Question

Course: Accounting theory and policies ACCT725 book: financial accounting theory 7th by Willian R. Scott The Happylife corporation is a manufacturing company situated in the

Course: Accounting theory and policies ACCT725

book: financial accounting theory 7th by Willian R. Scott

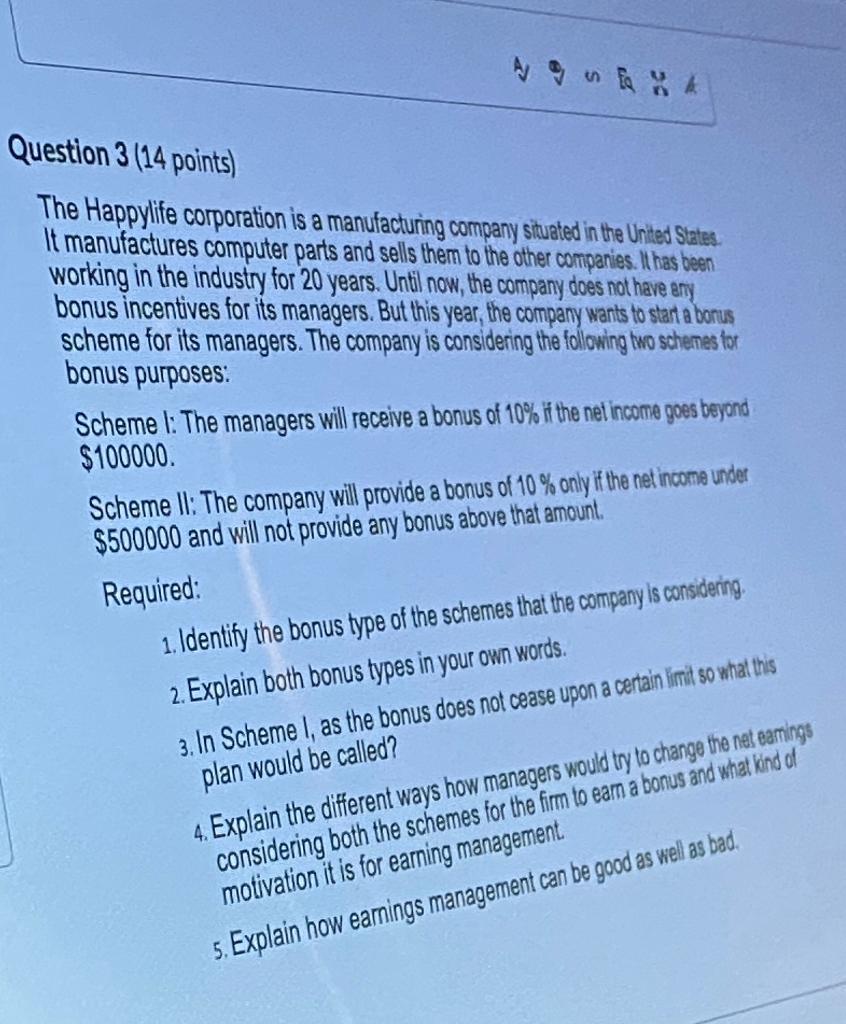

The Happylife corporation is a manufacturing company situated in the United States It manufactures computer parts and sells them to the other companies. It has been working in the industry for 20 years. Until now, the company does not have any bonus incentives for its managers. But this year, the company wants to start a bonus scheme for its managers. The company is considering the following two schemes for bonus purposes:

Scheme I: The managers will receive a bonus of 10% if the net income goes beyond $100000.

Scheme II: The company will provide a bonus of 10% only if the net income under $500000 and will not provide any bonus above that amount.

Required:

1. Identify the bonus type of the schemes that the company is considering.

2. Explain both bonus types in your own words.

3. In Scheme I, as the bonus does not cease upon a certain plan would be called? limit so what this

4. Explain the different ways how managers would try to change the net eamings considering both the schemes for the firm to earn a bonus and what kind of motivation it is for earning management.

5. Explain how earnings management can be good as well as bad.

This is all that there is in the question

this ia a complete question from a final exam. picture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started