Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please do all of these question please, really appreciate it, thumbs up for sure. sorry about using your time. but please, thank you

Could you please do all of these question please, really appreciate it, thumbs up for sure. sorry about using your time. but please, thank you so much:)

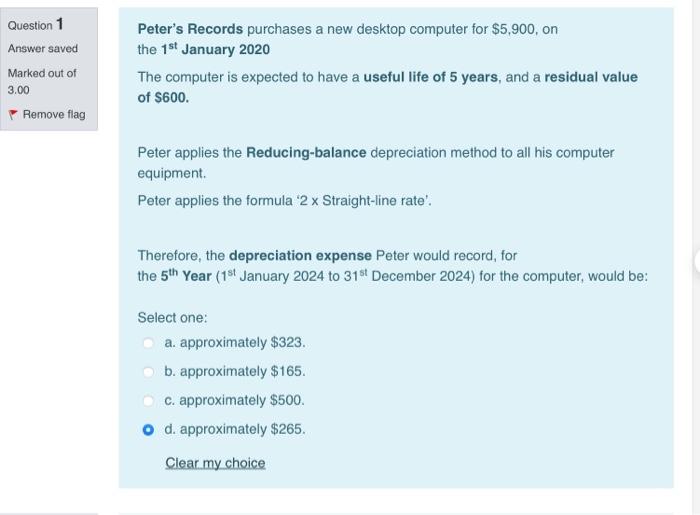

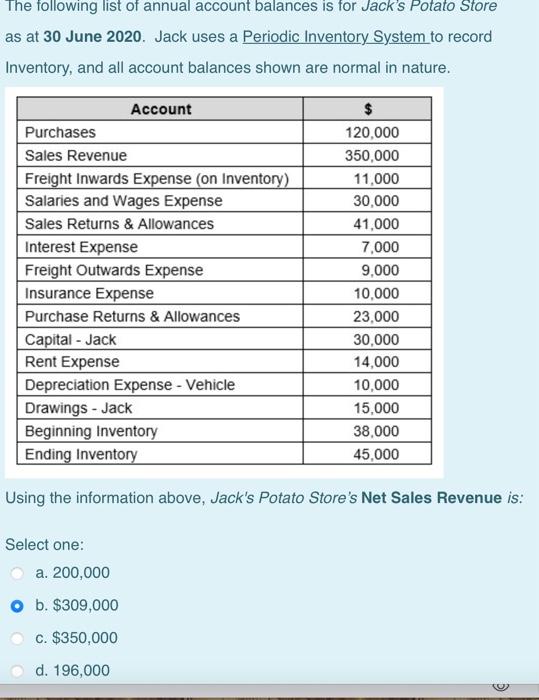

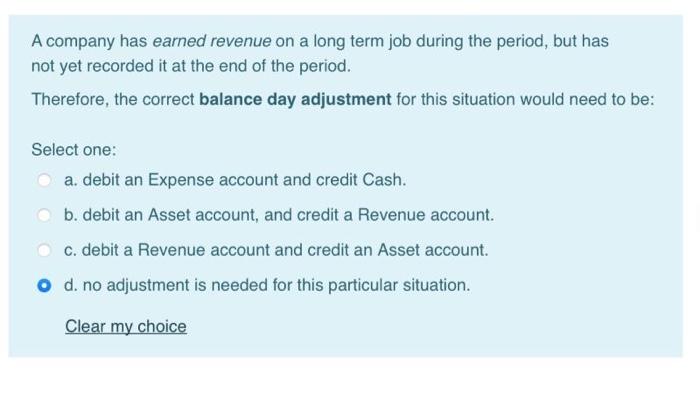

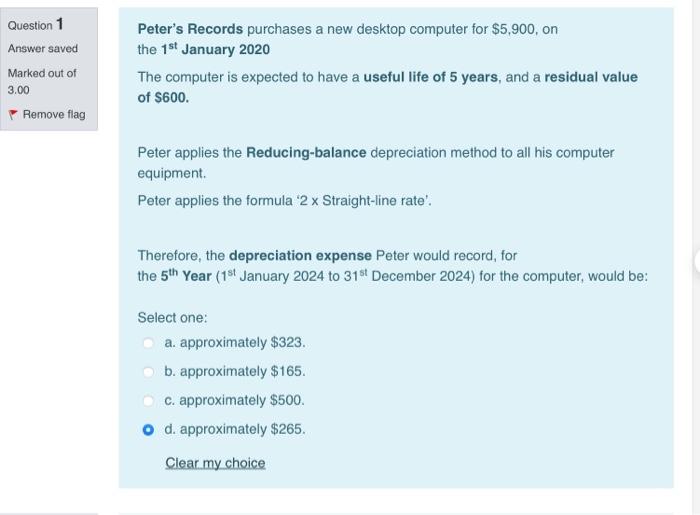

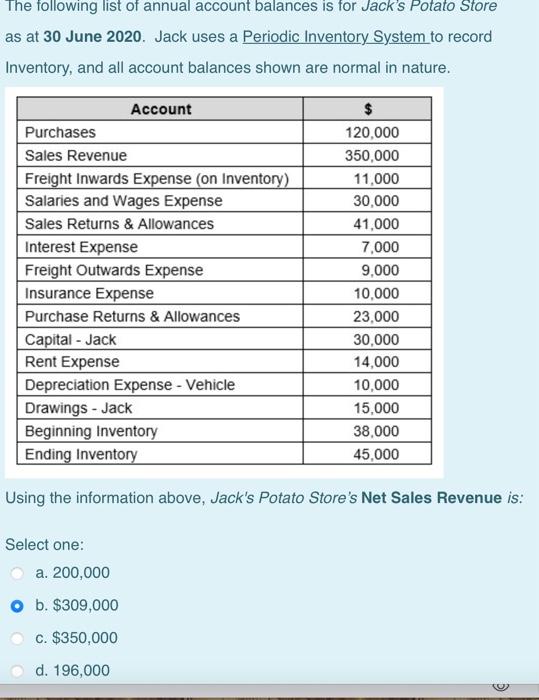

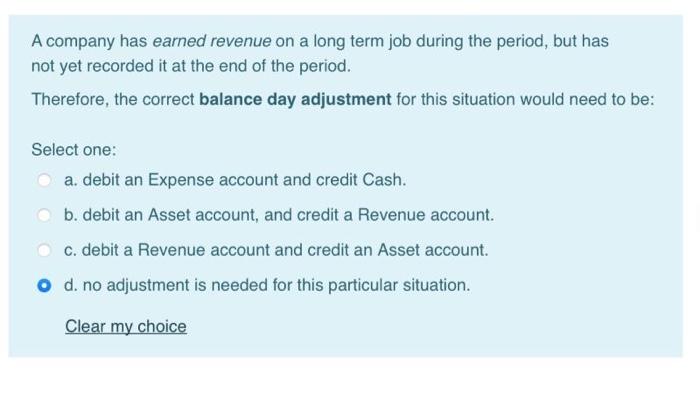

Question 1 Peter's Records purchases a new desktop computer for $5,900, on the 1st January 2020 Answer saved Marked out of 3.00 The computer is expected to have a useful life of 5 years, and a residual value of $600 Remove flag Peter applies the Reducing-balance depreciation method to all his computer equipment. Peter applies the formula 2 x Straight-line rate'. Therefore, the depreciation expense Peter would record, for the 5th Year (1st January 2024 to 31st December 2024) for the computer, would be: Select one: a. approximately $323. b. approximately $165. C. approximately $500. o d. approximately $265. Clear my choice The following list of annual account balances is for Jack's Potato Store as at 30 June 2020. Jack uses a Periodic Inventory System to record Inventory, and all account balances shown are normal in nature. Account Purchases 120,000 350,000 11,000 30,000 Sales Revenue Freight Inwards Expense (on Inventory) Salaries and Wages Expense Sales Returns & Allowances Interest Expense Freight Outwards Expense Insurance Expense 41,000 7,000 9,000 10,000 Purchase Returns & Allowances 23.000 30,000 14,000 10,000 Capital - Jack Rent Expense Depreciation Expense - Vehicle Drawings - Jack Beginning Inventory Ending Inventory 15,000 38,000 45,000 Using the information above, Jack's Potato Store's Net Sales Revenue is: Select one: a. 200,000 O b. $309,000 c. $350,000 d. 196,000 A company has earned revenue on a long term job during the period, but has not yet recorded it at the end of the period. Therefore, the correct balance day adjustment for this situation would need to be: Select one: a. debit an Expense account and credit Cash. b. debit an Asset account, and credit a Revenue account. C. debit a Revenue account and credit an Asset account. O d. no adjustment is needed for this particular situation. Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started