Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please show step be step in detail of where the values are coming from and how they are come about to the nearest

Could you please show step be step in detail of where the values are coming from and how they are come about

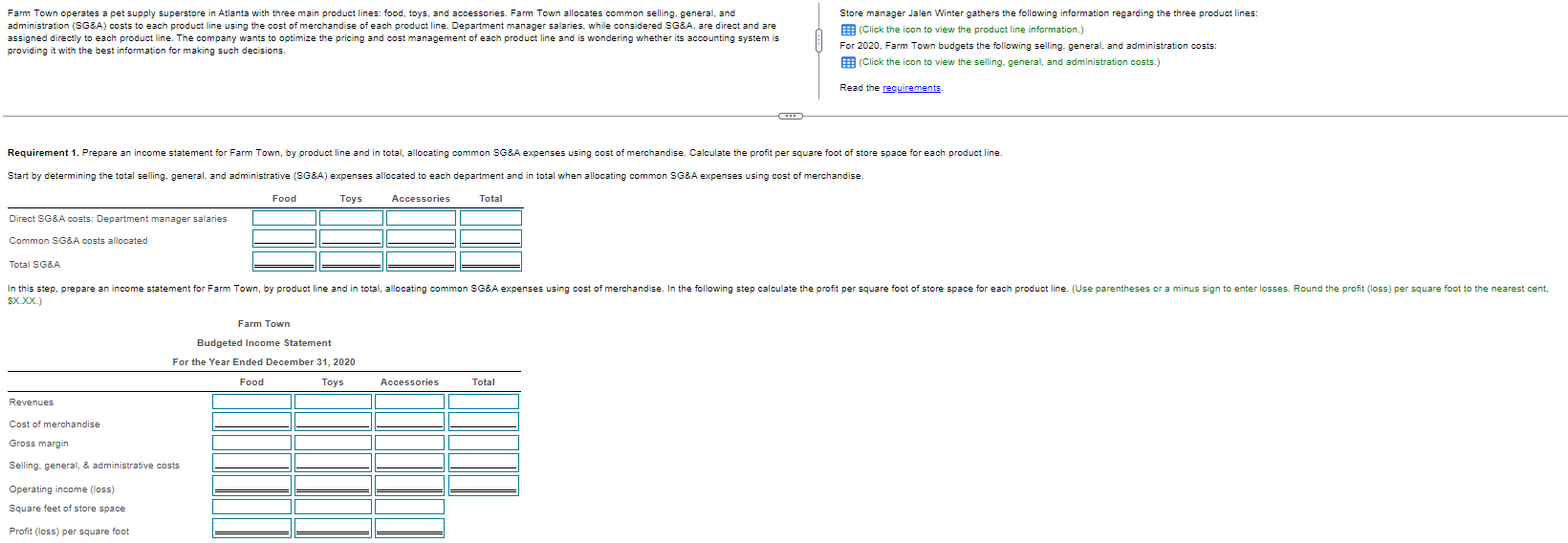

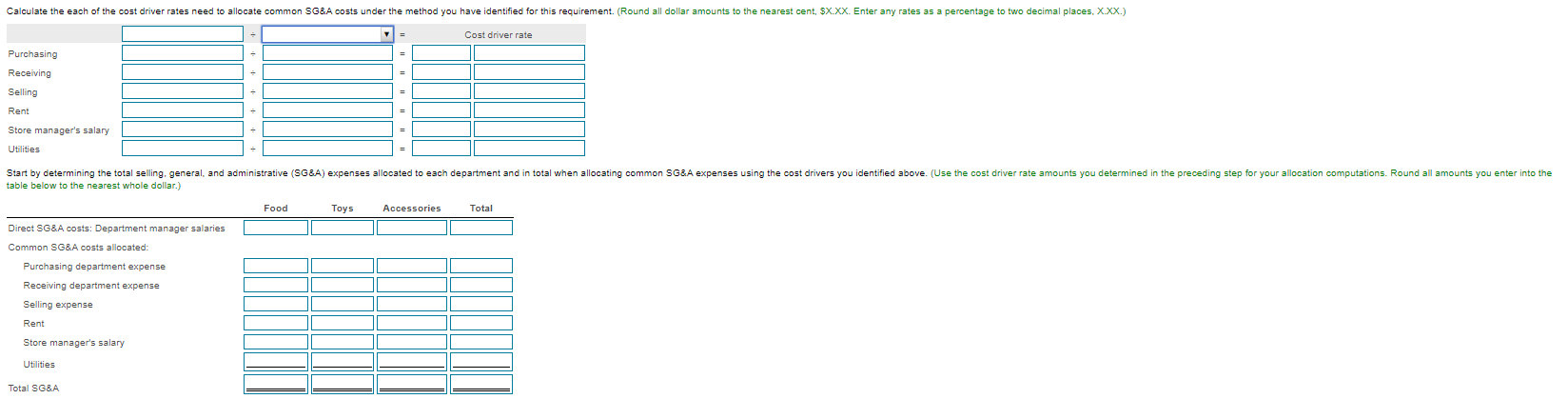

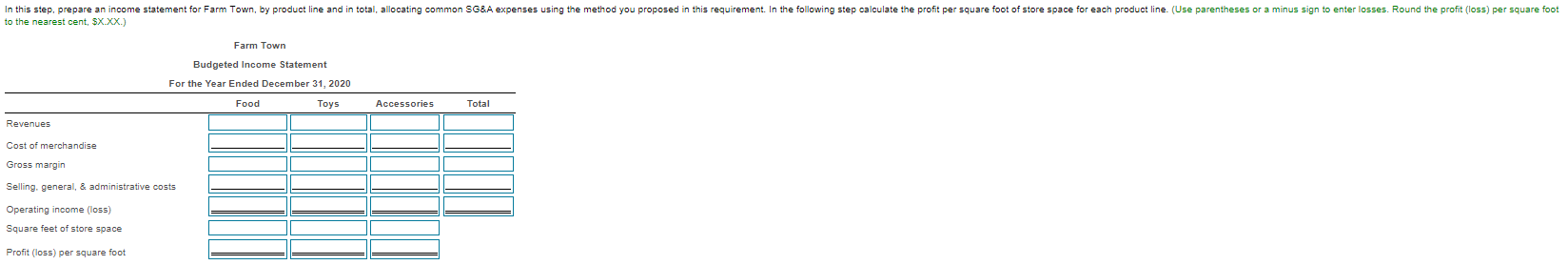

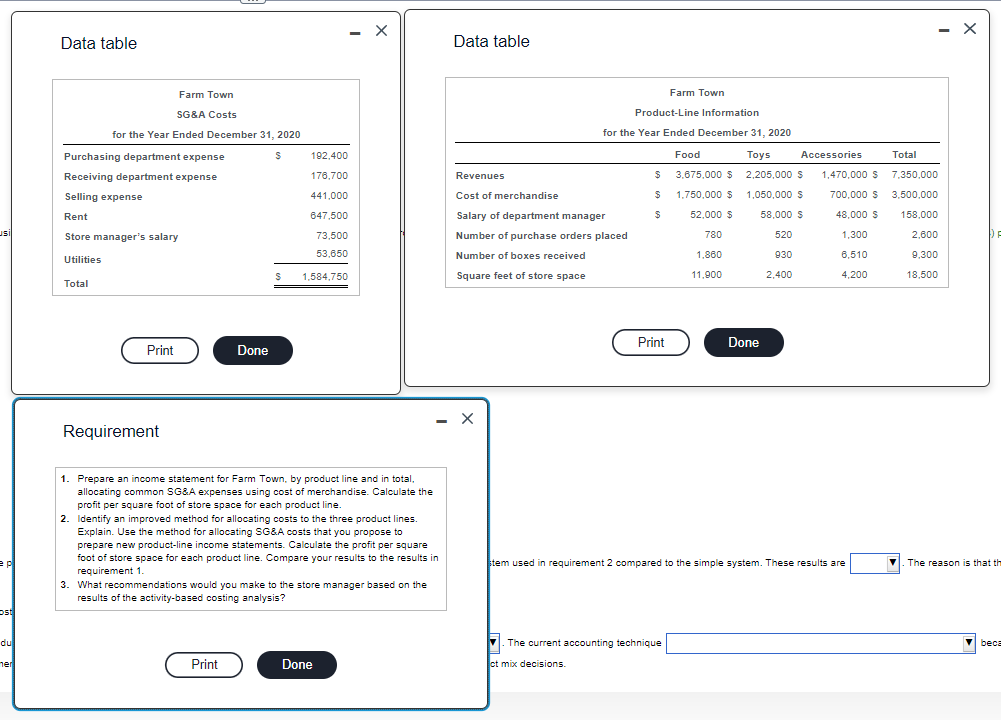

to the nearest cent, $XX.) Farm Town Budgeted Income Statement For the Year Ended December 31, 2020 \begin{tabular}{lll} \hline Revenues & Food \\ Cost of merchandise & Toys \\ Gross margin & Selling. general, \& administrative costs \\ Operating income (loss) & Square feet of store space \\ Profit (loss) per square foot & \end{tabular} Data table Data table Requirement 1. Prepare an income statement for Farm Town, by product line and in total, allocating common SG\&A expenses using cost of merchandise. Calculate the profit per square foot of store space for each product line. 2. Identify an improved method for allocating costs to the three product lines. Explain. Use the method for allocating SG\&A costs that you propose to prepare new product-line income statements. Calculate the profit per square foot of store space for each product line. Compare your results to the results in requirement 1. 3. What recommendations would you make to the store manager based on the results of the activity-based costing analysis? tem used in requirement 2 compared to the simple system. These results are Farm Town operates a pet supply superstore in Atlanta with three main product lines: food, toys, and accessories. Farm Town allocates common selling. general, and administration (SG\&A) costs to each product line using the cost of merchandise of each product line. Department manager salaries, while considered SG\&A, are direct and are assigned directly to each product line. The company wants to optimize the pricing and cost management of each product line and is wondering whether its accounting system is providing it with the best information for making such decisions. Store manager Jalen Winter gathers the following information regarding the three product lines: | (Click the icon to view the product line information.) rul 2020, Farm Town budgets the following selling. general, and administration costs: | (Click the icon to view the selling. general, and administration costs.) Read the Start by determining the total selling, general, and administrative (SG\&A) expenses allocated to each department and in total when allocating common SG\&A expenses using cost of merchandise. to the nearest cent, $XX.) Farm Town Budgeted Income Statement For the Year Ended December 31, 2020 \begin{tabular}{lll} \hline Revenues & Food \\ Cost of merchandise & Toys \\ Gross margin & Selling. general, \& administrative costs \\ Operating income (loss) & Square feet of store space \\ Profit (loss) per square foot & \end{tabular} Data table Data table Requirement 1. Prepare an income statement for Farm Town, by product line and in total, allocating common SG\&A expenses using cost of merchandise. Calculate the profit per square foot of store space for each product line. 2. Identify an improved method for allocating costs to the three product lines. Explain. Use the method for allocating SG\&A costs that you propose to prepare new product-line income statements. Calculate the profit per square foot of store space for each product line. Compare your results to the results in requirement 1. 3. What recommendations would you make to the store manager based on the results of the activity-based costing analysis? tem used in requirement 2 compared to the simple system. These results are Farm Town operates a pet supply superstore in Atlanta with three main product lines: food, toys, and accessories. Farm Town allocates common selling. general, and administration (SG\&A) costs to each product line using the cost of merchandise of each product line. Department manager salaries, while considered SG\&A, are direct and are assigned directly to each product line. The company wants to optimize the pricing and cost management of each product line and is wondering whether its accounting system is providing it with the best information for making such decisions. Store manager Jalen Winter gathers the following information regarding the three product lines: | (Click the icon to view the product line information.) rul 2020, Farm Town budgets the following selling. general, and administration costs: | (Click the icon to view the selling. general, and administration costs.) Read the Start by determining the total selling, general, and administrative (SG\&A) expenses allocated to each department and in total when allocating common SG\&A expenses using cost of merchandiseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started