Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please help me solve this ; i somehow get whats asking me to do but not 100% ; at least list of what

could you please help me solve this ; i somehow get whats asking me to do but not 100%

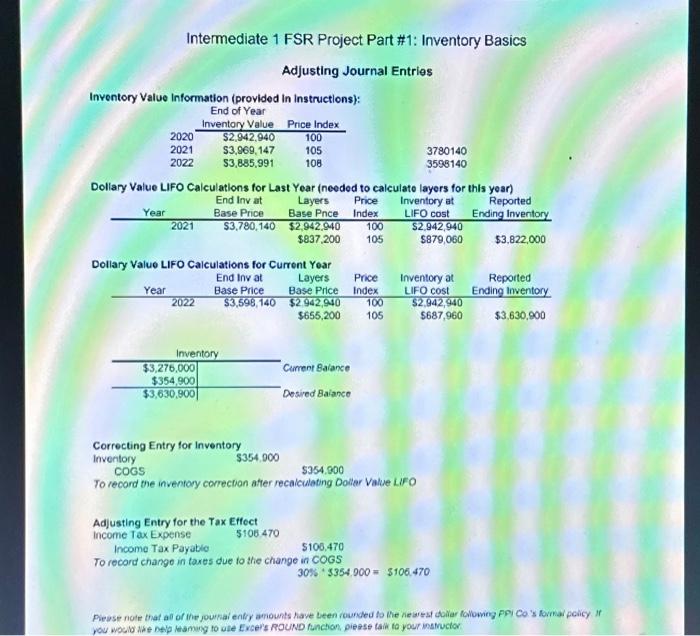

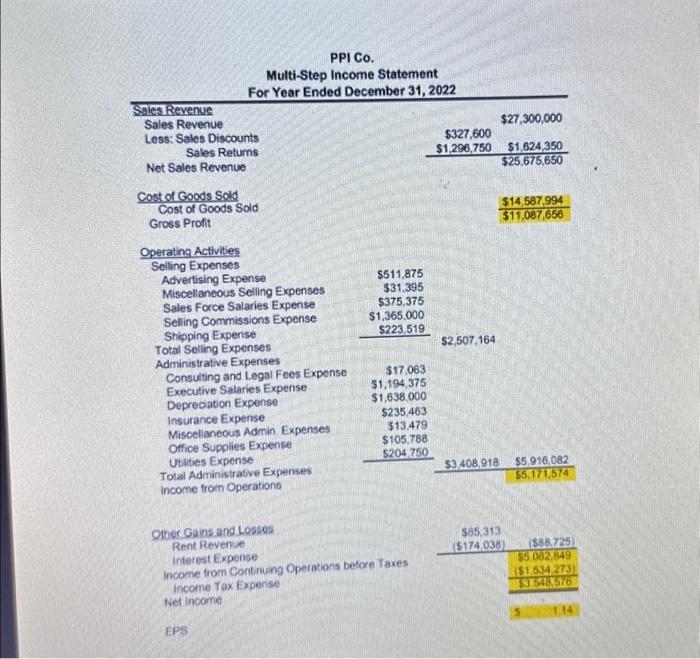

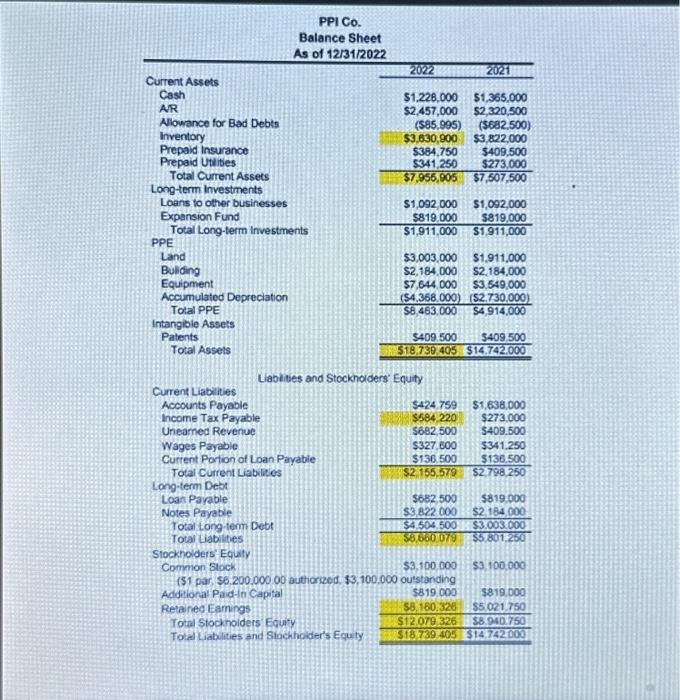

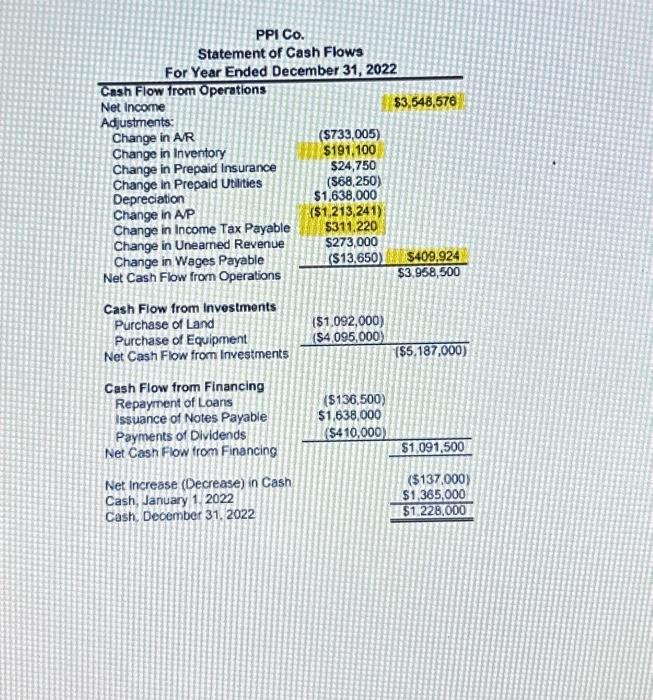

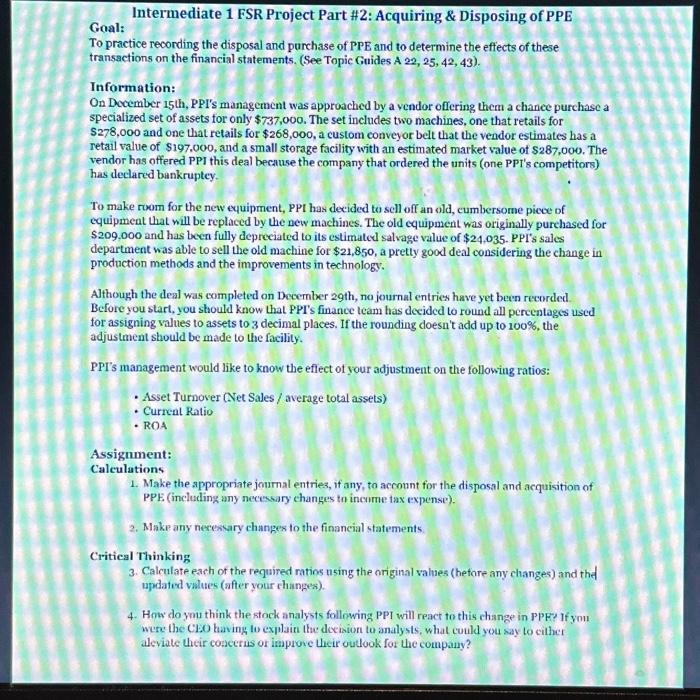

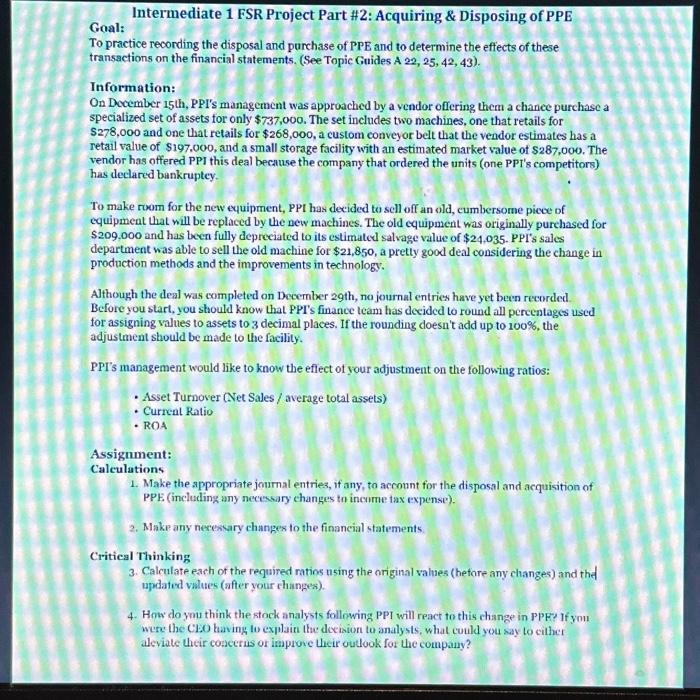

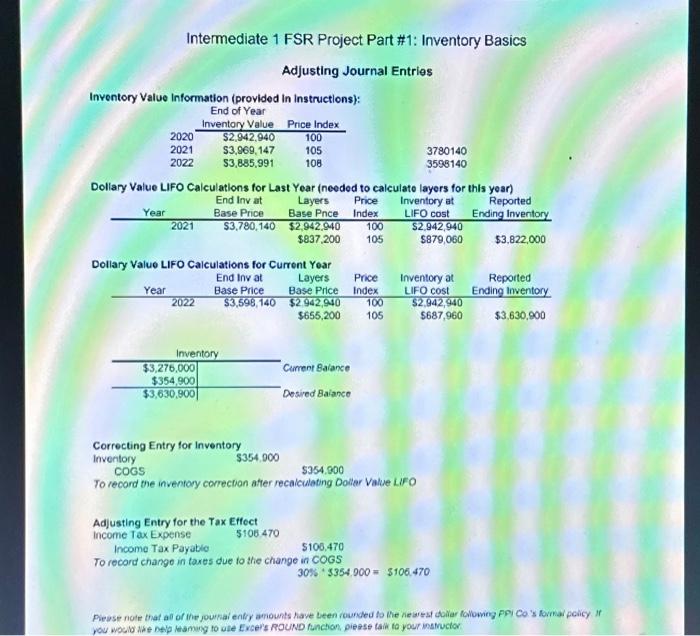

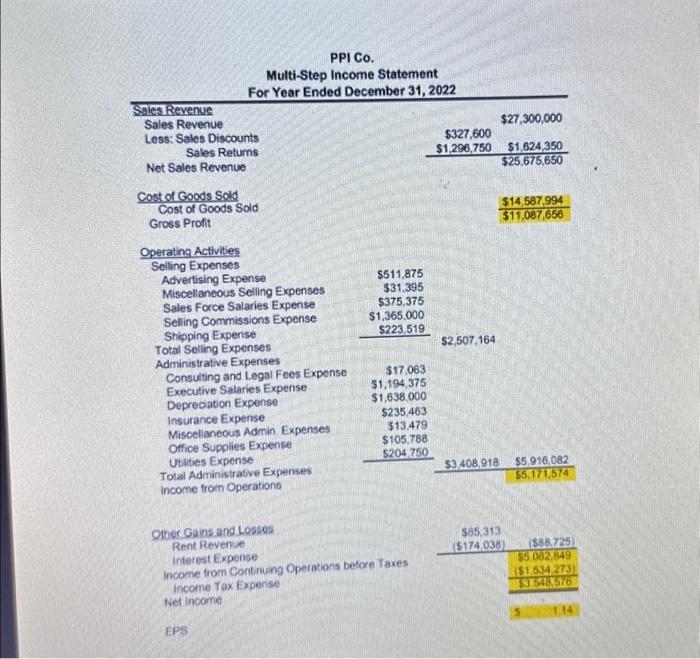

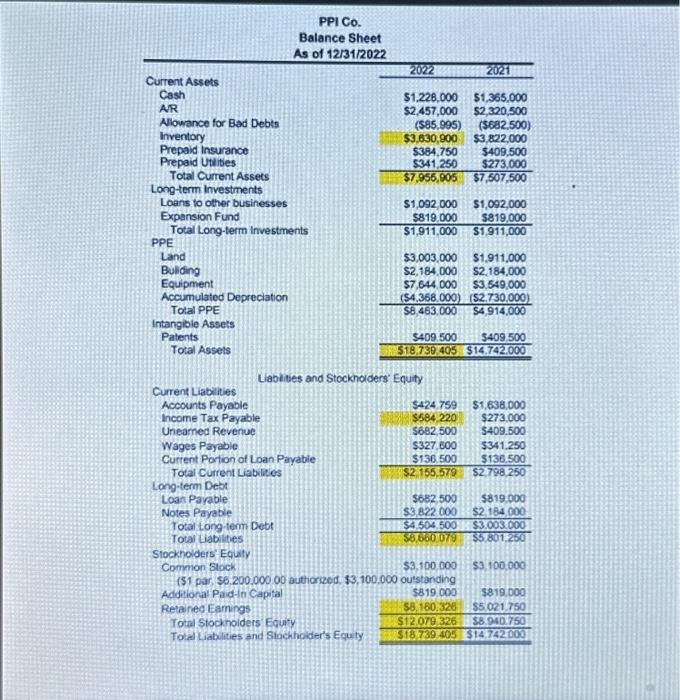

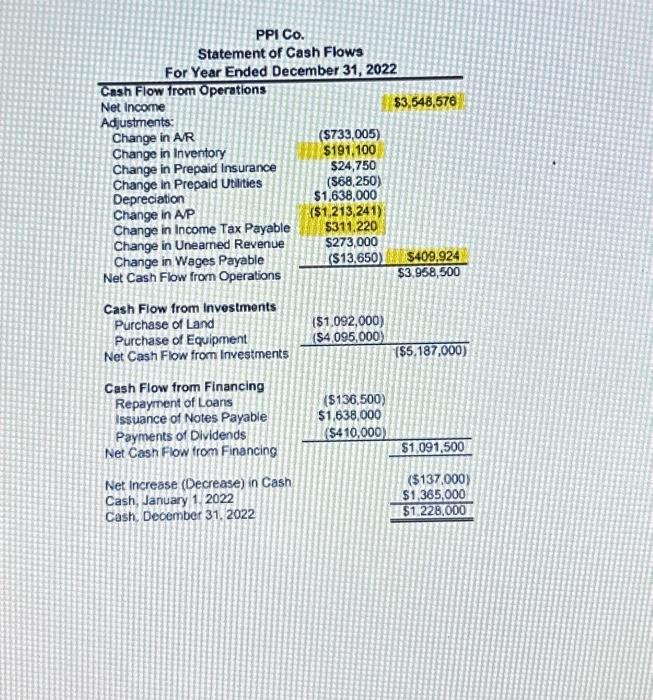

Intermediate 1 FSR Project Part \#1: Inventory Basics Adjusting Journal Entries Inventory Value Information (provided in instructions): Correcting Entry for Inventory Inventory $354,000 coGs $354,900 To recard the inventory correction atter recalculating Doliar Value LIFO you wocib the nelp kamang to ule Excer's ROUND funchion, piease taik to your inatructor Liapibes and stocknoiders Equity PPI Co. Multi-Step Income Statement For Year Ended December 31, 2022 Sales Revenue Sales Revenue Less: Sales Discounts Sales Retums Net Sales Revenue CostofGoodsSoldCostofGoodsSold Gross Profit \begin{tabular}{rr} $327,600 & $27,300,000 \\ $1,296,750 & $1,624,350 \\ \hline$25,675,650 \end{tabular} $11,007,656$14,587,994 Operating Activities Selling Expenses Advertising Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Seling Expenses Administrative Expenses Consulting and Legal Fees Expense Executive Salaries Expense Depreciation Expense Insurance Expense Miscelianeous Admin. Expenses Office Supplies Expense Ututies Expense Total Administrative Expenses income from Operations $25.313 Rent Revenue interest Expense income from Continuing Operations before Taxes income Tax Experise (5) 1.14 EP5 Intermediate 1 FSR Project Part \#2: Acquiring \& Disposing of PPE Goal: To practice recording the disposal and purchase of PPE and to determine the effects of these transactions on the financial statements. (See Topic Guides A 22, 25, 42, 43). Information: On December 15 th, PPI's management was approached by a vendor offering them a chanee purchase a specialized set of assets for only $737,000. The set includes two machines, one that retails for $278,000 and one that retails for $268,000, a custom conveyor belt that the vendor estimates has a retail value of $197,000, and a small storage facility with an estimated market value of $287,000. The vendor has offered PPI this deal because the company that ordered the units (one PPI's competitors) has declared bankruptey. To make room for the new eyuipment, PPI has decided to scll off an old, cumbersome piece of equipment that will be replaced by the new machines. The old equipment was originally purehased for $209,000 and has been fully depreciated to its estimated salvage value of $24,035. PPIs sales department was able to sell the old machine for $21,850, a pretty good deal considering the change in production methods and the improvements in technology. Although the deal was completed on Decenber 29th, no journal entries have yet bein recorded Before you start, you stould know that PPT's finance team has decided to round all percentages used for assigning values to assets to 3 decimal places. If the rounding doesn't add up to 100%, the adjustment should be made to the facility. PPIs management would like to know the effect of your adjustment on the following ratios: - Asset Turnover (Net Sales / average total assets) - Curreal Ratio - ROA Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the disposal and acquisition of PPE (including any necessary changes to incume tax expense). 2. Make any necescary changes to the financial statements Critical Thinking 3. Calculate each of the required ratios nsing the original values (hefore any changes) and the updated vilues (after your changes). 4. How do you think the stock analysts following PPI will react to this change in PPF? If you were the CLO having to explain the dociaion to analysts, what could you say to cither aleviate their cossecrus or impiove their outlook for the company? PPICo. Statement of Cash Flows For Year Ended December 31, 2022 \begin{tabular}{|c|c|c|} \hline Cash Flow from Operations & & \\ \hline Net incorne & & $3,548,576 \\ \hline Adjustments: & & \\ \hline Change in AVR & ($733,005) & \\ \hline Change in Inventory & $191,100 & \\ \hline Change in Prepaid Insurance & $24,750 & \\ \hline Change in Prepaid Utalties & ($68,250) & \\ \hline Depreciation & $1,638,000 & \\ \hline Change in AP & ($1,213,241) & \\ \hline Change in Income Tax Payable & $311.220 & \\ \hline Change in Unearned Revenue & $273,000 & \\ \hline Change in Wages Payable & ($13,650) & $409,924 \\ \hline Net Cash Flow from Operations & & 3,958,500 \\ \hline \end{tabular} \begin{tabular}{ll} CashFlowfrominvestmentsPurchaseofLandPurchaseofEquipment & ($1,092,000)NetCashFlowfromInvestments \\ \cline { 2 - 2 } & ($4,095,000) \end{tabular} Cash Flow from Financing Repayment of Loans issuance of Notes Payable Payments of Dividends Net Cash Flow trom Financing Net Increase (Decrease) in Cash Cash, January 1, 2022 Cash. December 31, 2022 \begin{tabular}{|c|c|} \hline ($136,500)$1,638,000($410,000) & \\ \hline & $1,091,500 \\ \hline & ($137,000) \\ \hline & $1,365,000 \\ \hline & $1,228,000 \\ \hline \end{tabular} ; at least list of what i need to do like what i need to jounalize . exaple 1.) jounnal entry to update deprectistion ;etc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started