Answered step by step

Verified Expert Solution

Question

1 Approved Answer

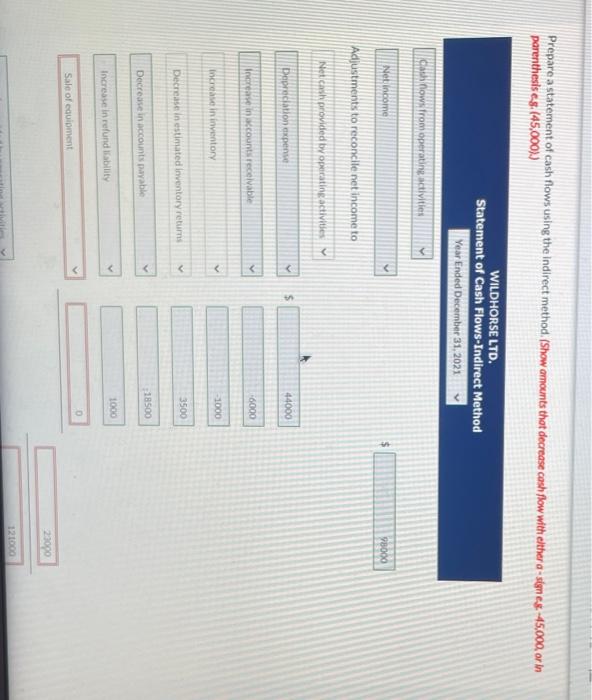

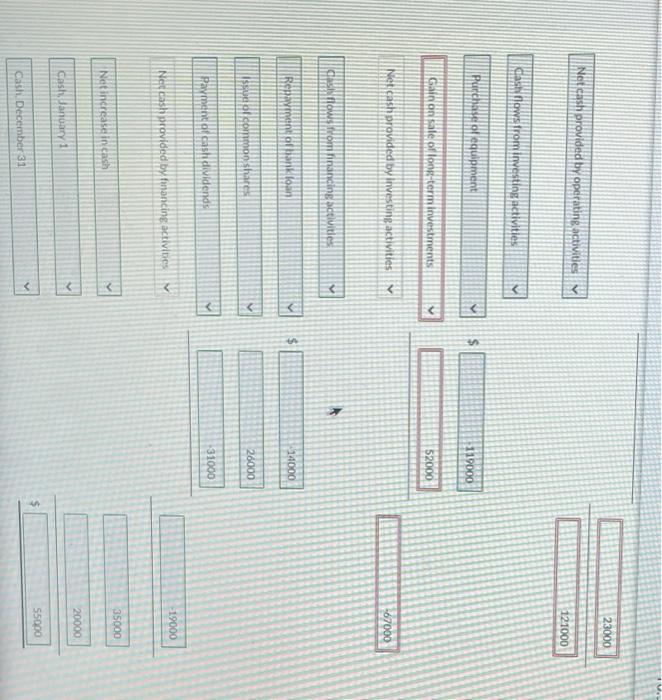

Could you help me with the boxes that are not colored green? (Red and white boxes, I do not know the answers to them!) I

Could you help me with the boxes that are not colored green? (Red and white boxes, I do not know the answers to them!) I really appreciate it!

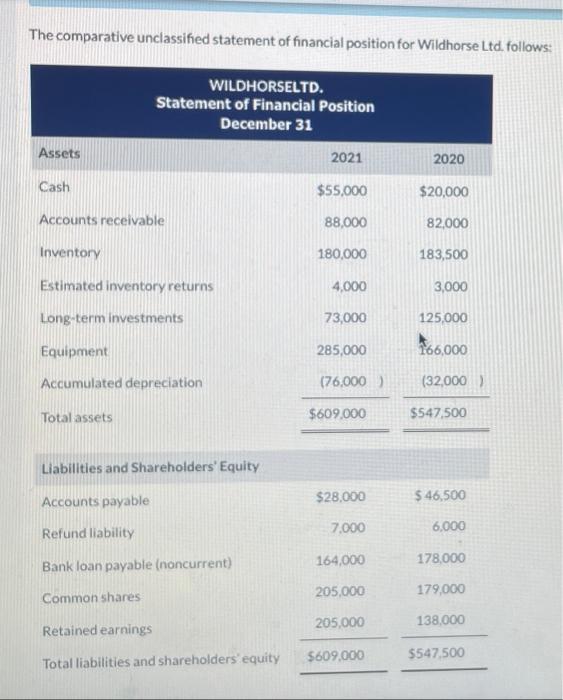

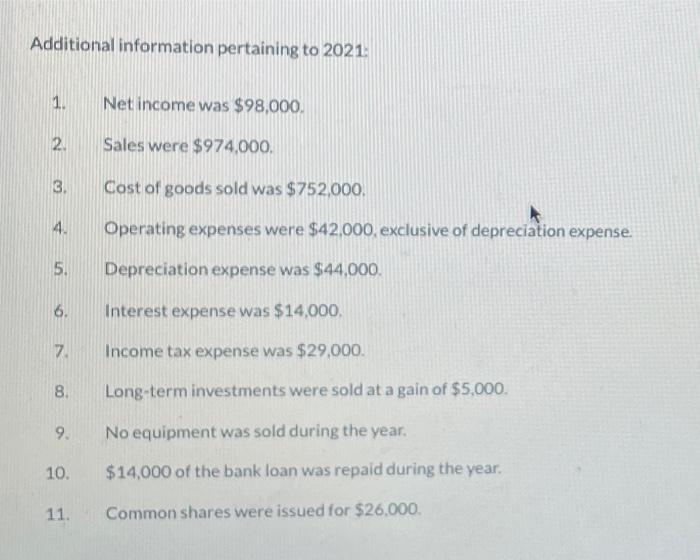

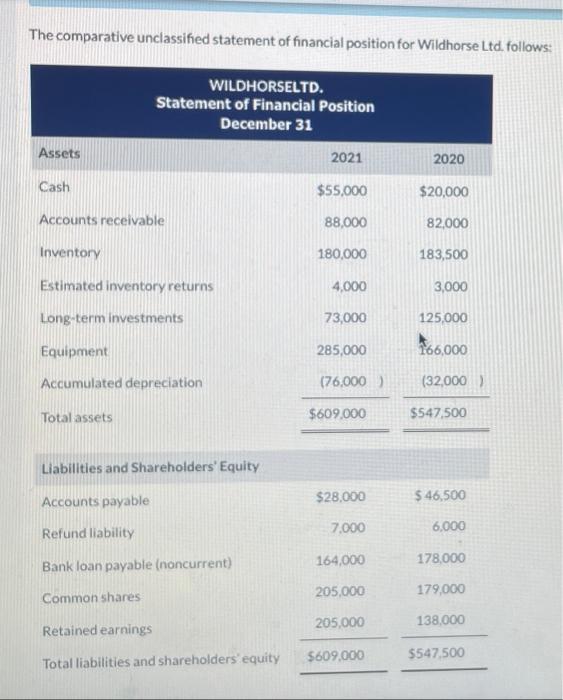

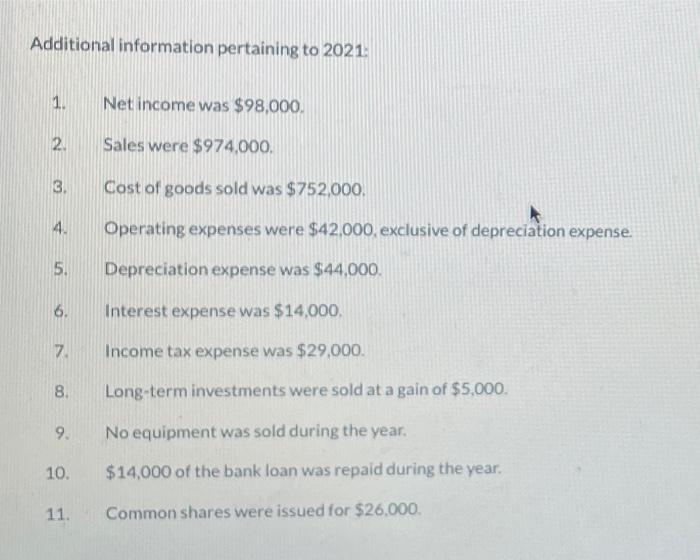

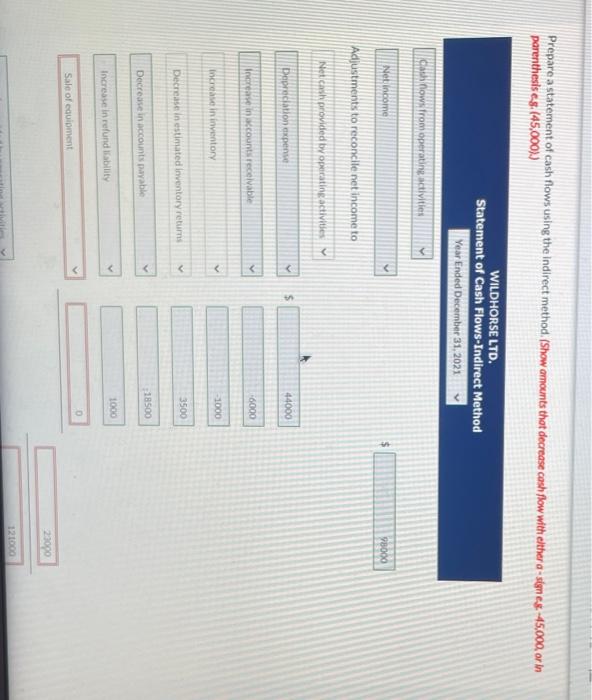

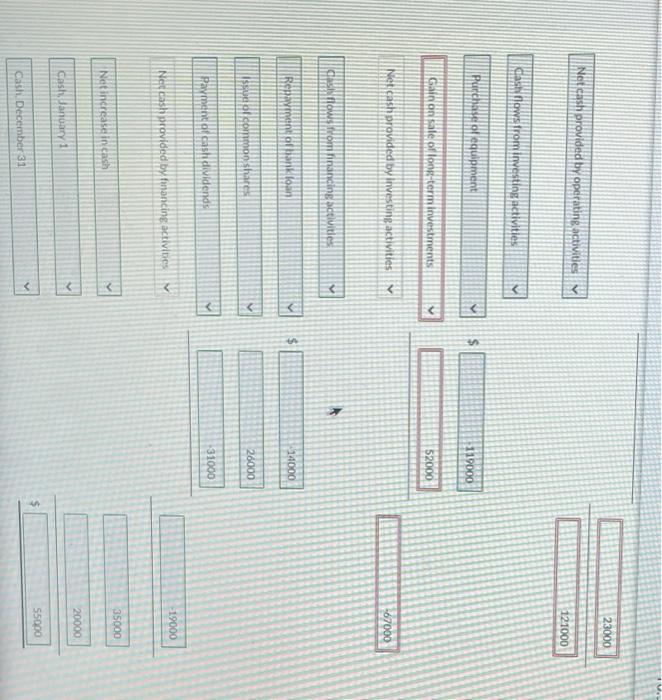

The comparative unclassified statement of financial position for Wildhorse Ltd. follows: WILDHORSELTD. Statement of Financial Position December 31 Assets 2021 2020 Cash $55.000 $20,000 Accounts receivable 88,000 82,000 Inventory 180,000 183,500 Estimated inventory returns 4,000 3,000 Long-term investments 73,000 125,000 Equipment 285,000 166,000 Accumulated depreciation (76,000 (32,000) Total assets $609,000 $547,500 Liabilities and Shareholders' Equity $28,000 $ 46,500 Accounts payable Refund liability 7.000 6,000 164,000 178,000 Bank loan payable (noncurrent) 205,000 179,000 Common shares 205,000 138,000 Retained earnings $609,000 $547,500 Total liabilities and shareholders' equity Additional information pertaining to 2021 1. Net income was $98,000, 2. Sales were $974,000. 3. Cost of goods sold was $752,000. 4. Operating expenses were $42.000, exclusive of depreciation expense. 5. Depreciation expense was $44,000. 6. Interest expense was $14,000. 7 Income tax expense was $29,000. 8. Long-term investments were sold at a gain of $5,000. 9. No equipment was sold during the year. 10. $14,000 of the bank loan was repaid during the year. 11. Common shares were issued for $26.000. Prepare a statement of cash flows using the Indirect method, (Show amounts that decrease cash flow with either a-signes. 45.000, or in parenthesis 8. (45,000)) WILDHORSE LTD. Statement of Cash Flows-Indirect Method Year Ended December 31, 2021 cash now from operating activities Net income 98000 Adjustments to reconcile net income to Netcash provided by operating activities Depreciation expens $ 44000 Increase in accounts receivable 6000 Increase in inventory -1000 > 3500 Decrease in estimated Inventory returns 18500 Decrease in accounts payable 1000 Increase in refund ability Sale of equipment 23000 12100 23000 Net cash provided by operating activities 121000 cash flows from investing activities Purchase of equipment 119000 Gain on sale of lon term investments 52000 Net cash provided by investing activities V -67000 CANows from inancing activities Renaidnt of bank loan $ 14000 issue of common shares 26000 31000 Pavandafcasti dividends 19000 Netcash provided by financing activities 35000 Netincrease in cash 20000 cash anary 1 55000 Cast December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started