Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number 3 please All examples ignore transaction costs and taxes. Sell 100 LAST short at $520; value of sale is $52,000. This is a margin

number 3 please

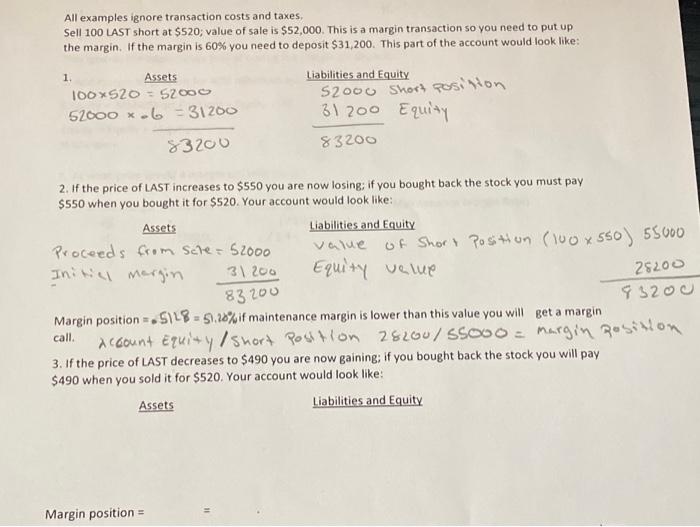

All examples ignore transaction costs and taxes. Sell 100 LAST short at $520; value of sale is $52,000. This is a margin transaction so you need to put up the margin. If the margin is 60% you need to deposit $31,200. This part of the account would look like: Liabilities and Equity 1. Assets 100X520 = 52000 52000 x 6 = 31200 52000 Short posi Non 31200 Equity 83200 83200 2. If the price of LAST increases to $550 you are now losing: if you bought back the stock you must pay $550 when you bought it for $520. Your account would look like: Assets Liabilities and Equity Proceeds from Sale - 52000 value of Short Position (100x550) 55000 Initial margin 31 200 Equity value 28200 9320 Margin position=5128 - 51.28% if maintenance margin is lower than this value you will get a margin call. account Equity / short position 28200/S5ooo = margin position 3. If the price of LAST decreases to $490 you are now gaining: If you bought back the stock you will pay $490 when you sold it for $520. Your account would look like: Assets Liabilities and Equity 83200 = Margin position =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started