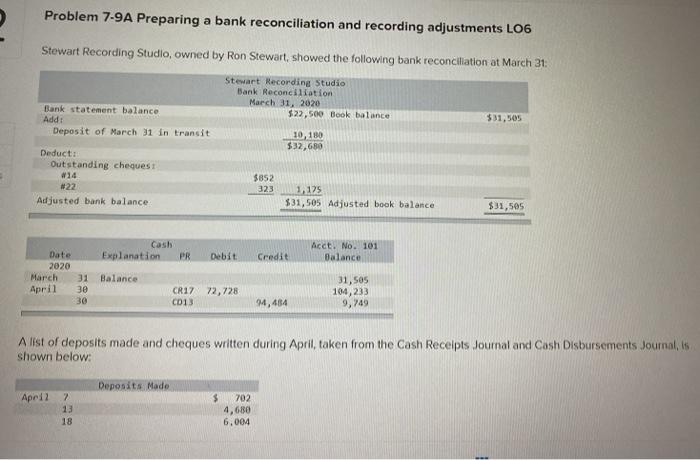

could you plz help me to complete my assignment and tell me if the last two pics of my choice are correct :)

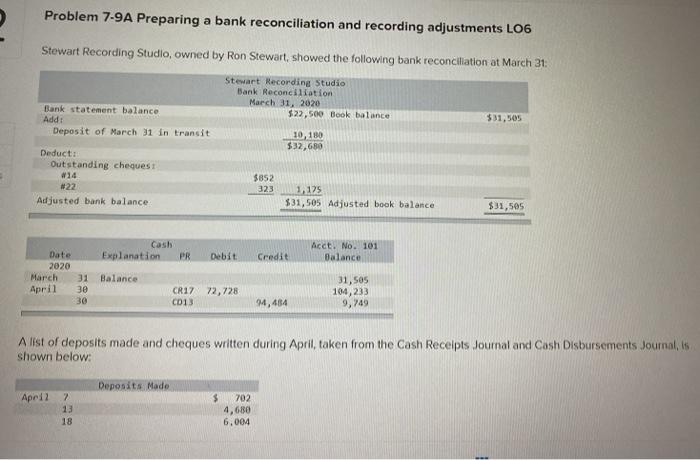

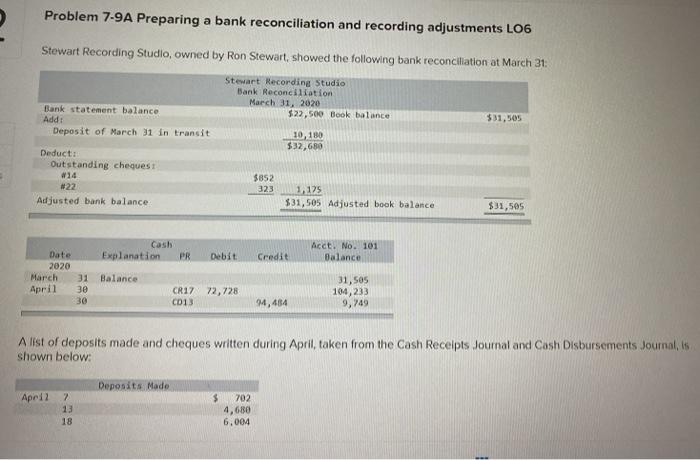

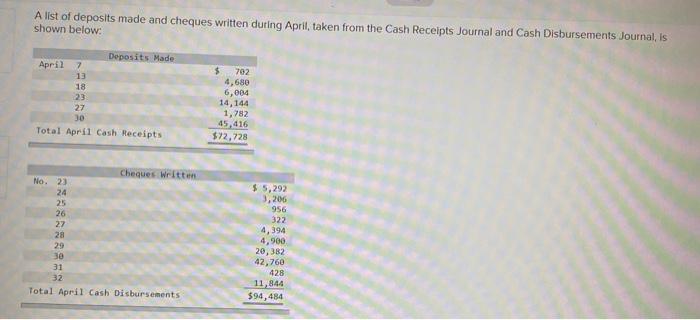

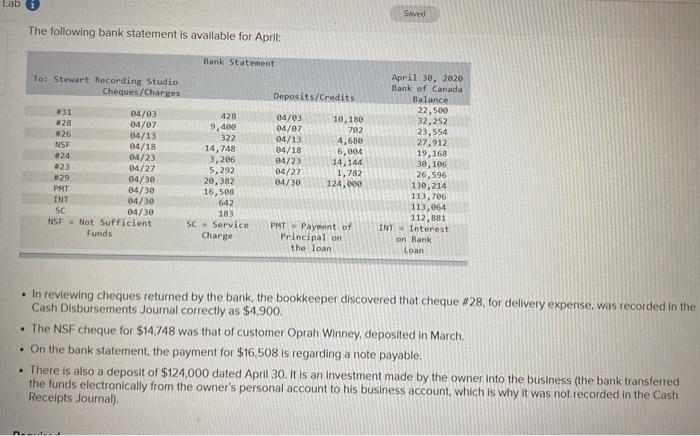

Problem 7-9 A Preparing a bank reconciliation and recording adjustments LO6 Stewart Recording Studio, owned by Ron Stewart, showed the following bank reconciliation at March 31: Stewart Recording Studio Bank Reconciliation March 31, 2020 Bank statement balance $22,500 Book balance $31,505 Add: Deposit of March 31 in transit 10, 180 $32,680 Deduct: Outstanding chequest 14 $852 #22 323 1,175 Adjusted bank balance $31,505 Adjusted book balance $31,505 Credit Acct. No. 101 Balance Cash Date Explanation PR Debit 2020 March 31 Balance April 30 CR17 72,728 2013 31,505 104,233 9,749 94,434 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journalis shown below: Deposits Made April 2 13 18 $ 702 4,680 6.004 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, is shown below: Deposits Made April 7 13 18 23 27 30 Total April Cash Receipts $ 702 4,680 6,004 14,144 1,782 45,416 $72,728 Cheques written No. 23 24 25 26 27 28 29 30 31 32 Total April Cash Disbursements $ 5,292 3,206 956 322 4,394 4,900 20,382 42,760 428 11,844 $94,484 Lab Saved The following bank statement is available for April: Bank Statement To! Stewart Recording Studio Cheques/Charges Deposits/Credits W31 04/03 #28 04/07 326 04/13 NSE 04/18 324 04/23 #23 84/27 29 04/30 PMT 04/30 INT 04/30 SC 04/30 NSF Not sufficient Funds 428 9,400 322 14,748 3,206 5,292 20,382 16,588 642 183 SC - Service Charge 84703 04/07 04/13 04/18 04/23 04/27 04/30 10,180 702 4,680 6,004 14,144 1,782 124,000 April 30, 2020 Bank of Canada Balance 22,500 32,252 23,554 27,912 19,168 30,106 26,596 130,214 113,706 113,064 112,81 INT Interest on Bank Loan PMT Payment of Principal on the loan . In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #28, for delivery expense was recorded in the Cash Disbursements Journal correctly as $4.900. The NSF cheque for $14.748 was that of customer Oprah Winney, deposited in March . On the bank statement, the payment for $16,508 is regarding a note payable. There is also a deposit of $124.000 dated April 30. It is an investment made by the owner into the business (the bank transferred the funds electronically from the owner's personal account to his business account, which is why it was not recorded in the Cash Receipts Journal) Requirea. o. Prepare a bank reconciliation for Stewart Recording Studio at April 30, STEWART RECORDING STUDIO Bank Reconciliation April 30, 2020 Company's Books Bank Statement Bank statement balance Add: Deposit of April 30 in transit $ s 9,749 112.881 Book balance Add: 45 416 Owner investment 124.000 133,749 $ $ Deduct: Outstanding cheques Outstanding cheque #14 Outstanding cheque #22 Outstanding cheque #25 Outstanding cheque #27 Outstanding cheque #30 Outstanding cheque #32 852 323 956 4,394 42.760 11,844 158 297 Deduct: Error Chq #28 NSF - Oprah Winney Payment of note Interest expense Service charge 4,500 14,748 16,508 642 183 Adjusted bank balance 61,129 97 168 Adjusted book balance $ 36,581 97 168 $ b. Prepare the necessary Journal entries to bring the General Ledger Cash account into agreement with the adjusted balance on the bank reconciliation View transaction list View journal entry worksheet No Date Apr 30 Debit Credit 1 General Journal Accounts receivable - Oprah Winney Cash 14.748 14,748 2 2 Apr 30 Bank service charges expense Cash 183 183 3 3 Apr 30 Interest expense Cash 642 642 4 Apr 30 Note payable Cash 16.508 16,508 5 Apr 30 Cash Ron Stewart, capital 124,000 124.000 TB 07-45 An error made by the bank should result in a... An error made by the bank should result in a reconciling item on the book side of a bank reconciliation True or False True False In reimbursing the petty cash fund, Multiple Choice Expense accounts are debited. Petty Cash is debited. Petty Cash is credited and expense accounts are debited. Petty Cash is credited