Answered step by step

Verified Expert Solution

Question

1 Approved Answer

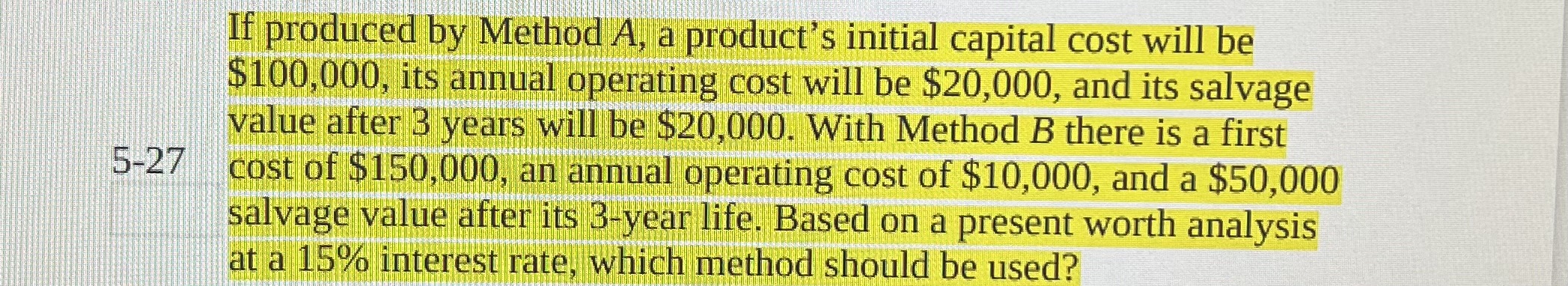

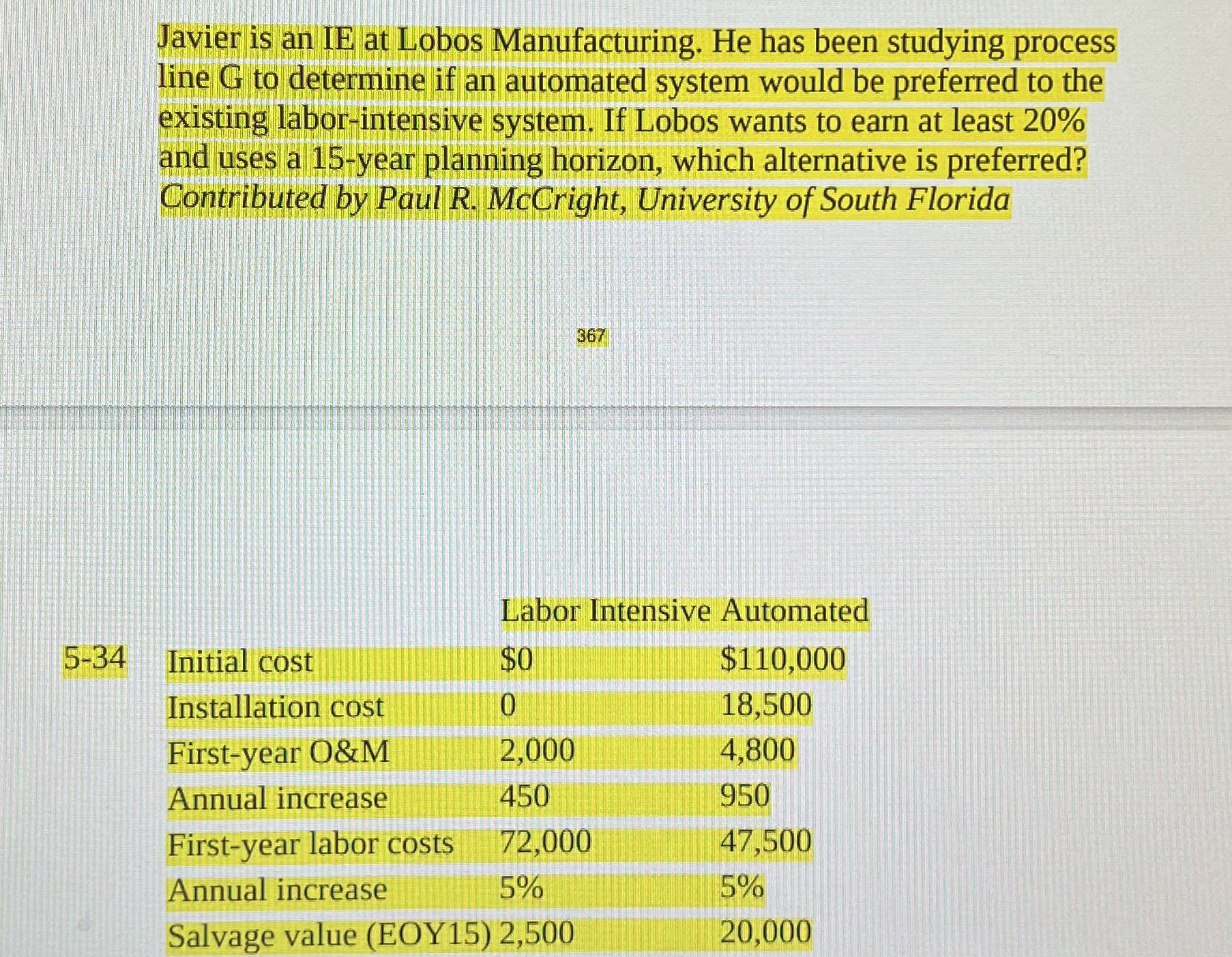

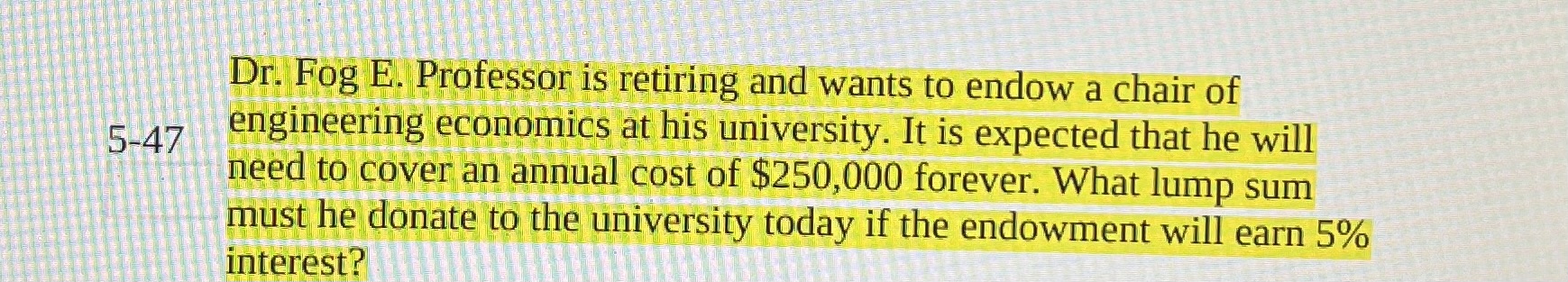

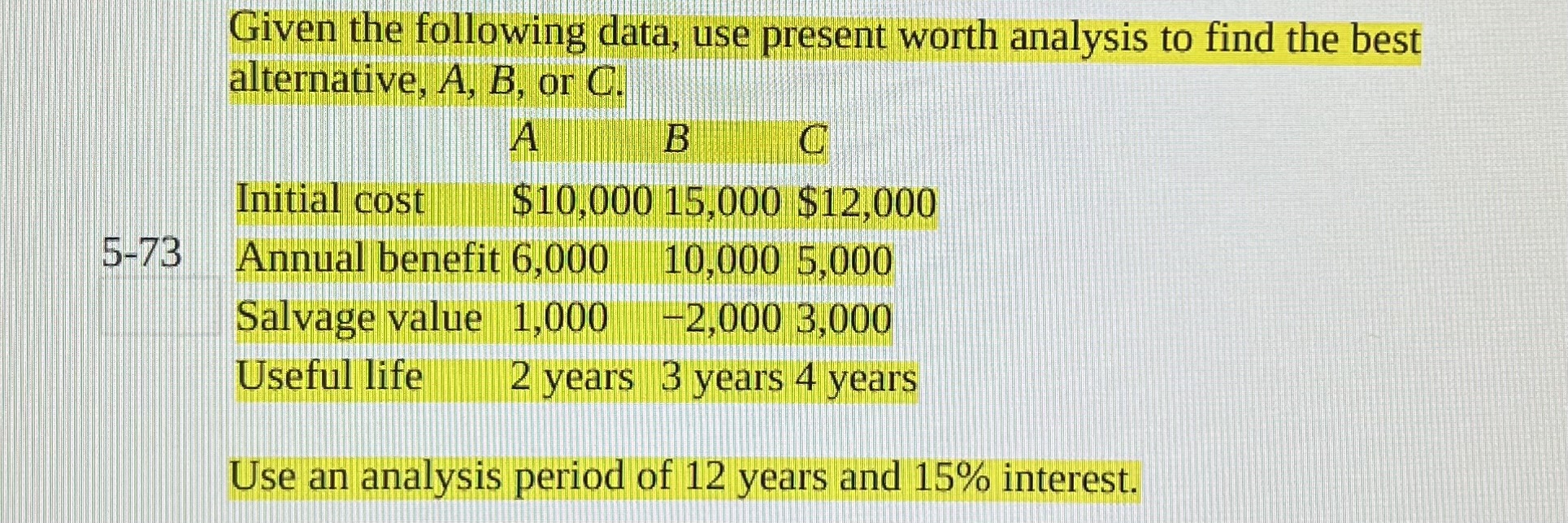

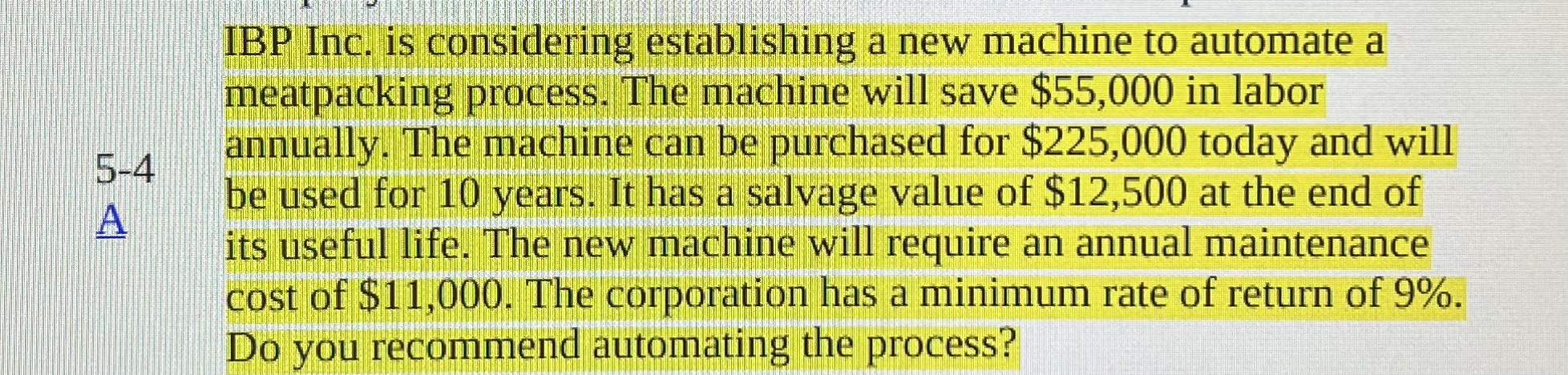

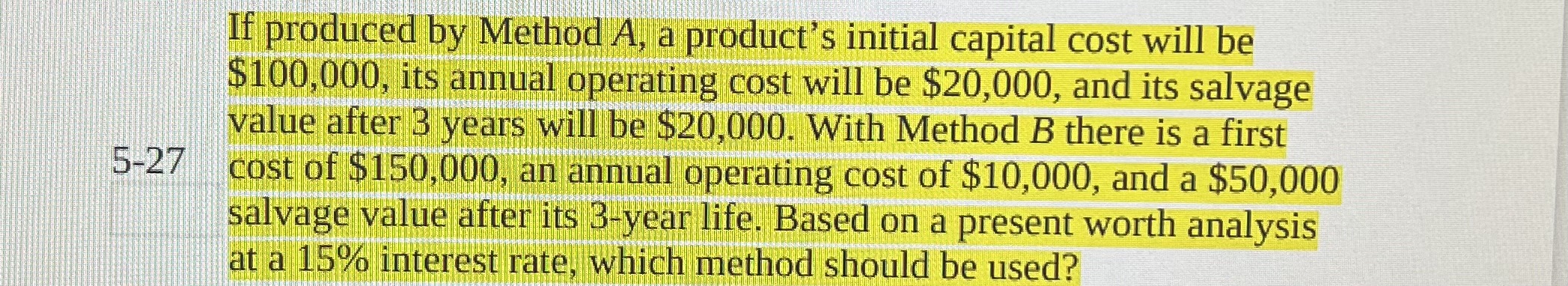

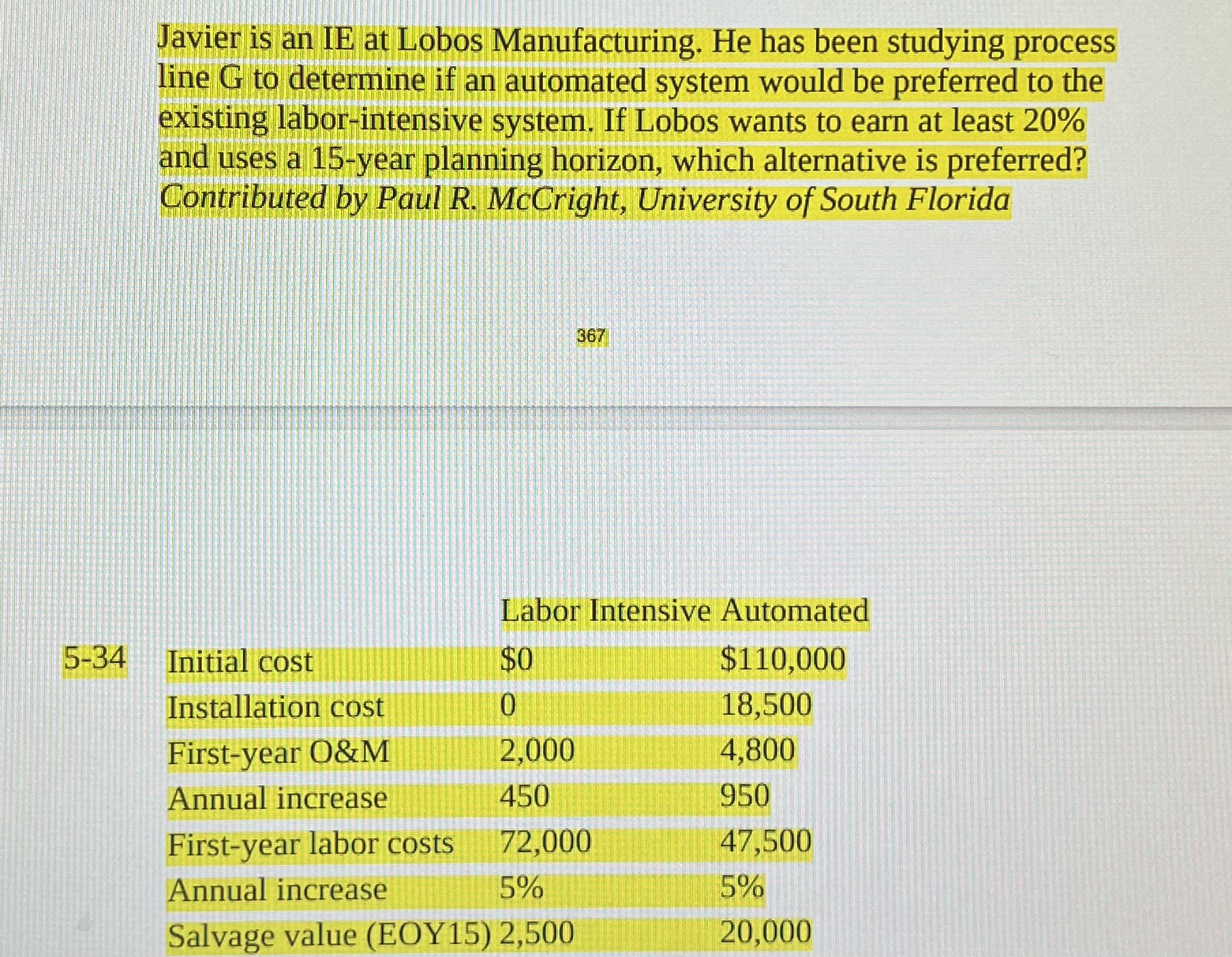

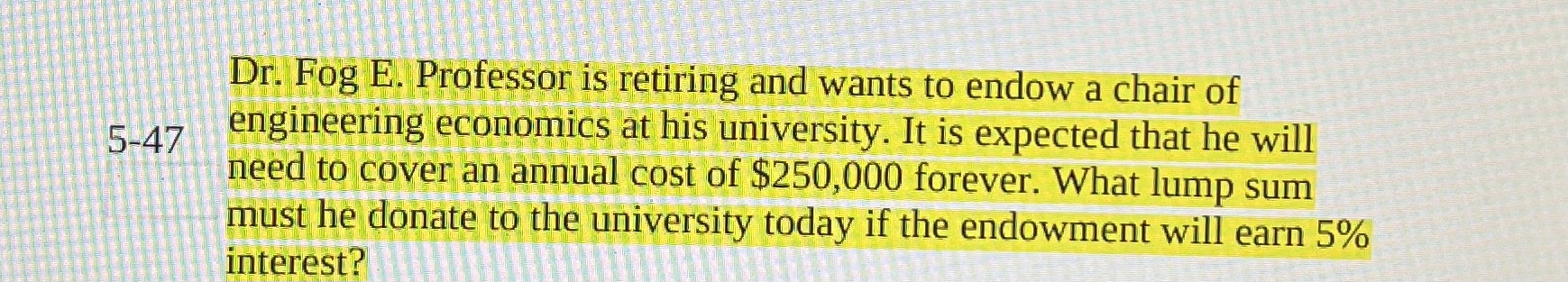

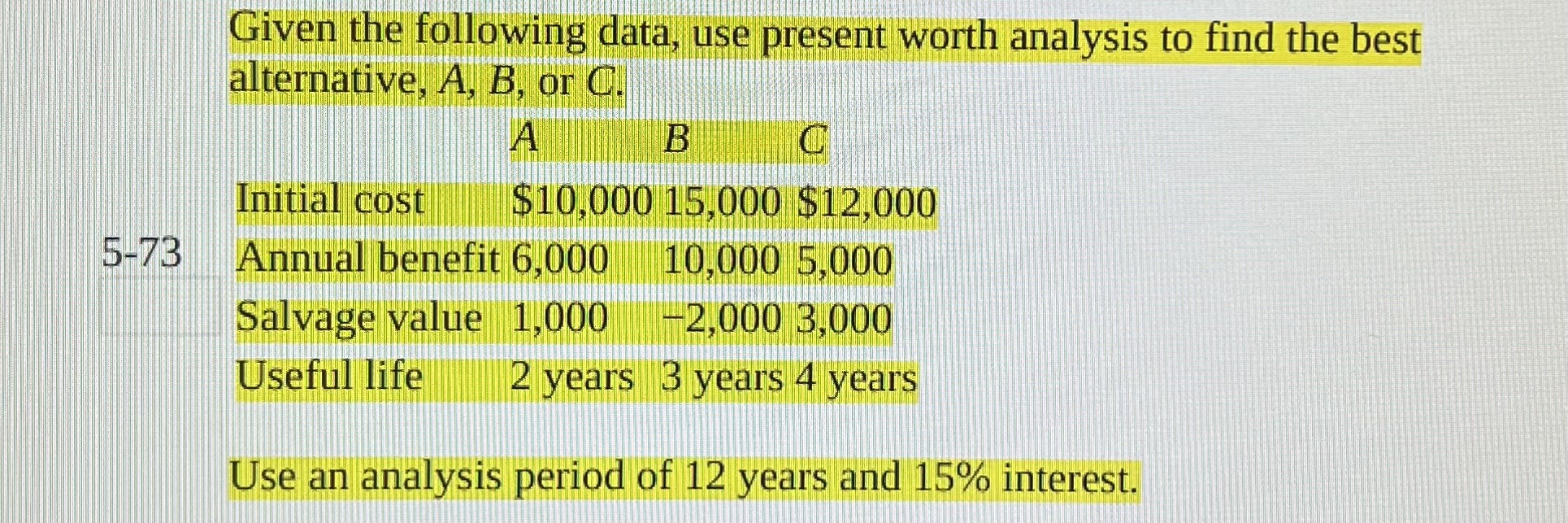

Please complete the highlighted problems (4, 27, 34, 47, 73). You MUST use the Present Worth Analysis Method for all problems to work out all

Please complete the highlighted problems (4, 27, 34, 47, 73). You MUST use the Present Worth Analysis Method for all problems to work out all the problems. Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started