Could you please help to to solve these practice questions 1&2?

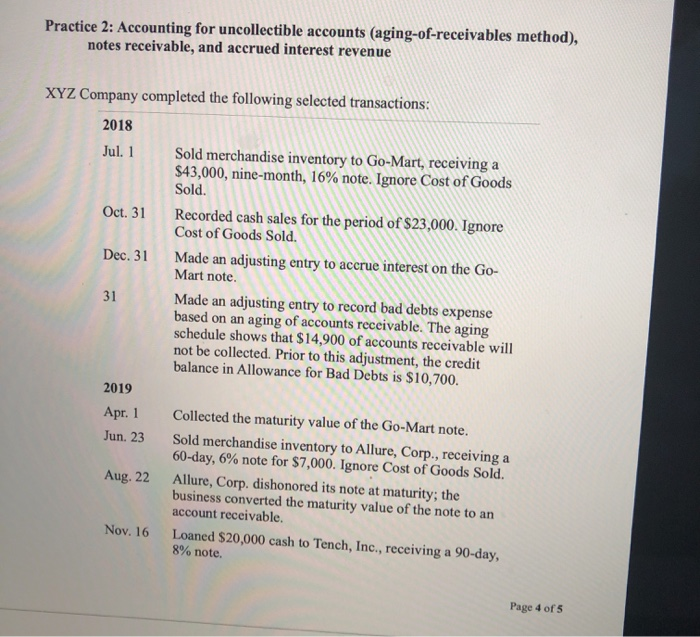

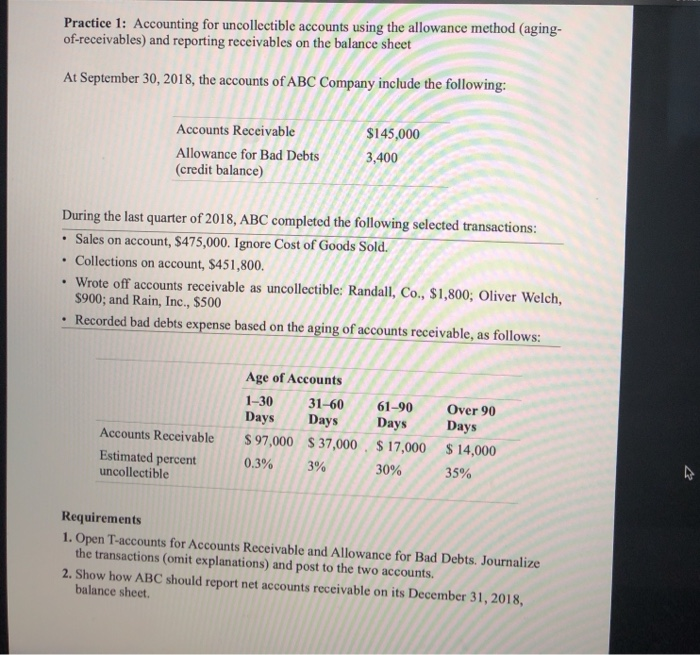

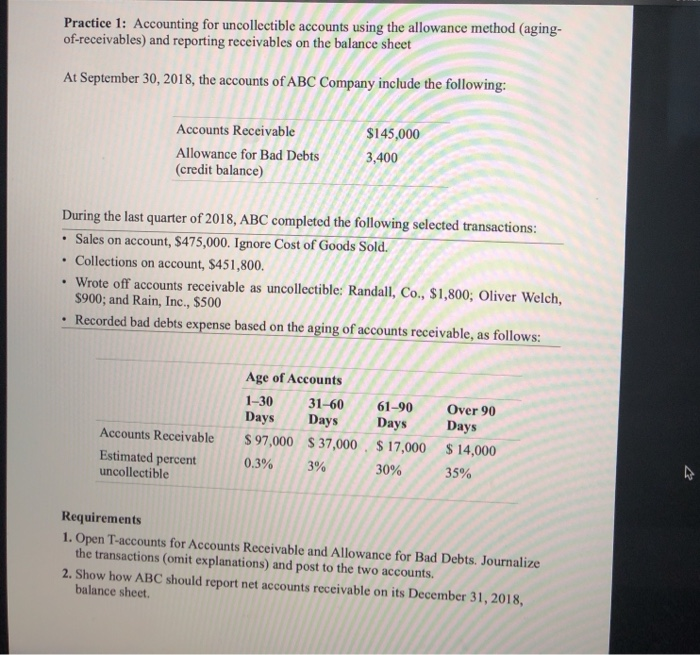

Practice 1: Accounting for uncollectible accounts using the allowance method (aging- of-receivables) and reporting receivables on the balance sheet At September 30, 2018, the accounts of ABC Company include the following: Accounts Receivable Allowance for Bad Debts (credit balance) $145,000 3,400 . During the last quarter of 2018, ABC completed the following selected transactions: Sales on account, $475,000. Ignore Cost of Goods Sold. Collections on account, $451,800. Wrote off accounts receivable as uncollectible: Randall, Co., $1,800; Oliver Welch, $900; and Rain, Inc., $500 Recorded bad debts expense based on the aging of accounts receivable, as follows: . Age of Accounts 1-30 31-60 61-90 Over 90 Days Days Days Days $ 97,000 $ 37,000 $ 17,000 $14,000 0.3% 3% 30% 35% Accounts Receivable Estimated percent uncollectible Requirements 1. Open T-accounts for Accounts Receivable and Allowance for Bad Debts. Journalize the transactions (omit explanations) and post to the two accounts. 2. Show how ABC should report net accounts receivable on its December 31, 2018, balance sheet Requirement 1: Provide journal entries and a completed aging schedule: MacBook Pro Chapter 8 - Practice Problem Requirement 2: Provide two T accounts for A/R the Allowance for Bad Debts: Requirement 3: Provide the balance sheet presentation for A/R: Page 3 of 5 Practice 2: Accounting for uncollectible accounts (aging-of-receivables method), notes receivable, and accrued interest revenue XYZ Company completed the following selected transactions: 2018 Jul. 1 Sold merchandise inventory to Go-Mart, receiving a $43,000, nine-month, 16% note. Ignore Cost of Goods Sold. Oct. 31 Recorded cash sales for the period of $23,000. Ignore Cost of Goods Sold. Dec. 31 Made an adjusting entry to accrue interest on the Go- Mart note. 31 Made an adjusting entry to record bad debts expense based on an aging of accounts receivable. The aging schedule shows that $14,900 of accounts receivable will not be collected. Prior to this adjustment, the credit balance in Allowance for Bad Debts is $10,700. 2019 Apr. 1 Collected the maturity value of the Go-Mart note. Jun. 23 Sold merchandise inventory to Allure, Corp., receiving a 60-day, 6% note for $7,000. Ignore Cost of Goods Sold. Aug. 22 Allure, Corp. dishonored its note at maturity; the business converted the maturity value of the note to an account receivable. Nov. 16 Loaned $20,000 cash to Tench, Inc., receiving a 90-day, 8% note. Page 4 of 5 Dec. 5 31 Collected in full on account from Allure, Corp. Accrued the interest on the Tench, Inc. note. Record the transactions in the journal of XYZ. Explanations are not required. (Round to the nearest dollar.) Provide all of the journal entries: MacBook Pro 80

Could you please help to to solve these practice questions 1&2?

Could you please help to to solve these practice questions 1&2?