Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please answer any or all of the questions above? 1. A, an individual, is an architect and general contractor. B is a wealthy

could you please answer any or all of the questions above?

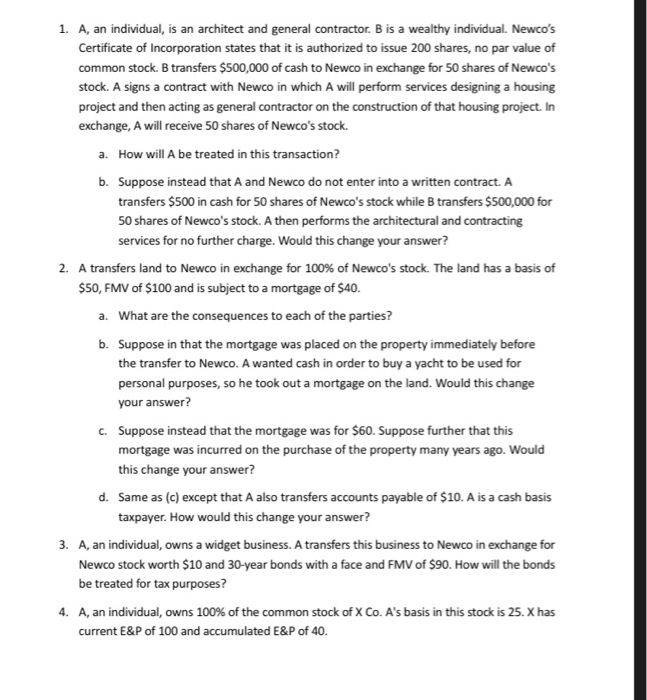

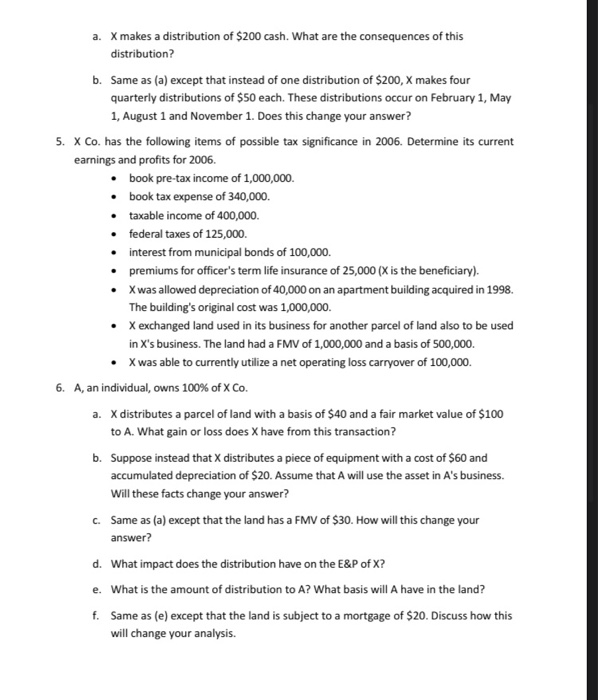

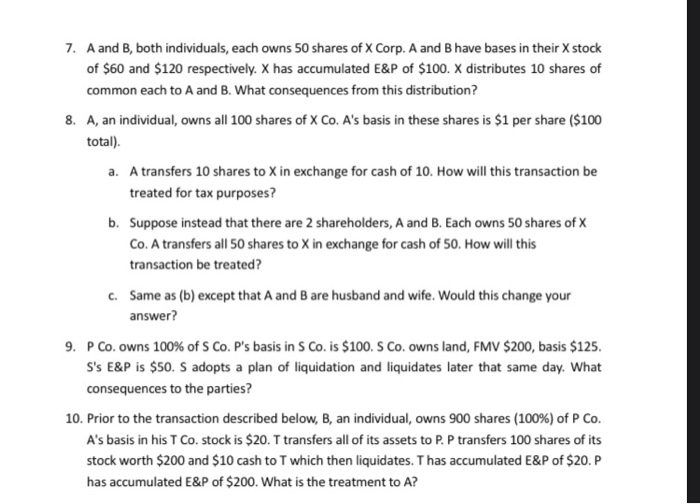

1. A, an individual, is an architect and general contractor. B is a wealthy individual. Newco's Certificate of Incorporation states that it is authorized to issue 200 shares, no par value of common stock. B transfers $500,000 of cash to Newco in exchange for 50 shares of Newco's stock. A signs a contract with Newco in which A will perform services designing a housing project and then acting as general contractor on the construction of that housing project. In exchange, A will receive 50 shares of Newco's stock. a. How will A be treated in this transaction? b. Suppose instead that A and Newco do not enter into a written contract. A transfers $500 in cash for 50 shares of Newco's stock while B transfers $500,000 for 50 shares of Newco's stock. A then performs the architectural and contracting services for no further charge. Would this change your answer? 2. A transfers land to Newco in exchange for 100% of Newco's stock. The land has a basis of $50, FMV of $100 and is subject to a mortgage of $40. a. What are the consequences to each of the parties? b. Suppose in that the mortgage was placed on the property immediately before the transfer to Newco. A wanted cash in order to buy a yacht to be used for personal purposes, so he took out a mortgage on the land. Would this change your answer? c. Suppose instead that the mortgage was for $60. Suppose further that this mortgage was incurred on the purchase of the property many years ago. Would this change your answer? d. Same as (c) except that A also transfers accounts payable of $10.A is a cash basis taxpayer. How would this change your answer? 3. A, an individual, owns a widget business. A transfers this business to Newco in exchange for Newco stock worth $10 and 30-year bonds with a face and FMV of $90. How will the bonds be treated for tax purposes? 4. A, an individual, owns 100% of the common stock of X Co. A's basis in this stock is 25. X has current E&P of 100 and accumulated E&P of 40. a. X makes a distribution of $200 cash. What are the consequences of this distribution? b. Same as (a) except that instead of one distribution of $200, X makes four quarterly distributions of $50 each. These distributions occur on February 1, May 1. August 1 and November 1. Does this change your answer? 5. X Co. has the following items of possible tax significance in 2006. Determine its current earnings and profits for 2006. book pre-tax income of 1,000,000 book tax expense of 340,000. taxable income of 400,000. federal taxes of 125,000. interest from municipal bonds of 100,000. premiums for officer's term life insurance of 25,000 (X is the beneficiary). X was allowed depreciation of 40,000 on an apartment building acquired in 1998 The building's original cost was 1,000,000. X exchanged land used in its business for another parcel of land also to be used in X's business. The land had a FMV of 1,000,000 and a basis of 500,000. X was able to currently utilize a net operating loss carryover of 100,000 6. A, an individual, owns 100% of X Co. a. X distributes a parcel of land with a basis of $40 and a fair market value of $100 to A. What gain or loss does X have from this transaction? b. Suppose instead that X distributes a piece of equipment with a cost of $60 and umulated depreciation of $20. Assume that A will use the asset in A's business Will these facts change your answer? c. Same as (a) except that the land has a FMV of $30. How will this change your answer? d. What impact does the distribution have on the E&P of X? e. What is the amount of distribution to A? What basis will A have in the land? f. Same as (e) except that the land is subject to a mortgage of $20. Discuss how this will change your analysis. 7. A and B, both individuals, each owns 50 shares of X Corp. A and B have bases in their X stock of $60 and $120 respectively. X has accumulated E&P of $100. X distributes 10 shares of common each to A and B. What consequences from this distribution? 8. A, an individual, owns all 100 shares of X Co. A's basis in these shares is $1 per share ($100 total). a. A transfers 10 shares to X in exchange for cash of 10. How will this transaction be treated for tax purposes? b. Suppose instead that there are 2 shareholders, A and B. Each owns 50 shares of X Co. A transfers all 50 shares to X in exchange for cash of 50. How will this transaction be treated? c. Same as (b) except that A and B are husband and wife. Would this change your answer? 9. P Co. owns 100% of S Co. P's basis in S Co. is $100. S Co. owns land, FMV $200, basis $125. S's E&P is $50. S adopts a plan of liquidation and liquidates later that same day. What consequences to the parties? 10. Prior to the transaction described below, B, an individual, owns 900 shares (100%) of P Co. A's basis in his T Co. stock is $20. T transfers all of its assets to P. P transfers 100 shares of its stock worth $200 and $10 cash to T which then liquidates. Thas accumulated E&P of $20.P has accumulated E&P of $200. What is the treatment to A Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started