Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please answer the question that have 2 part , last person tried to answer part two of my question but I couldn't understand

could you please answer the question that have 2 part , last person tried to answer part two of my question but I couldn't understand her/his hand writing . I need solutions for two part please.

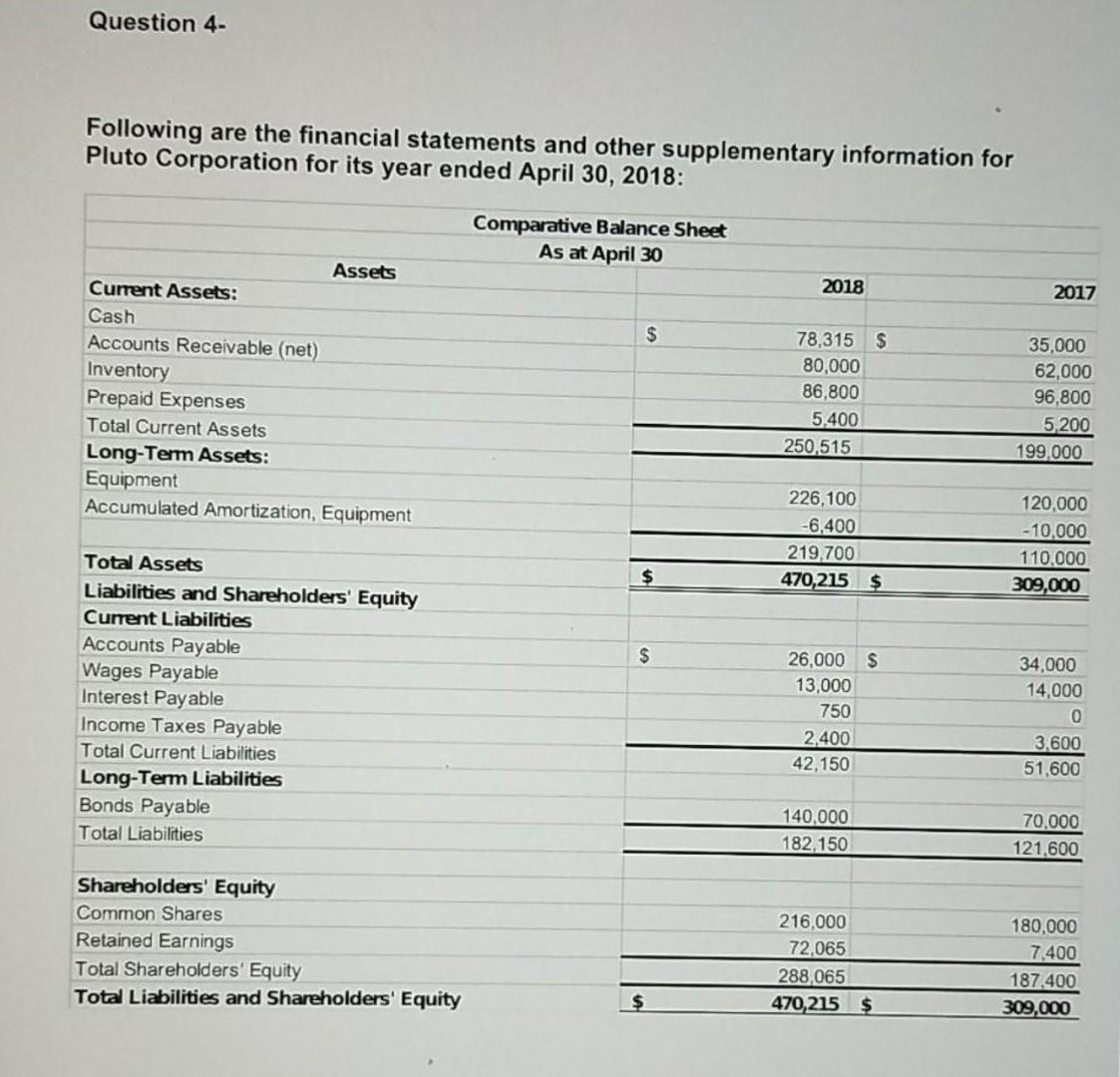

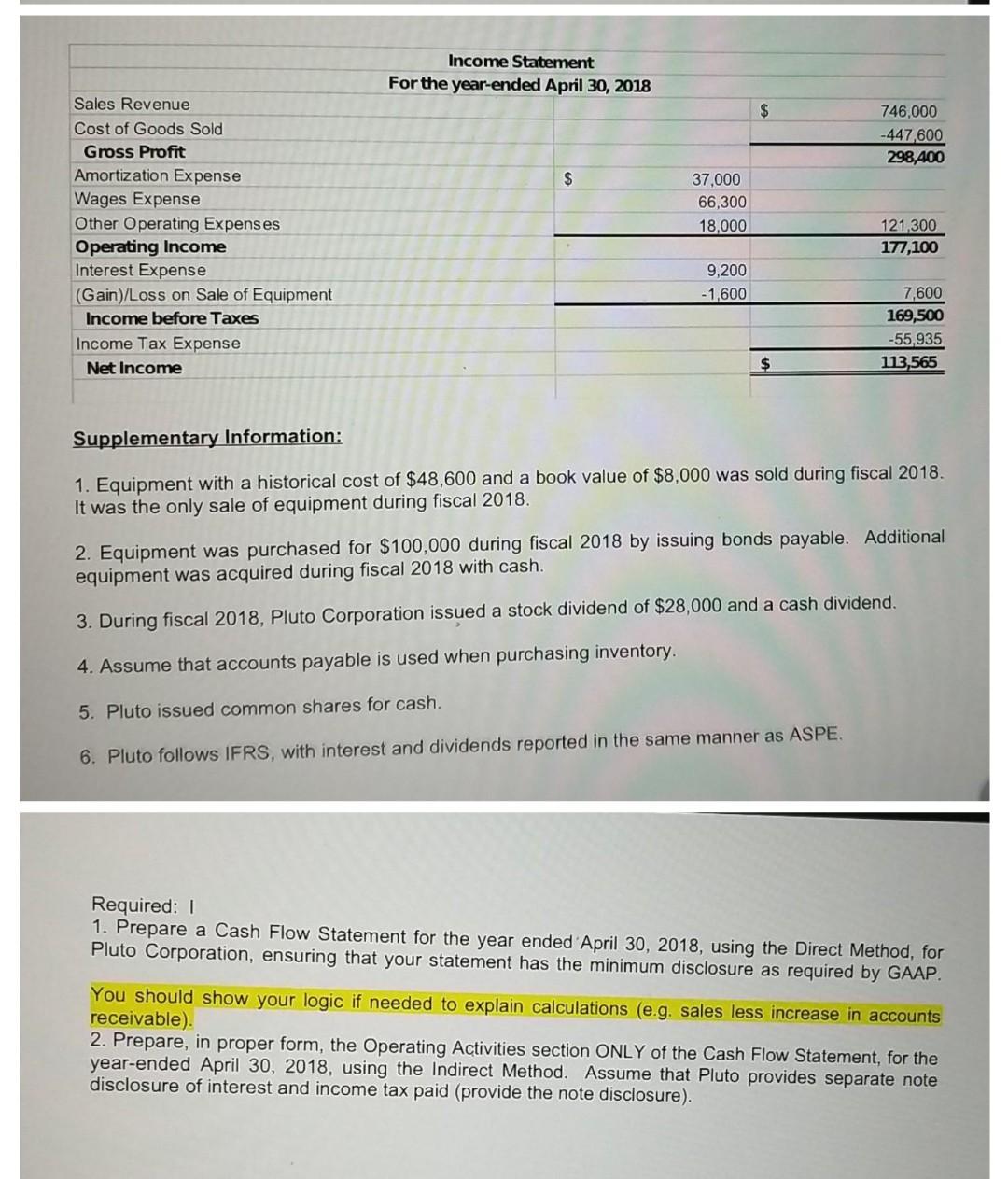

Question 4- Following are the financial statements and other supplementary information for Pluto Corporation for its year ended April 30, 2018: Comparative Balance Sheet As at April 30 2018 2017 $ Assets Current Assets: Cash Accounts Receivable (net) Inventory Prepaid Expenses Total Current Assets Long-Term Assets: Equipment Accumulated Amortization, Equipment 78,315 $ 80,000 86,800 5.400 250,515 35,000 62,000 96,800 5,200 199.000 226,100 -6,400 219,700 470,215 $ 120.000 - 10,000 110,000 309,000 $ $ Total Assets Liabilities and Shareholders' Equity Current Liabilities Accounts Payable Wages Payable Interest Payable Income Taxes Payable Total Current Liabilities Long-Term Liabilities Bonds Payable Total Liabilities 26,000 $ 13,000 750 2,400 42,150 34,000 14,000 0 3,600 51.600 140,000 182.150 70,000 121,600 Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 216.000 72,065 288,065 470,215 $ 180,000 7.400 187,400 309,000 $ Income Statement For the year-ended April 30, 2018 $ 746,000 -447,600 298,400 $ 37,000 66,300 18,000 Sales Revenue Cost of Goods Sold Gross Profit Amortization Expense Wages Expense Other Operating Expenses Operating Income Interest Expense (Gain)/Loss on Sale of Equipment Income before Taxes Income Tax Expense Net Income 121,300 177,100 9,200 -1,600 7,600 169,500 -55,935 113,565 $ Supplementary Information: 1. Equipment with a historical cost of $48,600 and a book value of $8,000 was sold during fiscal 2018. It was the only sale of equipment during fiscal 2018. 2. Equipment was purchased for $100,000 during fiscal 2018 by issuing bonds payable. Additional equipment was acquired during fiscal 2018 with cash. 3. During fiscal 2018, Pluto Corporation issued a stock dividend of $28,000 and a cash dividend. 4. Assume that accounts payable is used when purchasing inventory. 5. Pluto issued common shares for cash. 6. Pluto follows IFRS, with interest and dividends reported in the same manner as ASPE. Required: 1 1. Prepare a Cash Flow Statement for the year ended April 30, 2018, using the Direct Method, for Pluto Corporation, ensuring that your statement has the minimum disclosure as required by GAAP. You should show your logic if needed to explain calculations (e.g. sales less increase in accounts receivable) 2. Prepare, in proper form, the Operating Activities section ONLY of the Cash Flow Statement, for the year-ended April 30, 2018, using the Indirect Method. Assume that Pluto provides separate note disclosure of interest and income tax paid (provide the note disclosure)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started