Question: Could you please solve via equations, and if possible show the Excel equations to use? IBP Inc. is considering establishing a new machine to automate

Could you please solve via equations, and if possible show the Excel equations to use?

Could you please solve via equations, and if possible show the Excel equations to use?

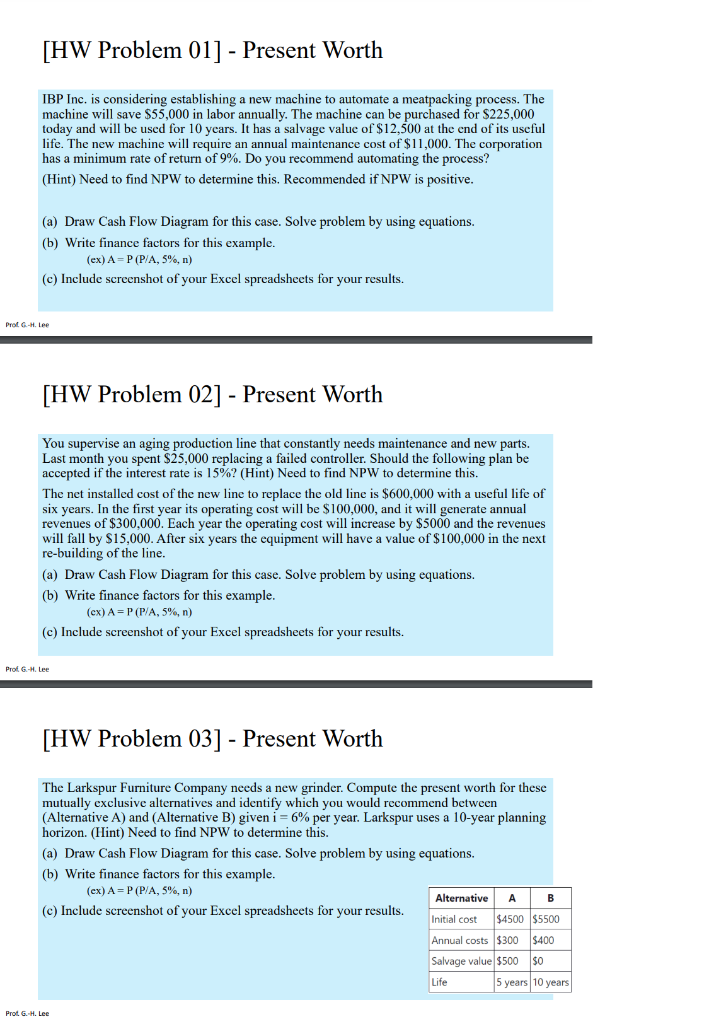

IBP Inc. is considering establishing a new machine to automate a meatpacking process. The machine will save $55,000 in labor annually. The machine can be purchased for $225,000 today and will be used for 10 years. It has a salvage value of $12,500 at the end of its useful life. The new machine will require an annual maintenance cost of $11,000. The corporation has a minimum rate of return of 9%. Do you recommend automating the process? (Hint) Need to find NPW to determine this. Recommended if NPW is positive. (a) Draw Cash Flow Diagram for this case. Solve problem by using equations. (b) Write finance factors for this example. (ex)A=P(P/A,5%,n) (c) Include screenshot of your Excel spreadsheets for your results. [HW Problem 02] - Present Worth You supervise an aging production line that constantly needs maintenance and new parts. Last month you spent $25,000 replacing a failed controller. Should the following plan be accepted if the interest rate is 15% ? (Hint) Need to find NPW to determine this. The net installed cost of the new line to replace the old line is $600,000 with a useful life of six years. In the first year its operating cost will be $100,000, and it will generate annual revenues of $300,000. Each year the operating cost will increase by $5000 and the revenues will fall by $15,000. After six years the equipment will have a value of $100,000 in the next re-building of the line. (a) Draw Cash Flow Diagram for this case. Solve problem by using equations. (b) Write finance factors for this example. (cx)A=P(P/A,5%,n) (c) Include screenshot of your Excel spreadsheets for your results. [HW Problem 03] - Present Worth The Larkspur Furniture Company needs a new grinder. Compute the present worth for these mutually exclusive alternatives and identify which you would recommend between (Alternative A) and (Alternative B) given i=6% per year. Larkspur uses a 10 -year planning horizon. (Hint) Need to find NPW to determine this. (a) Draw Cash Flow Diagram for this case. Solve problem by using equations. (b) Write finance factors for this example. (ex)A=P(P/A,5%,n) (c) Include screenshot of your Excel spreadsheets for your results. IBP Inc. is considering establishing a new machine to automate a meatpacking process. The machine will save $55,000 in labor annually. The machine can be purchased for $225,000 today and will be used for 10 years. It has a salvage value of $12,500 at the end of its useful life. The new machine will require an annual maintenance cost of $11,000. The corporation has a minimum rate of return of 9%. Do you recommend automating the process? (Hint) Need to find NPW to determine this. Recommended if NPW is positive. (a) Draw Cash Flow Diagram for this case. Solve problem by using equations. (b) Write finance factors for this example. (ex)A=P(P/A,5%,n) (c) Include screenshot of your Excel spreadsheets for your results. [HW Problem 02] - Present Worth You supervise an aging production line that constantly needs maintenance and new parts. Last month you spent $25,000 replacing a failed controller. Should the following plan be accepted if the interest rate is 15% ? (Hint) Need to find NPW to determine this. The net installed cost of the new line to replace the old line is $600,000 with a useful life of six years. In the first year its operating cost will be $100,000, and it will generate annual revenues of $300,000. Each year the operating cost will increase by $5000 and the revenues will fall by $15,000. After six years the equipment will have a value of $100,000 in the next re-building of the line. (a) Draw Cash Flow Diagram for this case. Solve problem by using equations. (b) Write finance factors for this example. (cx)A=P(P/A,5%,n) (c) Include screenshot of your Excel spreadsheets for your results. [HW Problem 03] - Present Worth The Larkspur Furniture Company needs a new grinder. Compute the present worth for these mutually exclusive alternatives and identify which you would recommend between (Alternative A) and (Alternative B) given i=6% per year. Larkspur uses a 10 -year planning horizon. (Hint) Need to find NPW to determine this. (a) Draw Cash Flow Diagram for this case. Solve problem by using equations. (b) Write finance factors for this example. (ex)A=P(P/A,5%,n) (c) Include screenshot of your Excel spreadsheets for your results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts