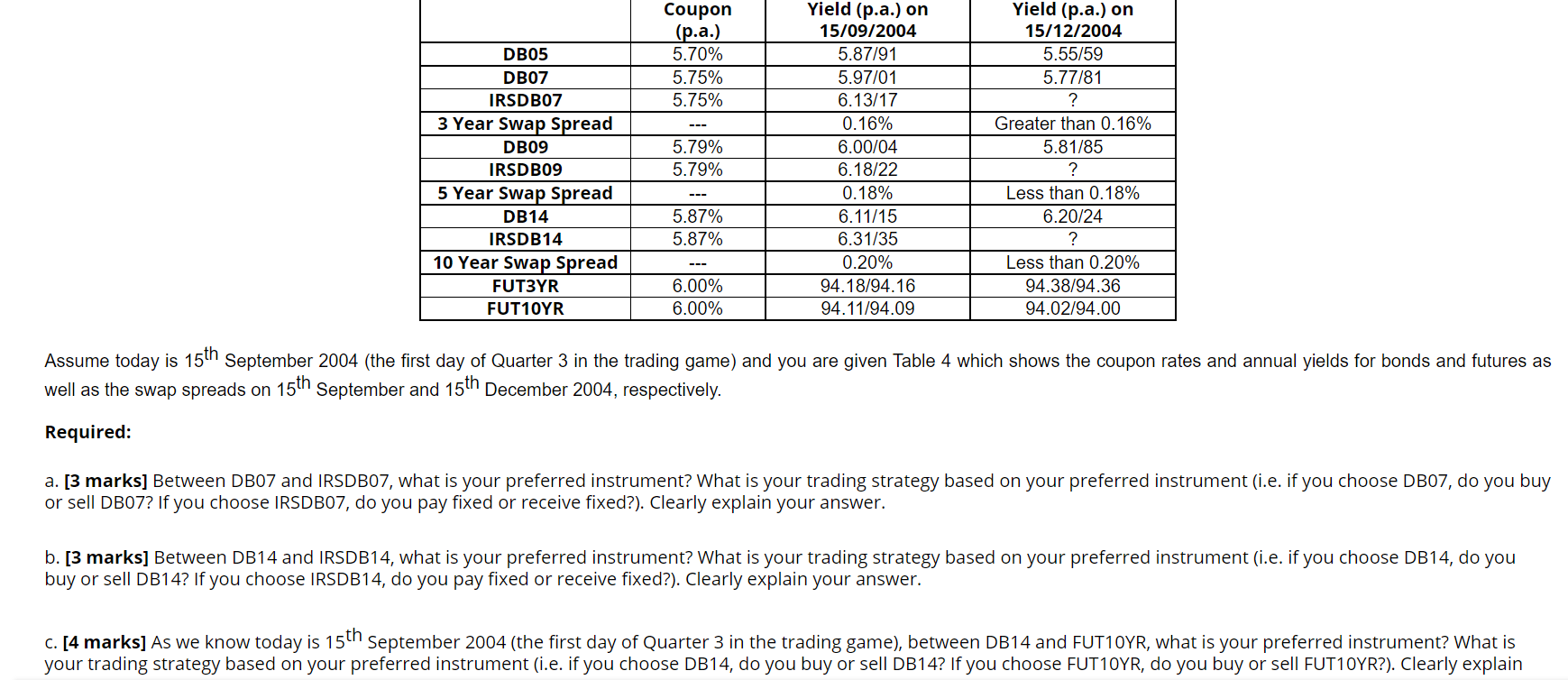

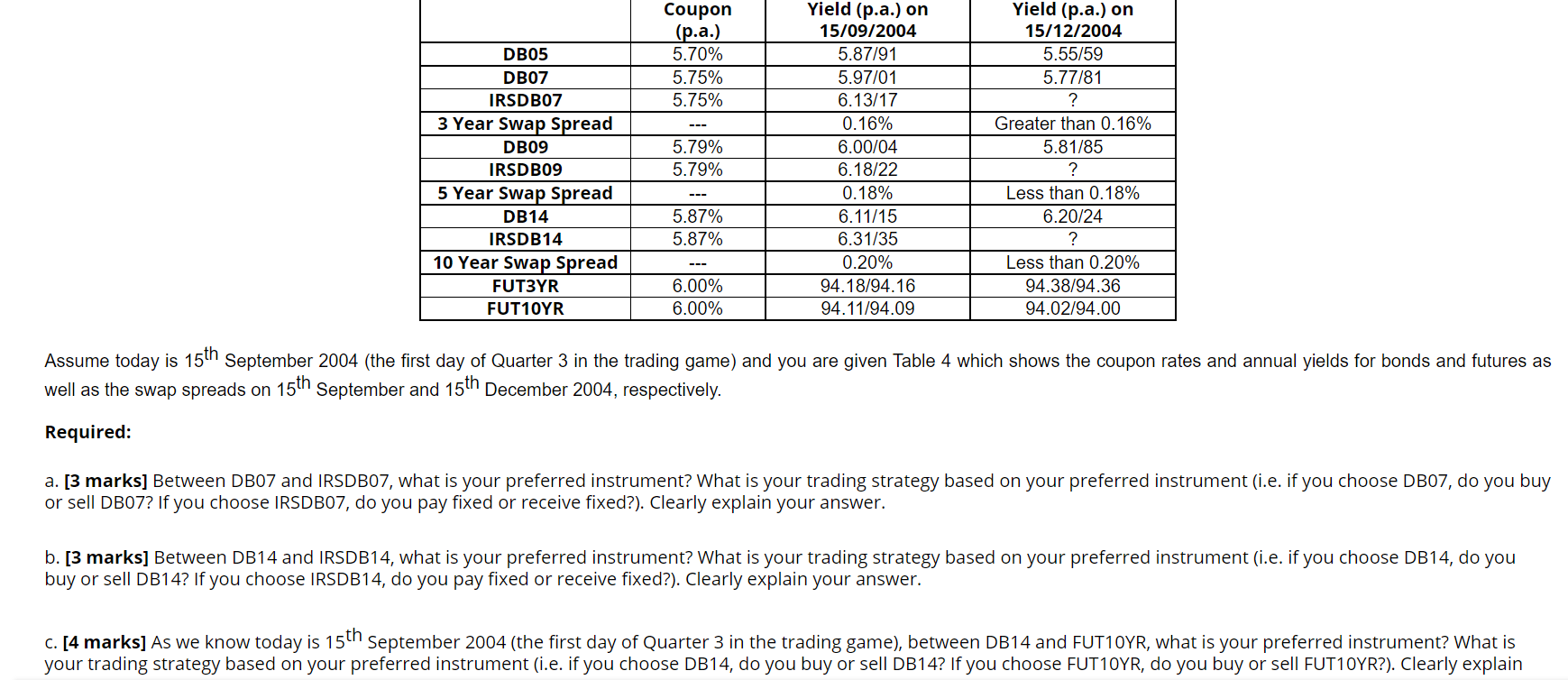

Coupon (p.a.) 5.70% DB05 Yield (p.a.) on 15/09/2004 5.87/91 5.97/01 6.13/17 Yield (p.a.) on 15/12/2004 5.55/59 5.77/81 ? DB07 5.75% 5.75% 0.16% Greater than 0.16% IRSDBOZ 3 Year Swap Spread DB09 IRSDB09 5 Year Swap Spread DB14 5.79% 5.79% 5.81/85 ? 6.00/04 6.18/22 0.18% 6.11/15 6.31/35 Less than 0.18% 6.20/24 5.87% 5.87% IRSDB14 ? 10 Year Swap Spread 0.20% FUTBYR 6.00% 94.18/94.16 94. 11/94.09 Less than 0.20% 94.38/94.36 94.02/94.00 FUT10YR 6.00% Assume today is 15th September 2004 (the first day of Quarter 3 in the trading game) and you are given Table 4 which shows the coupon rates and annual yields for bonds and futures as well as the swap spreads on 15th September and 15th December 2004, respectively. Required: a. [3 marks] Between DB07 and IRSDB07, what is your preferred instrument? What is your trading strategy based on your preferred instrument (i.e. if you choose DB07, do you buy or sell DB07? If you choose IRSDB07, do you pay fixed or receive fixed?). Clearly explain your answer. b. [3 marks] Between DB14 and IRSDB14, what is your preferred instrument? What is your trading strategy based on your preferred instrument (i.e. if you choose DB14, do you buy or sell DB14? If you choose IRSDB14, do you pay fixed or receive fixed?). Clearly explain your answer. C. [4 marks] As we know today is 15th September 2004 (the first day of Quarter 3 in the trading game), between DB14 and FUT1OYR, what is your preferred instrument? What is your trading strategy based on your preferred instrument (i.e. if you choose DB14, do you buy or sell DB14? If you choose FUT10YR, do you buy or sell FUT10YR?). Clearly explain Coupon (p.a.) 5.70% DB05 Yield (p.a.) on 15/09/2004 5.87/91 5.97/01 6.13/17 Yield (p.a.) on 15/12/2004 5.55/59 5.77/81 ? DB07 5.75% 5.75% 0.16% Greater than 0.16% IRSDBOZ 3 Year Swap Spread DB09 IRSDB09 5 Year Swap Spread DB14 5.79% 5.79% 5.81/85 ? 6.00/04 6.18/22 0.18% 6.11/15 6.31/35 Less than 0.18% 6.20/24 5.87% 5.87% IRSDB14 ? 10 Year Swap Spread 0.20% FUTBYR 6.00% 94.18/94.16 94. 11/94.09 Less than 0.20% 94.38/94.36 94.02/94.00 FUT10YR 6.00% Assume today is 15th September 2004 (the first day of Quarter 3 in the trading game) and you are given Table 4 which shows the coupon rates and annual yields for bonds and futures as well as the swap spreads on 15th September and 15th December 2004, respectively. Required: a. [3 marks] Between DB07 and IRSDB07, what is your preferred instrument? What is your trading strategy based on your preferred instrument (i.e. if you choose DB07, do you buy or sell DB07? If you choose IRSDB07, do you pay fixed or receive fixed?). Clearly explain your answer. b. [3 marks] Between DB14 and IRSDB14, what is your preferred instrument? What is your trading strategy based on your preferred instrument (i.e. if you choose DB14, do you buy or sell DB14? If you choose IRSDB14, do you pay fixed or receive fixed?). Clearly explain your answer. C. [4 marks] As we know today is 15th September 2004 (the first day of Quarter 3 in the trading game), between DB14 and FUT1OYR, what is your preferred instrument? What is your trading strategy based on your preferred instrument (i.e. if you choose DB14, do you buy or sell DB14? If you choose FUT10YR, do you buy or sell FUT10YR?). Clearly explain