| Coupon Bond: Salient Facts |

| Face Value | $12,500.00 |

| Coupon Rate | 6.50% |

| Coupon PMT ($) | $812.50 |

| N (Years) | 6 |

| YTM @ Time 0 | 7.25% |

| | | | | | | | | | |

| | Time Period | | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

| | | | | | | | | | |

| | Nominal (i.e., undiscounted) Cash Flows | | | | | | | | |

| | Face Value | | | | | | | | |

| | Coupon Payments | | | $0.00 | | $0.00 | $0.00 | $0.00 | $0.00 |

| | Total Nominal Cash Flows | | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| | | | | | | | | | |

| | PV of Each Cash Flow @ Time 0 | | | | | | | | |

| | | | | | | | | | |

| | Bond's Present Value @ Time 0 | | $0.00 | | | | | | |

| | Net Present Value @ Time 0 | | $0.00 | | | | | | |

| | | | | | | | | |

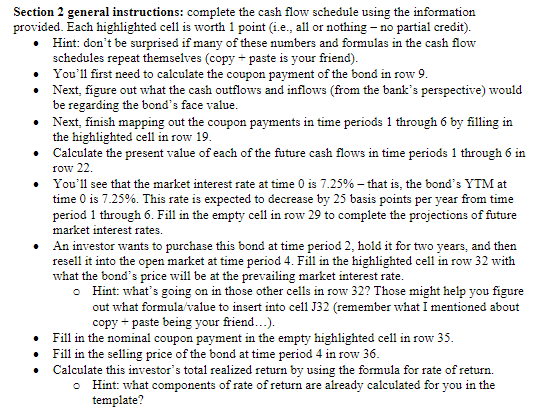

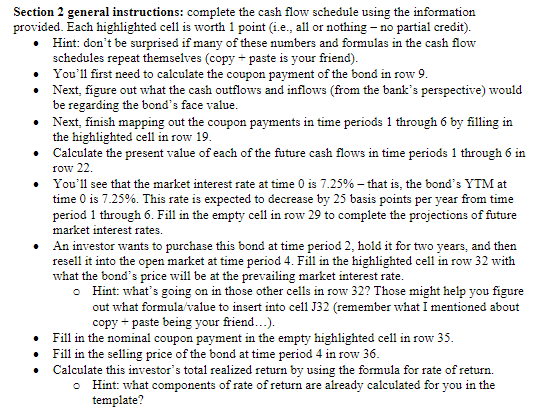

Section 2 general instructions: complete the cash flow schedule using the information provided. Each highlighted cell is worth 1 point (1.e., all or nothing no partial credit). Hint: don't be surprised if many of these numbers and formulas in the cash flow schedules repeat themselves (copy-paste is your friend). You'll first need to calculate the coupon payment of the bond in row 9. Next, figure out what the cash outflows and inflows (from the bank's perspective) would be regarding the bond's face value. Next, finish mapping out the coupon payments in time periods 1 through 6 by filling in the highlighted cell in row 19. Calculate the present value of each of the future cash flows in time periods 1 through 6 in row 22. You'll see that the market interest rate at time 0 is 7.25%- that is, the bond's YTM at time 0 is 7.25%. This rate is expected to decrease by 25 basis points per year from time period 1 through 6. Fill in the empty cell in row 29 to complete the projections of future market interest rates. An investor wants to purchase this bond at time period 2. hold it for two years, and then resell it into the open market at time period 4. Fill in the highlighted cell in row 32 with what the bond's price will be at the prevailing market interest rate. Hint: what's going on in those other cells in row 32? Those might help you figure out what formula/value to insert into cell J32 (remember what I mentioned about copy-paste being your friend...). Fill in the nominal coupon payment in the empty highlighted cell in row 35. Fill in the selling price of the bond at time period 4 in row 36. Calculate this investor's total realized return by using the formula for rate of return. Hint: what components of rate of return are already calculated for you in the template? Section 2 general instructions: complete the cash flow schedule using the information provided. Each highlighted cell is worth 1 point (1.e., all or nothing no partial credit). Hint: don't be surprised if many of these numbers and formulas in the cash flow schedules repeat themselves (copy-paste is your friend). You'll first need to calculate the coupon payment of the bond in row 9. Next, figure out what the cash outflows and inflows (from the bank's perspective) would be regarding the bond's face value. Next, finish mapping out the coupon payments in time periods 1 through 6 by filling in the highlighted cell in row 19. Calculate the present value of each of the future cash flows in time periods 1 through 6 in row 22. You'll see that the market interest rate at time 0 is 7.25%- that is, the bond's YTM at time 0 is 7.25%. This rate is expected to decrease by 25 basis points per year from time period 1 through 6. Fill in the empty cell in row 29 to complete the projections of future market interest rates. An investor wants to purchase this bond at time period 2. hold it for two years, and then resell it into the open market at time period 4. Fill in the highlighted cell in row 32 with what the bond's price will be at the prevailing market interest rate. Hint: what's going on in those other cells in row 32? Those might help you figure out what formula/value to insert into cell J32 (remember what I mentioned about copy-paste being your friend...). Fill in the nominal coupon payment in the empty highlighted cell in row 35. Fill in the selling price of the bond at time period 4 in row 36. Calculate this investor's total realized return by using the formula for rate of return. Hint: what components of rate of return are already calculated for you in the template