Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you help solve this question? Farm Bred Chicken grows and process chickens. Each chicken diesembled into five main parts. Information pertaining to production in

could you help solve this question?

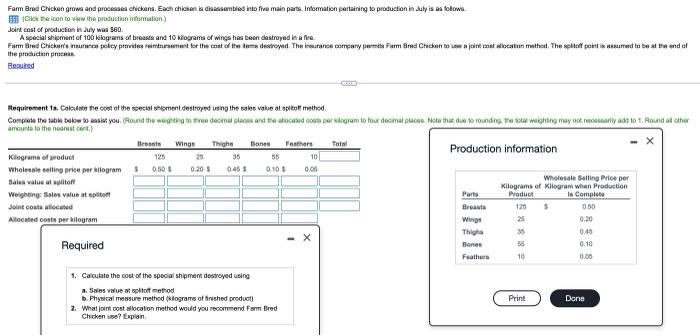

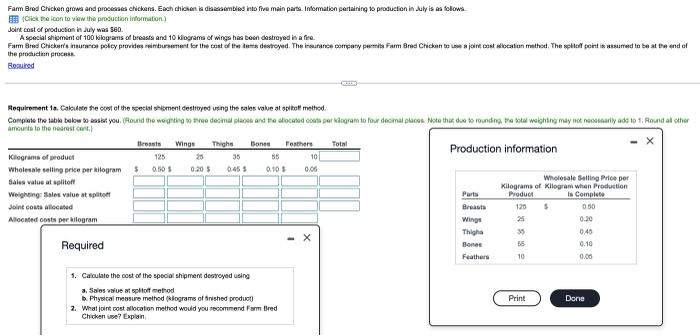

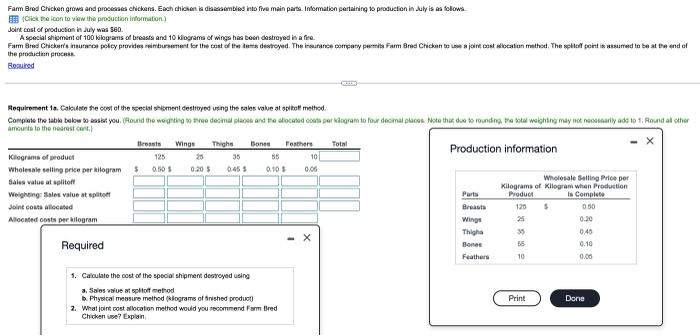

Farm Bred Chicken grows and process chickens. Each chicken diesembled into five main parts. Information pertaining to production in July is as foliowa Click the icon to view the production information Joint cost of production in July was 560. A special shipment of 100 kilograms of breasts and 10 kilograms of wings has been destroyed in a fire Farm Bred Chicken in policy provides rimbursement for the cost of the dents destroyed. The insurance company em Farm Bed Chicken tjocost estimethod. The shtoff point is assumed to be at the end of the prodion process Required Requirement 1a. Calcule the cost of the specialment destroyed using the sales value at stof method Complete the table below beast you. Round the weighting to the decimal place and the stocated to per degram to four domas. Note that due ronding the tawaghing may not necessary ads to 1. Round all other amounts to the nearest theast Wings Thigh Bones Feathers Total Kilograms of product Production information 125 25 35 55 10 Wholesale selling price per kilogram 5 0.50 $ 0.205 0.45$ 0.101 0.06 Salus value at stort Wholesale Selling Price per Kilograms of Kilogram when Production Weighting Sales value at split Parts Product Is Complete Joint costa allocated Breasts 120 $ 050 Allcomed osts per kilogram Wings 25 0.20 Thigh 35 0.48 Required Bones 56 0.10 Feathers 10 0.00 1. Calculate the cost of the special shipment soyed using a. Salos value at phtof method b. Physical measure method (klograms of finished product Print Done 2. What joint cost allocation method would you recommend Form Bred Chickene? Explain Farm Bred Chicken grows and process chickens. Each chicken diesembled into five main parts. Information pertaining to production in July is as foliowa Click the icon to view the production information Joint cost of production in July was 560. A special shipment of 100 kilograms of breasts and 10 kilograms of wings has been destroyed in a fire Farm Bred Chicken in policy provides rimbursement for the cost of the dents destroyed. The insurance company em Farm Bed Chicken tjocost estimethod. The shtoff point is assumed to be at the end of the prodion process Required Requirement 1a. Calcule the cost of the specialment destroyed using the sales value at stof method Complete the table below beast you. Round the weighting to the decimal place and the stocated to per degram to four domas. Note that due ronding the tawaghing may not necessary ads to 1. Round all other amounts to the nearest theast Wings Thigh Bones Feathers Total Kilograms of product Production information 125 25 35 55 10 Wholesale selling price per kilogram 5 0.50 $ 0.205 0.45$ 0.101 0.06 Salus value at stort Wholesale Selling Price per Kilograms of Kilogram when Production Weighting Sales value at split Parts Product Is Complete Joint costa allocated Breasts 120 $ 050 Allcomed osts per kilogram Wings 25 0.20 Thigh 35 0.48 Required Bones 56 0.10 Feathers 10 0.00 1. Calculate the cost of the special shipment soyed using a. Salos value at phtof method b. Physical measure method (klograms of finished product Print Done 2. What joint cost allocation method would you recommend Form Bred Chickene? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started