Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please help me with part a and part c? Thank you! C2. You are given the following information on two stocks and the

Could you please help me with part a and part c?

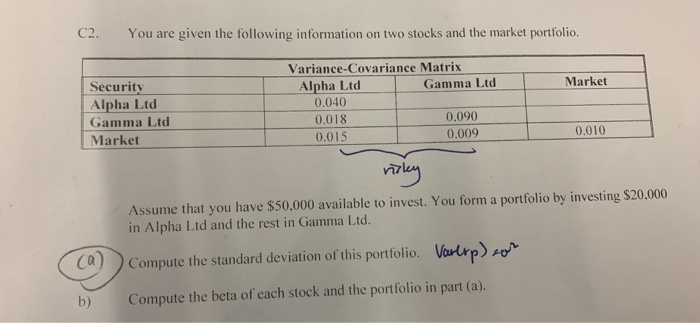

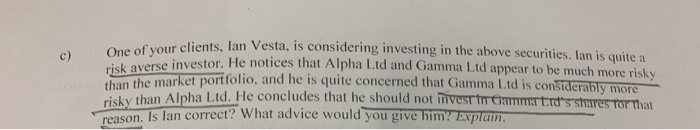

C2. You are given the following information on two stocks and the market portfolio. Variance-Covariance Matrix Security Alpha Ltd Alpha Ltd 0.040 Gamma Ltd Market Gamma Ltd 0.018 0.090 Market 0.015 0.010 0.009 valey Assume that you have $50,000 available to invest. You form a portfolio by investing $20,000 in Alpha Ltd and the rest in Gamma Ltd. Ca) Volrp) Compute the standard deviation of this portfolio. Compute the beta of each stock and the portfolio in part (a). b) One of your clients, lan Vesta, is considering investing in the above securities. lan is quite a risk averse investor. He notices that Alpha Ltd and Gamma Ltd appear to be much more risky than the market portfolio, and he is quite concerned that Gamma Ltd is considerably more risky than Alpha Ltd. He concludes that he should not mvest in Gammatat's shares for that reason. Is lan correct? What advice would you give him? Explain. cl Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started