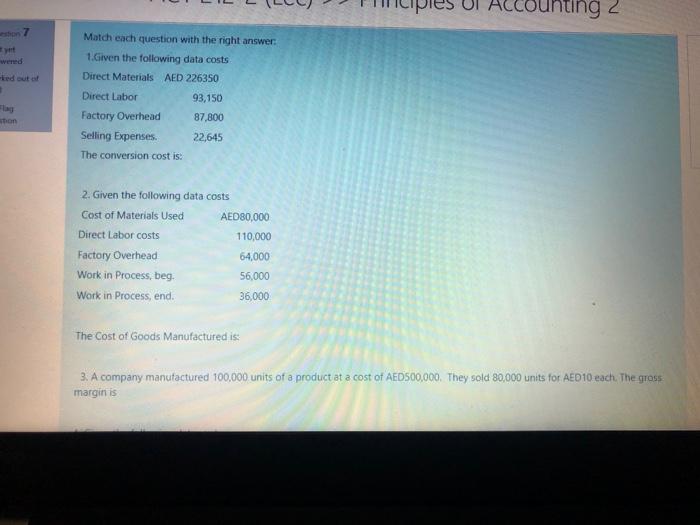

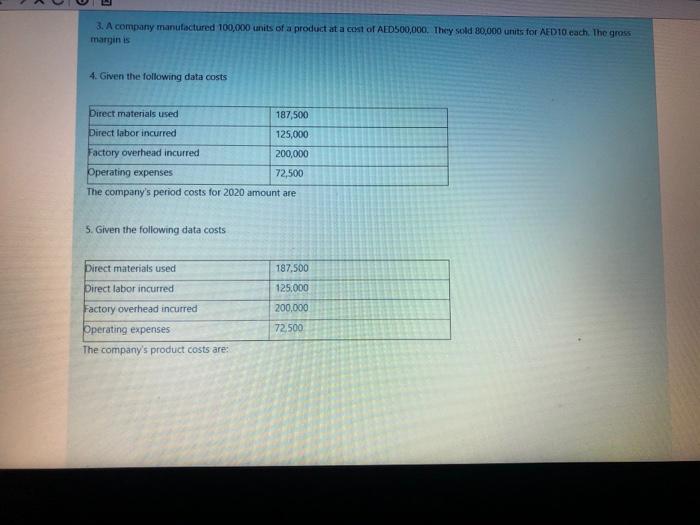

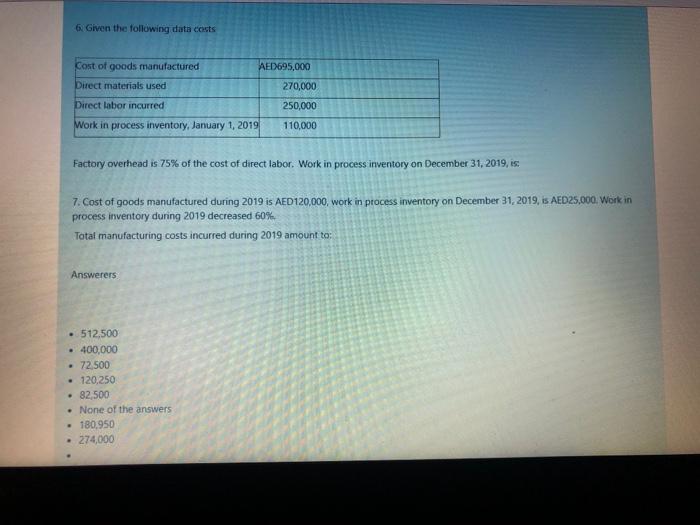

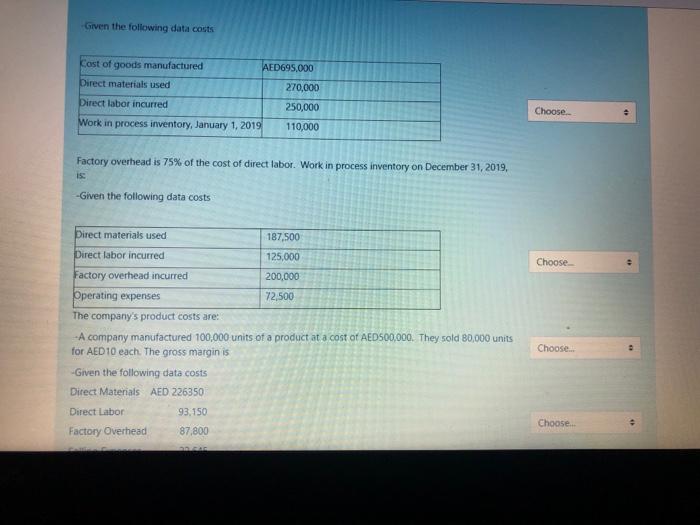

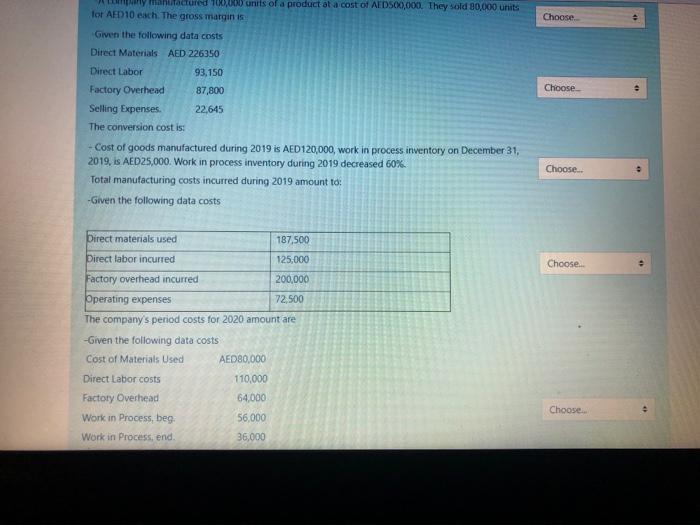

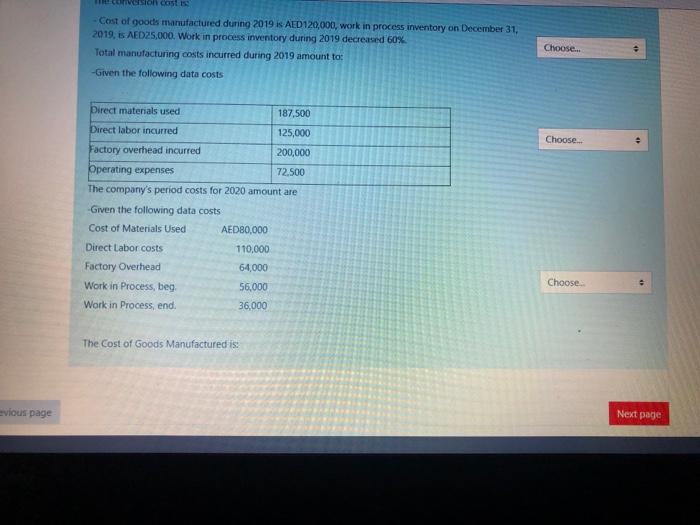

counting 2 Match each question with the right answer: 1. Given the following data costs Direct Materials AED 226350 ied out of 93,150 Direct Labor Factory Overhead Selling Expenses The conversion cost is: 87,800 22,645 2. Given the following data costs Cost of Materials Used AED80,000 Direct Labor costs 110,000 Factory Overhead 64,000 Work in Process, beg 56,000 Work in Process, end 36,000 The Cost of Goods Manufactured is: 3. A company manufactured 100,000 units of a product at a cost of AED500,000. They sold 80,000 units for AED 10 each. The gross margin is 3. A company manufactured 100,000 units of a product at a cost of AED500,000. They sold 80,000 units for AED10 each. The gross marginis 4. Given the following data costs Direct materials used 187,500 Direct labor incurred 125,000 200,000 Factory overhead incurred Operating expenses 72,500 The company's period costs for 2020 amount are 5. Given the following data costs Direct materials used 187,500 Direct labor incurred 125,000 200,000 Factory overhead incurred Operating expenses The company's product costs are: 72.500 6. Given the following data costs Cost of goods manufactured AED695,000 Direct materials used 270,000 Direct labor incurred 250,000 Work in process inventory, January 1, 2019 110,000 Factory overhead is 75% of the cost of direct labor. Work in process inventory on December 31, 2019, s. 7. Cost of goods manufactured during 2019 is AED 120.000, work in process inventory on December 31, 2019, is AED25,000. Work in process inventory during 2019 decreased 60% Total manufacturing costs incurred during 2019 amount to: Answerers 512,500 400,000 72.500 120.250 82.500 None of the answers 180,950 274,000 Given the following data costs Cost of goods manufactured AED695.000 Direct materials used 270,000 Direct labor incurred 250,000 Work in process inventory, January 1, 2019 110,000 Choose Factory overhead is 75% of the cost of direct labor. Work in process inventory on December 31, 2019, is --Given the following data costs Direct materials used 187,500 Direct labor incurred 125,000 Choose Factory overhead incurred 200,000 Operating expenses 72,500 The company's product costs are: A company manufactured 100,000 units of a product at a cost of AED500,000. They sold 80,000 units for AED 10 each. The gross margin is -Given the following data costs Direct Materials AED 226350 Choose.. Direct Labor 93.150 Choose. Factory Overhead 87,800 MAR Manufactured 100,000 units of a product at a cost of ALD500,000. They sold 80,000 units for AED10 each. The gross margin is Choose Choose Given the following data costs Direct Materials AED 226350 Direct Labor 93,150 Factory Overhead 87,800 Selling Expenses 22,645 The conversion cost is! - Cost of goods manufactured during 2019 is AED120,000, work in process inventory on December 31, 2019, is AED25,000. Work in process inventory during 2019 decreased 60% Total manufacturing costs incurred during 2019 amount to: -Given the following data costs Choose.. Choose Direct materials used 187,500 Direct labor incurred 125,000 Factory overhead incurred 200,000 Operating expenses 72,500 The company's period costs for 2020 amount are -Given the following data costs Cost of Materials Used AED80,000 Direct Labor costs 110,000 Factory Overhead 64,000 Work in Process, beg. 56,000 Work in Process, end. 36,000 Choose COR - Cost of goods manufactured during 2019 is AED120,000, work in process inventory on December 31, 2019, is AED25,000. Work in process inventory during 2019 decreased 60% Total manufacturing costs incurred during 2019 amount to: -Given the following data costs Choose... Choose... e Direct materials used 187,500 Direct labor incurred 125,000 Factory overhead incurred 200,000 Operating expenses 72.500 The company's period costs for 2020 amount are Given the following data costs Cost of Materials Used AED80,000 Direct Labor costs 110,000 Factory Overhead 64,000 Work in Process, beg 56,000 Work in Process, end 36,000 Choose. The Cost of Goods Manufactured is: vious page Next page