Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you help me with where is 0.20 come from? Regular MACRS [{700,00 - 25,000) * 0.20] , where is 0.20 come from and how

Could you help me with where is 0.20 come from? Regular MACRS [{700,00 - 25,000) * 0.20] , where is 0.20 come from and how can you get it ?

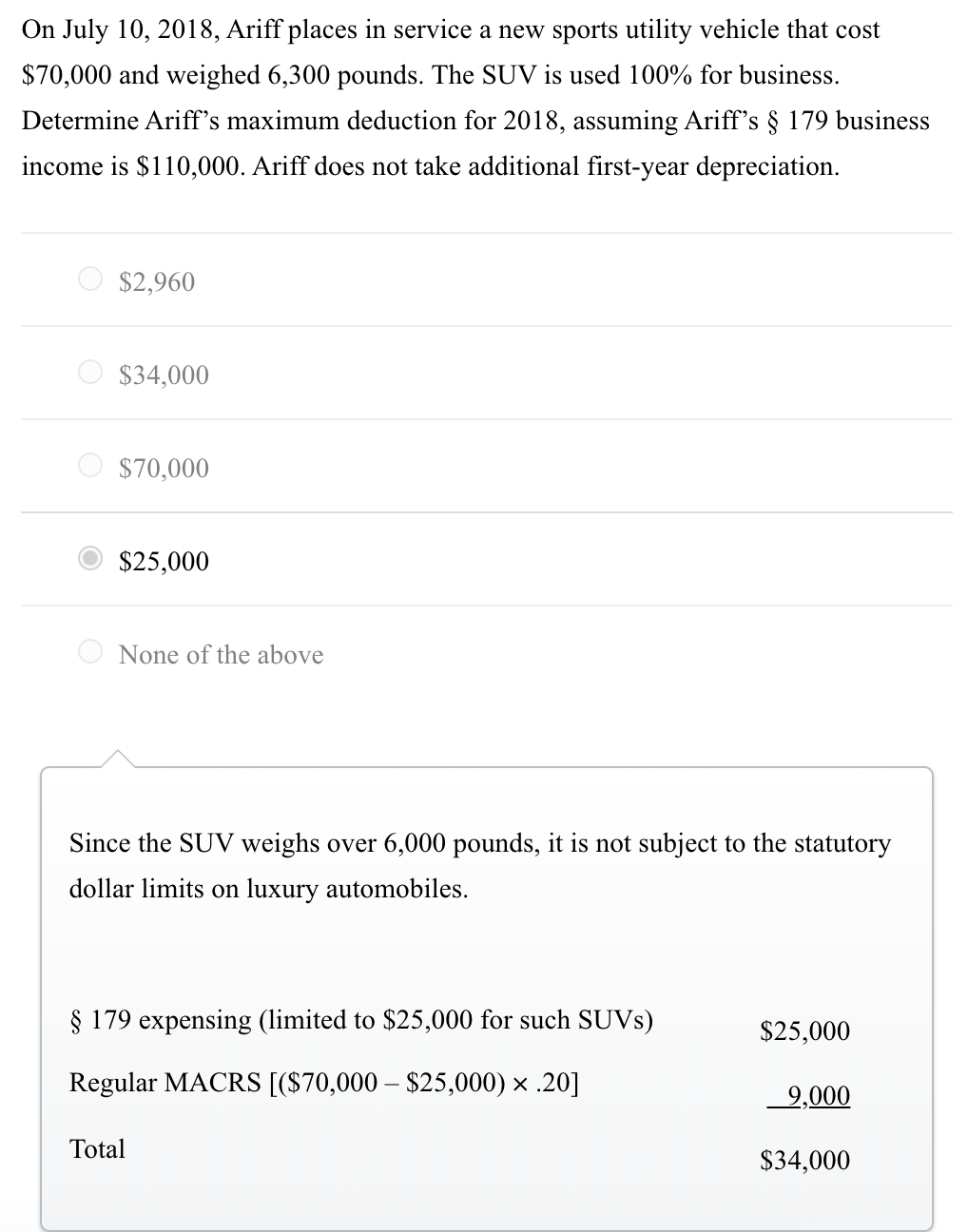

On July 10, 2018, Ariff places in service a new sports utility vehicle that cost $70,000 and weighed 6,300 pounds. The SUV is used 100% for business. Determine Ariff's maximum deduction for 2018, assuming Ariff's 179 business income is $110,000. Ariff does not take additional first-year depreciation. $2,960 0 $34,000 0 $70,000 $25,000 None of the above Since the SUV weighs over 6,000 pounds, it is not subject to the statutory dollar limits on luxury automobiles. 179 expensing (limited to $25,000 for such SUVs) $25,000 Regular MACRS [($70,000 $25,000) X.20] 9,000 Total $34,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started