Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please explain thoroughly how to solve it, I have a ready answers but dont know how they got it? . On 1 January

could you please explain thoroughly how to solve it, I have a ready answers but dont know how they got it?

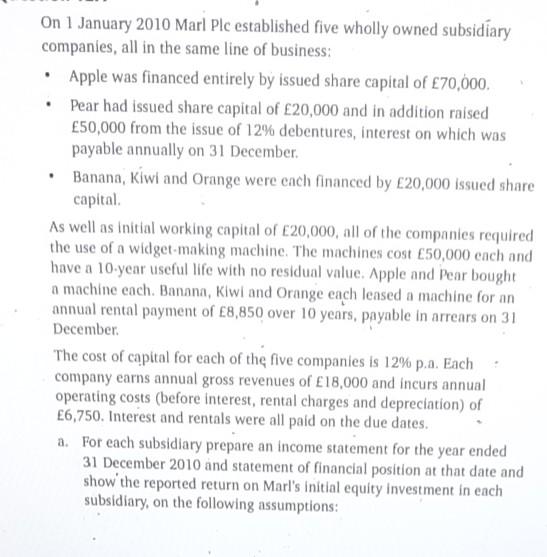

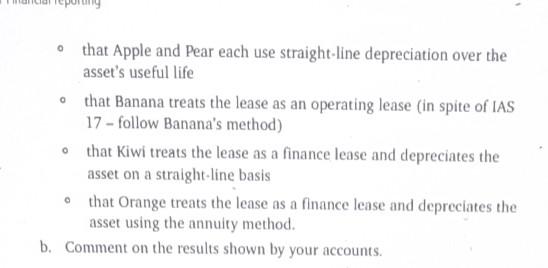

. On 1 January 2010 Marl Plc established five wholly owned subsidiary companies, all in the same line of business: Apple was financed entirely by issued share capital of 70,000, Pear had issued share capital of 20,000 and in addition raised 50,000 from the issue of 12% debentures, interest on which was payable annually on 31 December. Banana, Kiwi and Orange were each financed by 20,000 issued share capital As well as initial working capital of 20,000, all of the companies required the use of a widget-making machine. The machines cost 50,000 each and have a 10-year useful life with no residual value. Apple and Pear bought a machine cach. Banana, Kiwi and Orange each leased a machine for an annual rental payment of 8,850 over 10 years, payable in arrears on 31 December The cost of capital for each of the five companies is 12% p.a. Each company earns annual gross revenues of 18,000 and incurs annual operating costs (before interest, rental charges and depreciation) of 6,750. Interest and rentals were all paid on the due dates. a. For each subsidiary prepare an income statement for the year ended 31 December 2010 and statement of financial position at that date and show the reported return on Marl's initial equity investment in each subsidiary, on the following assumptions: that Apple and Pear each use straight-line depreciation over the asset's useful life o that Banana treats the lease as an operating lease (in spite of IAS 17 - follow Banana's method) that Kiwi treats the lease as a finance lease and depreciates the asset on a straight-line basis that Orange treats the lease as a finance lense and depreciates the asset using the annuity method. b. Comment on the results shown by your accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started