Answered step by step

Verified Expert Solution

Question

1 Approved Answer

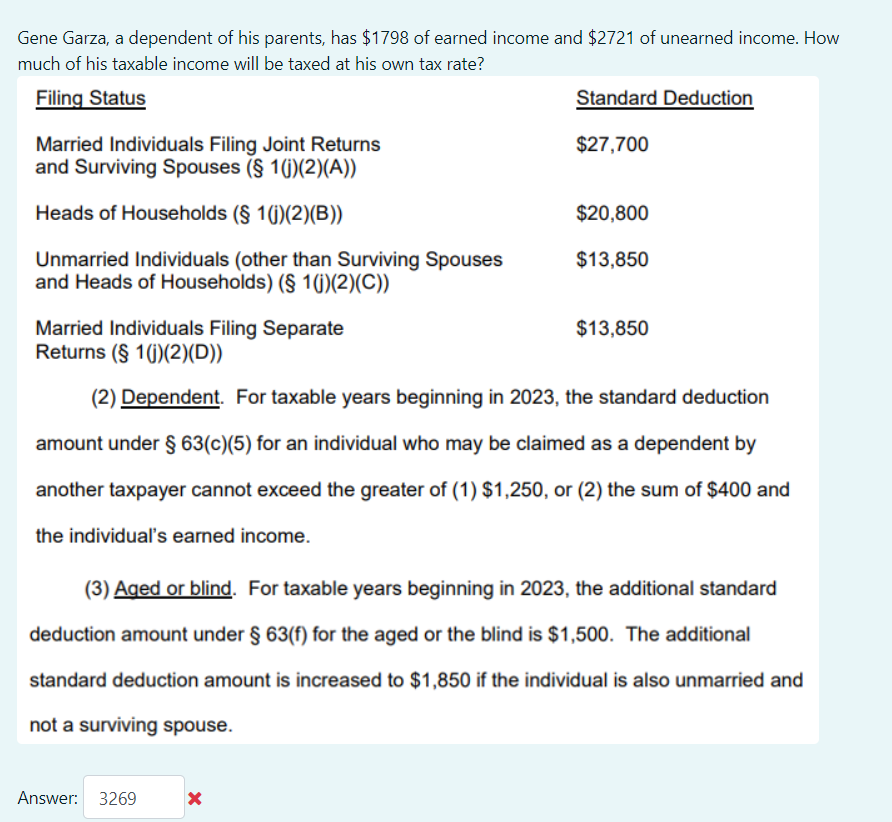

Could you please solve this problem in detail? Gene Garza, a dependent of his parents, has $1798 of earned income and $2721 of unearned income.

Could you please solve this problem in detail?

Gene Garza, a dependent of his parents, has $1798 of earned income and $2721 of unearned income. How much of his taxable income will be taxed at his own tax rate? (2) Dependent. For taxable years beginning in 2023, the standard deduction amount under 63(c)(5) for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of (1) $1,250, or (2) the sum of $400 and the individual's earned income. (3) Aged or blind. For taxable years beginning in 2023, the additional standard deduction amount under 63(f) for the aged or the blind is $1,500. The additional standard deduction amount is increased to $1,850 if the individual is also unmarried and not a surviving spouseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started