Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Country of Taxation = New Zealand Part A: Deductions Peter Thompson, who is a self-employed medical practitioner, has been operating a surgery from a building

Country of Taxation = New Zealand

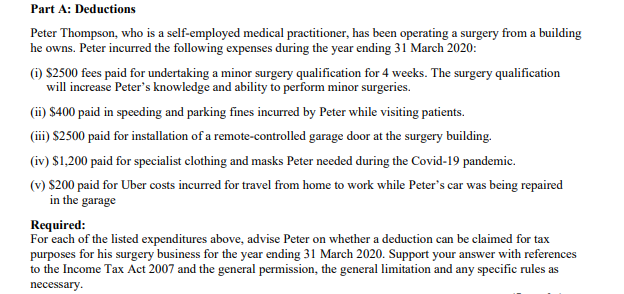

Part A: Deductions Peter Thompson, who is a self-employed medical practitioner, has been operating a surgery from a building he owns. Peter incurred the following expenses during the year ending 31 March 2020: (1) $2500 fees paid for undertaking a minor surgery qualification for 4 weeks. The surgery qualification will increase Peter's knowledge and ability to perform minor surgeries. (in) $400 paid in speeding and parking fines incurred by Peter while visiting patients. (iii) $2500 paid for installation of a remote-controlled garage door at the surgery building. (iv) $1,200 paid for specialist clothing and masks Peter needed during the Covid-19 pandemic. (v) $200 paid for Uber costs incurred for travel from home to work while Peter's car was being repaired in the garage Required: For each of the listed expenditures above, advise Peter on whether a deduction can be claimed for tax purposes for his surgery business for the year ending 31 March 2020. Support your answer with references to the Income Tax Act 2007 and the general permission, the general limitation and any specific rules as necessaryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started