Answered step by step

Verified Expert Solution

Question

1 Approved Answer

counting Cycle Homework #2 Age Group Not yet due 0 to 90 days past Check my work mode: This shows what is correct or incorrect

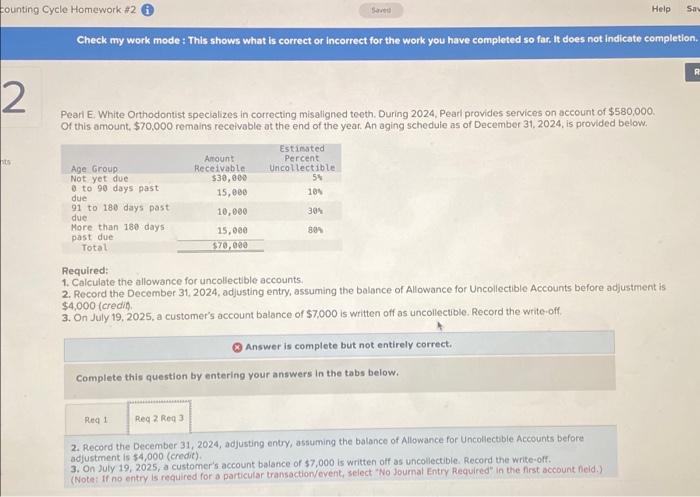

counting Cycle Homework #2 Age Group Not yet due 0 to 90 days past Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2024, Pearl provides services on account of $580,000. Of this amount, $70,000 remains receivable at the end of the year. An aging schedule as of December 31, 2024, is provided below. due 91 to 180 days past due More than 180 days past due Total Amount Receivable $30,000 15,000 10,000 15,000 $70,000 Req 1 Estimated Percent Uncollectible 5% 10% Req 2 Req 3 Saved 30% 80% Required: 1. Calculate the allowance for uncollectible accounts. 2. Record the December 31, 2024, adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $4,000 (credit). 3. On July 19, 2025, a customer's account balance of $7,000 is written off as uncollectible. Record the write-off. Complete this question by entering your answers in the tabs below. Help Answer is complete but not entirely correct. 2. Record the December 31, 2024, adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $4,000 (credit). 3. On July 19, 2025, a customer's account balance of $7,000 is written off as uncollectible. Record the write-off. (Note: If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Sav R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started