Answered step by step

Verified Expert Solution

Question

1 Approved Answer

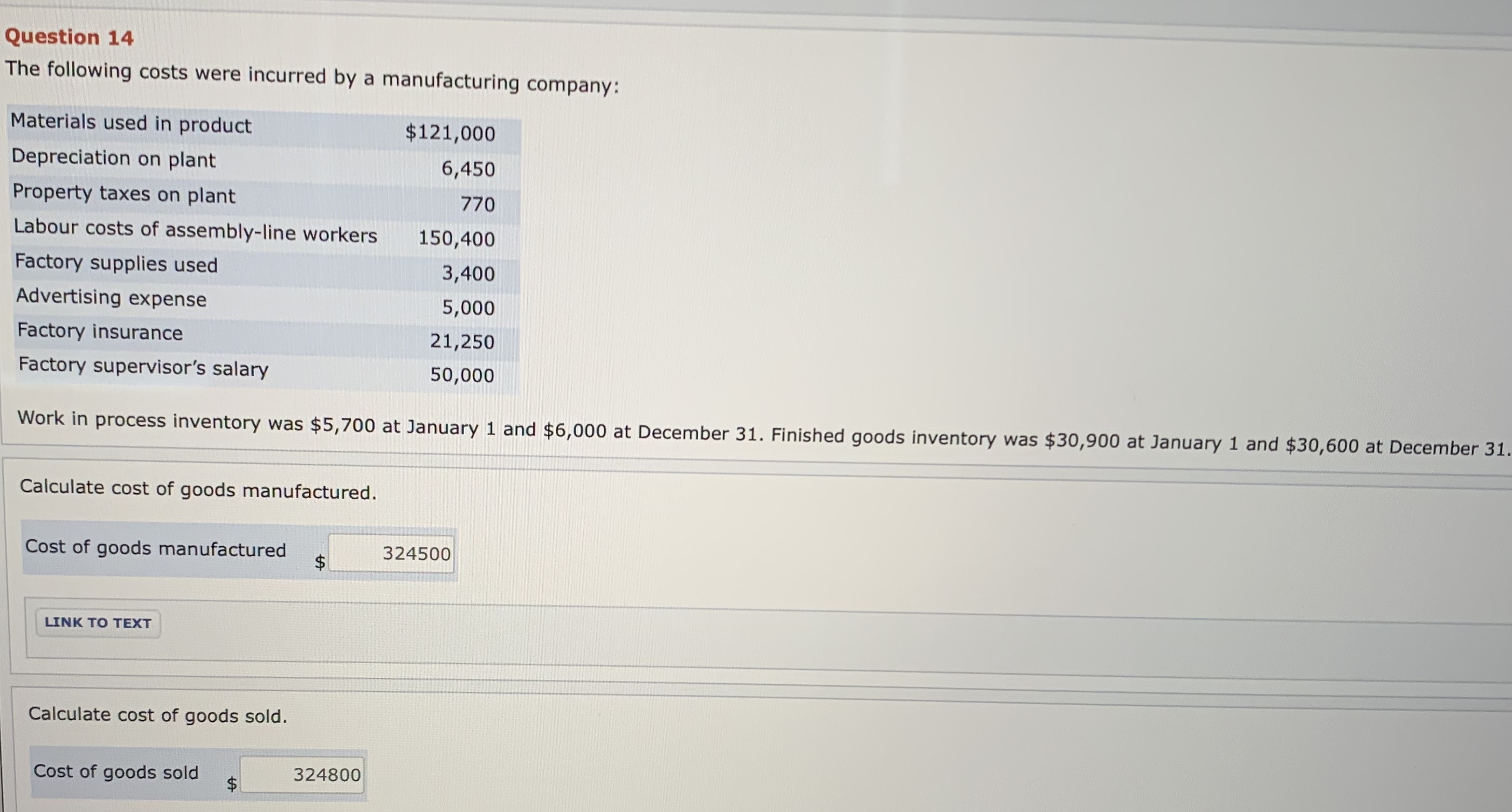

Could you please let me know how I would calculate COGM and COGS and what the values are here? Also, would depreciation on plant and

Could you please let me know how I would calculate COGM and COGS and what the values are here? Also, would depreciation on plant and property taxes on plant be included in Manufacturing Overhead or would they be considered a period cost and deducted as an expense in the income statement? What about factory supplies used and supervisors salary and factory insurance? Thanks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started