Could you please explain b and c? Thank you!

Could you please explain b and c? Thank you!

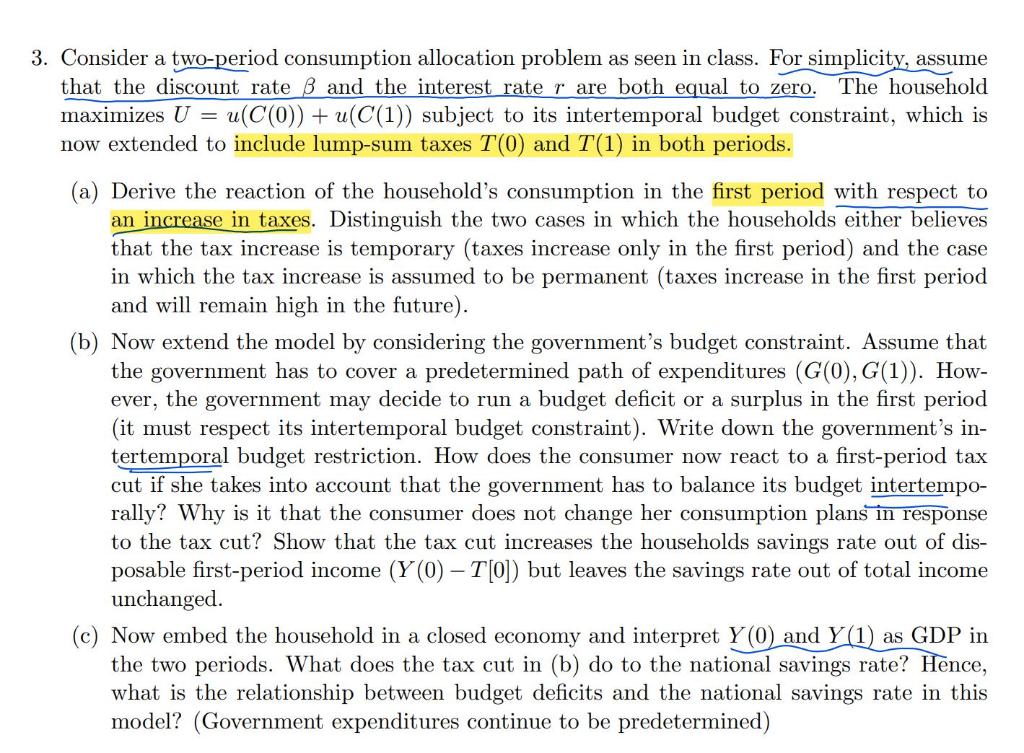

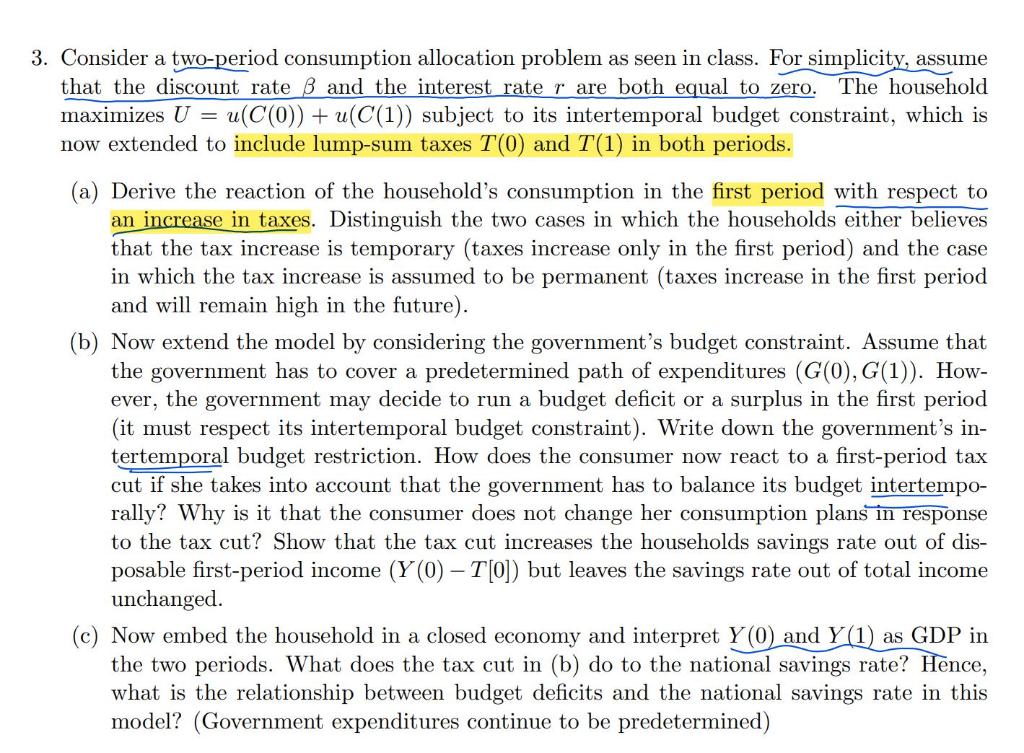

3. Consider a two-period consumption allocation problem as seen in class. For simplicity, assume that the discount rate and the interest rate r are both equal to zero. The household maximizes U=u(C(0))+u(C(1)) subject to its intertemporal budget constraint, which is now extended to include lump-sum taxes T(0) and T(1) in both periods. (a) Derive the reaction of the household's consumption in the first period with respect to an increase in taxes. Distinguish the two cases in which the households either believes that the tax increase is temporary (taxes increase only in the first period) and the case in which the tax increase is assumed to be permanent (taxes increase in the first period and will remain high in the future). (b) Now extend the model by considering the government's budget constraint. Assume that the government has to cover a predetermined path of expenditures (G(0),G(1)). However, the government may decide to run a budget deficit or a surplus in the first period (it must respect its intertemporal budget constraint). Write down the government's intertemporal budget restriction. How does the consumer now react to a first-period tax cut if she takes into account that the government has to balance its budget intertemporally? Why is it that the consumer does not change her consumption plans in response to the tax cut? Show that the tax cut increases the households savings rate out of disposable first-period income (Y(0)T[0]) but leaves the savings rate out of total income unchanged. (c) Now embed the household in a closed economy and interpret Y(0) and Y(1) as GDP in the two periods. What does the tax cut in (b) do to the national savings rate? Hence, what is the relationship between budget deficits and the national savings rate in this model? (Government expenditures continue to be predetermined) 3. Consider a two-period consumption allocation problem as seen in class. For simplicity, assume that the discount rate and the interest rate r are both equal to zero. The household maximizes U=u(C(0))+u(C(1)) subject to its intertemporal budget constraint, which is now extended to include lump-sum taxes T(0) and T(1) in both periods. (a) Derive the reaction of the household's consumption in the first period with respect to an increase in taxes. Distinguish the two cases in which the households either believes that the tax increase is temporary (taxes increase only in the first period) and the case in which the tax increase is assumed to be permanent (taxes increase in the first period and will remain high in the future). (b) Now extend the model by considering the government's budget constraint. Assume that the government has to cover a predetermined path of expenditures (G(0),G(1)). However, the government may decide to run a budget deficit or a surplus in the first period (it must respect its intertemporal budget constraint). Write down the government's intertemporal budget restriction. How does the consumer now react to a first-period tax cut if she takes into account that the government has to balance its budget intertemporally? Why is it that the consumer does not change her consumption plans in response to the tax cut? Show that the tax cut increases the households savings rate out of disposable first-period income (Y(0)T[0]) but leaves the savings rate out of total income unchanged. (c) Now embed the household in a closed economy and interpret Y(0) and Y(1) as GDP in the two periods. What does the tax cut in (b) do to the national savings rate? Hence, what is the relationship between budget deficits and the national savings rate in this model? (Government expenditures continue to be predetermined)

Could you please explain b and c? Thank you!

Could you please explain b and c? Thank you!