Answered step by step

Verified Expert Solution

Question

1 Approved Answer

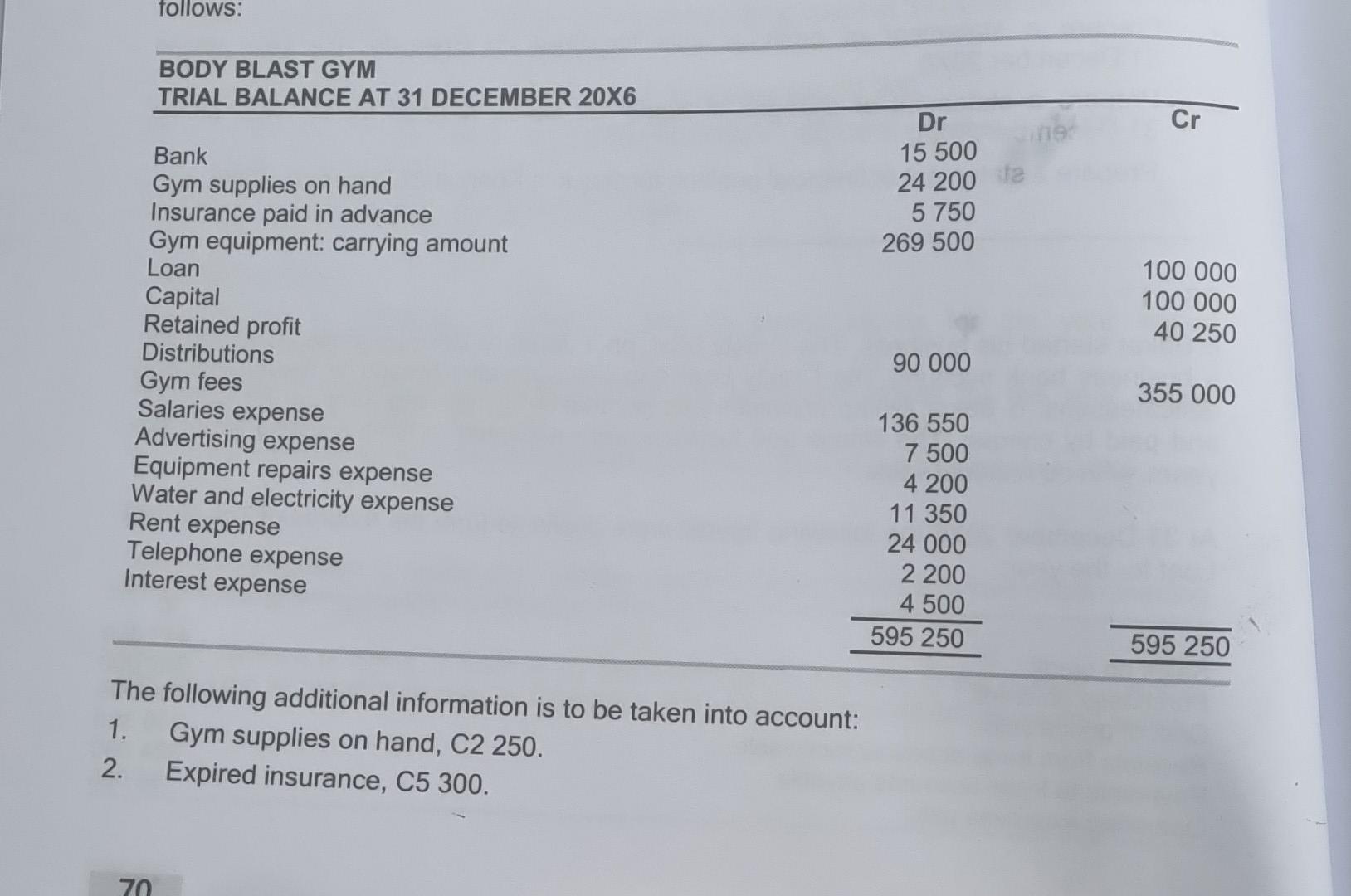

could you help me work out these problems The following additional information is to be taken into account: 1. Gym supplies on hand, C2 250.

could you help me work out these problems

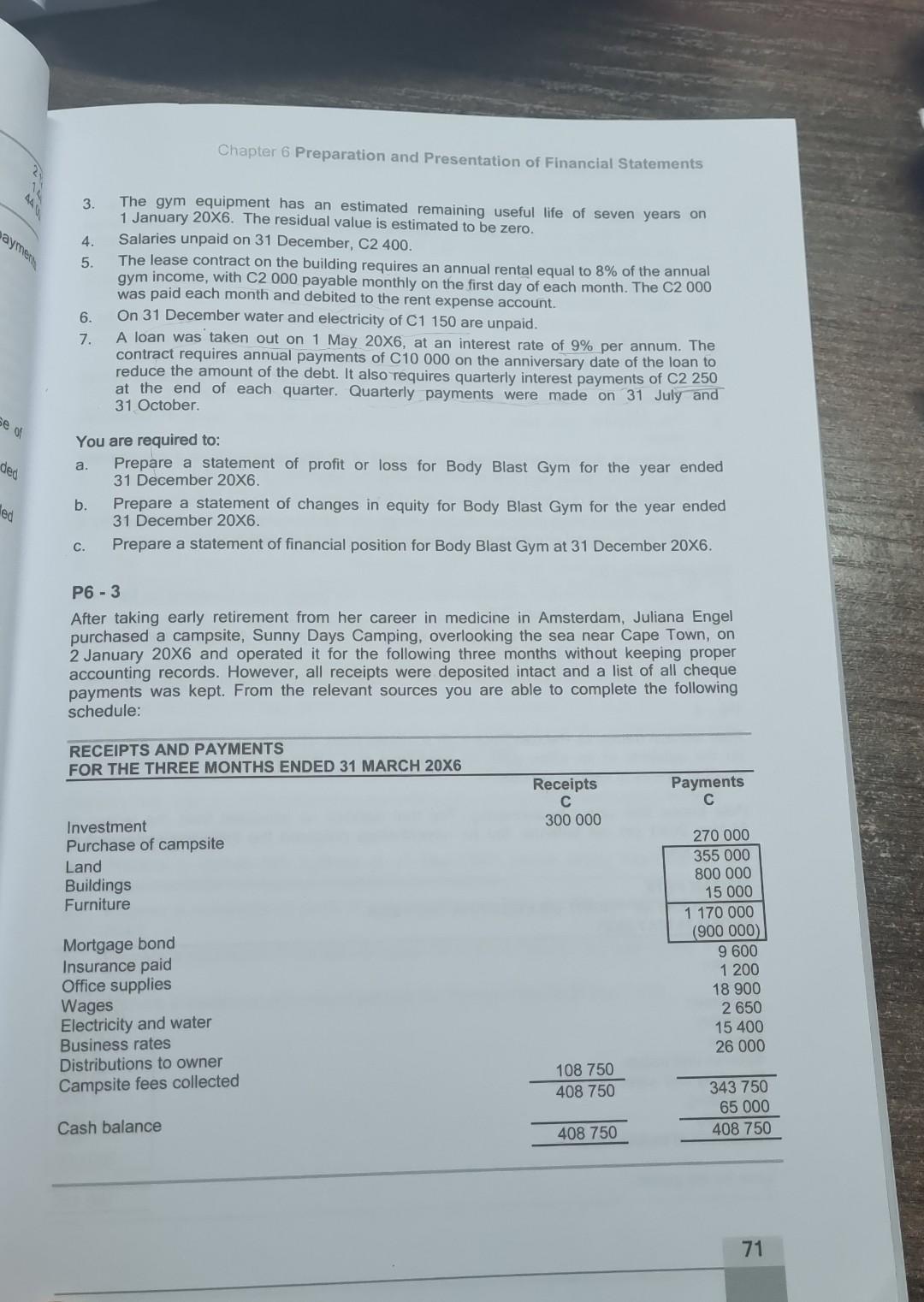

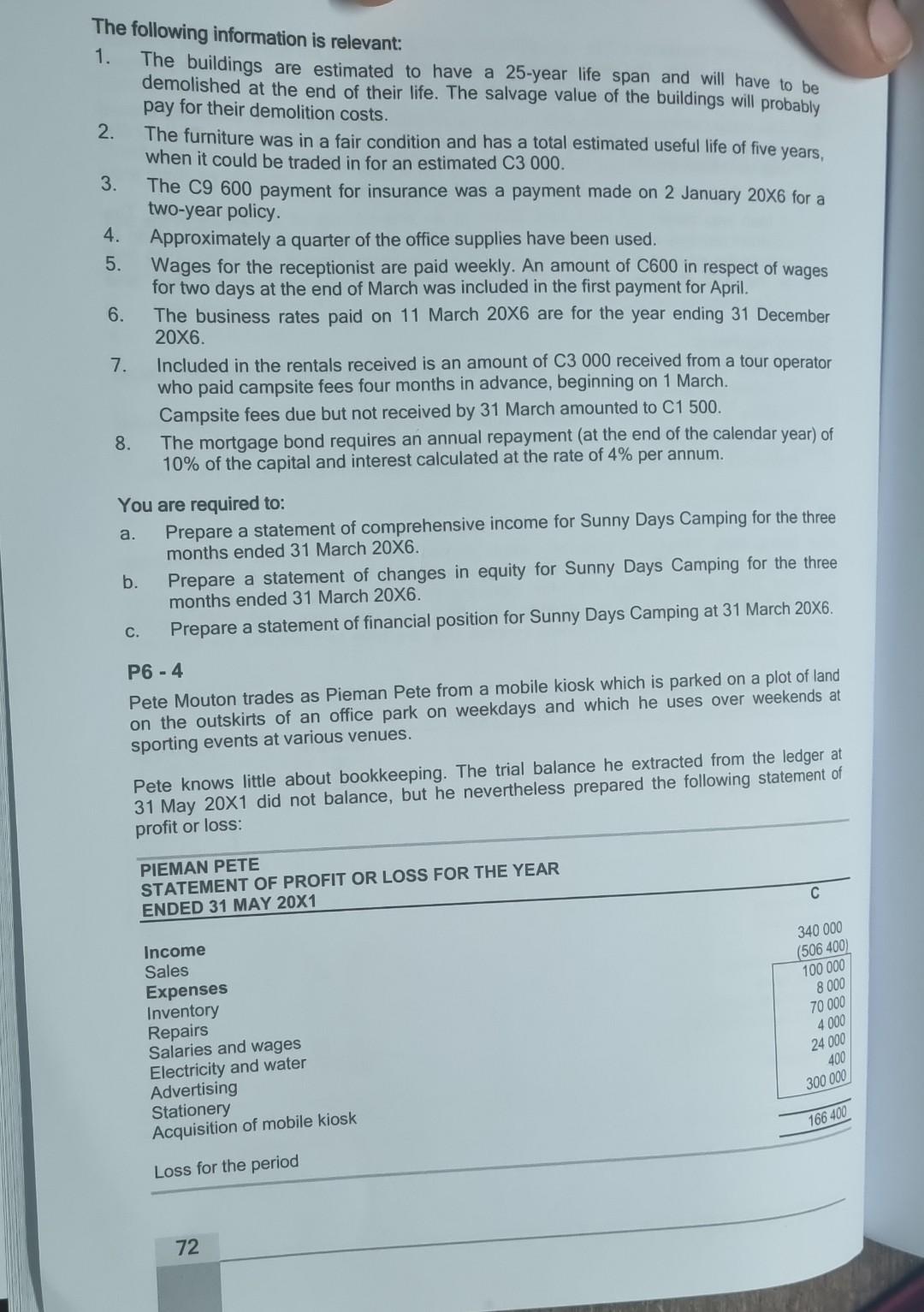

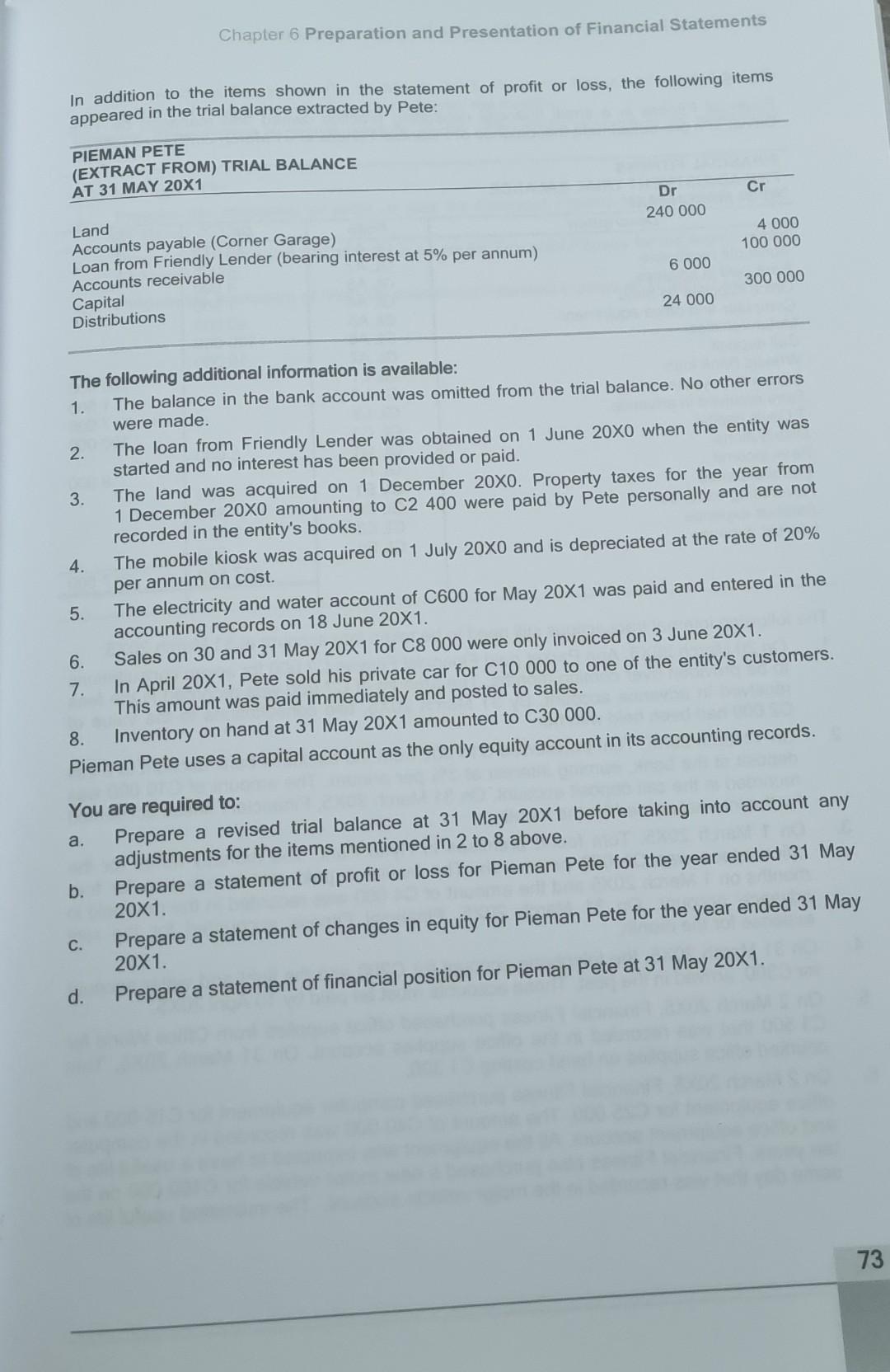

The following additional information is to be taken into account: 1. Gym supplies on hand, C2 250. 2. Expired insurance, C5 300. The following information is relevant: 1. The buildings are estimated to have a 25-year life span and will have to be demolished at the end of their life. The salvage value of the buildings will probably pay for their demolition costs. 2. The furniture was in a fair condition and has a total estimated useful life of five years, when it could be traded in for an estimated C3 000 . 3. The C9 600 payment for insurance was a payment made on 2 January 206 for a two-year policy. 4. Approximately a quarter of the office supplies have been used. 5. Wages for the receptionist are paid weekly. An amount of C600 in respect of wages for two days at the end of March was included in the first payment for April. 6. The business rates paid on 11 March 206 are for the year ending 31 December 206. 7. Included in the rentals received is an amount of C3000 received from a tour operator who paid campsite fees four months in advance, beginning on 1 March. Campsite fees due but not received by 31 March amounted to C1 500 . 8. The mortgage bond requires an annual repayment (at the end of the calendar year) of 10% of the capital and interest calculated at the rate of 4% per annum. You are required to: a. Prepare a statement of comprehensive income for Sunny Days Camping for the three months ended 31 March 206. b. Prepare a statement of changes in equity for Sunny Days Camping for the three months ended 31 March 20X6. c. Prepare a statement of financial position for Sunny Days Camping at 31 March 20X6. P6 - 4 Pete Mouton trades as Pieman Pete from a mobile kiosk which is parked on a plot of land on the outskirts of an office park on weekdays and which he uses over weekends at sporting events at various venues. Pete knows little about bookkeeping. The trial balance he extracted from the ledger at 31 May 201 did not balance, but he nevertheless prepared the following statement of Chapter 6 Preparation and Presentation of Financial Statements 3. The gym equipment has an estimated remaining useful life of seven years on 1 January 20X6. The residual value is estimated to be zero. 4. Salaries unpaid on 31 December, C2400. 5. The lease contract on the building requires an annual rental equal to 8% of the annual gym income, with C2 000 payable monthly on the first day of each month. The C2 000 was paid each month and debited to the rent expense account. 6. On 31 December water and electricity of C1150 are unpaid. 7. A loan was taken out on 1 May 20X6, at an interest rate of 9% per annum. The contract requires annual payments of C10000 on the anniversary date of the loan to reduce the amount of the debt. It also requires quarterly interest payments of C2 250 at the end of each quarter. Quarterly payments were made on 31 July and 31 October. You are required to: a. Prepare a statement of profit or loss for Body Blast Gym for the year ended 31 December 206. b. Prepare a statement of changes in equity for Body Blast Gym for the year ended 31 December 206. c. Prepare a statement of financial position for Body Blast Gym at 31 December 206. P6 - 3 After taking early retirement from her career in medicine in Amsterdam, Juliana Engel purchased a campsite, Sunny Days Camping, overlooking the sea near Cape Town, on 2 January 206 and operated it for the following three months without keeping proper accounting records. However, all receipts were deposited intact and a list of all cheque payments was kept. From the relevant sources you are able to complete the following schedule: Chapter 6 Preparation and Presentation of Financial Statements In addition to the items shown in the statement of profit or loss, the following items appeared in the trial balance extracted by Pete: The following additional information is available: 1. The balance in the bank account was omitted from the trial balance. No other errors were made. 2. The loan from Friendly Lender was obtained on 1 June 200 when the entity was started and no interest has been provided or paid. 3. The land was acquired on 1 December 200. Property taxes for the year from 1 December 200 amounting to C2 400 were paid by Pete personally and are not recorded in the entity's books. 4. The mobile kiosk was acquired on 1 July 200 and is depreciated at the rate of 20% per annum on cost. 5. The electricity and water account of C600 for May 201 was paid and entered in the accounting records on 18 June 201. 6. Sales on 30 and 31 May 201 for C 8000 were only invoiced on 3 June 201. 7. In April 20X1, Pete sold his private car for C10000 to one of the entity's customers. This amount was paid immediately and posted to sales. 8. Inventory on hand at 31 May 201 amounted to C30000. Pieman Pete uses a capital account as the only equity account in its accounting records. You are required to: a. Prepare a revised trial balance at 31 May 201 before taking into account any adjustments for the items mentioned in 2 to 8 above. b. Prepare a statement of profit or loss for Pieman Pete for the year ended 31 May c. Prepare a statement of changes in equity for Pieman Pete for the year ended 31 May d. Prepare a statement of financial position for Pieman Pete at 31 May 201

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started