Question

Country Style Food Services Inc. In December 2001, Country Style Food Services Inc., found itself in financial trouble. It had just filed for bankruptcy protection

Country Style Food Services Inc.

In December 2001, Country Style Food Services Inc., found itself in financial trouble. It had just filed for bankruptcy protection with the goal of restructuring operations in order to return to profitable growth. The company owed a total of $23 million to secured and unsecured creditors. At the same time a letter was sent to all franchise owners stating that 49 outlets would be closing. The company's goal was to pair down to about 250 outlets before growing again.

Company History and Situation

Founded in March 1963 in Toronto, Country Style has grown to 350 franchises in Canada, concentrated in Ontario, British Columbia and Alberta. The company also has about 190 international outlets in countries such as Brazil, the Philippines, Indonesia and Thailand. Country Style also operates the Buns Master Franchise System, which began franchising in 1977 to satisfy the growing demand for its unique offering of bakery products at inexpensive prices. The company is presently owned by CAI Capital Partners, a U.S. based company.

About the closings, company president Patrick Gibbons stated, "We have critically examined the performance of all locations. Every store was assessed on its ability to generate consumer traffic, present an inviting and consistent Country Style atmosphere and meet sales objectives. The company will continue to operate only strong locations that will ensure our customers receive high quality products and excellent service." The stores that were closed did not perform well, did not meet the criteria described above, and did not have drive-thru. A drive-thru is as much as 60% of the business in some profitable locations.

Market and Competition

Country Style along with many other smaller chains has fallen well behind Tim Hortons. Refer to Figure 1 for details. Since 1995, when Wendy's took over Tim Hortons, the competition has been brutal. Tim Hortons has expanded from 1200 outlets to 2000 outlets. Tim Hortons is Canada's preferred brand?a cultural icon so to speak.

The Canadian coffee shop market in the year 2000 was worth about $2.8 billion. Presently, Country Style is Canada's third largest donut chain behind Tim Horton's and Coffee Time Donuts. As of 2000, annual sales at Country Style's Canadian stores were $120.4 million. Based on 340 locations operating in Canada, the average sales revenue is $344,000 per store. In contrast, Tim Hortons sales revenue in 2000 (as reported by Wendy's International) was $1.9 billion from 2100 outlets.

Sales per store are a critical performance metric for franchisees in the coffee shop / donut shop market as that is a key driver of the profitability of the store owner/operators. It is also critical to the franchisor (i.e. Country Style Food Service Inc.) as their income is driven almost entirely by system wide sales levels. Country Style Food Service Inc. earns a royalty rate of 5% on all sales. In addition, franchisors pay 3% of sales into a marketing fund that the franchisor must spend on marketing activities.

Given the size and marketing resources of a Tim Horton's one would question the wisdom of any competitor trying to compete with them with similar product offerings. Tim Hortons successfully repositioned itself from a sweet snack chain to a quick serve restaurant serving hot soups and deli-style sandwiches. They are competing more with McDonald's now than they are other coffee shop chains. As Tim Hortons has grown, they have focused on driving operational efficiencies through standardization and shifting much of their production (e.g. donuts are no longer fried in the stores, they are brought into the store in a frozen state, and then baked off and glazed in the store).

The Canadian coffee shop / donut shop market appears to be saturated. Canada now has more doughnut stores per capita than any country in the world, making it a particularly tough environment for older players like Country Style. Specialty coffee shops such as Starbucks and Second Cup are eating into the coffee-and-snack market and Starbucks, in particular, has plans to grow its store count rapidly over the next 5 years.

All of the bad news at Country Style comes at a time when they face competition from a new and potentially powerful player in the market, Krispy Kreme. Presently they have two large "factory store" outlets (Mississauga and Richmond Hill) that are also production facilities and can offer their signature donuts hot out of the flyer. Krispy Kreme plans to open 30 outlets over the next two years in Ontario, Quebec and the Atlantic provinces. Some of these outlets will be their large "factory store" model but the majority of them will be traditional donut & coffee stores that get their products from the factory stores.

Recent Marketing Strategies

Country Style has already taken some steps to improve operations. New products such as the "cinnamon twister" and "chicken stew" were added to the lunch menu. In 2001 Country Style opened its first twinned restaurant with A&W, in which service includes an integrated cash system.

One of Country Style's most valuable assets is its coffee, which accounts for over 50% of sales. Further, Country Style is the only chain that grinds its coffee fresh in the store. Many loyal customers go to Country Style just for the coffee. The company has never really promoted how good the coffee really is. Coffee, for all coffee/donut shop operators, is not only the biggest selling menu item, it is also the highest gross margin product that they sell. Coffee has an average gross margin, including cups, lids, milk, sugar, etc. of approximately 85% for an average Country Style outlet. The total blended gross margin across all sales for a typical Country Style outlet is 72.5%. This is gross margin, of course, and does not include any variable or fixed expenses or the owner-operator's profits.

Historically, Country Style has not invested much money in advertising and most of the marketing fund dollars have been spent on supporting tactical promotions and limited time product offers (e.g. the new cinnamon twister). Consequently, the level of awareness and knowledge of what they offer is low, particularly among consumers under the age of 30 years. In addition, there hasn't been a lot of money spent by either Country Style or their franchisees on store renovations and updates so that there are many outdated and tired looking outlets with many different dcor and image packages depending on when the store was open.

Taking a follow-the-leader approach to promotion strategy, Country Style launched a "Turn Up A Winner" contest very similar to Tim Hortons "Roll Up the Rim." Unlike Tim Hortons' contest, Country Style offered a prize under every lip, anything from a free donut to a sport utility vehicle. No customer would be disappointed. The potential impact of a copycat promotion has to be questioned.

On the consolidation and building side of things, CEO Gibbons would like to open 20 new outlets in 2002 with several non-traditional locations (e.g., gasoline stations) under consideration. It costs Country Style about $20,000 to open a new outlet since most of the requirement capital investment (approximately $150,000 for a full size store or $50,000 for a non-traditional location) is made by the franchisee. The closing of outdated and poor performing outlets will continue. Renovating a store with new dcor, fixtures, signage and updated equipment costs about $15,000 per store and Country Style Food Services Inc. would be responsible for this as the low level of franchisee profitability over the last few years means they generally don't have the financial resources to invest back in their outlets.

Present Situation

The fact that Country Style does the same thing as Tim Hortons but now quite as well, makes it difficult for them to compete. They have never been able to develop a significant differential advantage so consumers are perplexed about what they actually offer. CAI is willing to invest $3 million immediately to implement business strategies that will help right the ship for the long term. What can they offer that will give people a reason to visit? Should it be an all-embracing operation like Tim Hortons or should the menu be streamlined in order to concentrate on what County Style does well? What does Country Style do well? What can they do well that will differentiate them from competitors? Given their size, financial position, and potential marketing resources available what direction should they proceed in?

Figure 1

Market Shares?Coffee Shop Chains

Rank 2000 | Rank 1999 | Chain | Share 2000 | Share 1999 | Share 1998 |

| 1 | 1 | TDL Group (Tim Hortons) | 67.8 | 62.2 | 59.7 |

| 2 | 2 | Second Cup | 5.7 | 13.2 | 12.8 |

| 3 | 3 | Coffee Time Donuts | 5.2 | 5.5 | 5.5 |

| 4 | 4 | Starbucks | 4.7 | 4.9 | 4.9 |

| 5 | 4 | Allied-Domecq (Dunkin' Donuts) | 4.3 | 4.9 | 6.3 |

| 6 | 6 | Country Style Food Services | 4.3 | 4.7 | 4.9 |

| 7 | N/A | Afton Food Group | 3.0 | n/a | n/a |

| 8 | 7 | Timothy's World Coffee | 1.8 | 1.7 | 1.8 |

| 9 | 9 | Baker's Dozen | 1.6 | 1.3 | 1.7 |

| 10 | 7 | Mmmuffins Canada** | 1.6 | 1.7 | 2.5 |

* Owner of Robin's Donuts, Donut Delite Caf and Mrs. Powell's Bakery Eatery

** mmmuffins was acquired by Timothy's World Coffee in January 2002.

OCMC 2002 Retailing Case - modified by Duncan Reith

Questions:

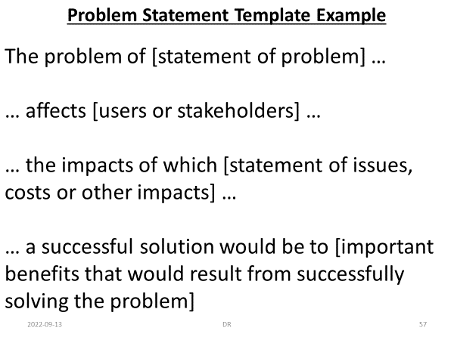

1 State the problem in the Country Style case using the problem statement template.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started