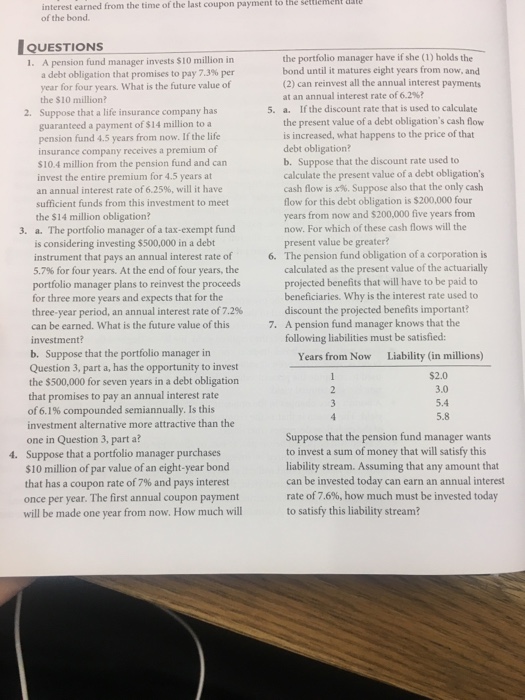

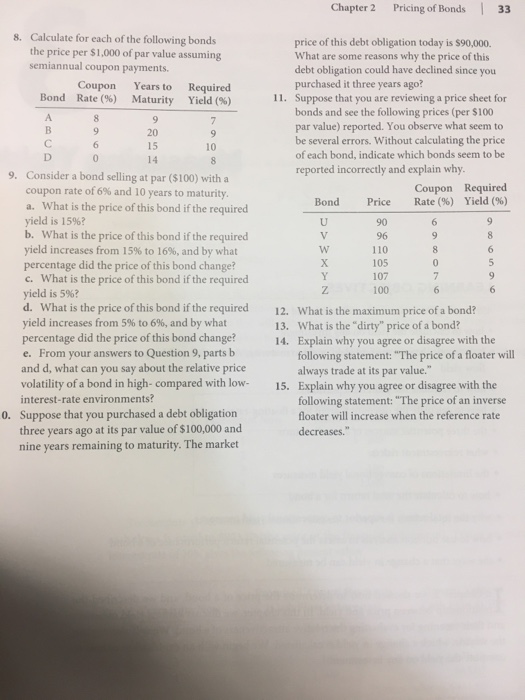

coupon payment to the seltlement as interest earned from the time of the last of the bond. QUESTIONS 1. A pension fund manager invests S10 million in the portfolio manager have if she (1) holds the bond until it matures eight years from now, and (2) can reinvest all the annual interest payments at an annual interest rate of 6.2%? a. If the discount rate that is used to calculate the present value of a debt obligation's cash flow is increased, what happens to the price of that debt obligation? b. Suppose that the discount rate used to calculate the present value of a debt obligation's cash flow is x%. Suppose also that the only cash flow for this debt obligation is $200,000 four years from now and $200,000 five years from now. For which of these cash flows will the present value be greater? The pension fund obligation of a corporation is calculated as the present value of the actuarially projected benefits that will have to be paid to beneficiaries. Why is the interest rate used to discount the projected benefits important? A pension fund manager knows that the following liabilities must be satisfied a debt obligation that promises to pay 7.3% per year for four years. What is the future value of 2. Suppose that a life insurance company has 5. guaranteed a payment of $14 million to a pension fund 4.5 years from now. If the life insurance company receives a premium of $10.4 million from the pension fund and can invest the entire premium for 4.5 years at an annual interest rate of6.25%, will it have sufficient funds from this investment to meet the $14 million obligation? a. The portfolio manager of a tax-exempt fund is considering investing $500,000 in a debt instrument that pays an annual interest rate of 5.7% for four years. At the end of four years, the portfolio manager plans to reinvest the proceeds for three more years and expects that for the three-year period, an annual interest rate of 7.2% can be earned. What is the future value of this investment? b. Suppose that the portfolio manager in Question 3, part a, has the opportunity to invest the $500,000 for seven years in a debt obligation 3. 6. 7. Years from Now Liability (in millions) that promises to pay an annual interest rate of6.1% compounded semiannually. Is this investment alternative more attractive than the one in Question 3, part a? Suppose that a portfolio manager purchases $10 million of par value of an eight-year bond that has a coupon rate of 7% and pays interest once per year. The first annual coupon payment will be made one year from now. How much will Suppose that the pension fund manager wants to invest a sum of money that will satisfy this liability stream. Assuming that any amount that can be invested today can earn an annual interest rate of 7.6%, how much must be invested today to satisfy this liability stream? 4