Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you Please ASAP (URGENT) see if 22 and 24 are correct and if so! how do you get number 23 E. None of the

Could you Please ASAP (URGENT) see if 22 and 24 are correct and if so! how do you get number 23

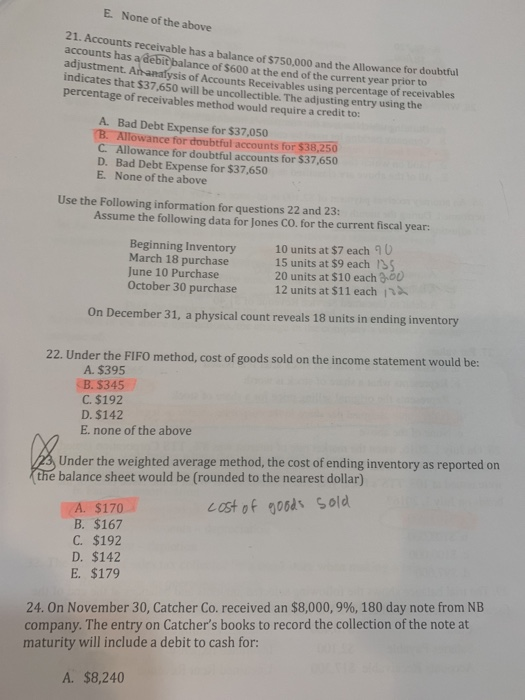

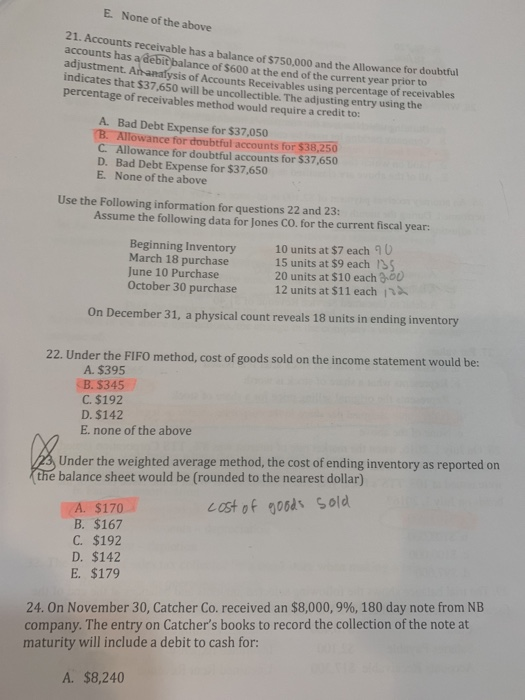

E. None of the above 21. Accounts receivable has a balance of $750.000 and the Allowance for doubtful accounts has a debit balance of $600 at the end of the current year prior to adjustment. Aanalysis of Accounts Receivables using percentage of receivables indicates that $37,650 will be uncollectible. The adjusting entry using the percentage of receivables method would require a credit to: A. Bad Debt Expense for $37,050 250 B. Allowance for doubtful accounts for $38,250 C. Allowance for doubtful accounts for $37,650 D. Bad Debt Expense for $37,650 None of the above E. Use the Following information for questions 22 and 23: Assume the following data for Jones CO. for the current fiscal year: 10 units at $7 each 15 units at $9 each sS 20 units at $10 each a0 Beginning inventory March 18 purchase June 10 Purchase October 30 purchase 12 units at $11 each n On December 31, a physical count reveals 18 units in ending inventory 22. Under the FIFO method, cost of goods sold on the income statement would be: A. $395 $345 C. $192 D. $142 E. none of the above Under the weighted average method, the cost of ending inventory as reported on e balance sheet would be (rounded to the nearest dollar) ost of gods sold A. $170 B. $167 C. $192 D. $142 E. $179 24. On November 30, Catcher Co. received an $8,000, 9%, 180 day note from NB company. The entry on Catcher's books to record the collection of the note at maturity will include a debit to cash for: A. $8,240

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started