Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please answer this question? I am in a hurry a little bit, so fast answer would be appreciated! Thank you! Question 14 (1

Could you please answer this question?

I am in a hurry a little bit, so fast answer would be appreciated!

Thank you!

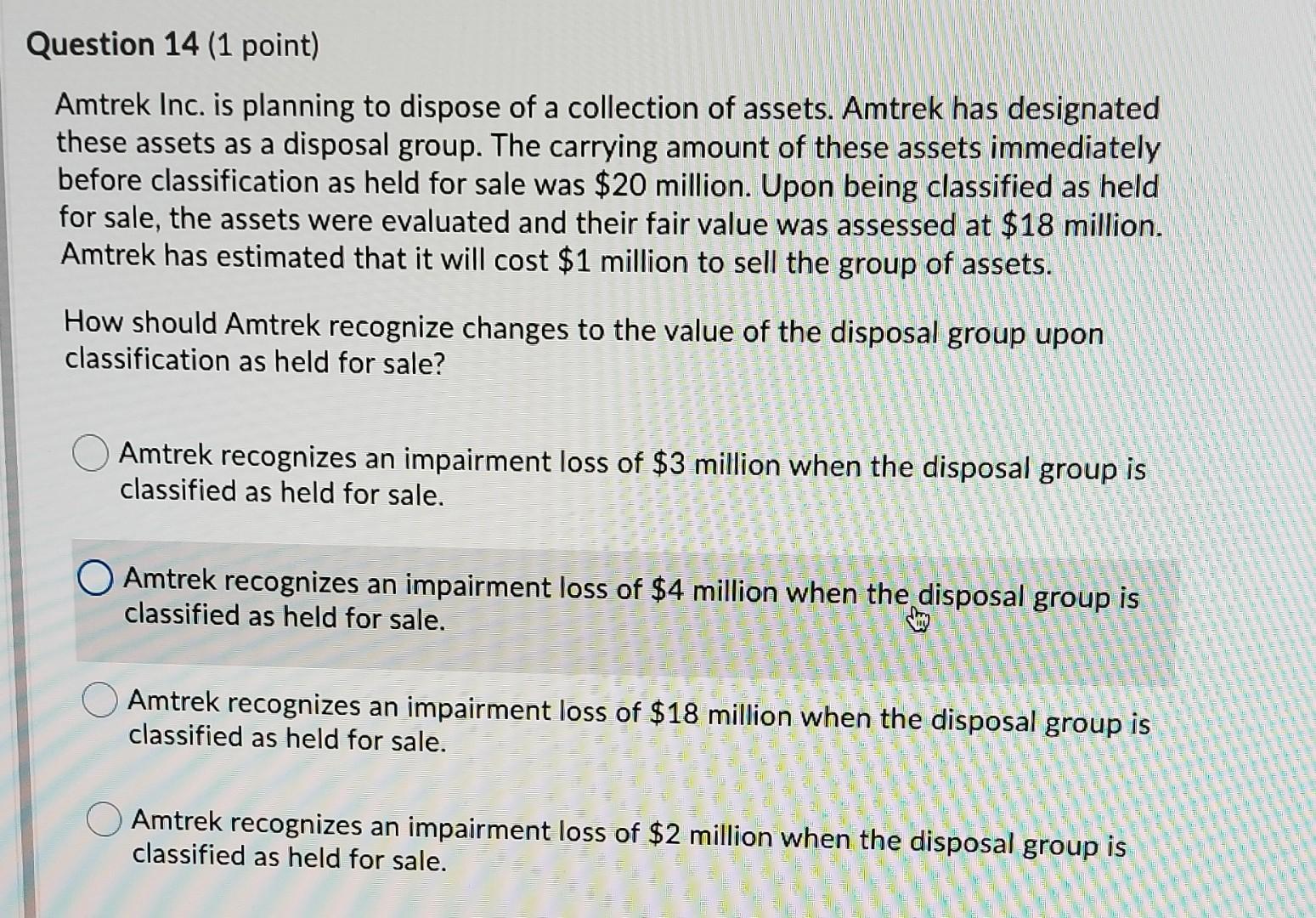

Question 14 (1 point) Amtrek Inc. is planning to dispose of a collection of assets. Amtrek has designated these assets as a disposal group. The carrying amount of these assets immediately before classification as held for sale was $20 million. Upon being classified as held for sale, the assets were evaluated and their fair value was assessed at $18 million. Amtrek has estimated that it will cost $1 million to sell the group of assets. How should Amtrek recognize changes to the value of the disposal group upon classification as held for sale? Amtrek recognizes an impairment loss of $3 million when the disposal group is classified as held for sale. O Amtrek recognizes an impairment loss of $4 million when the disposal group is classified as held for sale. Amtrek recognizes an impairment loss of $18 million when the disposal group is classified as held for sale. Amtrek recognizes an impairment loss of $2 million when the disposal group is classified as held for sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started