Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please do question 1.1 and 1.2! thanks so much! I have uploaded this question 4 times now and it either comes back wrong

could you please do question 1.1 and 1.2! thanks so much! I have uploaded this question 4 times now and it either comes back wrong or without the invoice statement! please don't forget the invoice statement! thanks again

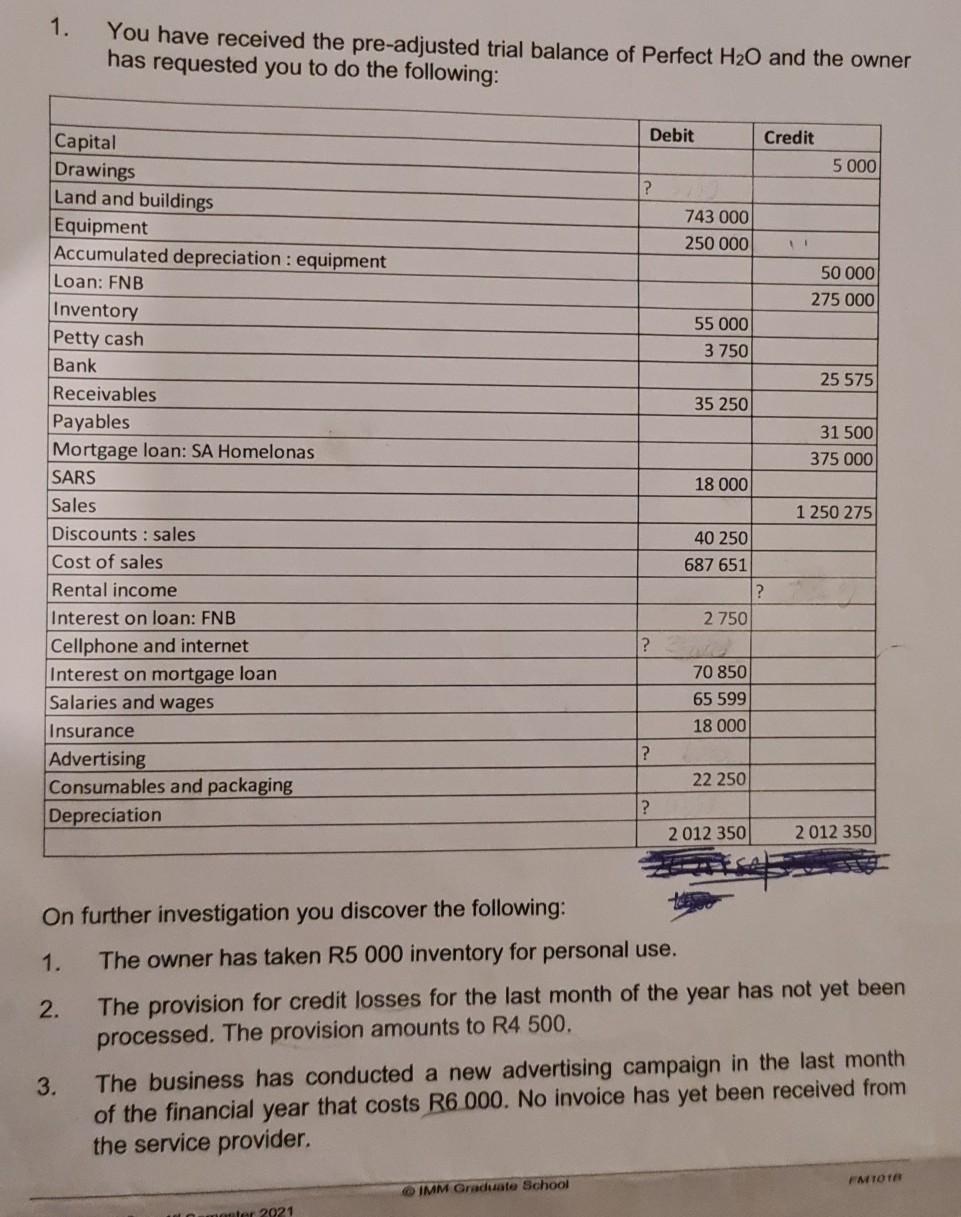

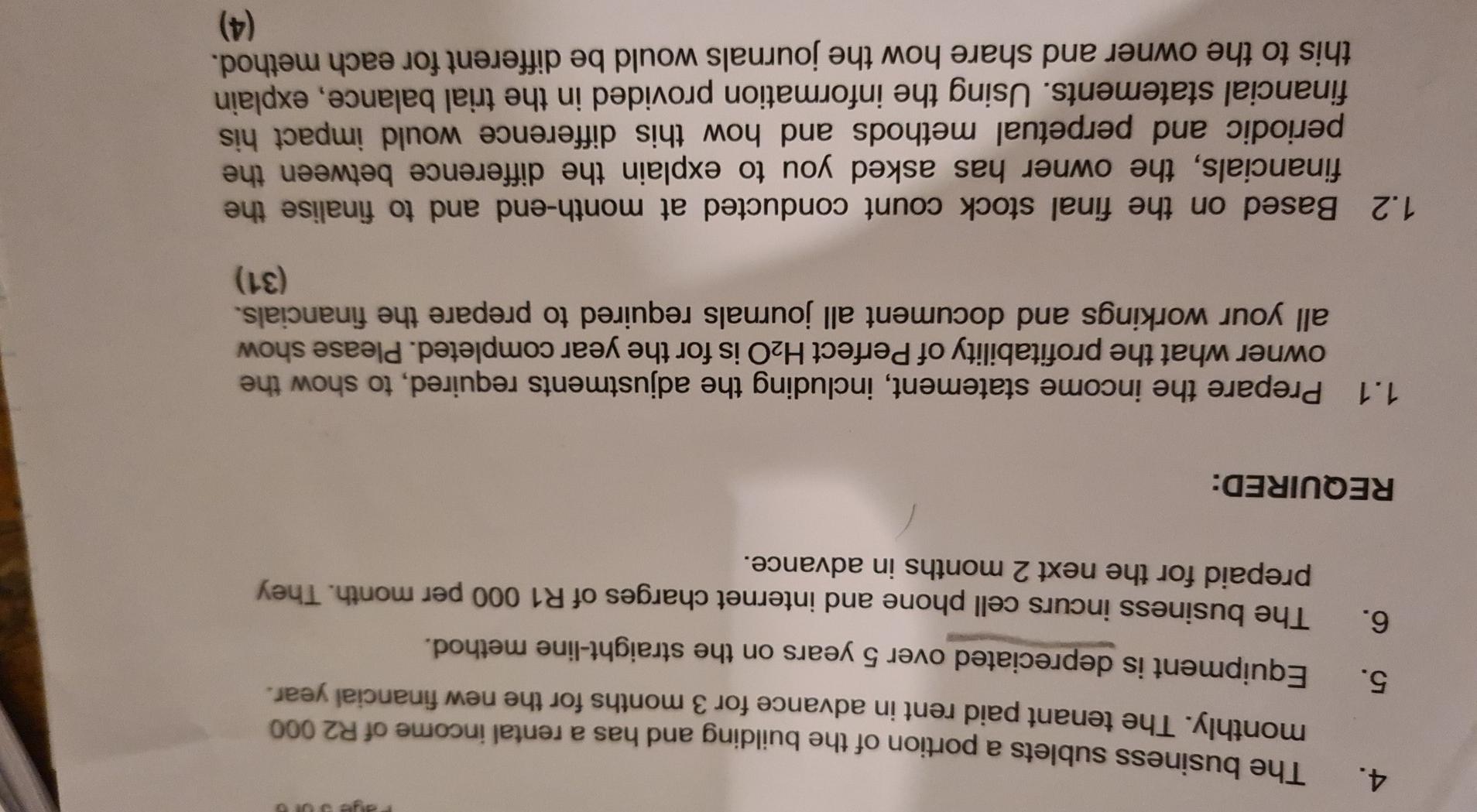

1. You have received the pre-adjusted trial balance of Perfect H20 and the owner has requested you to do the following: Debit Credit 5 000 ? 743 000 250 000 50 000 275 000 55 000 3 750 25 575 35 250 31 500 375 000 Capital Drawings Land and buildings Equipment Accumulated depreciation : equipment Loan: FNB Inventory Petty cash Bank Receivables Payables Mortgage loan: SA Homelonas SARS Sales Discounts : sales Cost of sales Rental income Interest on loan: FNB Cellphone and internet Interest on mortgage loan Salaries and wages Insurance Advertising Consumables and packaging Depreciation 18 000 1 250 275 40 250 687 651 ? 2 750 70 850 65 599 18 000 |? 22 250 ? 2012 350 2 012 350 On further investigation you discover the following: 1. The owner has taken R5 000 inventory for personal use. 2. The provision for credit losses for the last month of the year has not yet been processed. The provision amounts to R4 500. 3. The business has conducted a new advertising campaign in the last month of the financial year that costs R6 000. No invoice has yet been received from the service provider. FATOTA IMM Graduate School monter 2021 4. 5. The business sublets a portion of the building and has a rental income of R2 000 monthly. The tenant paid rent in advance for 3 months for the new financial year. Equipment is depreciated over 5 years on the straight-line method. The business incurs cell phone and internet charges of R1 000 per month. They prepaid for the next 2 months in advance. 6. REQUIRED: 1.1 Prepare the income statement, including the adjustments required, to show the owner what the profitability of Perfect H2O is for the year completed. Please show all your workings and document all journals required to prepare the financials. (31) 1.2 Based on the final stock count conducted at month-end and to finalise the financials, the owner has asked you to explain the difference between the periodic and perpetual methods and how this difference would impact his financial statements. Using the information provided in the trial balance, explain this to the owner and share how the journals would be different for each method. (4) 1. You have received the pre-adjusted trial balance of Perfect H20 and the owner has requested you to do the following: Debit Credit 5 000 ? 743 000 250 000 50 000 275 000 55 000 3 750 25 575 35 250 31 500 375 000 Capital Drawings Land and buildings Equipment Accumulated depreciation : equipment Loan: FNB Inventory Petty cash Bank Receivables Payables Mortgage loan: SA Homelonas SARS Sales Discounts : sales Cost of sales Rental income Interest on loan: FNB Cellphone and internet Interest on mortgage loan Salaries and wages Insurance Advertising Consumables and packaging Depreciation 18 000 1 250 275 40 250 687 651 ? 2 750 70 850 65 599 18 000 |? 22 250 ? 2012 350 2 012 350 On further investigation you discover the following: 1. The owner has taken R5 000 inventory for personal use. 2. The provision for credit losses for the last month of the year has not yet been processed. The provision amounts to R4 500. 3. The business has conducted a new advertising campaign in the last month of the financial year that costs R6 000. No invoice has yet been received from the service provider. FATOTA IMM Graduate School monter 2021 4. 5. The business sublets a portion of the building and has a rental income of R2 000 monthly. The tenant paid rent in advance for 3 months for the new financial year. Equipment is depreciated over 5 years on the straight-line method. The business incurs cell phone and internet charges of R1 000 per month. They prepaid for the next 2 months in advance. 6. REQUIRED: 1.1 Prepare the income statement, including the adjustments required, to show the owner what the profitability of Perfect H2O is for the year completed. Please show all your workings and document all journals required to prepare the financials. (31) 1.2 Based on the final stock count conducted at month-end and to finalise the financials, the owner has asked you to explain the difference between the periodic and perpetual methods and how this difference would impact his financial statements. Using the information provided in the trial balance, explain this to the owner and share how the journals would be different for each method. (4)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started