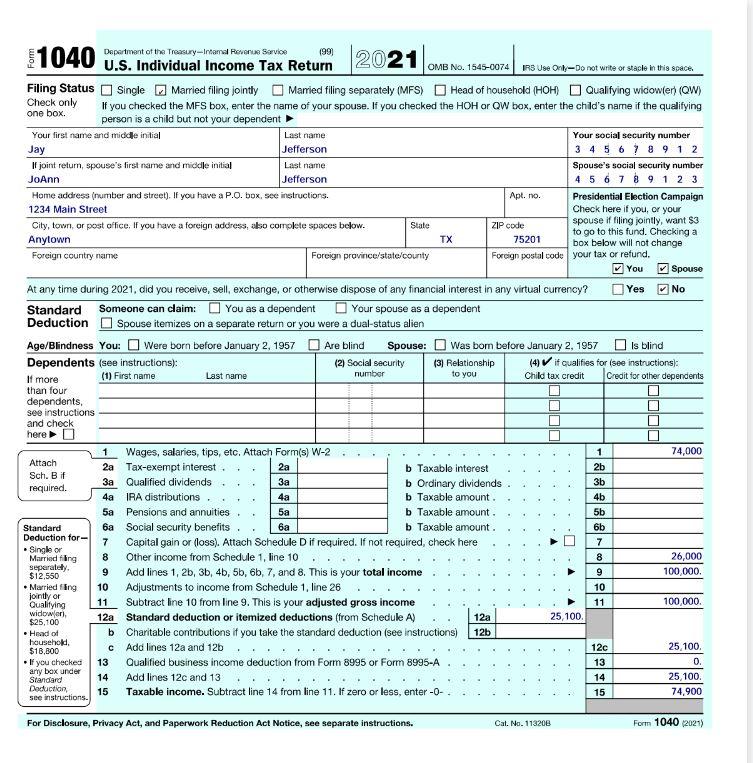

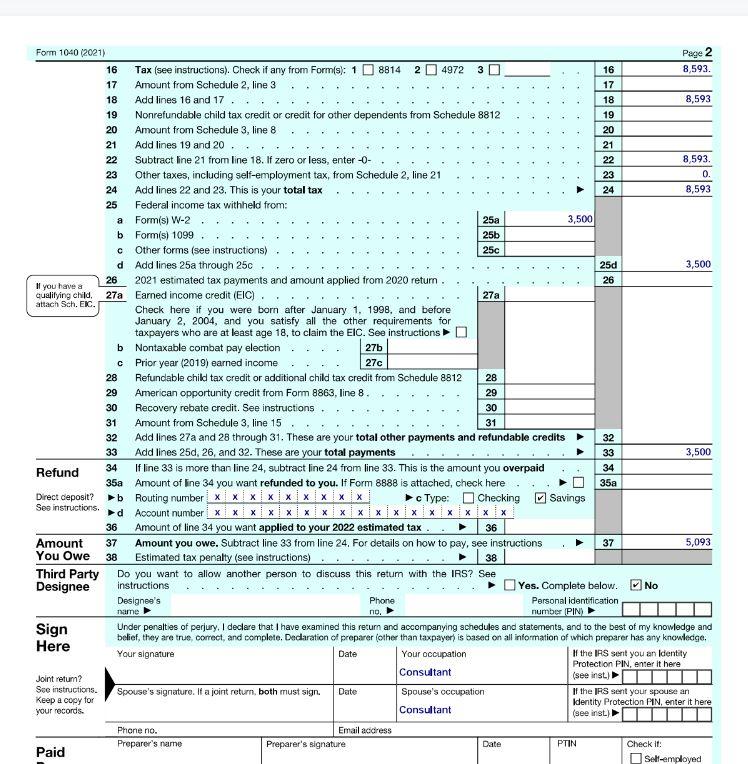

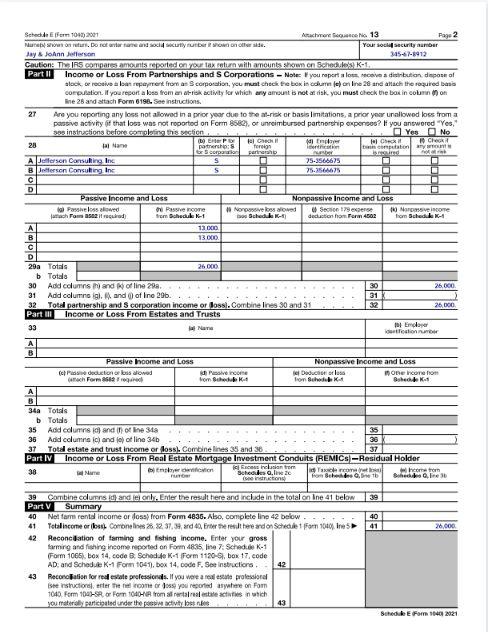

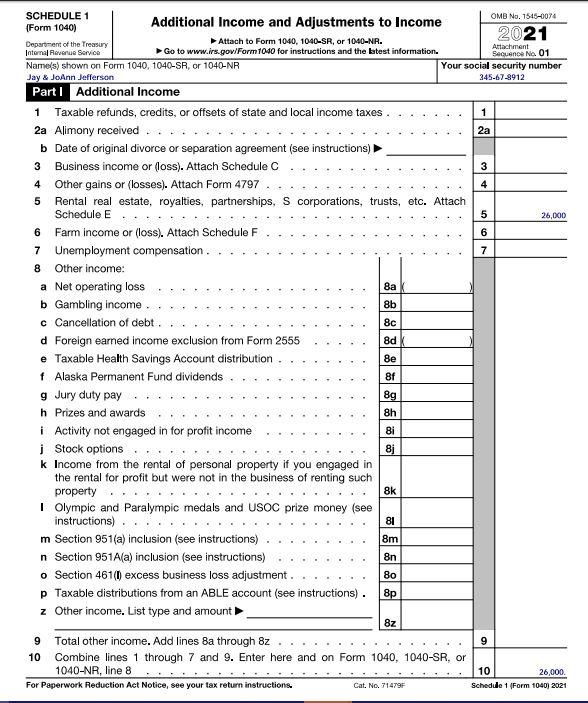

could you please check to see if I did the tax return correctly.

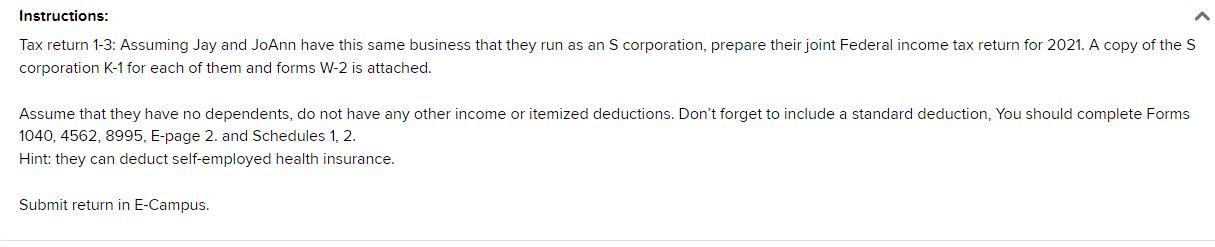

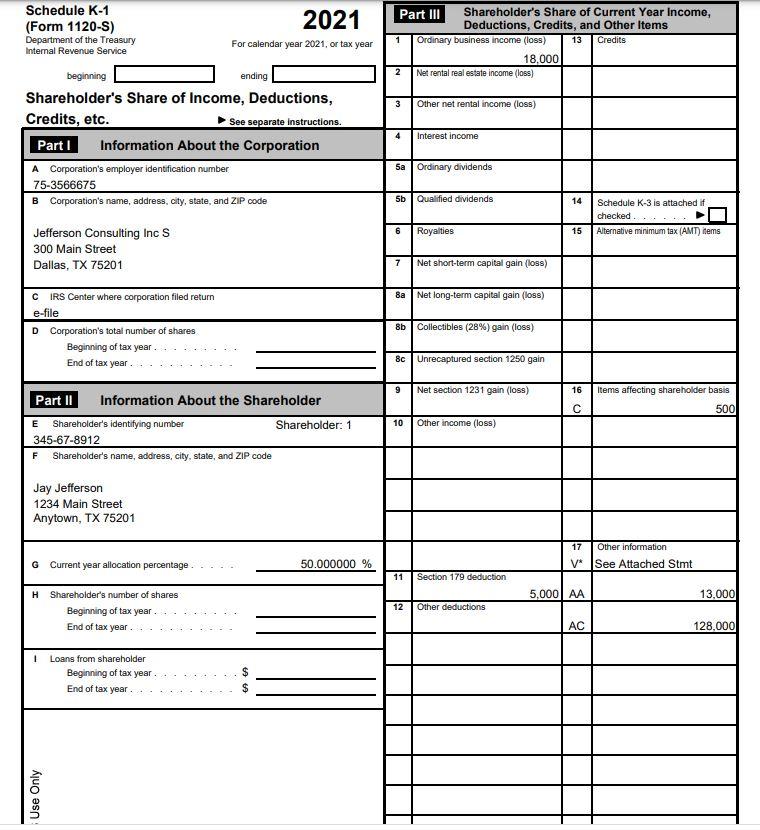

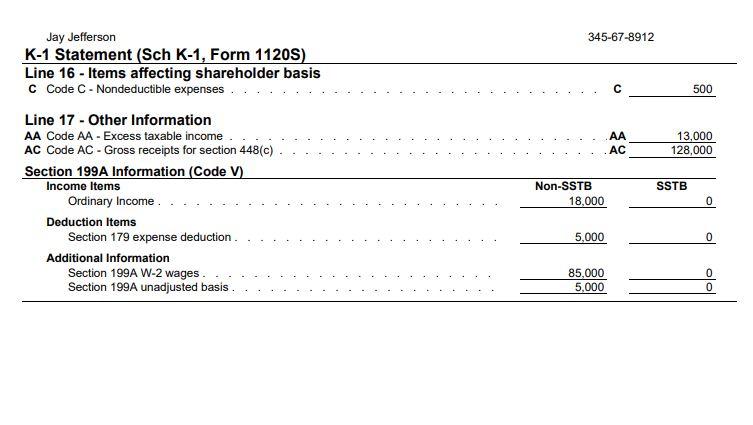

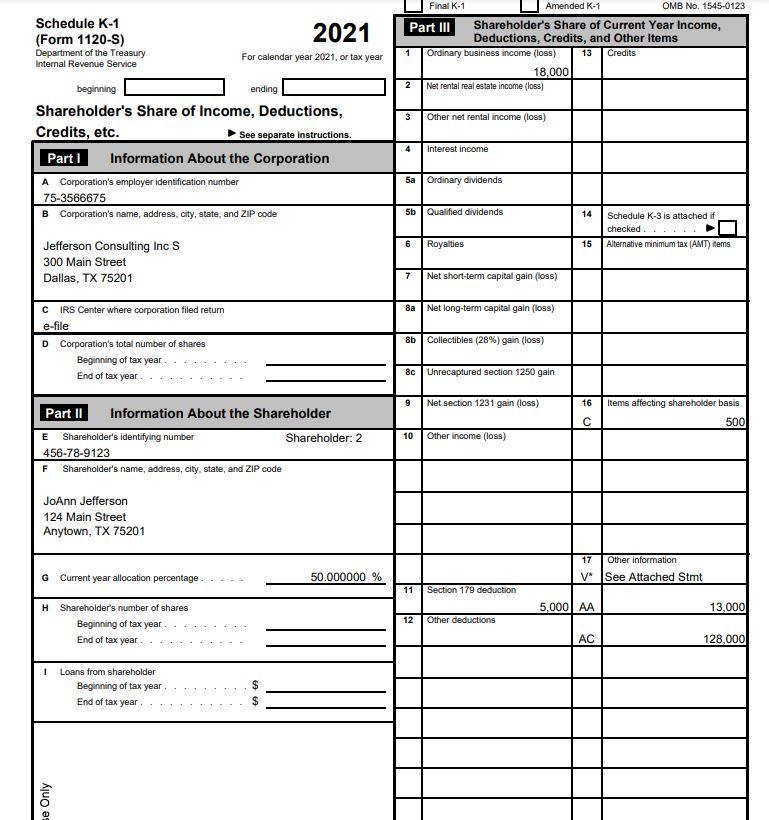

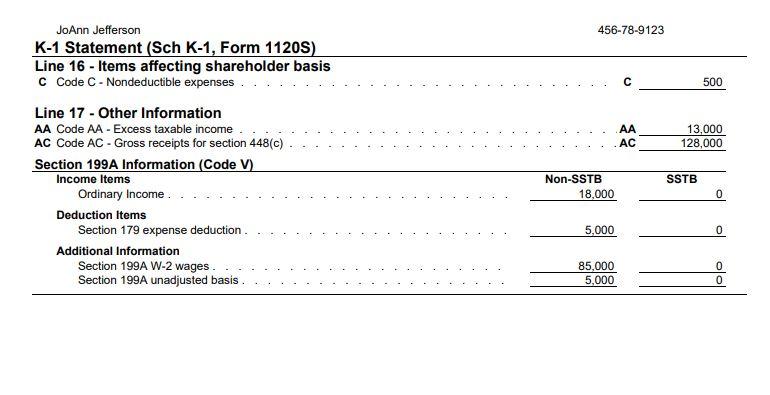

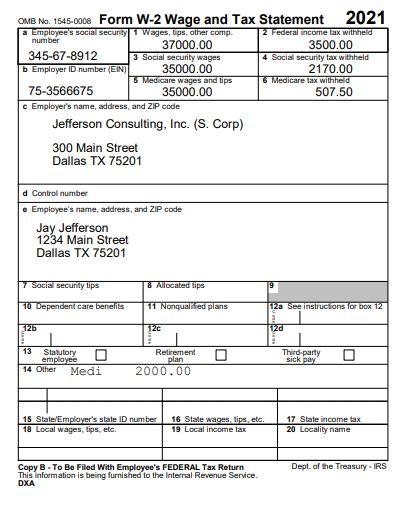

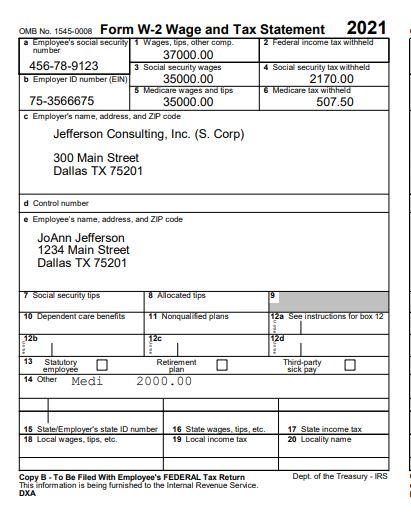

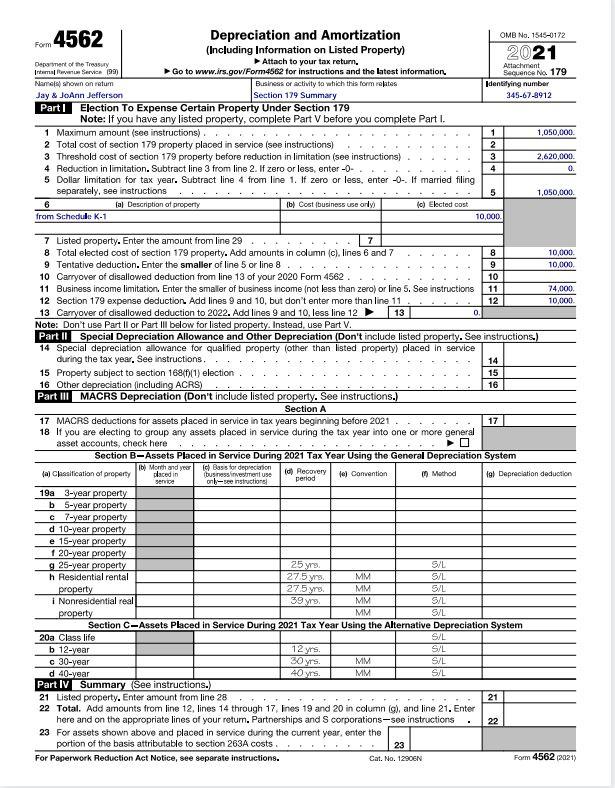

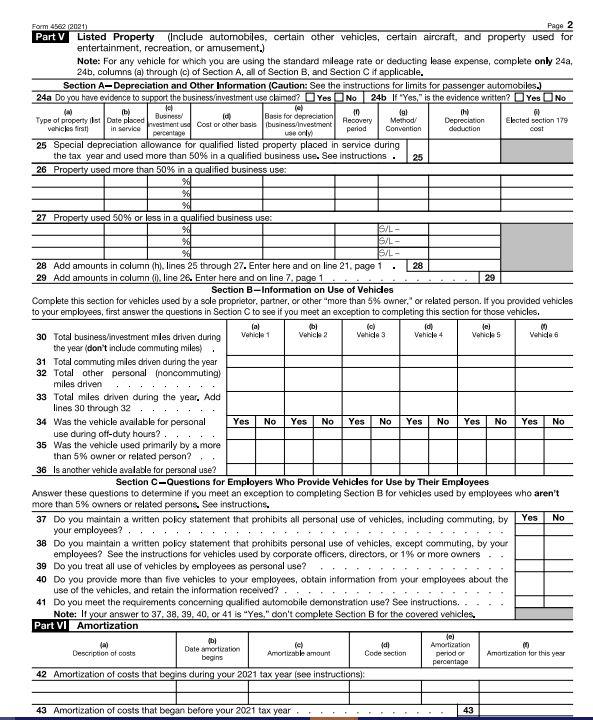

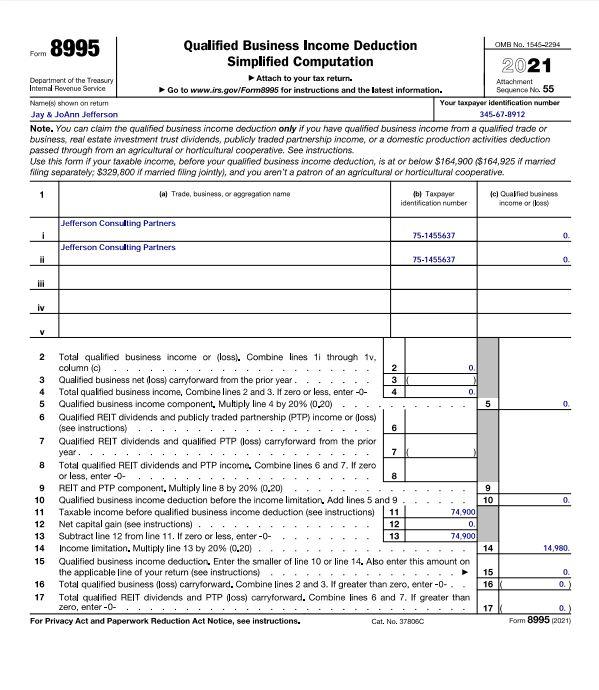

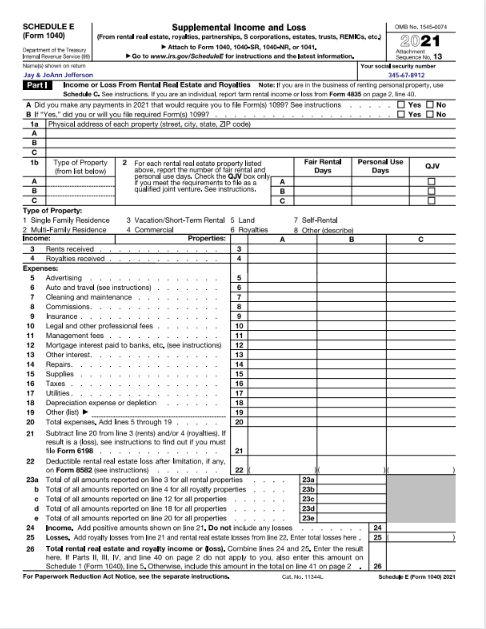

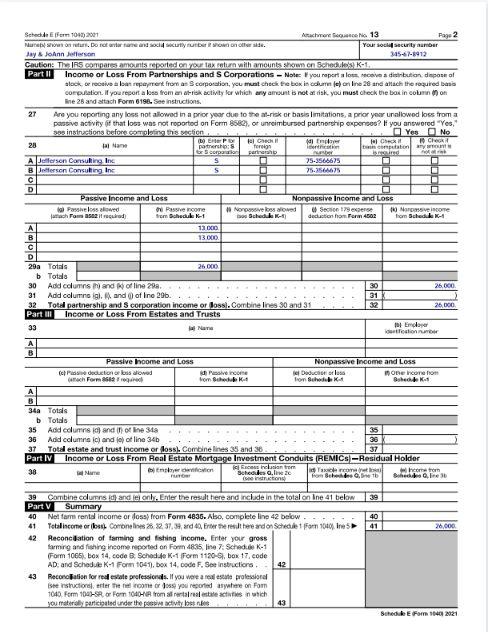

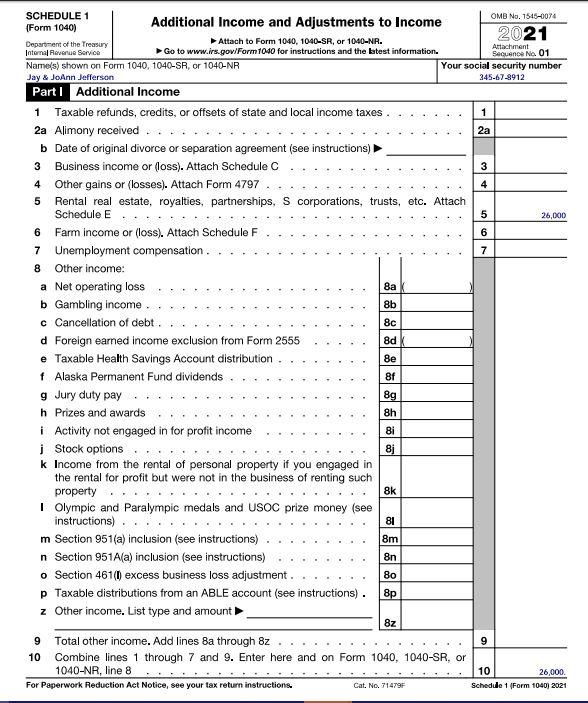

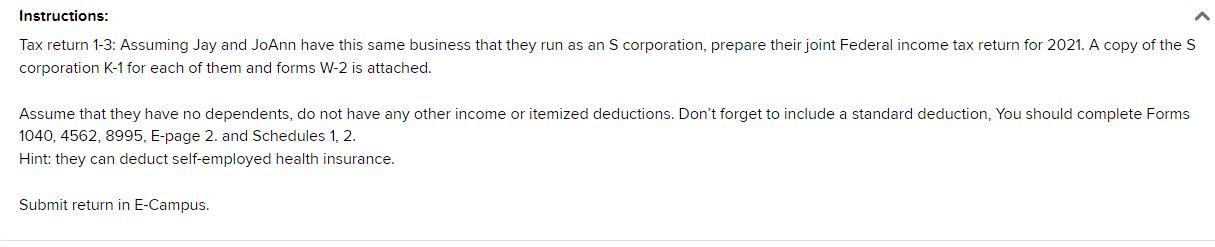

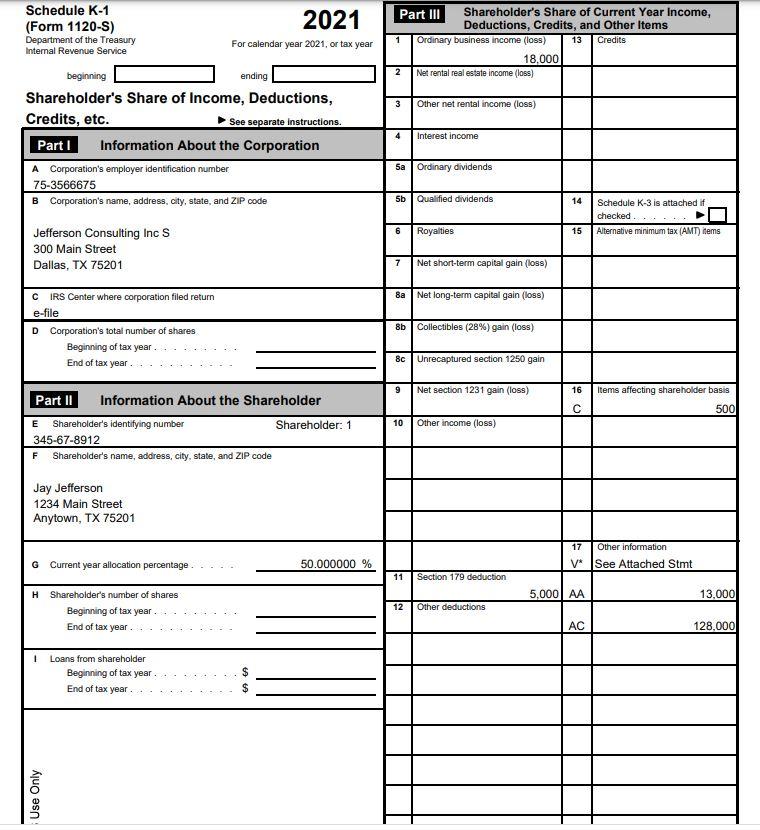

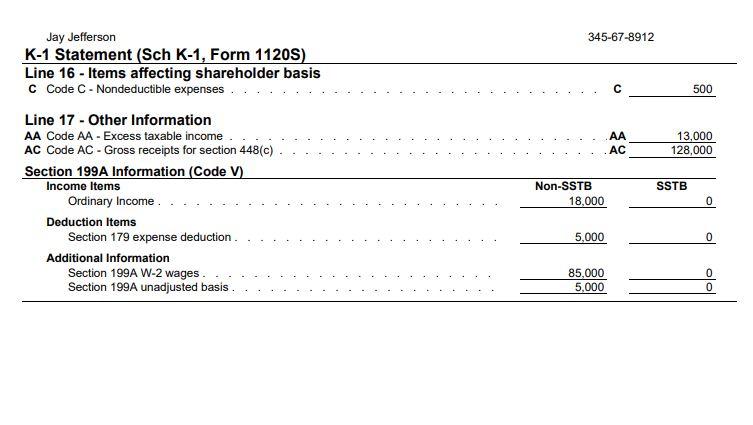

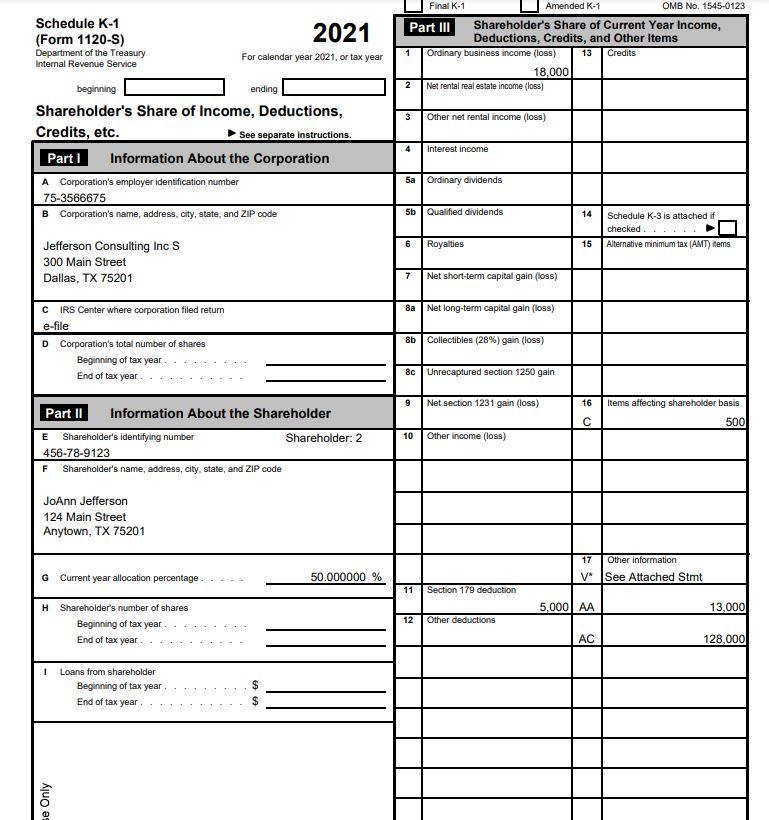

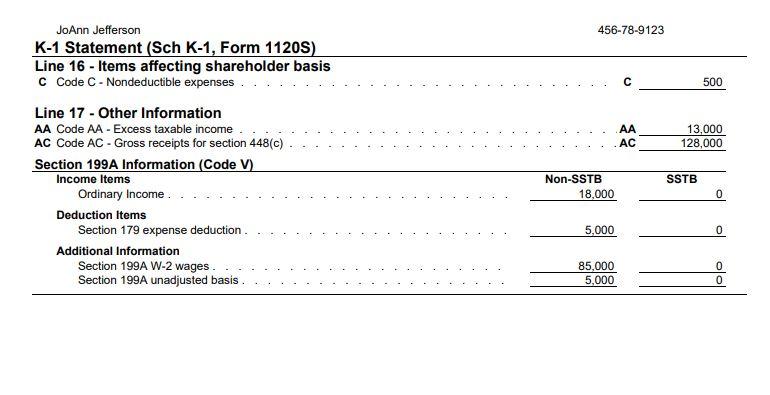

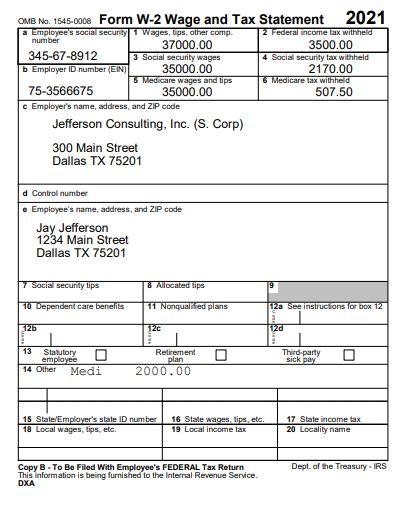

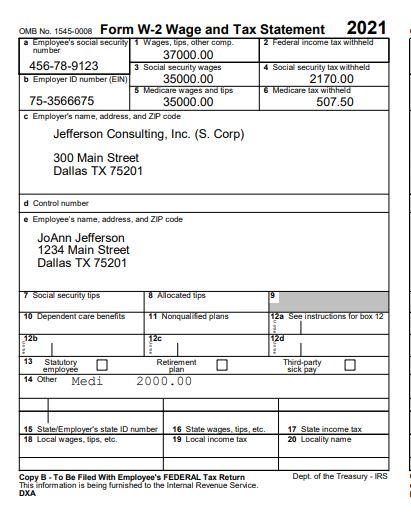

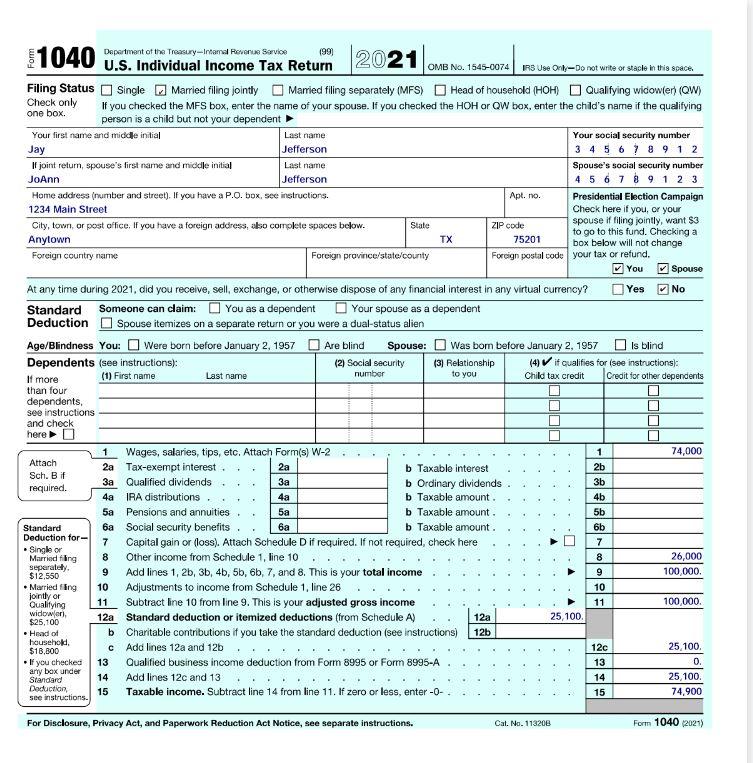

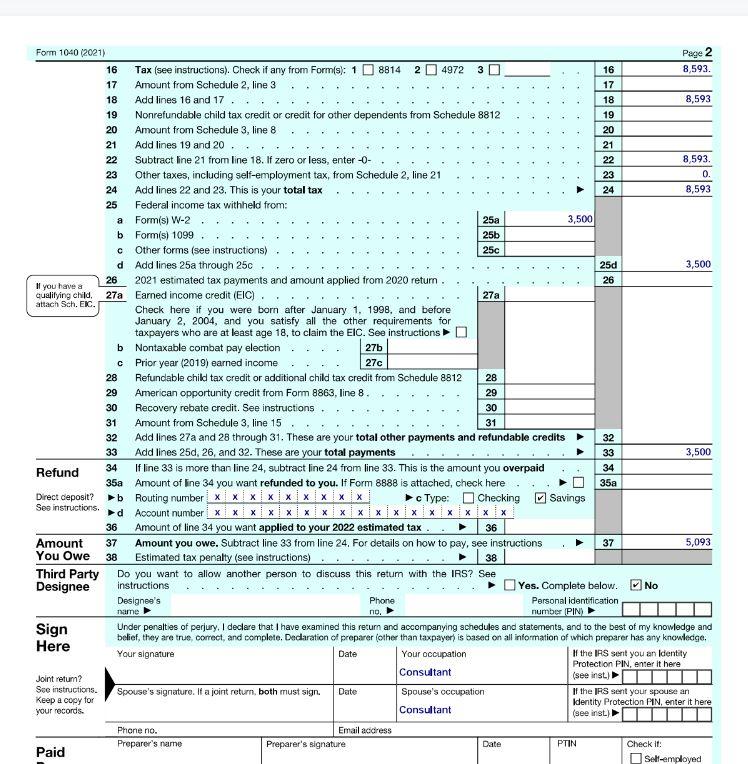

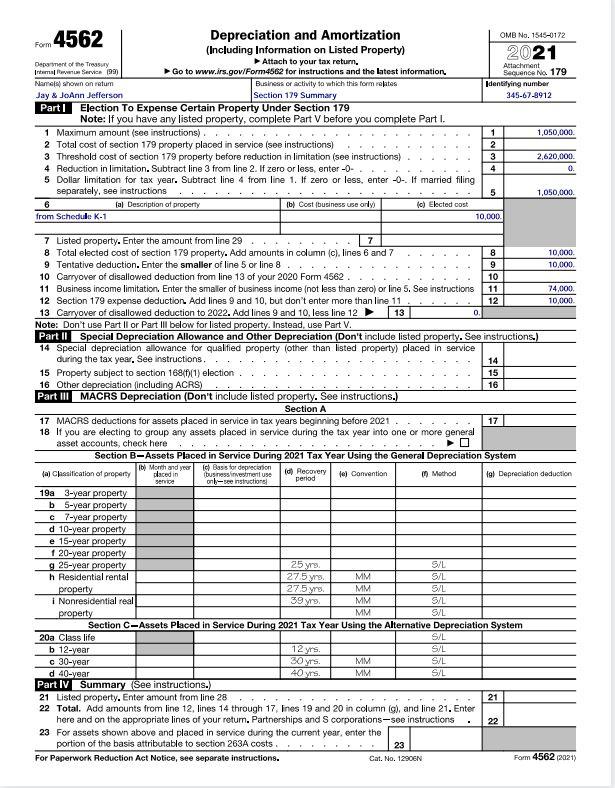

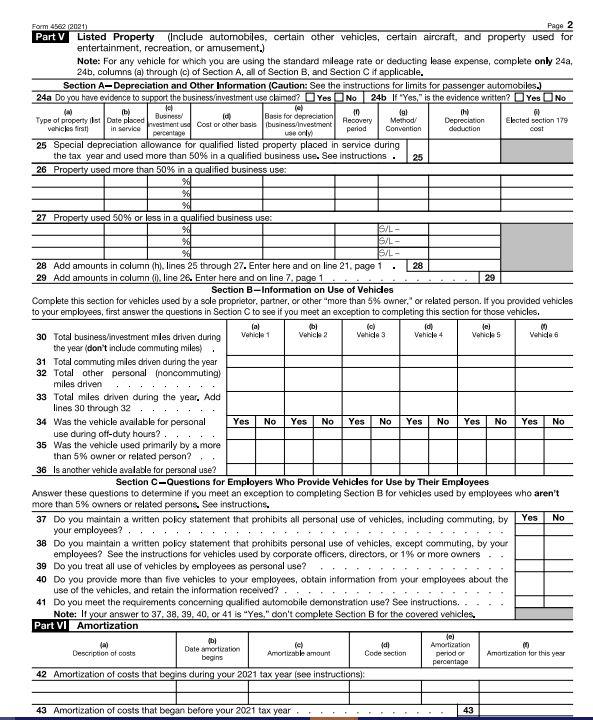

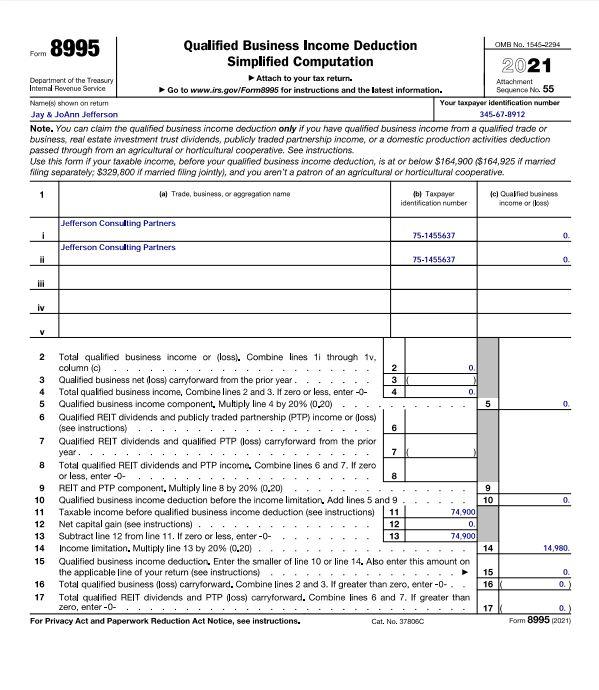

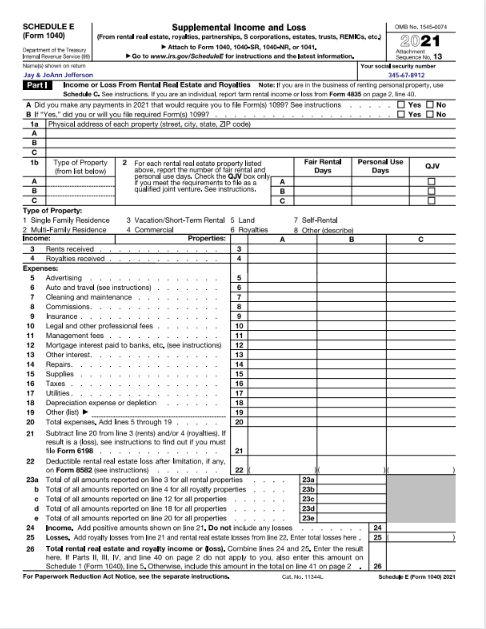

Tax return 1-3: Assuming Jay and JoAnn have this same business that they run as an S corporation, prepare their joint Federal income tax return for 2021 . A copy of the S corporation K1 for each of them and forms W2 is attached. Assume that they have no dependents, do not have any other income or itemized deductions. Don't forget to include a standard deduction, You should complete Forms 1040,4562,8995, E-page 2. and Schedules 1, 2. Hint: they can deduct self-employed health insurance. Submit return in E-Campus. No. 1445-0008 Form W-2 Wage and Tax Statement 2021 Copy B = To Bo Filled With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. Dept of the Treasury = IRS DXA. O No. 1545.008 Form W-2 Wage and Tax Statement 2021 Copy B = To Eo Filled With Employee's FEDERAL Tax Return Dept. af the Treasury = IRS This information is being furnished to the internal Revenue Service. DXA Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifyingwidow(er)(QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the chid's name if the qualifying one box. person is a child but not your dependent Sign Under penalties of perjury, I declere that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and Here belief, they are trus, comect, and complete. Declaration of preparer (other than taxpayer' is based on all information of which preparer has any knowledge; Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. Note: Don't use Part II or Part Ill below for listed property. Instead, use Part V. Section C-Assets Placed in Service During 2021 Tax Year Using the Alternative Depreciation System Part V Listed Property (Include automobiles, certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement.) Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24 a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. Section A-Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.) Note. You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividencts, publicly traded parthership income, or a domestic production activities deduction passed through from an agricultural or horticuitural cooperative. See instructions. Use this form if your faxable income, before your qualied business incame deduction, is at or below $164,900 \$\$164,925 if married filing separately; $329,800 if married filing jointly), and you aren't a patron of an agricultural or harticultural cooperative. Sebedud E |f BLtwd he E Fame 7|4ak de21 Tax return 1-3: Assuming Jay and JoAnn have this same business that they run as an S corporation, prepare their joint Federal income tax return for 2021 . A copy of the S corporation K1 for each of them and forms W2 is attached. Assume that they have no dependents, do not have any other income or itemized deductions. Don't forget to include a standard deduction, You should complete Forms 1040,4562,8995, E-page 2. and Schedules 1, 2. Hint: they can deduct self-employed health insurance. Submit return in E-Campus. No. 1445-0008 Form W-2 Wage and Tax Statement 2021 Copy B = To Bo Filled With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. Dept of the Treasury = IRS DXA. O No. 1545.008 Form W-2 Wage and Tax Statement 2021 Copy B = To Eo Filled With Employee's FEDERAL Tax Return Dept. af the Treasury = IRS This information is being furnished to the internal Revenue Service. DXA Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifyingwidow(er)(QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the chid's name if the qualifying one box. person is a child but not your dependent Sign Under penalties of perjury, I declere that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and Here belief, they are trus, comect, and complete. Declaration of preparer (other than taxpayer' is based on all information of which preparer has any knowledge; Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. Note: Don't use Part II or Part Ill below for listed property. Instead, use Part V. Section C-Assets Placed in Service During 2021 Tax Year Using the Alternative Depreciation System Part V Listed Property (Include automobiles, certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement.) Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24 a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. Section A-Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.) Note. You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividencts, publicly traded parthership income, or a domestic production activities deduction passed through from an agricultural or horticuitural cooperative. See instructions. Use this form if your faxable income, before your qualied business incame deduction, is at or below $164,900 \$\$164,925 if married filing separately; $329,800 if married filing jointly), and you aren't a patron of an agricultural or harticultural cooperative. Sebedud E |f BLtwd he E Fame 7|4ak de21