Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please use correct methods and answer in full detail! it is super important as i have a hard time inderstanding my teacher. thank

could you please use correct methods and answer in full detail! it is super important as i have a hard time inderstanding my teacher. thank you

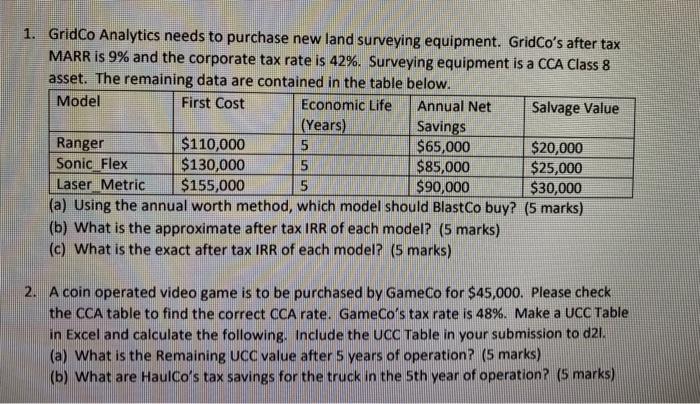

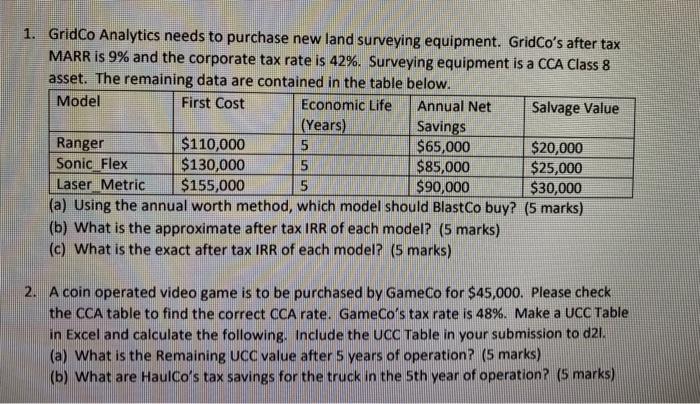

1. GridCo Analytics needs to purchase new land surveying equipment. GridCo's after tax MARR is 9% and the corporate tax rate is 42%. Surveying equipment is a CCA Class 8 asset. The remaining data are contained in the table below. Model First Cost Economic Life Annual Net Salvage Value (Years) Savings Ranger $110,000 5 $65,000 $20,000 Sonic Flex $130,000 5 $85,000 $25,000 Laser Metric $155,000 5 $90,000 $30,000 (a) Using the annual worth method, which model should BlastCo buy? (5 marks) (b) What is the approximate after tax IRR of each model? (5 marks) (c) What is the exact after tax IRR of each model? (5 marks) 2. A coin operated video game is to be purchased by GameCo for $45,000. Please check the CCA table to find the correct CCA rate. GameCo's tax rate is 48%. Make a UCC Table in Excel and calculate the following. Include the UCC Table in your submission to d2l. (a) What is the Remaining UCC value after 5 years of operation? (5 marks) (b) What are HaulCo's tax savings for the truck in the 5th year of operation? (5 marks) 1. GridCo Analytics needs to purchase new land surveying equipment. GridCo's after tax MARR is 9% and the corporate tax rate is 42%. Surveying equipment is a CCA Class 8 asset. The remaining data are contained in the table below. Model First Cost Economic Life Annual Net Salvage Value (Years) Savings Ranger $110,000 5 $65,000 $20,000 Sonic Flex $130,000 5 $85,000 $25,000 Laser Metric $155,000 5 $90,000 $30,000 (a) Using the annual worth method, which model should BlastCo buy? (5 marks) (b) What is the approximate after tax IRR of each model? (5 marks) (c) What is the exact after tax IRR of each model? (5 marks) 2. A coin operated video game is to be purchased by GameCo for $45,000. Please check the CCA table to find the correct CCA rate. GameCo's tax rate is 48%. Make a UCC Table in Excel and calculate the following. Include the UCC Table in your submission to d2l. (a) What is the Remaining UCC value after 5 years of operation? (5 marks) (b) What are HaulCo's tax savings for the truck in the 5th year of operation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started