Could you help me to solve these questions please. Kind regards!! Some of them are signle choice, some of them are multiple choice

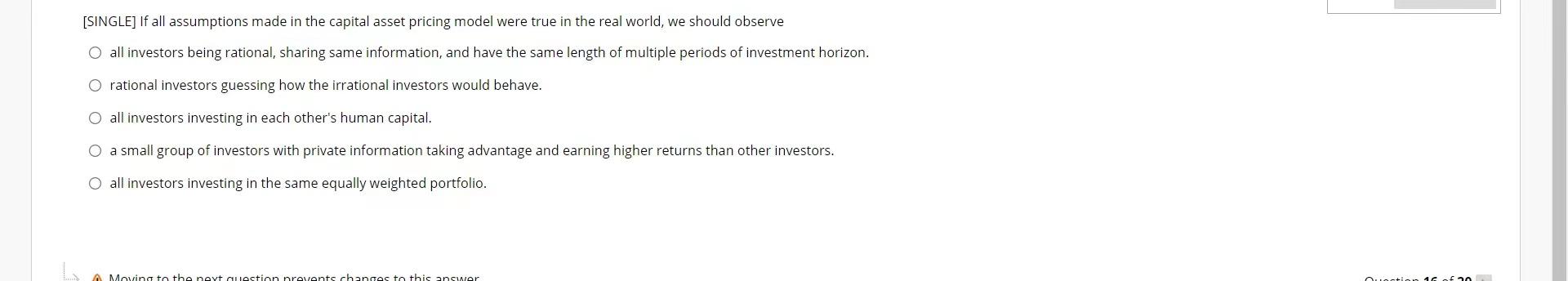

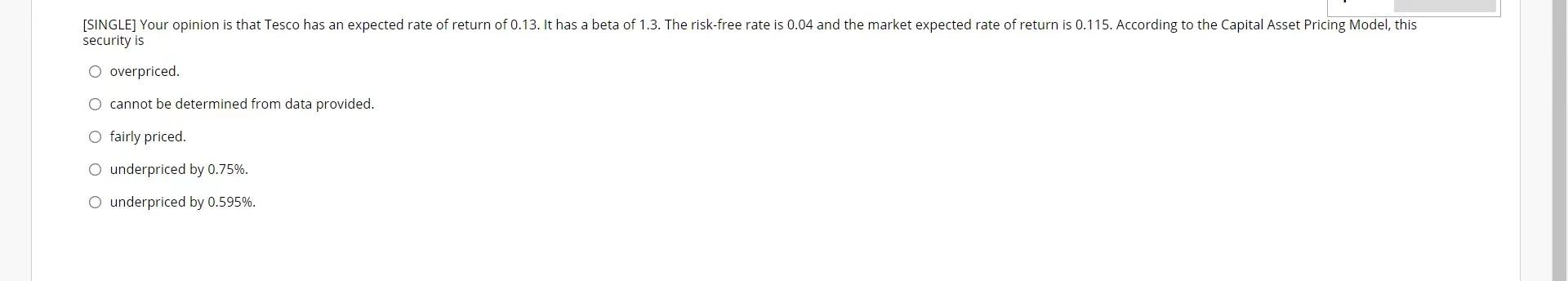

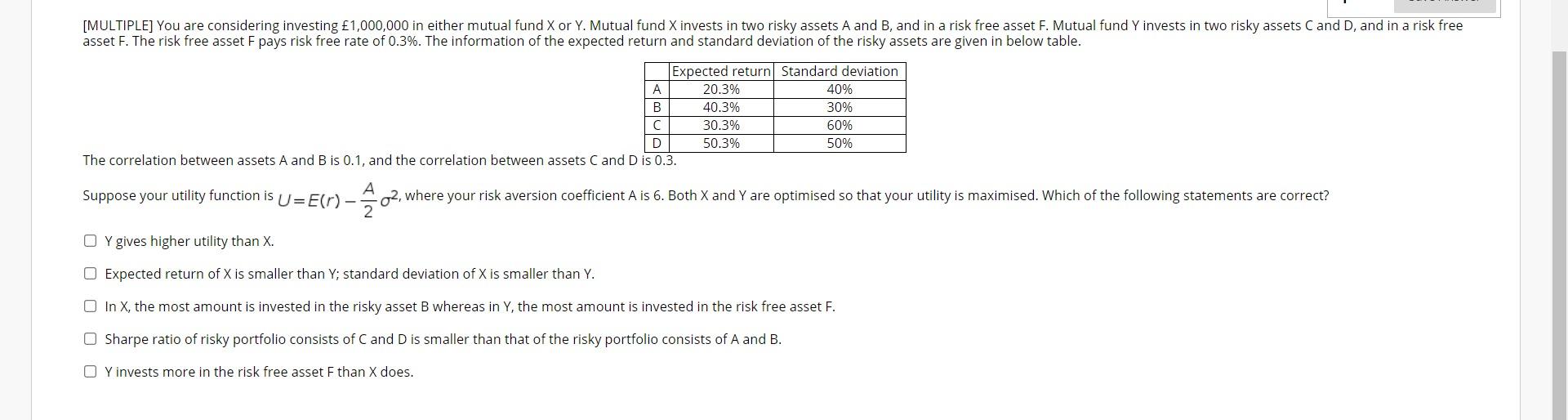

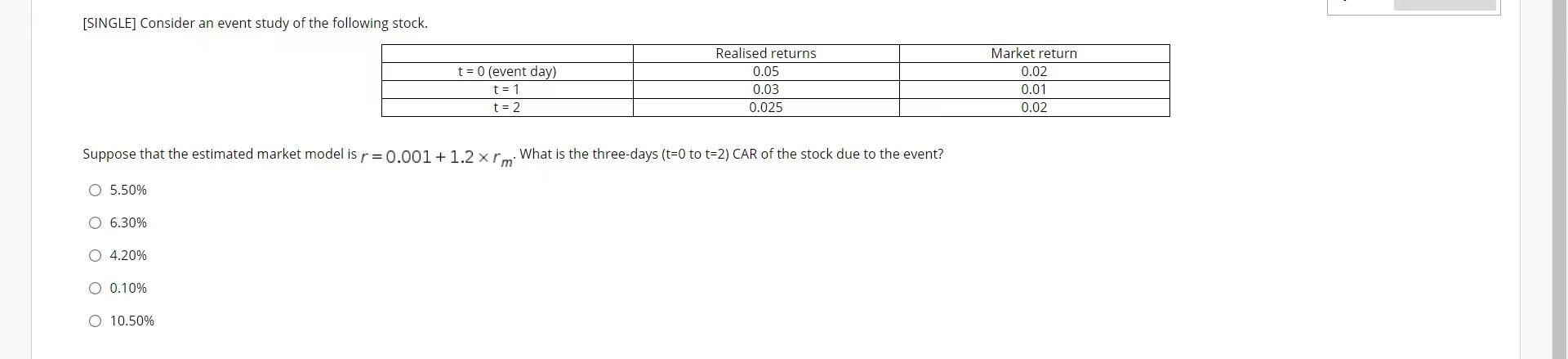

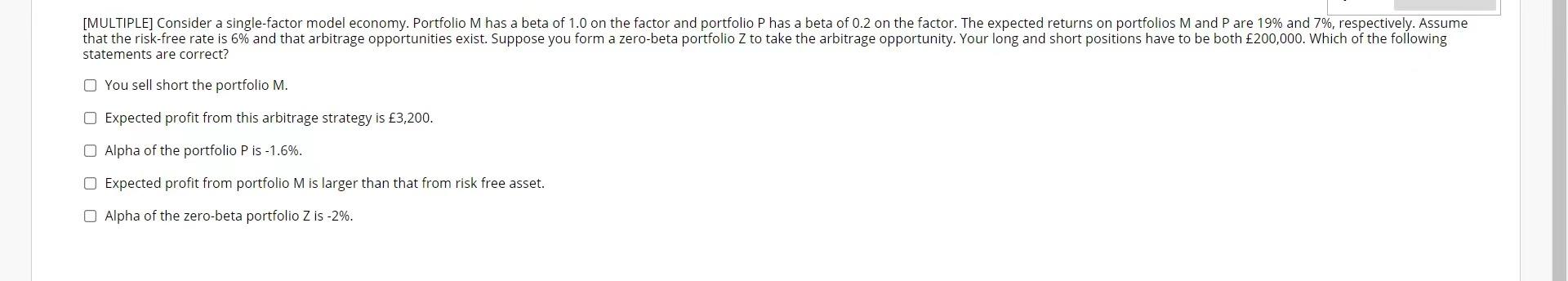

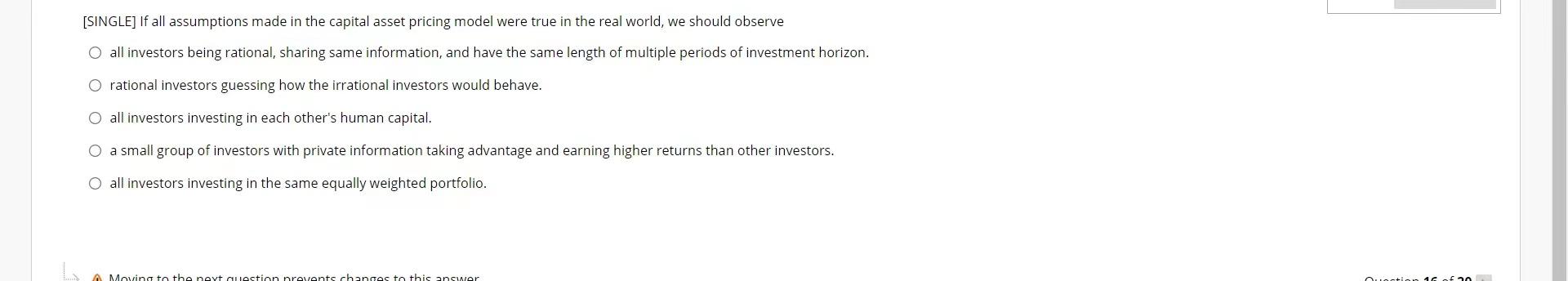

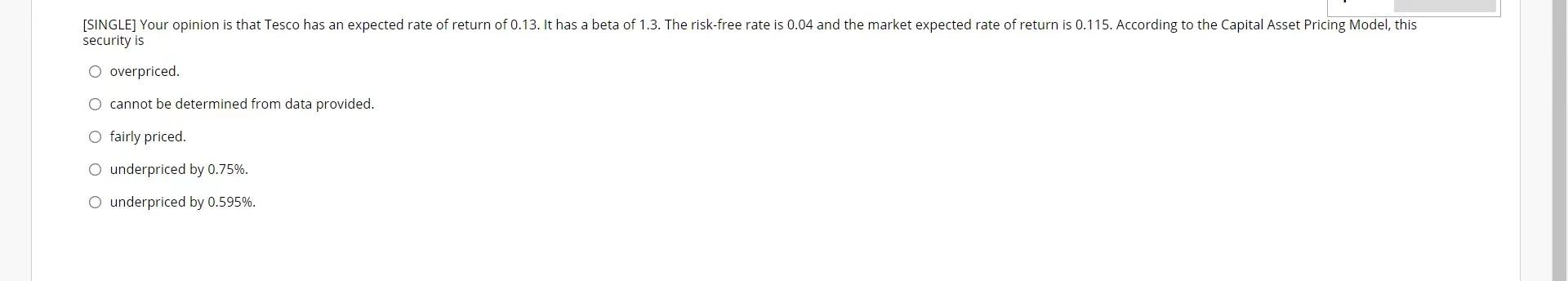

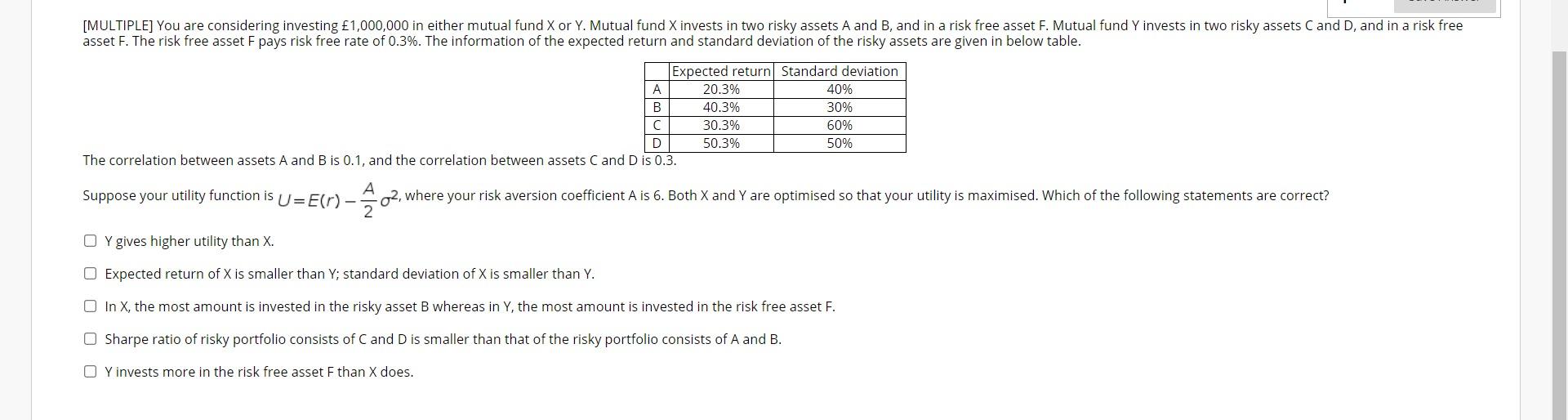

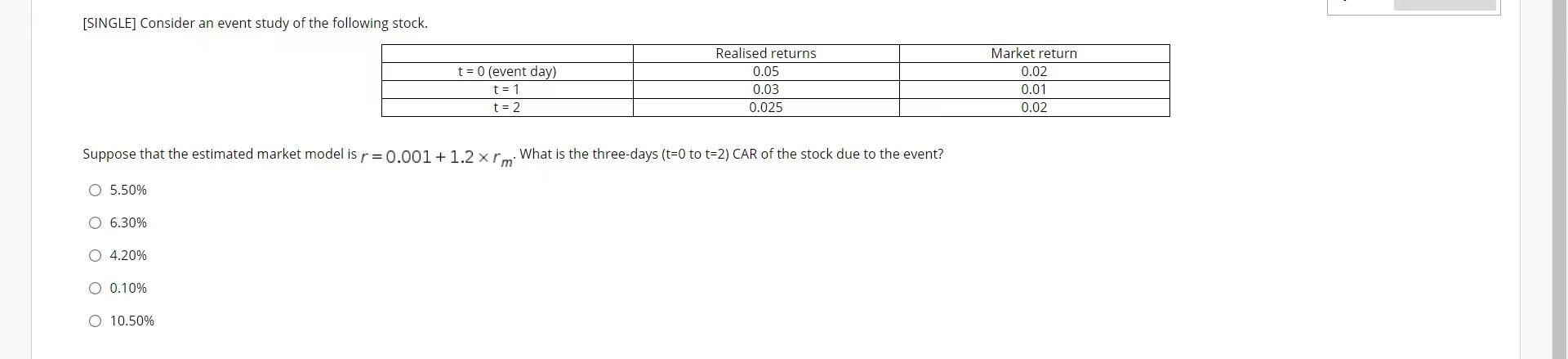

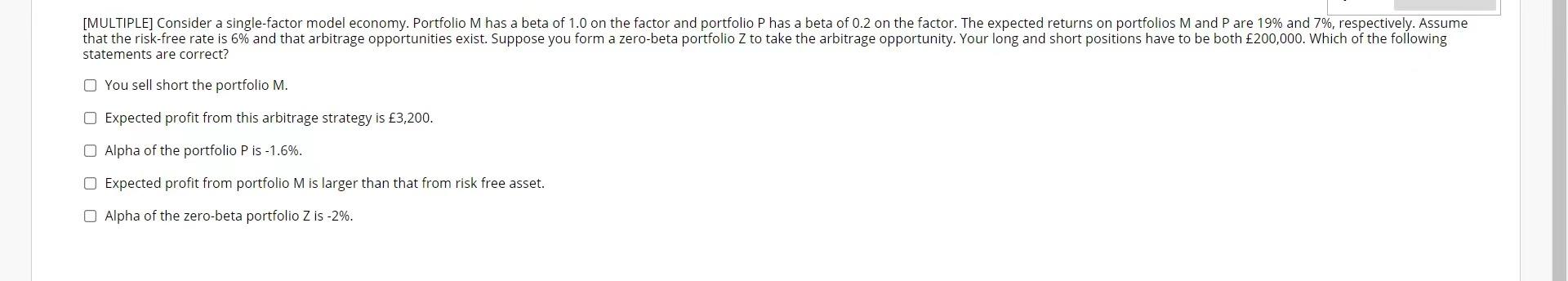

[SINGLE] If all assumptions made in the capital asset pricing model were true in the real world, we should observe O all investors being rational, sharing same information, and have the same length of multiple periods of investment horizon. rational investors guessing how the irrational investors would behave. all investors investing in each other's human capital. O a small group of investors with private information taking advantage and earning higher returns than other investors. all investors investing in the same equally weighted portfolio. A Moving to the next question prevents changes to this answer Loction 16 of 20 [SINGLE] Your opinion is that Tesco has an expected rate of return of 0.13. It has a beta of 1.3. The risk-free rate is 0.04 and the market expected rate of return is 0.115. According to the Capital Asset Pricing Model, this security is O overpriced. O cannot be determined from data provided. fairly priced. underpriced by 0.75%. O underpriced by 0.595%. [MULTIPLE] You are considering investing 1,000,000 in either mutual fund X or Y. Mutual fund X invests in two risky assets A and B, and in a risk free asset F. Mutual fund Y invests in two risky assets C and D, and in a risk free asset F. The risk free asset Fpays risk free rate of 0.3%. The information of the expected return and standard deviation of the risky assets are given in below table. Expected return Standard deviation 20.3% 40% B 40.3% 30% C 30.3% 60% 50.3% 50% The correlation between assets A and B is 0.1, and the correlation between assets C and D is 0.3. A D A Suppose your utility function is U=E(r) - 02, where your risk aversion coefficient A is 6. Both X and Y are optimised so that your utility is maximised. Which of the following statements are correct? 2 Y gives higher utility than X. Expected return of X is smaller than Y; standard deviation of X is smaller than Y. In X, the most amount is invested in the risky asset B whereas in Y, the most amount is invested in the risk free asset F. Sharpe ratio of risky portfolio consists of C and D is smaller than that of the risky portfolio consists of A and B. O Y invests more in the risk free asset F than X does. [SINGLE] Consider an event study of the following stock. t = 0 (event day) t = 1 t = 2 Realised returns 0.05 0.03 0.025 Market return 0.02 0.01 0.02 Suppose that the estimated market model is r=0.001 + 1.2 xrm What is the three-days (t=0 to t=2) CAR of the stock due to the event? O 5.50% 0 6.30% 04.20% O 0.10% O 10.50% [MULTIPLE] Consider a single-factor model economy. Portfolio M has a beta of 1.0 on the factor and portfolio P has a beta of 0.2 on the factor. The expected returns on portfolios M and P are 19% and 7%, respectively. Assume that the risk-free rate is 6% and that arbitrage opportunities exist. Suppose you form a zero-beta portfolio Z to take the arbitrage opportunity. Your long and short positions have to be both 200,000. Which of the following statements are correct? You sell short the portfolio M. Expected profit from this arbitrage strategy is 3,200. Alpha of the portfolio P is -1.6%. Expected profit from portfolio M is larger than that from risk free asset. Alpha of the zero-beta portfolio Z is -2%