Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please help me? 4. Suppose a U.S investor wishes to invest in a British firm currently selling for 40 per share. The investor

could you please help me?

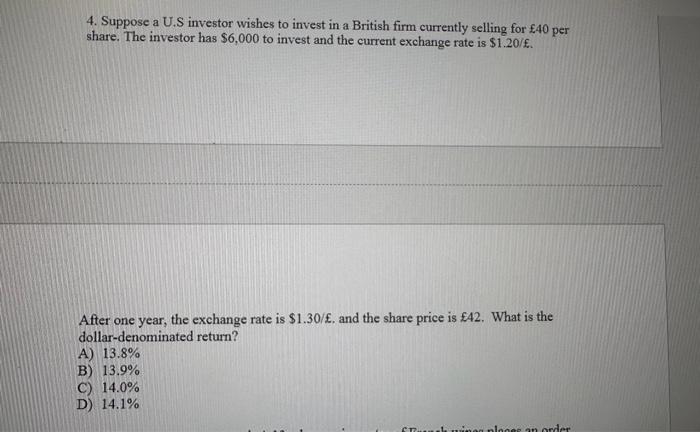

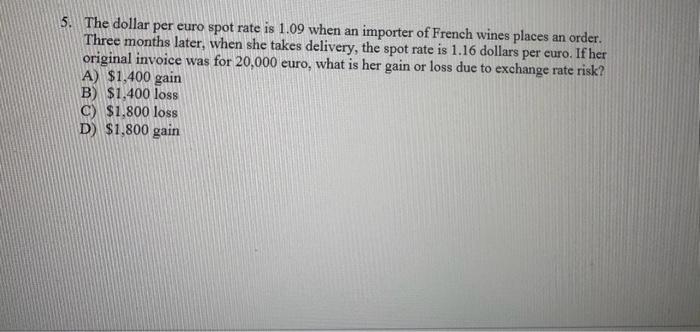

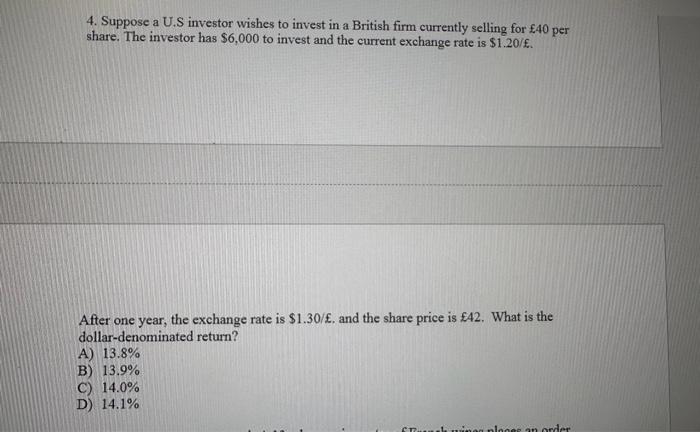

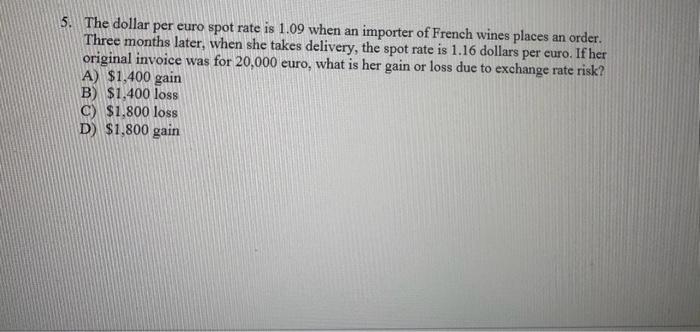

4. Suppose a U.S investor wishes to invest in a British firm currently selling for 40 per share. The investor has $6,000 to invest and the current exchange rate is $1.20/. After one year, the exchange rate is $1.30/, and the share price is 42. What is the dollar-denominated return? A) 13.8% B) 13.9% C) 14.0% D) 14.1% 5. The dollar per euro spot rate is 1.09 when an importer of French wines places an order. Three months later, when she takes delivery, the spot rate is 1.16 dollars per euro. If her original invoice was for 20,000 euro, what is her gain or loss due to exchange rate risk? A) $1,400 gain B) $1,400 loss C) $1,800 loss D) $1,800 gain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started