Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please help me solve this problem? There are practice problems for my exam, but I don't know how they are done, and I

Could you please help me solve this problem? There are practice problems for my exam, but I don't know how they are done, and I want to have the answer so I can practice them.

Thank you for your help.

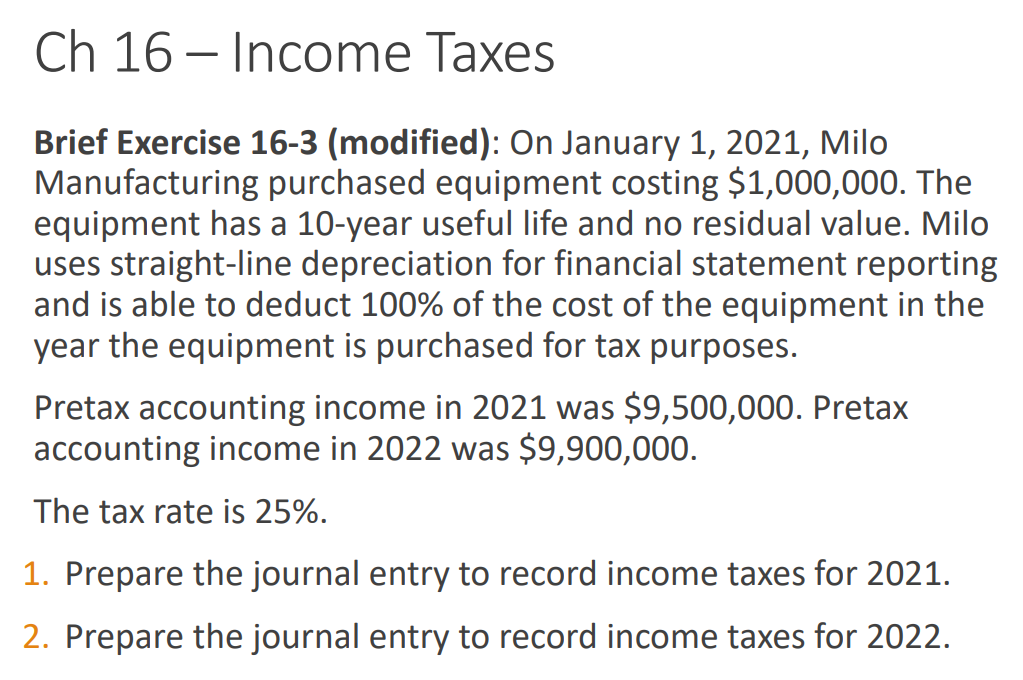

Brief Exercise 16-3 (modified): On January 1, 2021, Milo Manufacturing purchased equipment costing $1,000,000. The equipment has a 10-year useful life and no residual value. Milo uses straight-line depreciation for financial statement reporting and is able to deduct 100% of the cost of the equipment in the year the equipment is purchased for tax purposes. Pretax accounting income in 2021 was $9,500,000. Pretax accounting income in 2022 was $9,900,000. The tax rate is 25%. 1. Prepare the journal entry to record income taxes for 2021. 2. Prepare the journal entry to record income taxes for 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started