recognised immediately upon customers' payment in advance, rather than when passengers are transported. (Note that this scenario is a theoretical thought experimenti and does not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started