Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you write for E, F an e-mail in a professional email format direct to a manager? Spreadsheet Exercise: Chapter 8 Jane is considering investing

Could you write for E, F an e-mail in a professional email format direct to a manager?

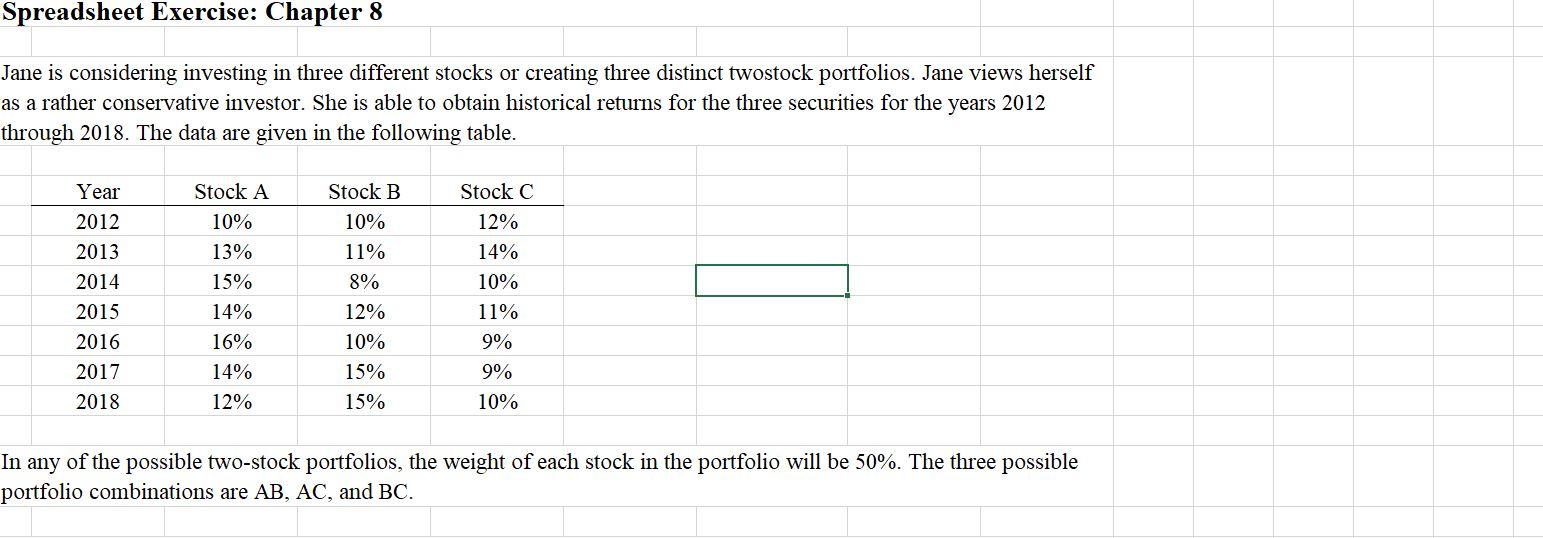

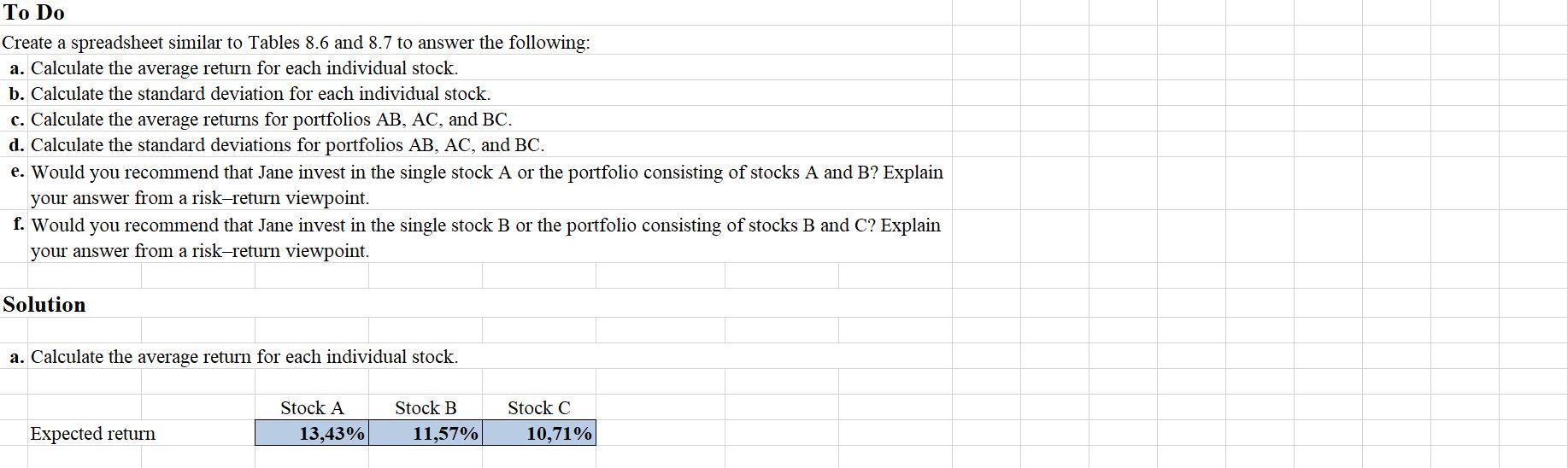

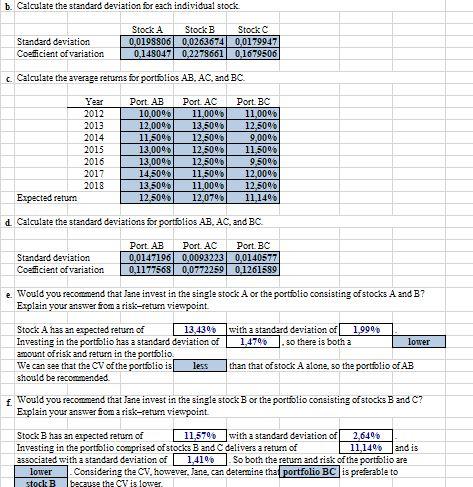

Spreadsheet Exercise: Chapter 8 Jane is considering investing in three different stocks or creating three distinct twostock portfolios. Jane views herself as a rather conservative investor. She is able to obtain historical returns for the three securities for the years 2012 through 2018. The data are given in the following table. Year Stock B 10% 11% Stock C 12% 14% 10% 2012 2013 2014 2015 2016 2017 2018 Stock A 10% 13% 15% 14% 16% 14% 12% 11% 8% 12% 10% 15% 15% 9% 9% 10% In any of the possible two-stock portfolios, the weight of each stock in the portfolio will be 50%. The three possible portfolio combinations are AB, AC, and BC. To Do Create a spreadsheet similar to Tables 8.6 and 8.7 to answer the following: a. Calculate the average return for each individual stock. b. Calculate the standard deviation for each individual stock. c. Calculate the average returns for portfolios AB, AC, and BC. d. Calculate the standard deviations for portfolios AB, AC, and BC. e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-return viewpoint. f. Would you recommend that Jane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk-return viewpoint. Solution a. Calculate the average return for each individual stock. Stock A 13,43% Stock B 11,57% Stock C 10,71% Expected return b. Calculate the standard deviation for each individual stock Standard deviation Coefficient of variation Stock A Stock B Stock C 0,0198806 0,0263674 0,01 79947 0.148047 0,2278661 0.1679506 c Calculate the average retums for portfolios AB. AC. and BC Year 2012 2013 2014 2015 2016 2017 2018 Port AB 10,000 12,00 11,5096 13,000 13,009 14,500 13,5096 12,5096 Port AC 11,000 13,506 12,5006 12,50% 12,5096 11,5096 11,000 12,07% Port BC 11,00% 12,50% 9,000 11,50% 9,50% 12,00% 12,50% 11,1496 Expected retum d. Calculate the standard deviations for portfolios AB. AC. and BC Port AB Port AC Port BC Standard deviation 0,0147196 0.0093223 0.0140577 Coeficient of variation 0.1177568 0,0772259 0,1261589 e Would you recommend that lane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-retum viewpoint Stock A has an expected return of 13.439 with a standard deviation of 1,990 Investing in the portfolio has a standard deviation of 1.470 so there is both a lower amount ofrisk and return in the portfolio We can see that the CV of the portfolio is less than that of stock A alone, so the portfolio of AB should be recommended I Would you recommend that lane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk-retum viewpoint Stock Bhas an expected return of 11,570 with a standard deviation of 2,649 Investing in the portfolio comprised of stocks B and C delivers a return of 11,14% and is associated with a standard deviation of 1,4106 So both the retum and risk of the portilio are lower Considering the CV. however, Jane can determine the portfolio BC is preferable to stock B because the CV is lower Spreadsheet Exercise: Chapter 8 Jane is considering investing in three different stocks or creating three distinct twostock portfolios. Jane views herself as a rather conservative investor. She is able to obtain historical returns for the three securities for the years 2012 through 2018. The data are given in the following table. Year Stock B 10% 11% Stock C 12% 14% 10% 2012 2013 2014 2015 2016 2017 2018 Stock A 10% 13% 15% 14% 16% 14% 12% 11% 8% 12% 10% 15% 15% 9% 9% 10% In any of the possible two-stock portfolios, the weight of each stock in the portfolio will be 50%. The three possible portfolio combinations are AB, AC, and BC. To Do Create a spreadsheet similar to Tables 8.6 and 8.7 to answer the following: a. Calculate the average return for each individual stock. b. Calculate the standard deviation for each individual stock. c. Calculate the average returns for portfolios AB, AC, and BC. d. Calculate the standard deviations for portfolios AB, AC, and BC. e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-return viewpoint. f. Would you recommend that Jane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk-return viewpoint. Solution a. Calculate the average return for each individual stock. Stock A 13,43% Stock B 11,57% Stock C 10,71% Expected return b. Calculate the standard deviation for each individual stock Standard deviation Coefficient of variation Stock A Stock B Stock C 0,0198806 0,0263674 0,01 79947 0.148047 0,2278661 0.1679506 c Calculate the average retums for portfolios AB. AC. and BC Year 2012 2013 2014 2015 2016 2017 2018 Port AB 10,000 12,00 11,5096 13,000 13,009 14,500 13,5096 12,5096 Port AC 11,000 13,506 12,5006 12,50% 12,5096 11,5096 11,000 12,07% Port BC 11,00% 12,50% 9,000 11,50% 9,50% 12,00% 12,50% 11,1496 Expected retum d. Calculate the standard deviations for portfolios AB. AC. and BC Port AB Port AC Port BC Standard deviation 0,0147196 0.0093223 0.0140577 Coeficient of variation 0.1177568 0,0772259 0,1261589 e Would you recommend that lane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-retum viewpoint Stock A has an expected return of 13.439 with a standard deviation of 1,990 Investing in the portfolio has a standard deviation of 1.470 so there is both a lower amount ofrisk and return in the portfolio We can see that the CV of the portfolio is less than that of stock A alone, so the portfolio of AB should be recommended I Would you recommend that lane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk-retum viewpoint Stock Bhas an expected return of 11,570 with a standard deviation of 2,649 Investing in the portfolio comprised of stocks B and C delivers a return of 11,14% and is associated with a standard deviation of 1,4106 So both the retum and risk of the portilio are lower Considering the CV. however, Jane can determine the portfolio BC is preferable to stock B because the CV is lowerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started