Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you help me with this Problems 1. For each item or event in the table below, select the best description/explanation from the following list

Could you help me with this

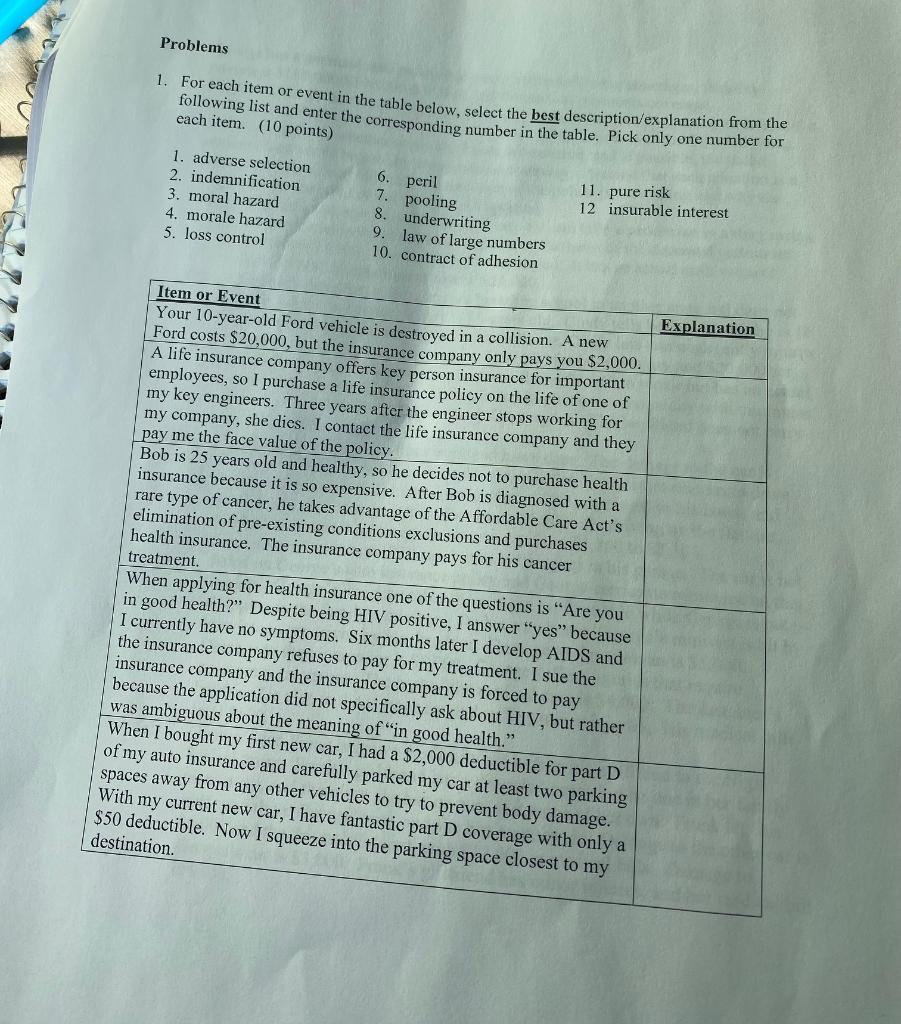

Problems 1. For each item or event in the table below, select the best description/explanation from the following list and enter the corresponding number in the table. Pick only one number for each item. (10 points) 1. adverse selection 2. indemnification 3. moral hazard 4. morale hazard 5. loss control 6. peril 7. pooling 8. underwriting 9. law of large numbers 10. contract of adhesion 11. pure risk 12 insurable interest Item or Event Explanation Your 10-year-old Ford vehicle is destroyed in a collision. A new Ford costs $20,000, but the insurance company only pays you $2,000. A life insurance company offers key person insurance for important employees, so I purchase a life insurance policy on the life of one of my key engineers. Three years after the engineer stops working for my company, she dies. I contact the life insurance company and they pay me the face value of the policy. Bob is 25 years old and healthy, so he decides not to purchase health insurance because it is so expensive. After Bob is diagnosed with a rare type of cancer, he takes advantage of the Affordable Care Act's elimination of pre-existing conditions exclusions and purchases health insurance. The insurance company pays for his cancer treatment. When applying for health insurance one of the questions is "Are you in good health?" Despite being HIV positive, I answer "yes" because I currently have no symptoms. Six months later I develop AIDS and the insurance company refuses to pay for my treatment. I sue the insurance company and the insurance company is forced to pay because the application did not specifically ask about HIV, but rather was ambiguous about the meaning of in good health." When I bought my first new car, I had a $2,000 deductible for part D of my auto insurance and carefully parked my car at least two parking spaces away from any other vehicles to try to prevent body damage. With my current new car, I have fantastic part D coverage with only a $50 deductible. Now I squeeze into the parking space closest to my destination. Problems 1. For each item or event in the table below, select the best description/explanation from the following list and enter the corresponding number in the table. Pick only one number for each item. (10 points) 1. adverse selection 2. indemnification 3. moral hazard 4. morale hazard 5. loss control 6. peril 7. pooling 8. underwriting 9. law of large numbers 10. contract of adhesion 11. pure risk 12 insurable interest Item or Event Explanation Your 10-year-old Ford vehicle is destroyed in a collision. A new Ford costs $20,000, but the insurance company only pays you $2,000. A life insurance company offers key person insurance for important employees, so I purchase a life insurance policy on the life of one of my key engineers. Three years after the engineer stops working for my company, she dies. I contact the life insurance company and they pay me the face value of the policy. Bob is 25 years old and healthy, so he decides not to purchase health insurance because it is so expensive. After Bob is diagnosed with a rare type of cancer, he takes advantage of the Affordable Care Act's elimination of pre-existing conditions exclusions and purchases health insurance. The insurance company pays for his cancer treatment. When applying for health insurance one of the questions is "Are you in good health?" Despite being HIV positive, I answer "yes" because I currently have no symptoms. Six months later I develop AIDS and the insurance company refuses to pay for my treatment. I sue the insurance company and the insurance company is forced to pay because the application did not specifically ask about HIV, but rather was ambiguous about the meaning of in good health." When I bought my first new car, I had a $2,000 deductible for part D of my auto insurance and carefully parked my car at least two parking spaces away from any other vehicles to try to prevent body damage. With my current new car, I have fantastic part D coverage with only a $50 deductible. Now I squeeze into the parking space closest to my destinationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started