Answered step by step

Verified Expert Solution

Question

1 Approved Answer

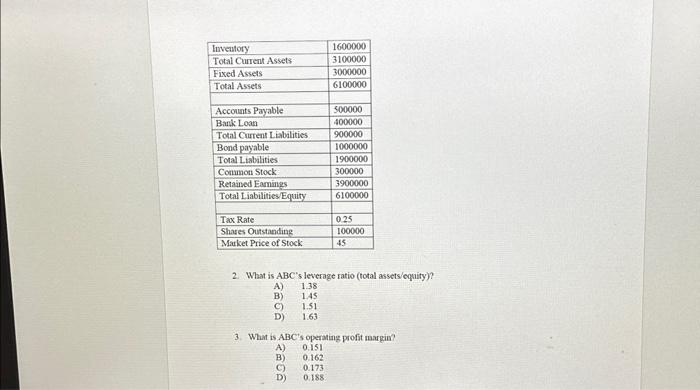

could you please help with these questions? thank you 2. What is ABC 's leverage ratio (total assets/equity)? A) 138 B) 1.45 C) 1.51 D)

could you please help with these questions? thank you

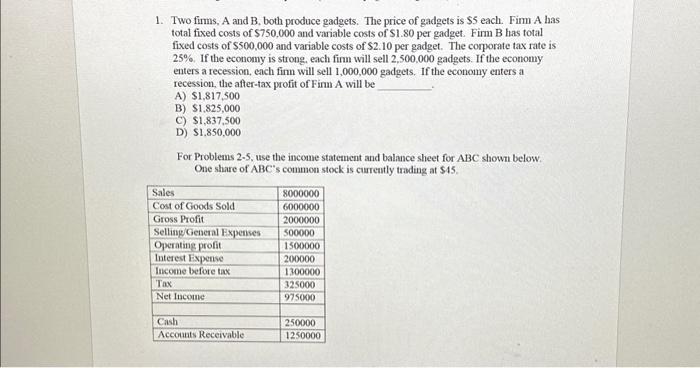

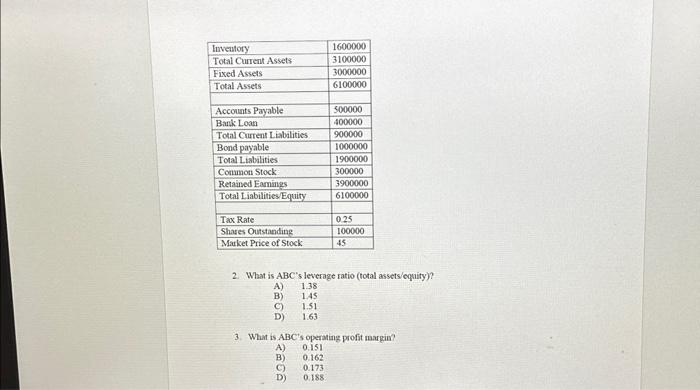

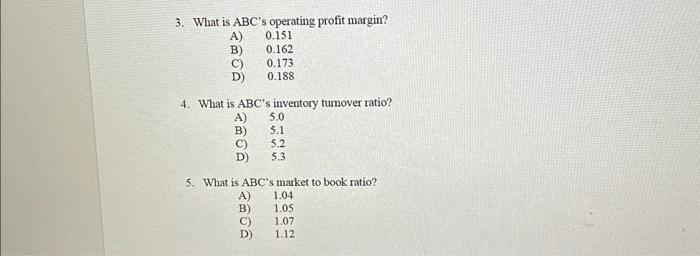

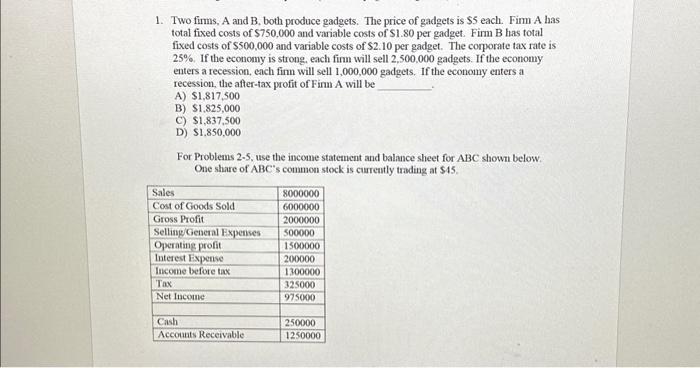

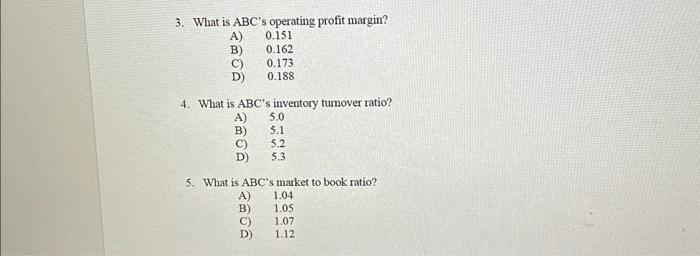

2. What is ABC 's leverage ratio (total assets/equity)? A) 138 B) 1.45 C) 1.51 D) 1.63 3. What is ABC's operating profit margin? A) 0.151 B) 0.162 C) 0.173 D) 0.188 1. Two firms, A and B, both produce gadgets. The price of gadgets is $5 each. Firm A has total fixed costs of $750,000 and variable costs of $1.80 per gadget. Firm B has total fixed costs of $500,000 and variable costs of $2.10 per gadget. The corporate tax rate is 25%, If the econony is strong, each firm will sell 2,500,000 gadgets. If the economy enters a recession, each firm will sell 1,000,000 gadgets. If the economy enters a recession, the after-tax profit of FimA will be A) $1,817,500 B) $1,825,000 C) $1,837,500 D) $1,850,000 For Problems 2-5, use the income statement and balance sheet for ABC shown below. 3. What is ABC 's operating profit margin? A) 0.151 B) 0.162 C) 0.173 D) 0.188 4. What is ABC 's inventory tumover ratio? A) 5.0 B) 5.1 C) 5.2 D) 5.3 5. What is ABC 's market to book ratio? A) 1.04 B) 1.05 C) 1.07 D) 1.12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started